Bitcoin has experienced significant price fluctuations, marked by a notable crash on August 5, which saw its value fall to $49,000. This was followed by a recovery to around $65,000, before experiencing another decline to around $52,000 last Friday.

Despite these challenges, the largest cryptocurrency by market cap is undergoing crucial retests of support, reminiscent of the patterns observed in September 2023 before surging to an all-time high of $73,700 in March.

Bitcoin could reach new all-time highs

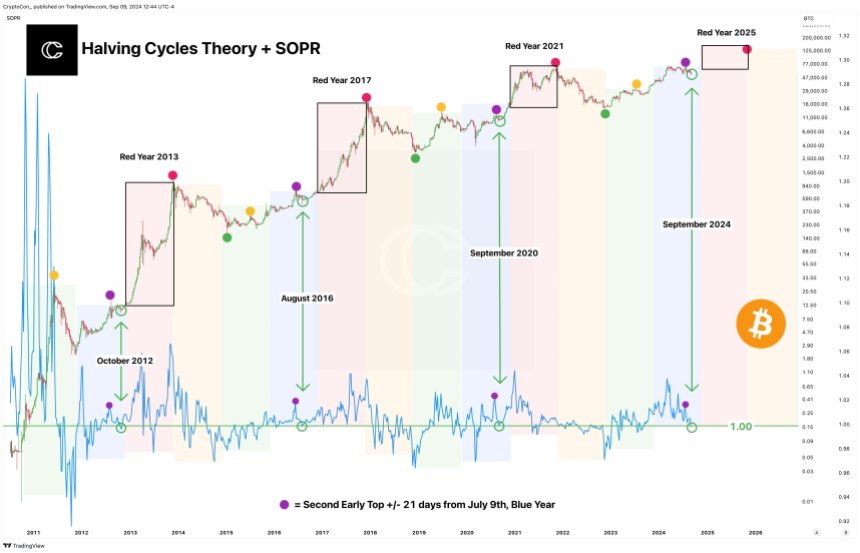

Crypto analyst Crypto Con highlighted this trend in a social media messagefocusing on Bitcoin’s spent output profit ratio (SOPR). According to Con, previous peaks have been correlated with the 1.0 value line on the SOPR chart, where the cryptocurrency typically finds a bottom before entering a bull market phase.

This cyclical behavior has been consistent around specific months (October, August and September) and draws parallels to the recession predictions that have recently emerged, as in September 2023 and at the cycle low in November 2022 after the implosion of crypto exchange FTX .

Current indicators suggest that Bitcoin may be on the verge of a significant price increase, possibly surpassing its previous all-time highs. This bullish sentiment is reinforced by historical data showing Bitcoin’s tendency to break previous peaks, as seen in the chart above.

Is September a ‘fake breakdown month’?

In a more detailed analysis of short-term price action, says fellow analyst Rekt Capital pointed out that Bitcoin’s weekly close above $53,250 is crucial for maintaining the support level within the buying range of $52,000 to $55,000.

This range is below a downtrend channel noted by the analyst at $56,500 on Bitcoin’s weekly chart. Rekt emphasized that regaining $55,881 as support would be essential for Bitcoin to build momentum and attempt a recovery within the channel.

Additionally, Rekt put forward an interesting hypothesis that September could possibly be a “fake slump month.” Historical data indicate that September typically has an average monthly return of -5%, while October averages 22.90%.

This pattern suggests that any support that Bitcoin price appears to have lost over the past month could be quickly regained, especially as the cryptocurrency is currently trading around $56,600. Should October follow its historical trend, a 22.90% surge would put Bitcoin below its all-time high at around $68,780.

At the time of writing, the largest cryptocurrency on the market is registering a 4% increase in the 24-hour time frame, pushing its price back to the $56,600 mark. However, over the past 30 days, BTC has recorded losses of more than 7%.

Featured image of DALL-E, chart from TradingView.com