Bitcoin Spot ETFs are aiming for a new all-time high after an incredible start to the new week. The price of BTC has risen 8% in the past day, creating euphoria in the market. There could be a number of factors behind this; However, institutional investors appear to be playing a major role as daily inflows continue to rise.

Find out that Bitcoin ETF inflows exceed $400 million

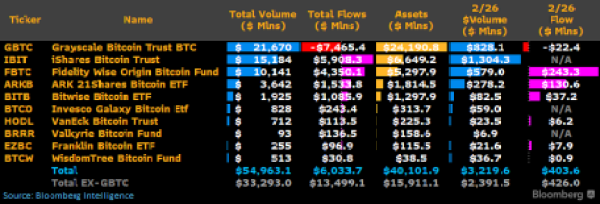

According to Bloomberg analyst James Seyffart, Spot BTC ETF inflows are not slowing down. In a screenshot shared By Analyst Tuesday, Seyffart revealed that inflows into Spot BTC ETFs rose above $400 million.

The image shows that the Fidelity Wise Origin Bitcoin Fund leads the way with inflows of $243.3 million, accounting for more than 50% of total inflows. The ARK 21Shares Bitcoin ETF follows with a significant inflow of $130.6 million. The third largest inflows into a single fund for the day were recorded in the Bitwise Bitcoin ETF, which saw inflows of $37.2 million.

Source: X

Other funds, including the Franklin Bitcoin ETF, VanEck Bitcoin Trust, and the WisdomTree Bitcoin Fund, all saw small inflows of $7.9 million, $6.2 million, and $0.9 million, respectively. In total, inflows to all six funds amounted to $426 million.

However, the Grayscale Bitcoin Trust (GBTC) continues to bleed during this period, with an outflow of $22.4 million in a 24-hour period. This brought total net flows to $403.6 million. At the same time, funds such as the iShares Bitcoin Trust, the Invesco Galaxy Bitcoin ETF, and The Valkyrie Bitcoin Fund all saw negligible inflows during this period.

On the hunt for a new record

The inflows into the Bitcoin Spot ETFs over the past day are a testament to the demand these products are receiving from the market. As institutional investors gain more exposure to BitBTCcoin, demand is expected to rise, especially as the BTC price continues to perform well.

The inflow volumes, while not the largest single day inflows to date, are significant compared to others. For example, Seyffart points out that the daily record dates back to the first day of trading, when inflows reached as high as $655 million. The second largest single-day net flow was recorded earlier this month, on February 13, at $631 million. “A big day from $IBIT could take us past that Day 1 record,” Seyffart said declared.

At the time of writing, the BTC price is experiencing a retracement after reaching a new 2-year high of $57,000. According to data from CoinMarketCap, it has seen a gain of 8.58% in the last 24 hours to trade at $55,900.

BTC price establishes support above $56,000 | Source: BTCUSD on Tradingview.com

Featured image from U.Today, chart from Tradingview.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.