- Buying pressure on BTC increased, indicating continued price appreciation.

- However, some technical indicators pointed to a correction.

Bitcoin [BTC] Investors enjoyed big gains last week as the coin’s price rose by double digits. The price increase increased bullish sentiment around the coin, causing a record drop in BTC supply on the exchanges. Will this lead to further price increases?

Investors buy Bitcoin

CoinMarketCaps facts revealed that Bitcoin witnessed a price increase of over 11% in the last seven days. At the time of writing, the king coin was trading at $67,866.54 with a market cap of over $1.34 trillion.

Basically AMBCrypto reported rather that there were chances of BTC rising above $67k. Thanks to the latest price increase, more than 50 million BTC addresses made a profit, accounting for more than 94% of the total number of BTC addresses.

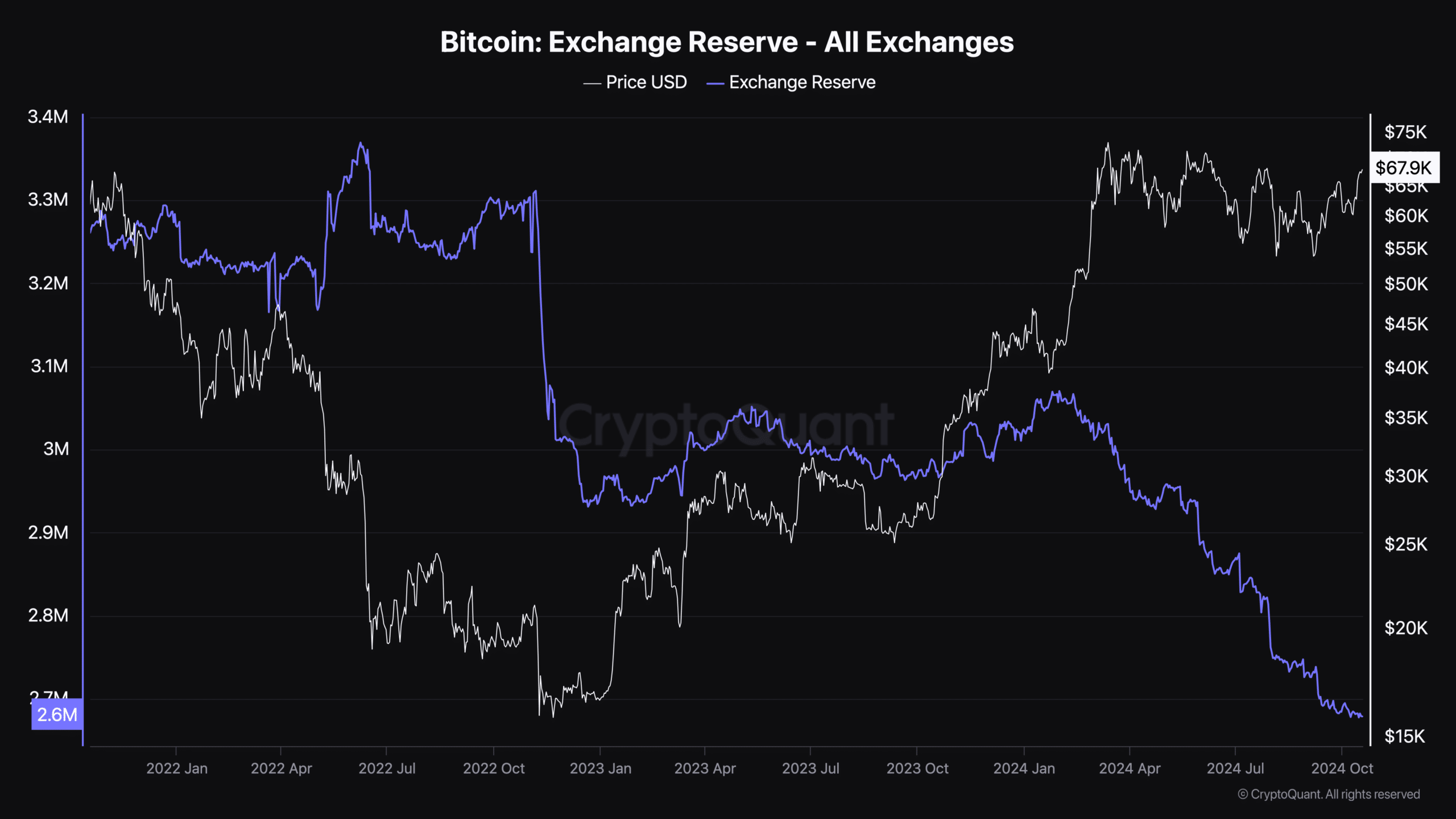

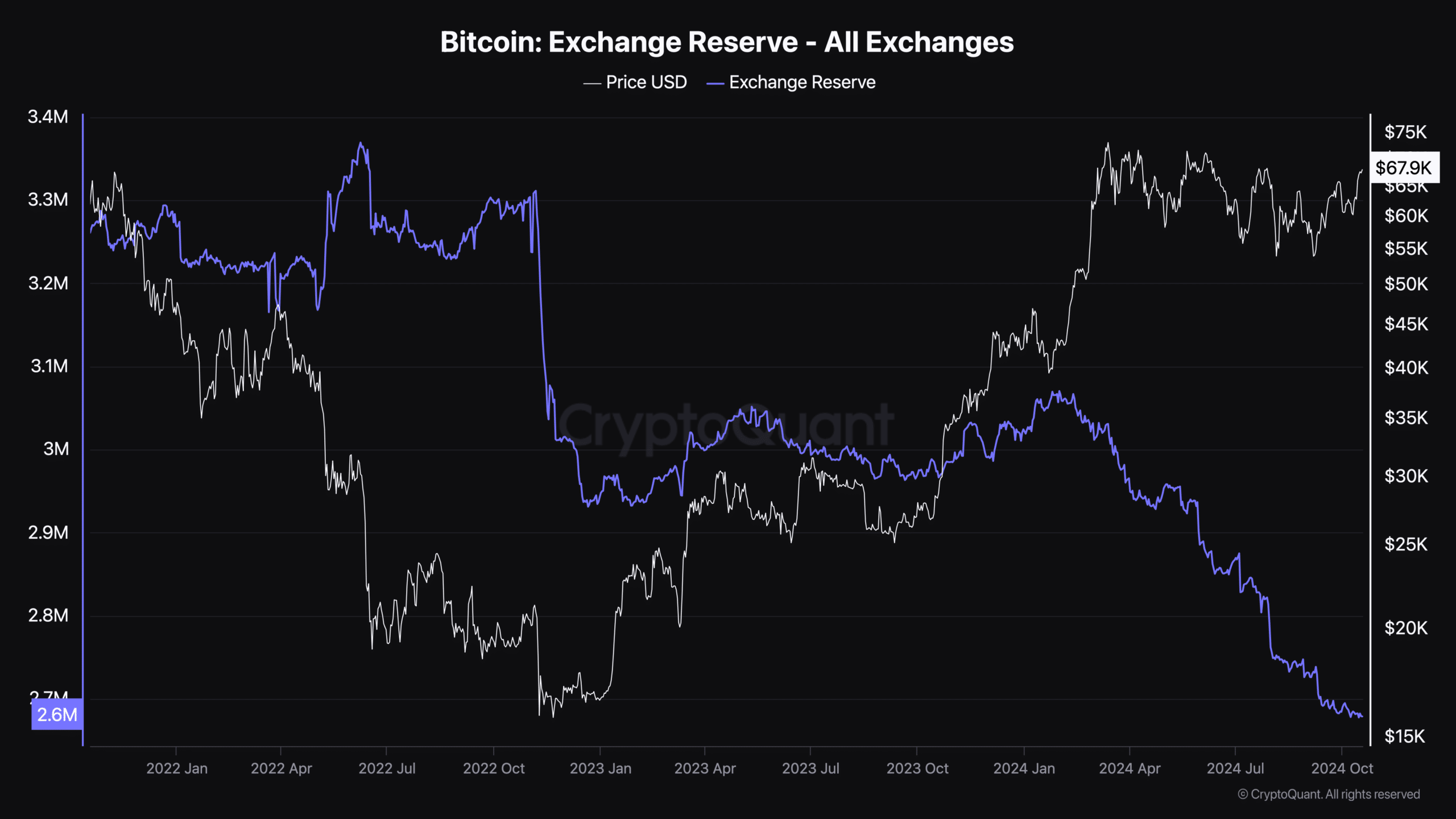

While all this was happening, a key BTC metric hit a record low. To be precise, the supply of Bitcoin on the exchanges has fallen to the lowest level in the past five years. A decline in this measure means that investors bought BTC in anticipation of a further price increase.

Therefore, AMBCrypto checked other data sets to find out if the buying pressure was high.

Where is BTC going?

AMBCrypto’s analysis of CryptoQuant facts established the above fact. Bitcoin’s foreign exchange reserve has fallen sharply in recent months, indicating a clear motive for investors to buy the king coin.

Source: CryptoQuant

Long-term holders were willing to hold on to their coins, which was evident from the coin’s green binary CDD. Things also looked quite optimistic on the derivatives market.

