- Historically, halvings have resulted in bull markets for Bitcoin.

- As BTC became scarcer, investors showed more willingness to HODL.

As optimism surrounding the first-ever spot exchange-traded funds (ETFs) in the US reaches a fever pitch, Bitcoin [BTC] once again has a strong bullish story to look forward to in 2024.

There are no prizes for guessing: it’s coming halving event due in April. This quadrennial event halves miners’ block rewards, eliminating the number of tokens in circulation and potentially increasing demand for the reduced supply.

Halvings have proven to be bullish events

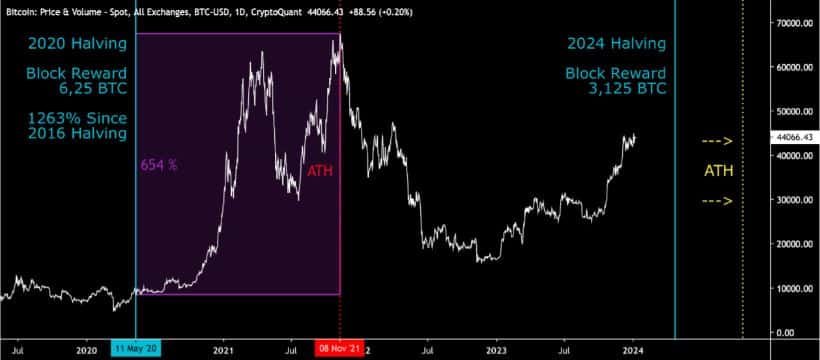

If history is anything to go by, these events preceded periods of high returns. An analyst from CryptoQuant drew attention to the different periods in history when Bitcoin’s price was heavily affected by the cyclical event.

If we don’t go back too far, the King Coin rose 1263% between the 2016 and 2020 halvings. Before that, Bitcoin witnessed a 5187% increase during the 2012-2016 phase.

Source: CryptoQuant

Another important takeaway from these historical numbers was how much Bitcoin rose from the halving to the subsequent peaks.

From the period between the last halving in 2020 and the all-time high (ATH) in November 2021, Bitcoin grew by 654%. Similarly, Bitcoin rose 2922% between 2016 and its 2017 peak.

After observing these trends, the analyst said:

“You can say that halving events act as a catalyst for price increases, both before and after the event.”

Meanwhile, there were other indicators that reflected investors’ bullish sentiment around the halving.

Investors are piling in ahead of the halving

A popular crypto analyst Kashif Raza revealed that investors were holding more Bitcoin than what was freshly mined in a month. He noted that such a development was unusual and had not occurred much in the past.

Investors received more Bitcoin than they mined in a month, for the first time since December.

This tells us a lot about how people use and hold their Bitcoin.

.. pic.twitter.com/nzK6TWUFde

— Kashif Raza (@simplykashif) January 8, 2024

The stored supply exceeding new issuance in a pre-halving environment reflected a shift in their strategy – a strategy that likely had a lot to do with Bitcoin becoming scarce and difficult to buy back once sold.

But as things stand now, the crucial element will still take more than three months. The immediate focus for Bitcoin and the broader crypto market remained the yet-to-be-approved ETFs.

Market observers and ETF issuers in the US pinned their hopes on Wednesday as the turning point day.

How much are 1,10,100 BTCs worth today?

Is the general public in the US enthusiastic?

But while US institutional interest in Bitcoin ETFs peaked, individual investors weren’t too enthusiastic.

This is evident from a study by cryptomarket tracker Coin geckothe US ranked 12th among the countries most interested in Bitcoin ETFs. In fact, US interest rates were less than half of Luxembourg’s.

Source: CoinGecko

This is an intriguing development, as US ETFs have the ability to change the way crypto is viewed globally. Such lower interest could be cause for concern, but at this point it is too early to say anything.