Bitcoin price has failed to break above the key USD 27,800 resistance level since Monday. With today’s release of the US Consumer Price Index (CPI), a directional decision may be imminent: will Bitcoin rise again to $30,000 or threaten a drop to $25,000?

Who will nod first?

The consumer price index (CPI) is announced one hour (8:30am EST) before the start of the US trading session. Annual headline inflation (yoy) is expected to remain unchanged at 5.0% (vs. 5.0% last time). The core interest rate is expected to fall slightly, from 5.6% to 5.5%. On a monthly basis, aggregate CPI is expected at 0.4% vs. 0.1% last year and the core rate at 0.3% vs. 0.4% last year.

Today’s CPI release could be of great significance as there is a significant discrepancy between the US Federal Reserve (Fed) and market expectations. According to the dot plot and Jerome Powell, no rate cuts are planned this year, while according to the CME FedWatch tool, the market is bluffing with the majority predicting two to three rate cuts.

One side will have to bow prematurely, and if the CPI numbers come out worse than expected, it could be the market. As a result, the stock market can be expected to plummet and possibly pull Bitcoin down as well. A positive surprise in the current CPI figures is therefore very important for the market.

Remarkable, Goldman Sachs expected core CPI rises 0.47% in April, above the consensus of 0.3%. This would also bring the annual rate to 5.59%, above the consensus of 5.5%. The banking giant also forecasts its overall CPI to rise to 0.50% (versus 0.4%), which would raise the annual rate to 5.09% (versus 5.0%).

Bitcoin ahead of CPI

Ahead of the CPI release, Bitcoin price is stuck in a tricky situation. The bears are starting to feel in control, but the bulls continue to have the upper hand in the higher time frames.

As analyst @52skew points out, there are signs that the Bitcoin perpetuals market is oversaturated with short positions. Although the Bitcoin Perp CVD Buckets & Delta Orders show some liquidation of short positions, they still show heavy short position on upturns. This is “often defined as short control,” the analyst said. Binance spot is the market selling aggressor these days.

$BTC Spot CVD bins and Delta orders

Still pretty much the same, daily vwap illustrates when MMs sell twap at price via small spot orders / MM spot orders & TWAP CVD / MM CVDBounces are still sold by MMs.

Binance spot is the market selling aggressor these days https://t.co/k02hc5qCDL pic.twitter.com/hwVw1YJcqm

— Slant Δ (@52kskew) May 10, 2023

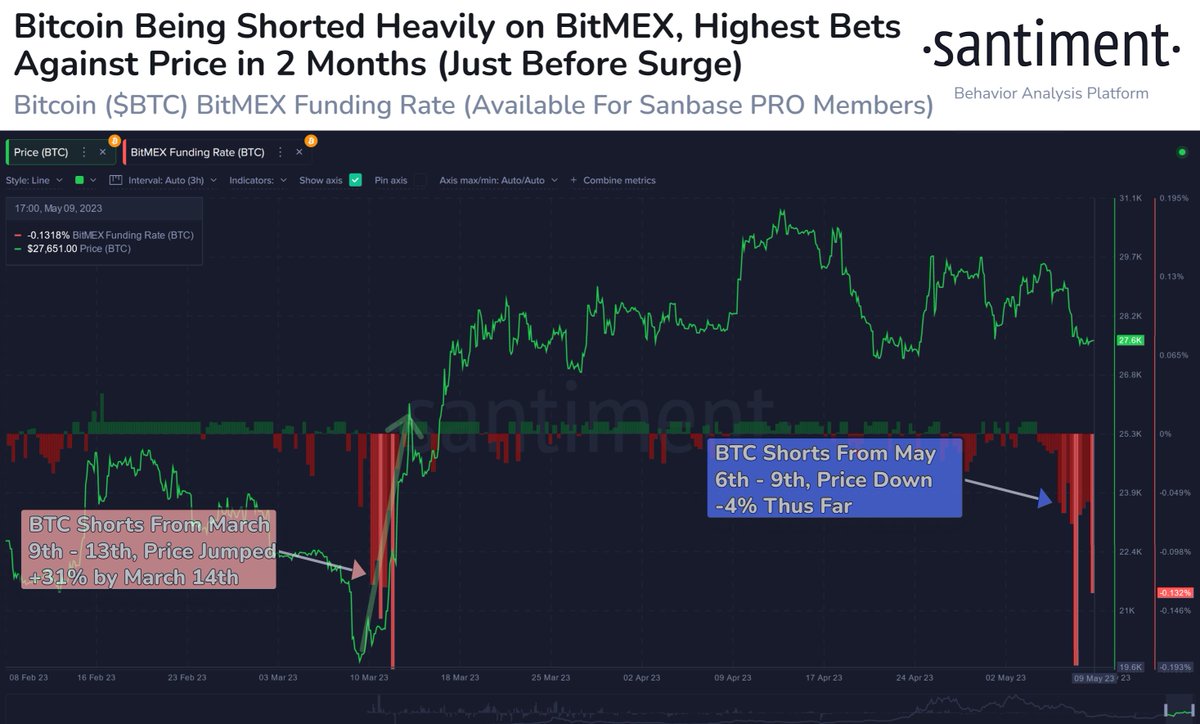

On the other hand, an old ‘reversion indicator’ from 2019 is just flashing: Bitmex trading under spot. As on-chain analytics service Santiment also points out, Bitcoin’s funding rate on BitMEX is showing its most negative ratio since the mass betting on prices in mid-March, just before prices peaked.

“In general, the chances of price increases increase when the masses massively assume that prices will fall,” says Santiment concludes.

Otherwise, a head-and-shoulders pattern on the 1-day chart is currently hotly debated. The bearish side states that BTC is facing a deeper fall. But there are also good arguments why this need not be the case.

Chartered Market Technician (CMT) Aksel Kibar makes the argument that chart patterns should be analyzed in relation to the previous price action:

While this past month’s consolidation looks like an H&S top, top reversals form after an extended uptrend and therefore cannot be analyzed as a top reversal. I’m more interested in playing the long end of this month-long consolidation. Support (bottom reversal neckline) remains at 25K.

At the time of writing, Bitcoin price was trading at $27,647.

Featured image from iStock, chart from TradingView.com