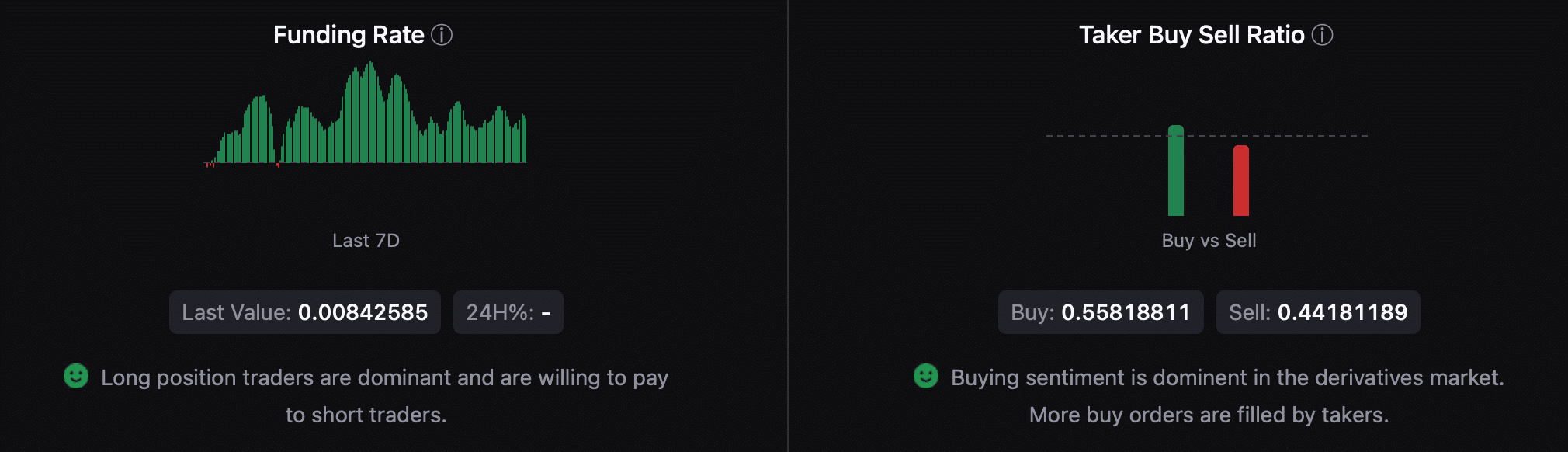

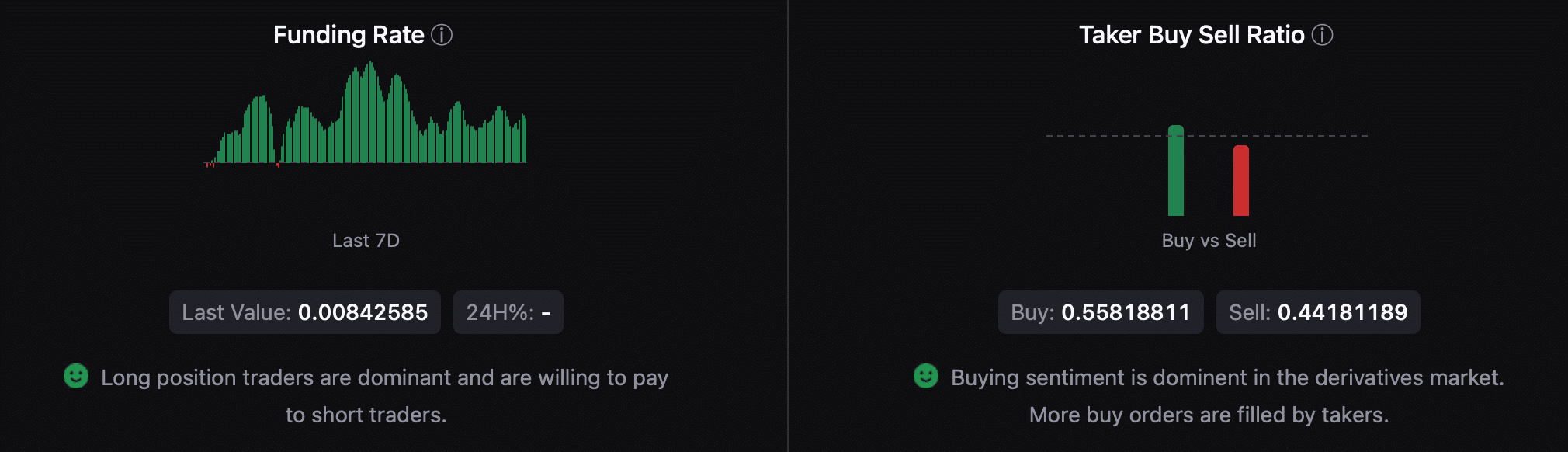

The coin’s funding rate rose, meaning long position traders were dominant and willing to pay short traders. Furthermore, Bitcoin’s taker buy/sell ratio indicated that buying sentiment was dominant in the derivatives market.

