This article is available in Spanish.

Bitcoin has started the month of October with a negative note, deviating from what many investors expected in the run-up to the month. Bitcoin, which previously saw a notable price increase, suffered setbacks at the end of September, leading up to the first 24 hours of October.

The first 24 hours of October have been riddled with outflows from the crypto industry. Bitcoin in particular fell below $61,000according to Coinmarketcap, when tensions began emerging in the Middle East. Judging from this drop, it has raised questions about Bitcoin’s prospects for the rest of the month.

Current Bitcoin Price Action

The buzz leading into October centered around expectations that Bitcoin would extend its bullish momentum and break through key resistance levels. According to price data, Bitcoin ended the month of September 7.11% above where it started, even peaking above $66,000 at one point.

Related reading

However, at the time of writing, Bitcoin is down almost 7% from its September peak. Moreover, Coinmarketcap data shows that Bitcoin is down 3.6% in the last 24 hours. The rapid downturn has changed market sentiment, with the once optimistic outlook giving way to fear and uncertainty. The Fear and Greed Index, which measures the market’s emotions and risk appetite, now reads 39 and signals ‘fear’. It seems crypto investors are now panicking, with crypto analyst Kaleo even highlighting this on social media platform X.

After five minutes of scrolling through the timeline, you’d think we’d never see a green candle again

— KALEO (@CryptoKaleo) October 1, 2024

Bitcoin’s price action is highly sensitive to world events. Notably, the recent decline in Bitcoin’s price can be attributed to geopolitical conflicts in the Middle East. The country’s recent performance in the face of geopolitical turmoil has cast doubt on its role as a safe haven.

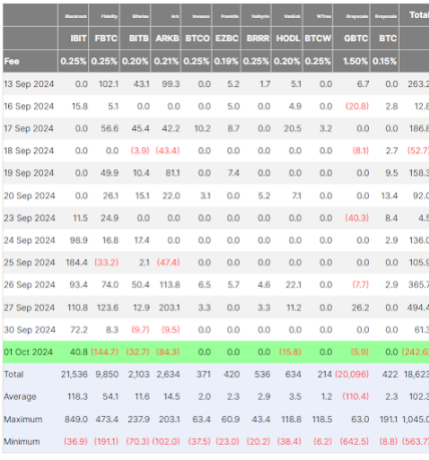

Spot Bitcoin ETFs, which aim to support Bitcoin’s spot price, also ended eight consecutive days of inflows on October 1 with massive outflows, most likely in response to tensions in the Middle East. According to Spot Bitcoin ETF flow data from Farside Investors, institutional investors raised $246.2 million yesterday.

Is Uptober a myth?

The optimistic outlook seems to have quickly faded for many crypto investors. However, many participants are still holding on to the bullish outlook, especially considering that the month still has a long way to go before it comes to an end.

Related reading

History shows more often than not that October has always been a positive month for Bitcoin. Most importantly, the positive performance mainly occurred in the second half of the month. Since the month is just beginning, it makes more sense to wait and research how the price action plays out for the rest of the week before drawing a conclusion on Uptober.

In light of these tensions, Bitcoin’s potential role as a safe haven, similar to gold, is increasing could increase among market participants during the rest of the month and beyond.

Featured image created with Dall.E, chart from Tradingview.com