- Bitcoin breaks through key resistance levels, surpassing the highs of the 2015-2018 cycle.

- Institutional adoption and macroeconomic trends are driving Bitcoin’s momentum toward a $100,000 target.

Bitcoin [BTC] has crossed a critical price milestone and surpassed key resistance levels that previously defined cyclical behavior during the 2015-2018 bull market.

This latest outbreak highlights the resilience and growing maturity of the cryptocurrency in a market that has evolved significantly since the early speculative days.

In contrast to the dramatic peaks and valleys of the 2015-2018 cycle, Bitcoin’s current trajectory appears more measured, supported by stronger fundamentals and broader adoption.

With the price breaching the level that many believed would act as insurmountable resistance, questions are being raised about whether this surge marks the start of a new bull cycle – or even a run toward a six-figure valuation.

Breaking historical cycles

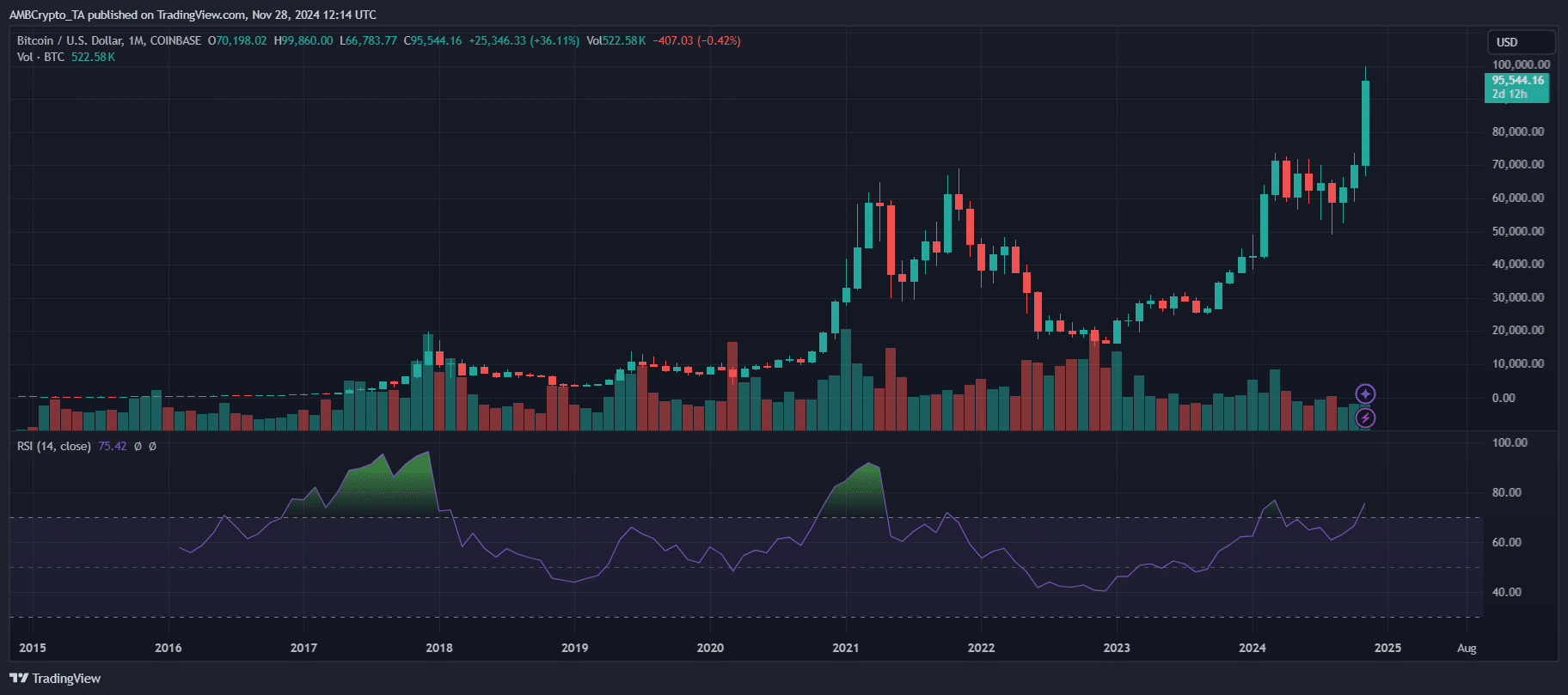

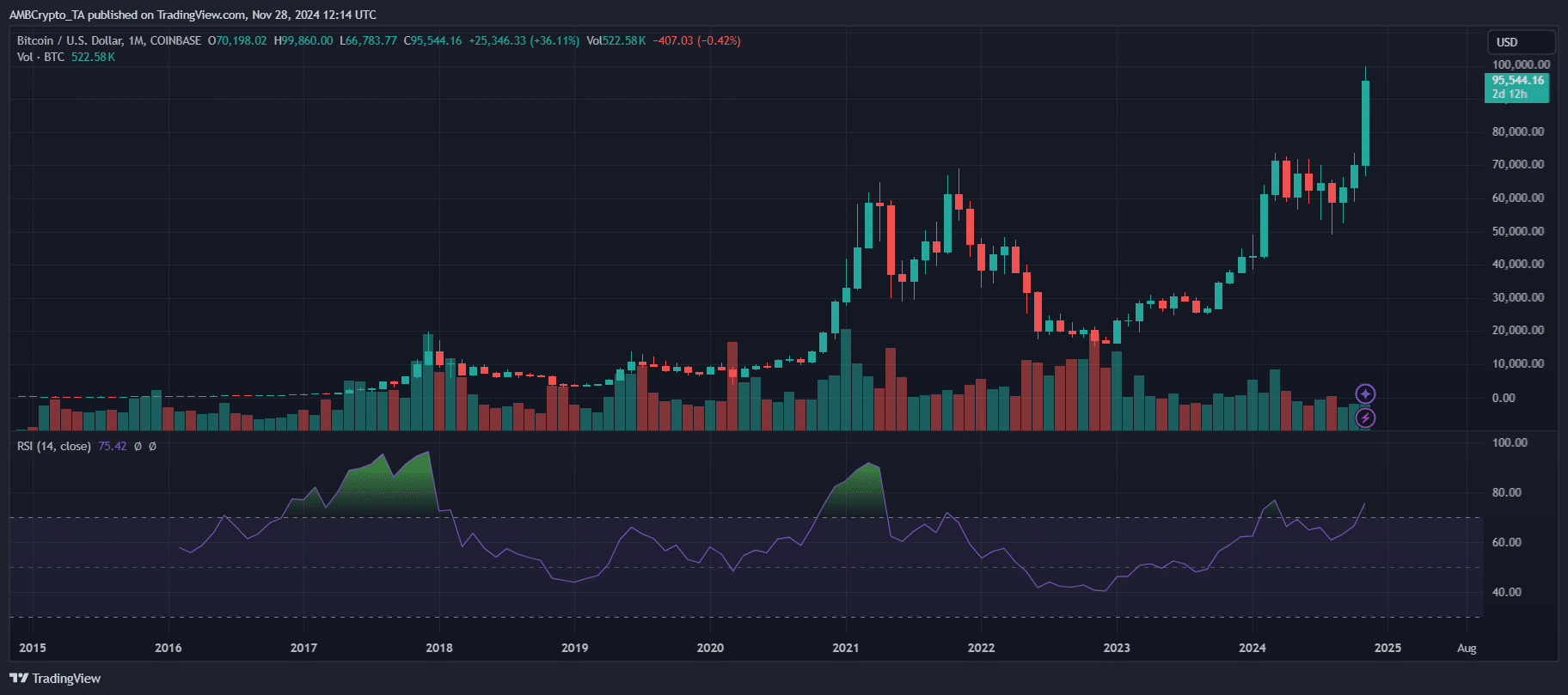

Bitcoin’s current cycle is progressing faster than its 2015-2018 counterpart. After peaking at $20,000 in 2017, Bitcoin took almost three years to recover, then consolidated at lower levels before the next bull run.

In contrast, the 2022 bottom was followed by a much faster recovery, with Bitcoin passing $50,000 within two years – almost a year faster than the previous recovery.

