- Bitcoin saw demand increase in the United States.

- The Coinbase Premium was still near the zero mark.

Bitcoin [BTC] was primed for short-term price volatility due to options expiration at the end of the week. A recent AMBCrypto report also noted that the increase in foreign exchange reserves could trigger a sell-off.

The MVRV metric revealed that Bitcoin has a crucial resistance that, if broken, could result in a strong price increase. The break from the 155-day MA could set the market up for a rally like the one that started last October.

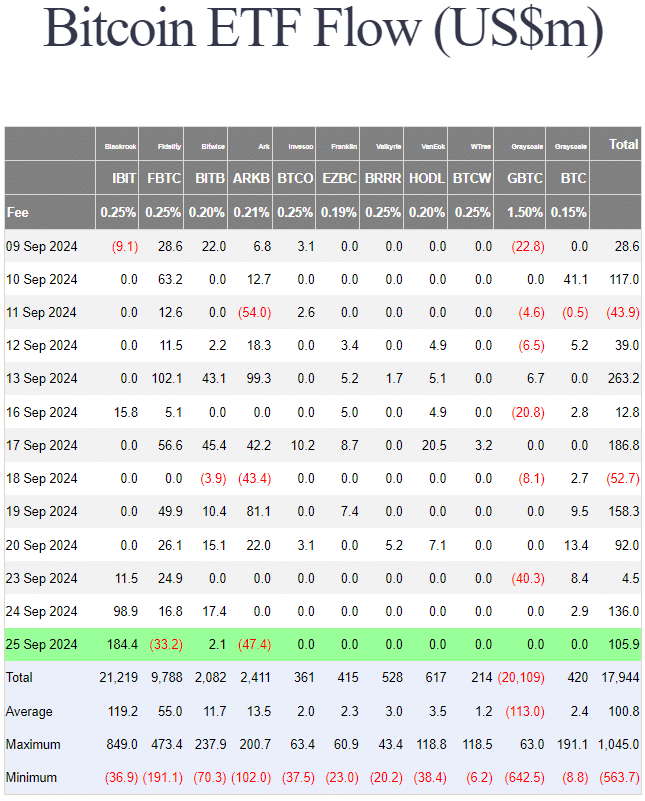

The Bitcoin spot ETF flow table showed that the total flows of the past two weeks are trending positively. This outlined positive expectations among private investors.

The 30-day net change in ownership also turned positive, Ki Young Ju noted in one message on X.

Spot ETF creates increasing buying pressure in the United States

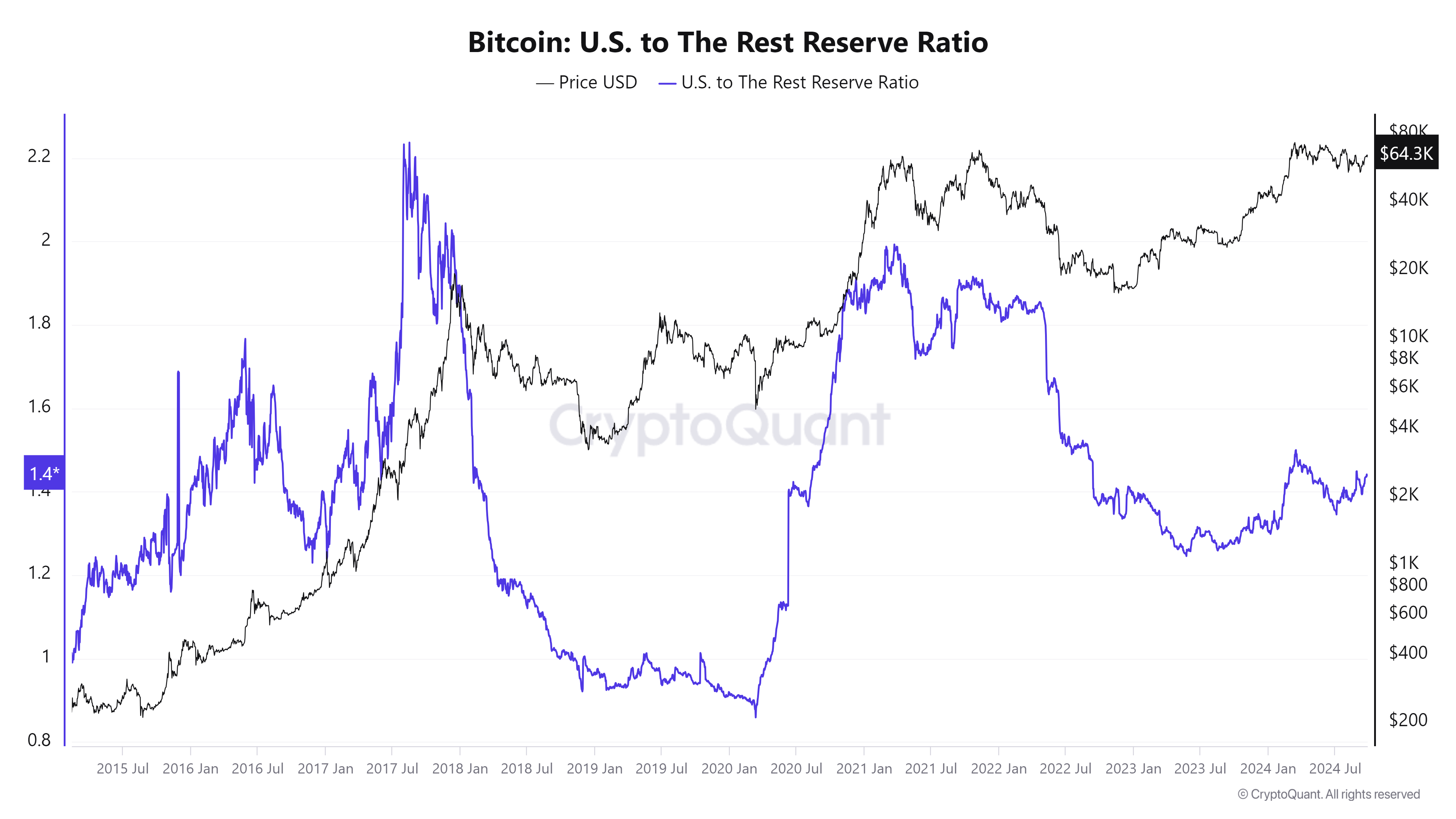

The founder and CEO of CryptoQuant also pointed out that the US Bitcoin Reserve Ratio rose, probably driven by demand for spot ETFs. The increase has been slow but steady over the past fourteen months.

