- Bitcoin supports the level above $ 85,000, with $ 95,000 as a significant subsequent resistance area.

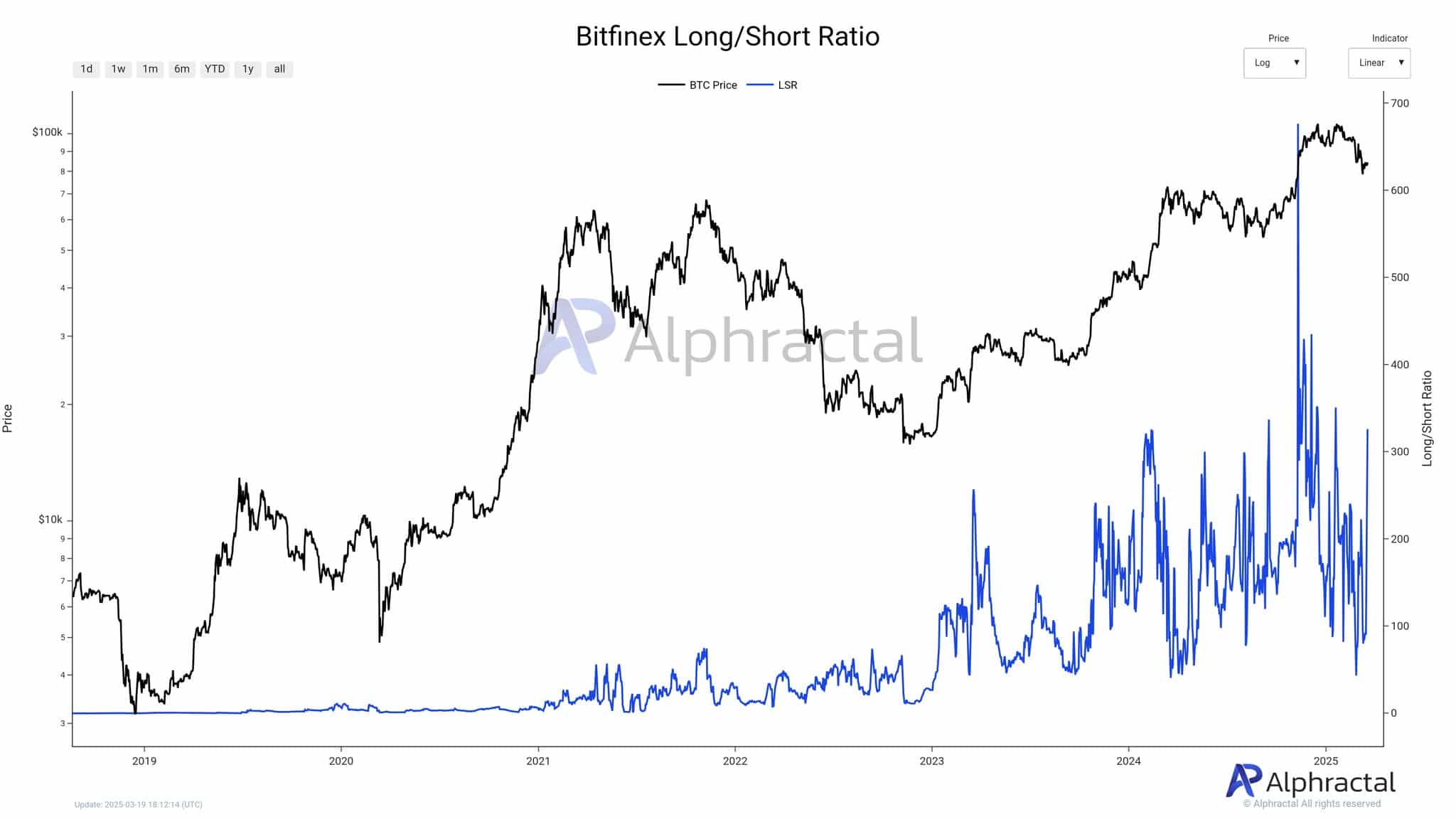

- The long/short ratio reached 650 early 2025.

Bitcoin’s [BTC] Long positions on Bitfinex experienced considerable growth, which validated that traders had positive market expectations.

The long/short ratio reached 650 at the beginning of 2025 at levels, which went much further than the essential 320 critical threshold.

Source: Alfractaal

A continuous preference for long positions among users materialized due to the long/short ratio that numbers of more than 100 accessible since mid -2023.

The number of BTC traders with long positions currently reached its maximum peak of 80,000, in addition to falling short position levels, which dropped to 20,000.

