- Bitcoin recently hit a new all-time high of $93,477, but is now stabilizing above $90,000.

- Analysts evaluate metrics such as MVRV and stock outflows to gauge the potential continuation or cooling of BTC’s rally.

After a week in which several new all-time highs were reached, Bitcoin [BTC] appears to have taken a breather as price momentum shows signs of cooling. The leading cryptocurrency recently hit an all-time high of $93,477 on November 13.

Since then, it has suffered a modest pullback of 2.8% and has stabilized above the $90,000 mark. As of now, Bitcoin is trading at $90,959, marking a slight increase of 0.6% in the past 24 hours.

Is there still room for upward momentum?

Amid this shift in Bitcoin’s price movement, market analysts are closely examining whether there is still potential for further gains.

Yonsei Dent, a CryptoQuant analyst, offered his insights about the current state of Bitcoin, with an emphasis on the MVRV ratio – a key indicator in the chain that compares the realized value with the market value, thus providing a measure of over- or undervaluation of the market.

Dent highlighted that peaks in the MVRV ratio have often coincided in previous market cycles market tops. For example, in 2013, 2017, and 2020, the peaks of Bitcoin’s market cycle aligned with a downward trend line observed in MVRV.

Source: CryptoQuant

Dent then noted that while the MVRV ratio peaked at 2.78 in March 2024 – just below the historical downtrend line – it has since recovered to 2.6 in the wake of Bitcoin’s recent rally.

He pointed out that a monthly moving average gold cross above the annual moving average indicates potential upside momentum.

While it remains uncertain whether the MVRV will reach the 2.9-3.0 range, this suggests that Bitcoin may still have some room for further price gains.

Key statistics that indicate Bitcoin’s next steps

In addition to analyzing the MVRV ratio, it is crucial to examine other key Bitcoin metrics to gauge the asset’s prospects.

