All spot Bitcoin exchange-traded fund (ETF) applicants have filed their final Form S-1 amendments with the U.S. Securities and Exchange Commission (SEC). This marks a pivotal moment, especially since the deadline for submission was scheduled for today, January 8, 8:00 am EST.

Lead the pack, Valkyrie submitted the final S-1 amendment well ahead of the specified date of January 10, which many industry insiders believe could see the first approvals of spot Bitcoin ETFs in the US. Following suit, major players such as WisdomTree, BlackRock, VanEck, Invesco, Galaxy, Grayscale, ARK Invest, 21Shares, Bitwise, Franklin Templeton and Grayscale also completed their entries.

However, Hashdex has not updated its S-1. The new filings are the penultimate step before the spot approval of Bitcoin ETFs. The latest is the SEC’s vote on the 19b-4s filings in the coming days, specifically on Wednesday.

Scott Johnsson, financial attorney at Davis Polk explains: “Best estimate of timing (not final): – Monday: “Final” S-1/3 filed – Wednesday: 19b-4 approval orders issued after closing – Thursday: Requests for acceleration of issuers – Friday: Notice of Effectiveness filed by SEC – Tuesday: Trading begins”

Best estimate of timing (not final):

– Monday: “Final” S-1/3 filed

– Wednesday: 19b-4 approval orders issued after close

– Thursday: Requests for acceleration from issuers

– Friday: Notice of Effectiveness filed by SEC

– Tuesday: Trading begins— Scott Johnsson (@SGJohnsson) January 8, 2024

Others expect the spot Bitcoin ETFs could even start trading as early as Thursday or Friday.

Fee War for Spot Bitcoin ETFs Begins

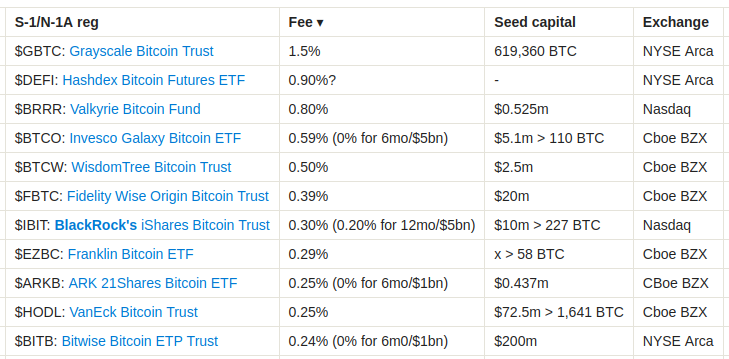

The S-1 amendments are critical because they reveal information about fees for the potential ETFs. In an interesting turn of events, several filers have significantly reduced the cost of trading their potential spot Bitcoin ETF products. Initially, BlackRock led with the lowest fees. Katie Greifeld, anchor of The Close and ETF IQ on Bloomberg, marked:

BLACKROCK’S FEE is finally mentioned. The final fee is 30 basis points, BUT 20 basis points in the first twelve months or up to the first $5 billion in assets. That is the new low water mark.

However, Cathie Wood’s Ark Invest announced lower fees shortly afterwards. Ark’s latest S-1 shows a drop from 0.80% to 0.25%, and a special offer of 0% fees for a period of six months from the day of listing, for the first $1 billion in transactions. Eric Balchunas, a Bloomberg analyst, commented about this competitive landscape:

But wait, ARK just dropped their fee to 0.25% in an S-1 filed 20 minutes after BlackRock’s. I told you all that the war on fees would break out if they were even launched. And this is without Vanguard in the mix. Damn. […] ARK going from 80 fps to 25 fps in one shot is breathtaking. The compensation wars are intense, but that’s another level. Although they had to. BlackRock at 30 bps is a potential instant destroyer of anyone much higher.#

However, Ark was also undermined at the last minute. Bitwise filed a 0.24% fee. You will not be charged for the first six months or $1 billion AUM.

Notably, VanEck also announced a fee of just 0.25%, but without any special promotions for the launch, unlike BlackRock and Ark Invest. The leading quartet is followed by Franklin Templeton (0.29%), Fidelity Wise Origin Bitcoin Trust (0.39%), WisdomTree Bitcoin Trust (0.50%), Invesco Galaxy Bitcoin ETF (0.59%), Valkyrie Bitcoin Fund (0.8%), Hashdex (0.90%) and Grayscale (1.5%).

Eric Balchunas explained that temporary fee waivers have historically not had a significant impact on investor decisions because advisors tend to focus on long-term fees. However, given the uniformity of services offered by these ETFs, he suggested that price differences could play a bigger role this time. “Historically, this hasn’t moved the needle much […] Advisors focused on regular fees because they are long-term investors. That said, given that all these ETFs are all doing the same thing, maybe the rest of it will be the same, we’ll see,” he noted.

Katie Greifeld commented: “I spoke too early re: low water mark! Ark and 21 shares go 0.25% and NO FEES for the first six months or up to $1 billion in assets. These are very, very low numbers. […] VanEck also comes in well with a fee of 25 bp. For context, GLD – the largest physically backed commodity ETF – charges 40 basis points.”

Following the news, Bitcoin price responded with a 2% jump, rising to $45,300.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.