The price increase of BTC reached $ 90,000 because of the unbalanced market that strengthened its upward process.

Moreover, the purchasing pressure was 320, which showed increased opportunities for BTC to achieve a price value of $ 100,000.

Thus the continuous maintenance of a ratio above 320 acted as the most important factor. This also made a bullish process possible, but every drift under this threshold can lead to $ 85,000.

Bitcoin -Marktsentiment

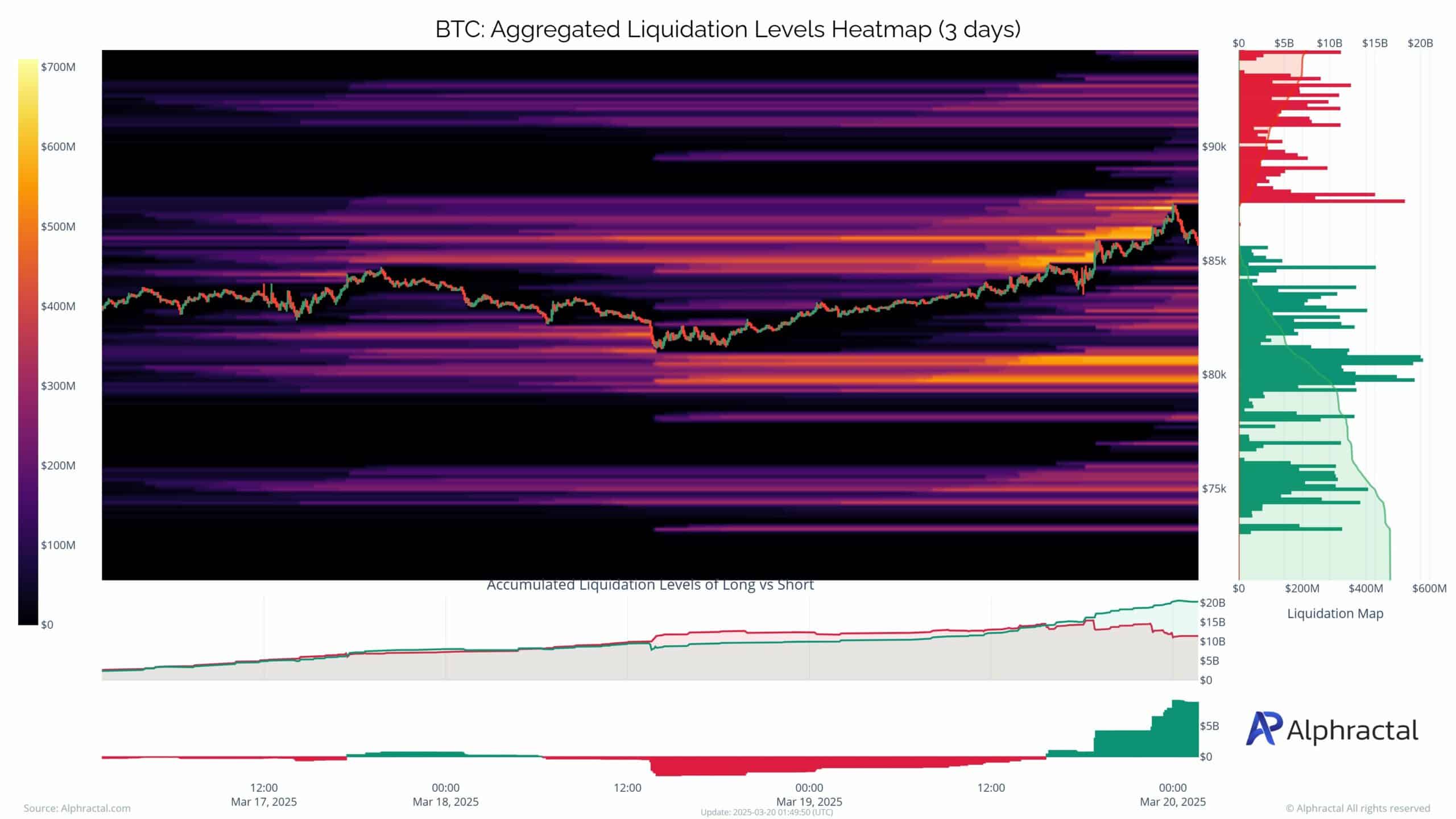

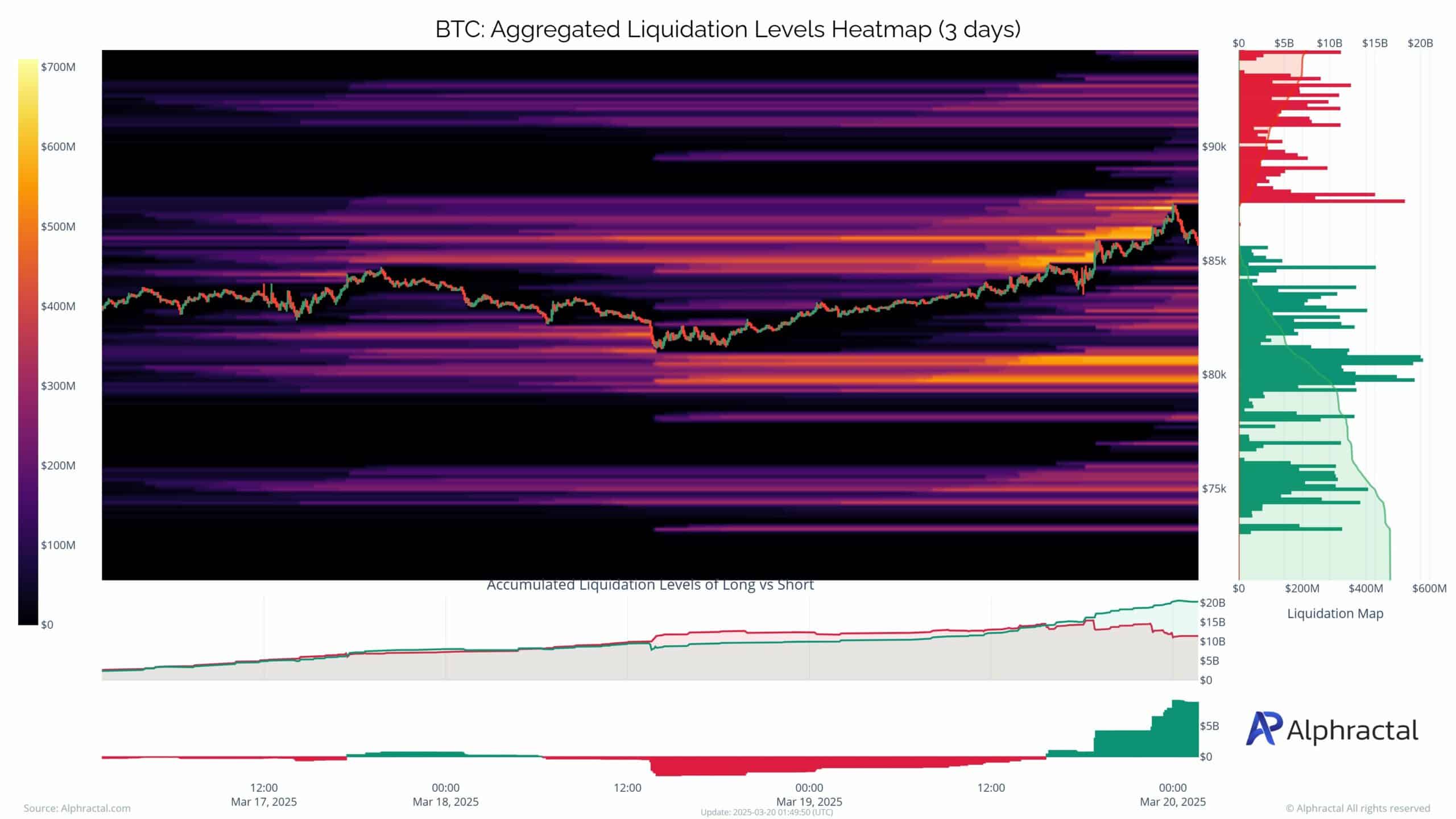

At the time of writing, a mass shorts suffered from liquidation on BTC’s Heatmap, which contributed to promoting the Bullish Market Momentum.

A significant $ 200 million in short positions was cleared at $ 85,000 when Bitcoin dropped before he returned to $ 90,000.

Source: Alfractaal

More than $ 500 million in short positions were also automatically liquidated in just three days within the price range from $ 80,000 to $ 85,000, which strengthens market pressure.

Thus Beerarish traders had to close their positions, creating extra upward impulse for BTC.

If BTC maintains the level above $ 85,000, this can result in a price objective for $ 95,000 as a considerable subsequent resistance area.

Surely, BTC showed an upward trend after large whale -fishing events, which gathered the possibility to reach $ 95,000.

The combination of whales that sell at increased price points and the marketing pressure of the market could have forced the prices to $ 85,000.

That is why whale activity in combination with Bitfinex’s long/short ratio of trends and liquidation data showed that the market is currently optimistic.