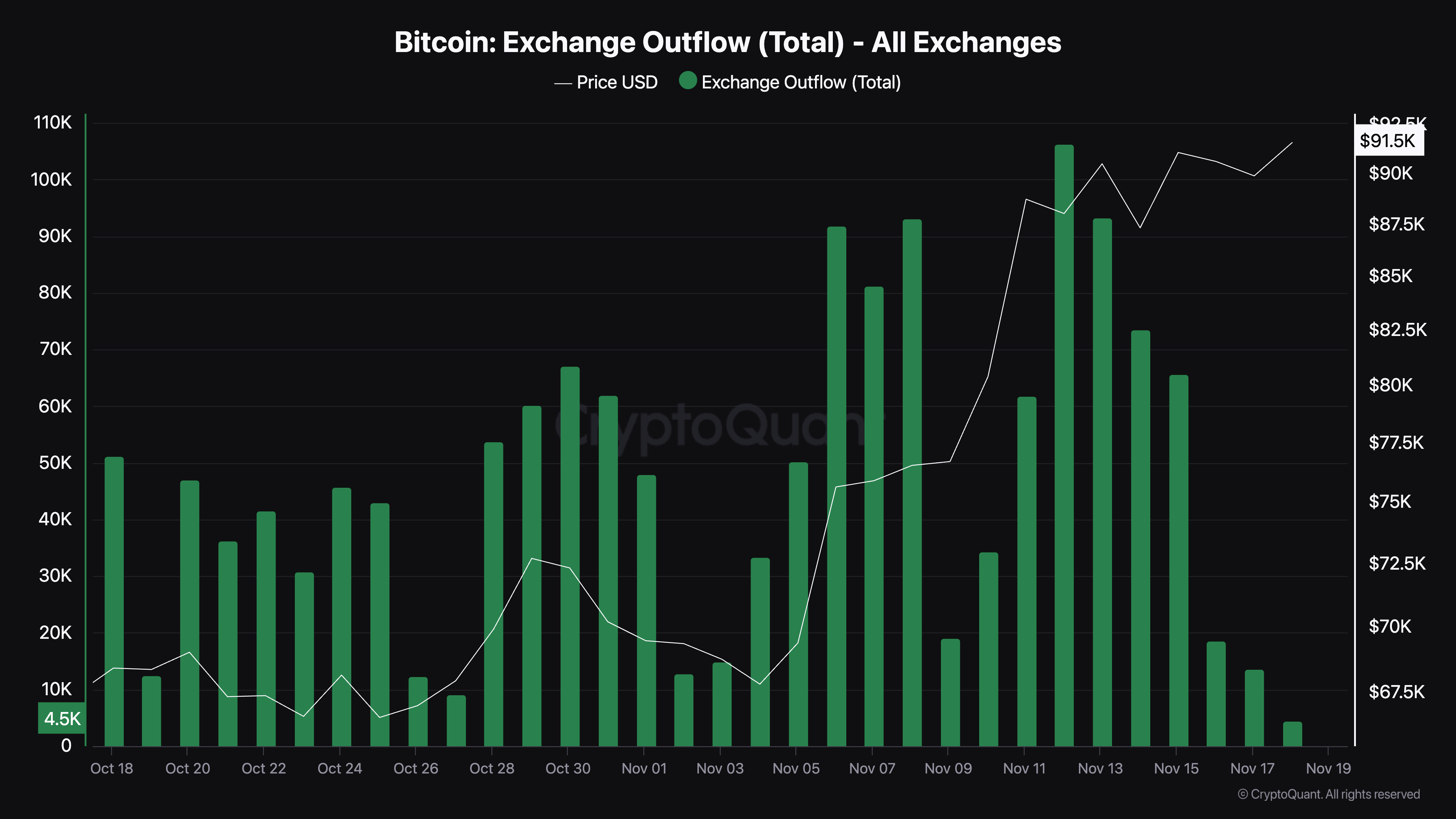

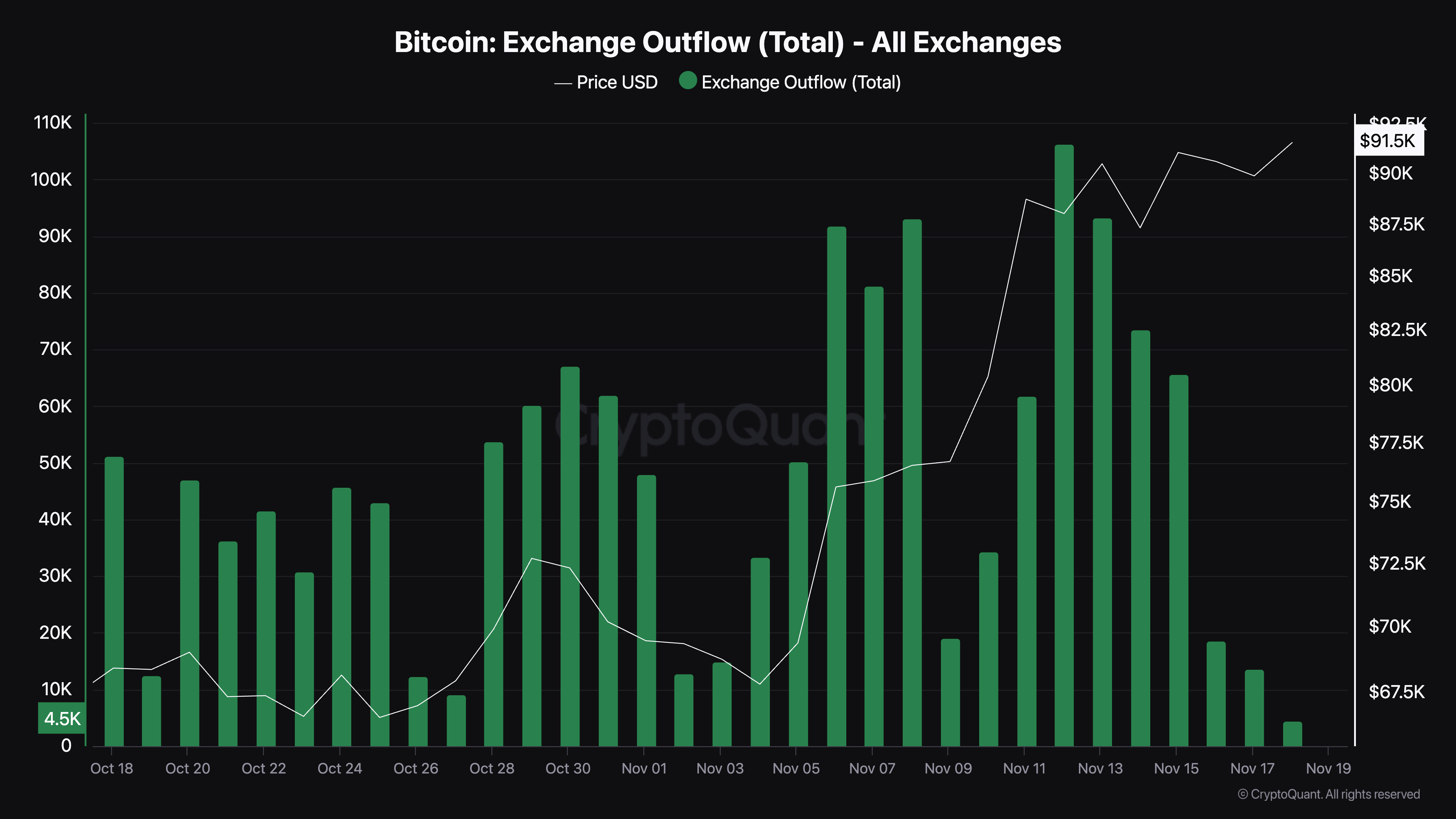

According to facts from CryptoQuant, Bitcoin outflows have consistently risen alongside the price over the past week. However, this trend appears to be slowing down at the start of the new week.

Specifically, the total outflow of BTC from the exchanges on Sunday, November 17, amounted to approximately 13,617 BTC – a notable drop from the over 30,000 BTC recorded the previous Sunday.

Source: CryptoQuant

This drop in outflows could indicate a shift in investor sentiment, which could indicate that market participants could pause their accumulation or hold off on withdrawing assets from the exchanges.

Such a development could reflect caution among investors and signal a period of consolidation or reduced demand pressure.

Another metric worth examining is Bitcoin’s open interest reported from Coinglass. Bitcoin’s open interest has risen 2.76% to reach a current valuation of $56.22 billion.

Source: Coinglass

This increase corresponds to an increase in Bitcoin’s open interest volume, which rose 16.42% to $61.83 billion. An increase in open interest indicates growing participation in the market, often due to increased trading activity and investor interest.

Read Bitcoin (BTC) price prediction 2024-25

However, an increase in open interest, especially in the futures market, can also bring potential volatility.

As more traders take derivatives positions, the market may experience sharp price movements in response to major developments or shifts in sentiment.