Source: CryptoQuant

However, American investors thought differently. This was reflected in the low Coinbase premium, which led to dominant selling sentiment among US investors. Rising selling pressure could end BTC’s bull rally.

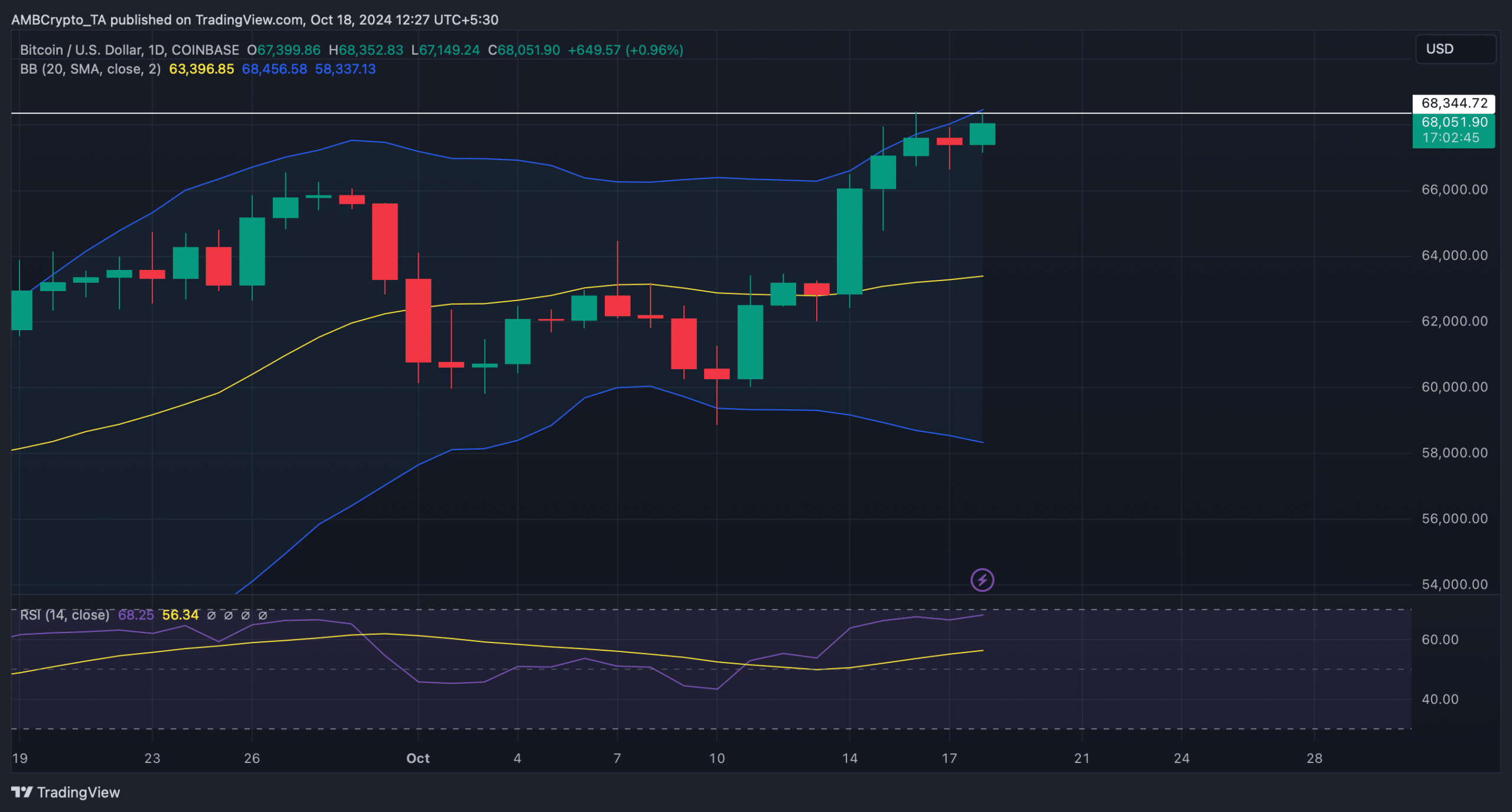

Therefore, AMBCrypto planned to look at Bitcoin’s daily chart to better understand which way the king coin was heading. According to our analysis, Bitcoin tested its resistance at the $68,000 mark. However, market indicators pointed to a rejection.

Read Bitcoins [BTC] Price prediction 2024–2025

For example, the price of BTC reached the upper limit of the Bollinger Bands, which often causes price corrections.

Moreover, the Relative Strength Index (RSI) was also on the verge of entering overbought territory. If that happens, selling pressure could increase, leading to a price drop in the coming days.

Source: TradingView