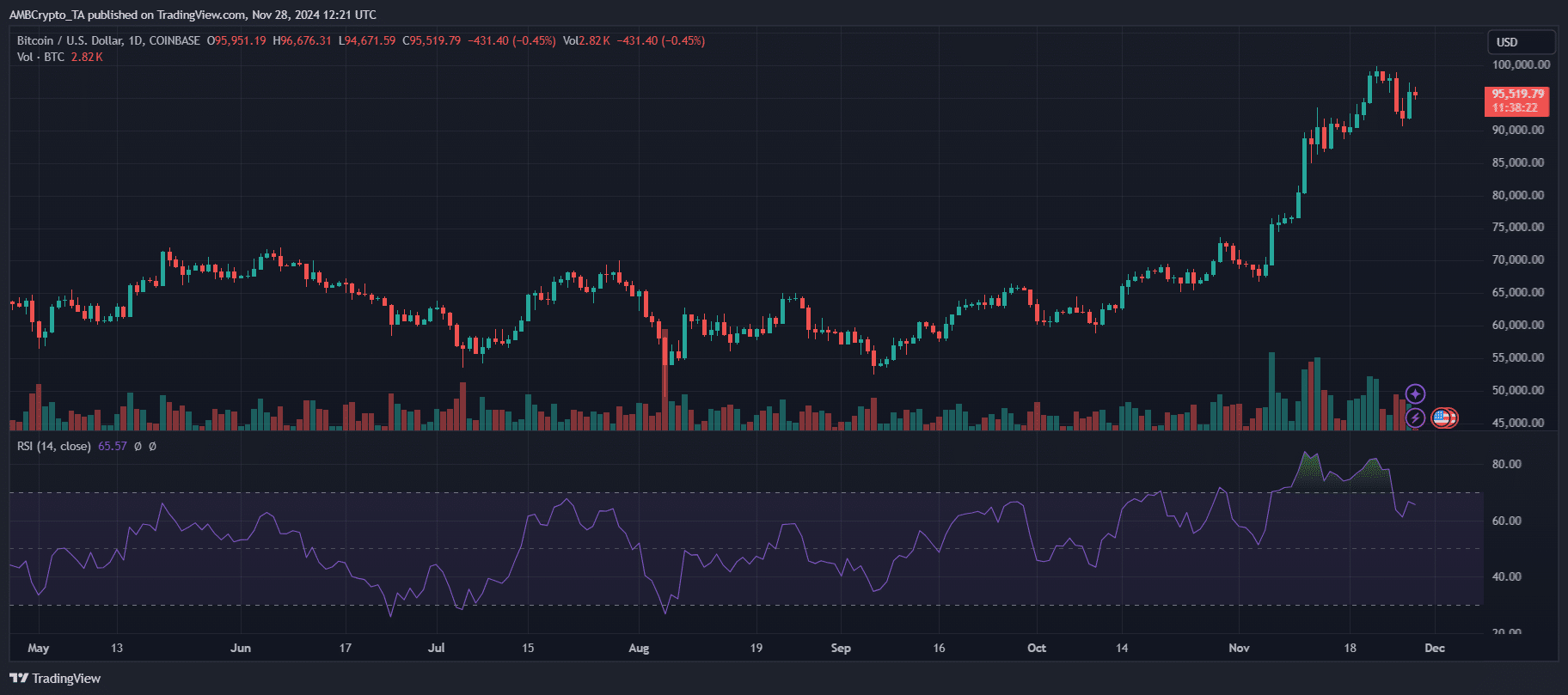

Source: TradingView

The chart shows Bitcoin maintaining momentum, with monthly RSI values above 75 indicating strong bullish conditions.

Trading volumes are also higher than the previous cycle, reflecting increased market participation.

This milestone represents an 80% recovery from the 2022 low, supported by long-term holder accumulation and reduced exchange balances.

These shifts within the chain highlight stronger fundamentals compared to previous cycles, pointing to less speculative activity and more sustainable growth. Bitcoin’s accelerated recovery sets it apart from historical patterns.