- Valkyrie, an institutional fund, has been accepted by the SEC for an official review of its ETF proposal.

- Short sellers, who are dwindling in number, are beginning to hedge their short positions as the likelihood of bullish momentum increases.

The running Bitcoin [BTC] ETF saga has been a topic of great interest for institutional investors eagerly awaiting SEC approval. In addition to the competition, Valkyrie, an institutional fund, recently joined the race to launch a Bitcoin ETF.

Read Bitcoin [BTC] Price forecast 2023-2024

With multiple players vying for approval, the outcome of the SEC’s decision remains highly anticipated and could have significant implications for the cryptocurrency market.

The race to the top is becoming increasingly competitive

According to the SEC’s listing, Valkyrie’s proposal for a mock Bitcoin ETF entered the official role on July 17.

This is the second Bitcoin ETF proposal under consideration by the SEC, with BlackRock’s proposal being published just a few days prior on July 13.

Valkyrie’s current filing is their second attempt to launch a spot Bitcoin ETF in the United States, having previously proposed listing the Valkyrie Bitcoin Trust on the New York Stock Exchange in January 2021.

The listing of the proposal on the SEC’s official calendar marks the beginning of the commentary period, a critical step in the regulatory process. During this period, the public and other institutions can express their views on the ETF. They can also address the potential impact on the market.

The SEC has set a deadline of 21 days from the date of filing in the Federal Register for comments to be submitted. At the end of the comment period, the SEC will review the ETF proposal and may request additional information from applicants before making a decision.

Bears start to shy away

The hype around ETFs and the strong interest from institutions have made short sellers more cautious.

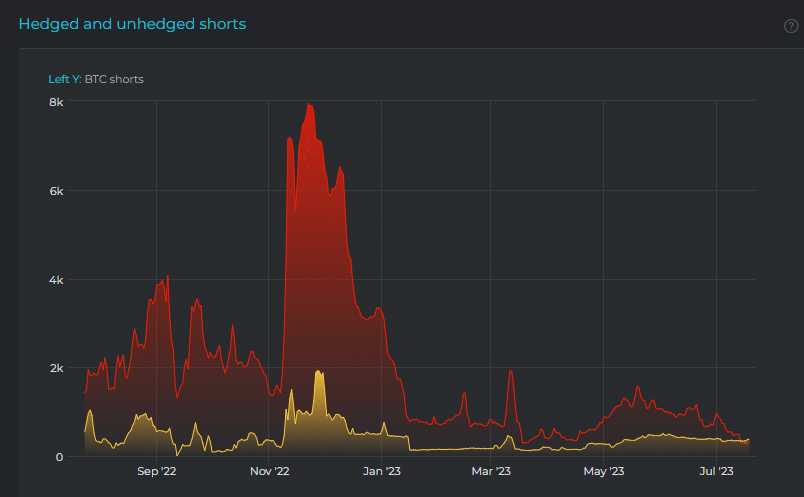

Based on recent data, short interest in the market has bottomed out so far this year. In addition, hedged short positions have surpassed uncovered short positions for the first time.

Is your wallet green? Check out the Bitcoin Profit Calculator

For context, hedged short positions include the use of risk management strategies, such as options or other derivatives, to offset potential losses from short positions. On the other hand, unhedged short positions are more exposed to market fluctuations and carry higher risks.

The fact that hedged short positions have overtaken uncovered short positions for the first time indicates that traders are becoming more cautious and looking for ways to protect their short positions against a possible rise in the price of BTC.

Source: Datamish