The past two cycles saw a rapid increase in the US reserve ratio, a few months before Bitcoin entered the final stages of the bull run.

If the pattern holds again, a rapid rise in the US reserve ratio could be an early sign of a potential BTC bull run.

It also begins to decrease noticeably about 4 to 6 months before the cycle reaches its peak. While these observations don’t guarantee similar performance during this run, it is something else investors should pay attention to.

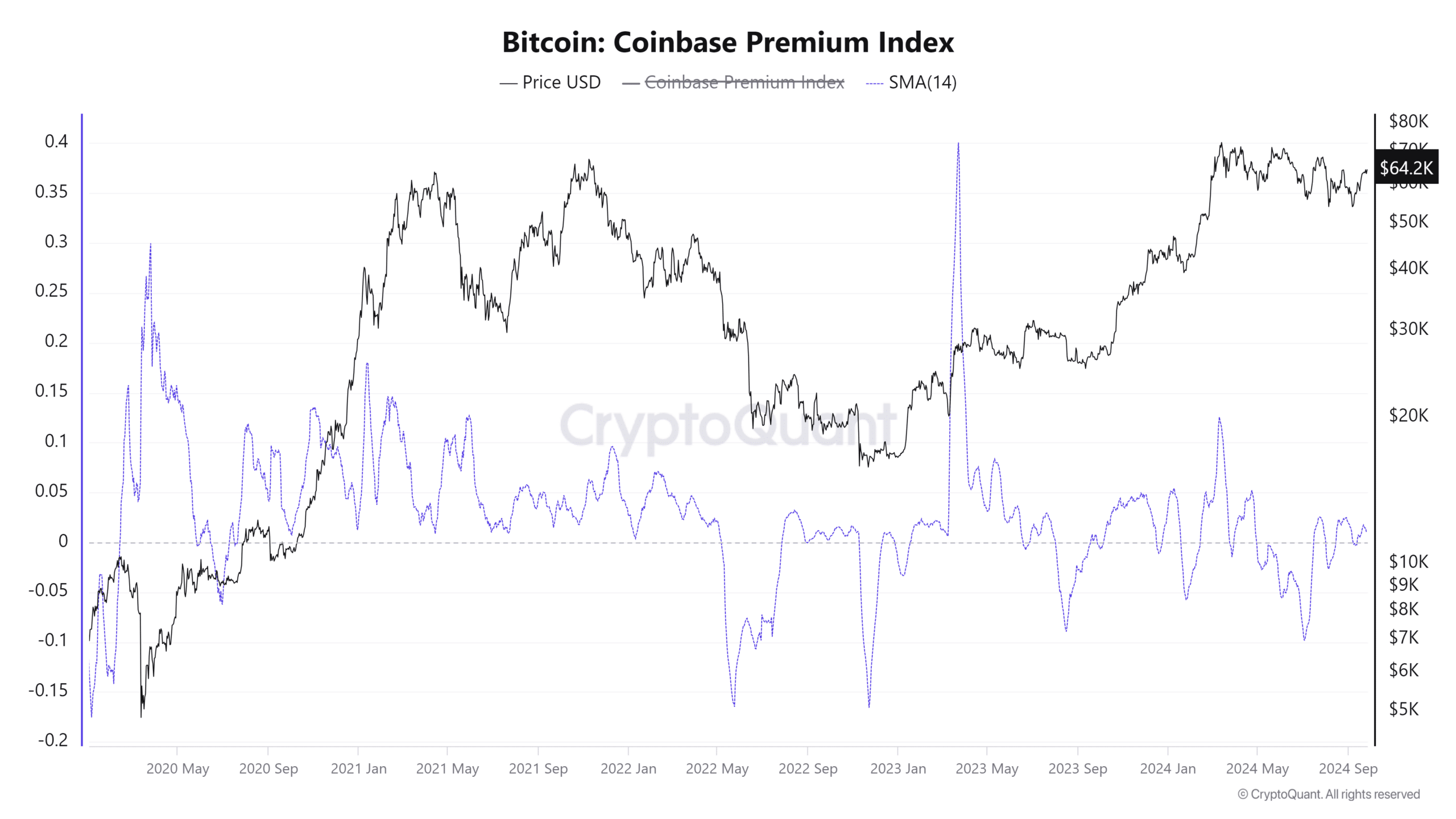

The Bitcoin Coinbase premium showed that demand has not yet reached its peak

Spot ETF flows and reserve ratios showed demand from the United States was increasing.

However, a look at the Coinbase Premium Index showed that this demand was not high enough to command a large premium.

Coinbase, one of the largest crypto exchanges available to US investors, tends to see a high Bitcoin premium during a bull run. This was the case during the 2020-2021 run.

Read Bitcoin’s [BTC] Price forecast 2024-25

It also applied to the rally that started in October 2023 and lasted until March 2024.

The low Coinbase premium does not erode the findings of the previous statistics, but it reinforces the idea that a bull run has not yet occurred.