- Relatively smaller Bitcoin addresses start accumulating BTC as prices rise.

- Profitability remained low, reducing the likelihood of a short-term sell-off.

Since Bitcoin[BTC] passed the $70,000 mark and subsequently witnessed a correction, speculation about what will happen next to the coin has flooded the cryptosphere.

Crabs and fish take the cake

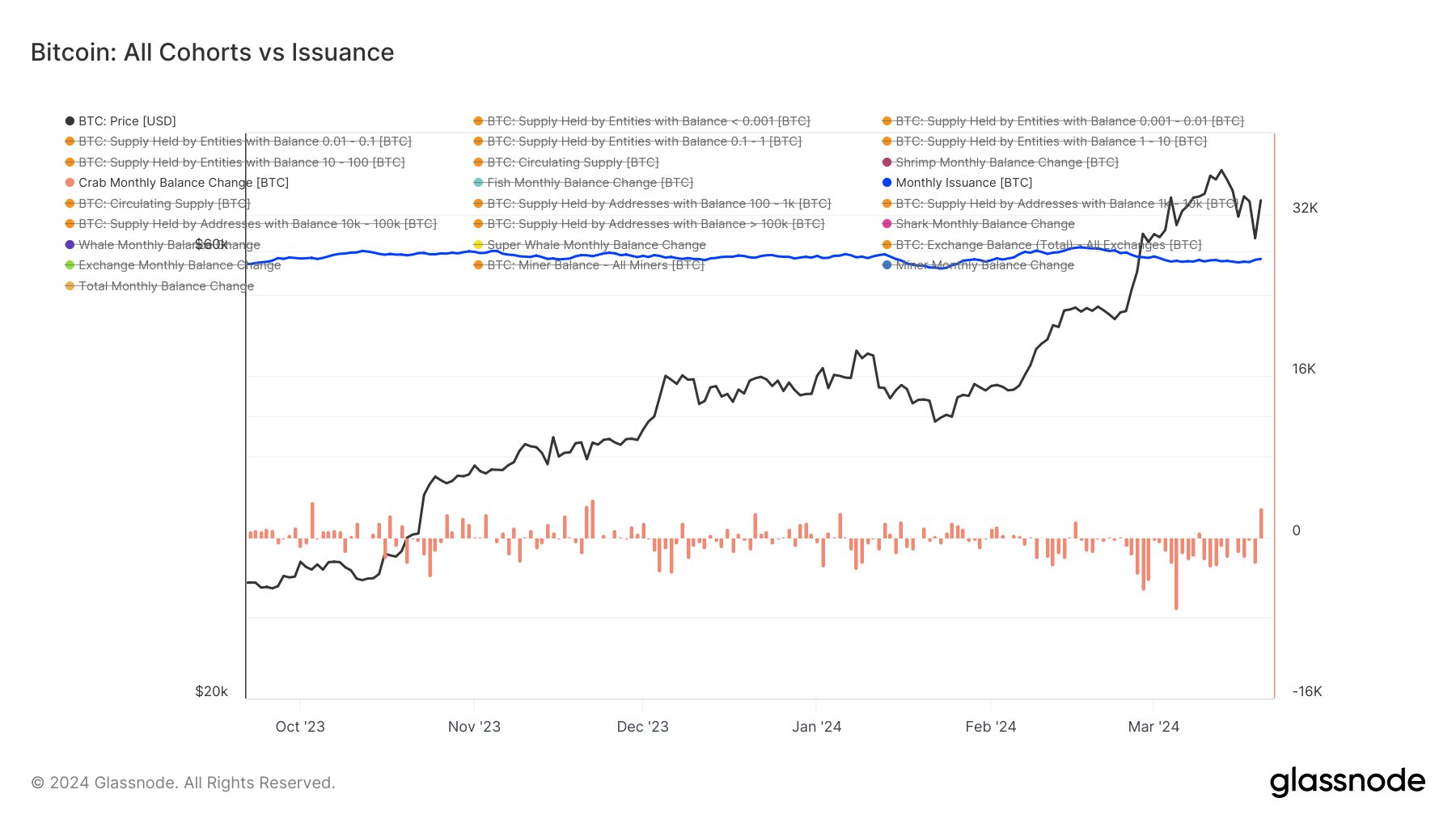

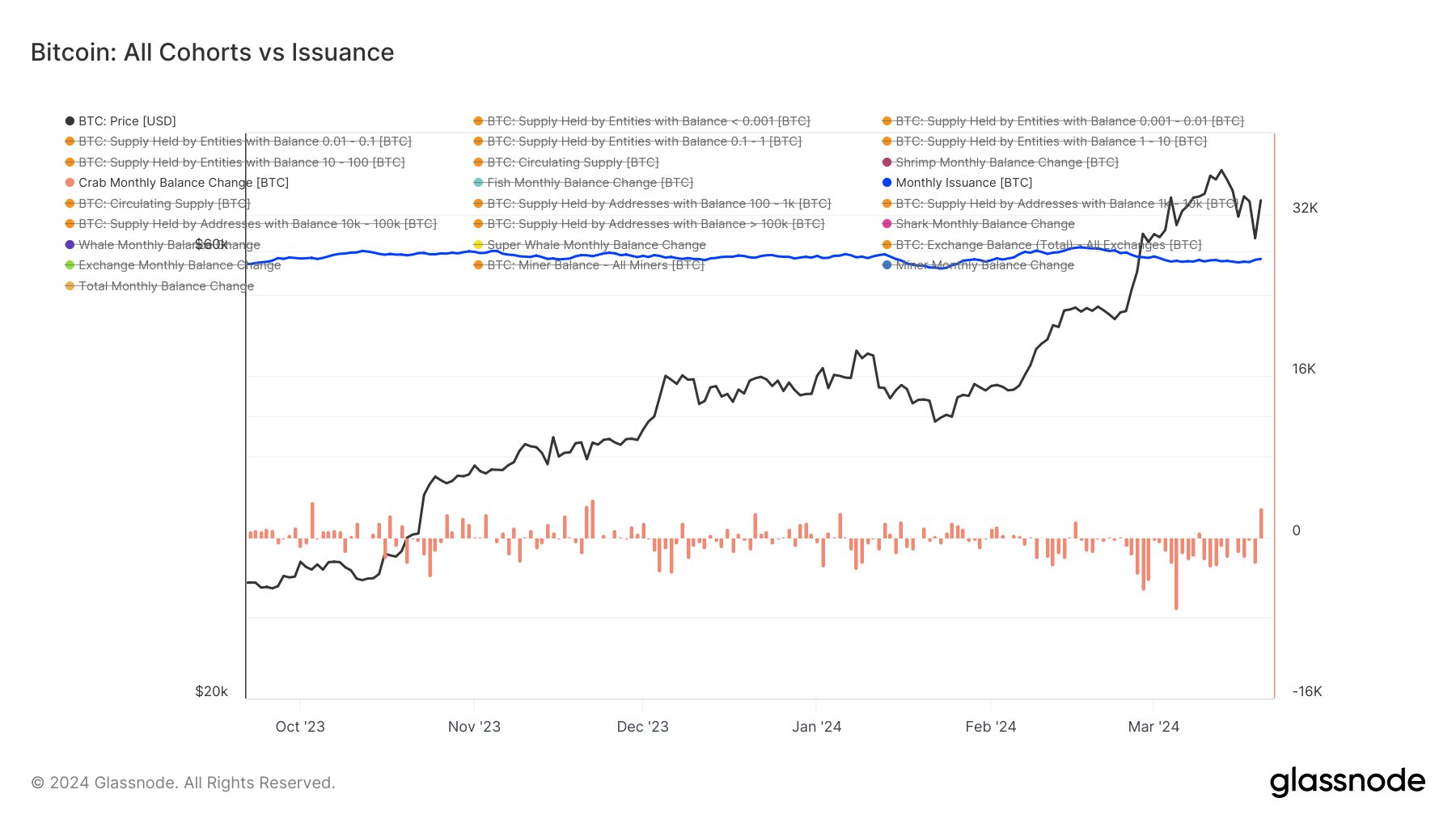

Bitcoin’s price may rise due to the behavior of two different groups of holders, known as ‘crabs’ and ‘fish’. These terms refer to holders with Bitcoin holdings ranging from 1 to 10 BTC for crabs and 10 to 100 BTC for fish.

Recent observations suggest a possible regime change among these holders, transitioning from a distribution to accumulation phase.

Both crabs and fish have experienced the highest levels of accumulation since November 2023. Moreover, there is evidence that even smaller holders, holding 0 to 1 BTC, are joining this accumulation trend, as shown by recent data.

While this accumulation broadens the investor base, it also concentrates assets among these medium-sized investors, which could lead to more centralized control of the market compared to a scenario with a broader spread of smaller assets controlled primarily by whales.

Source:

Some challenges ahead

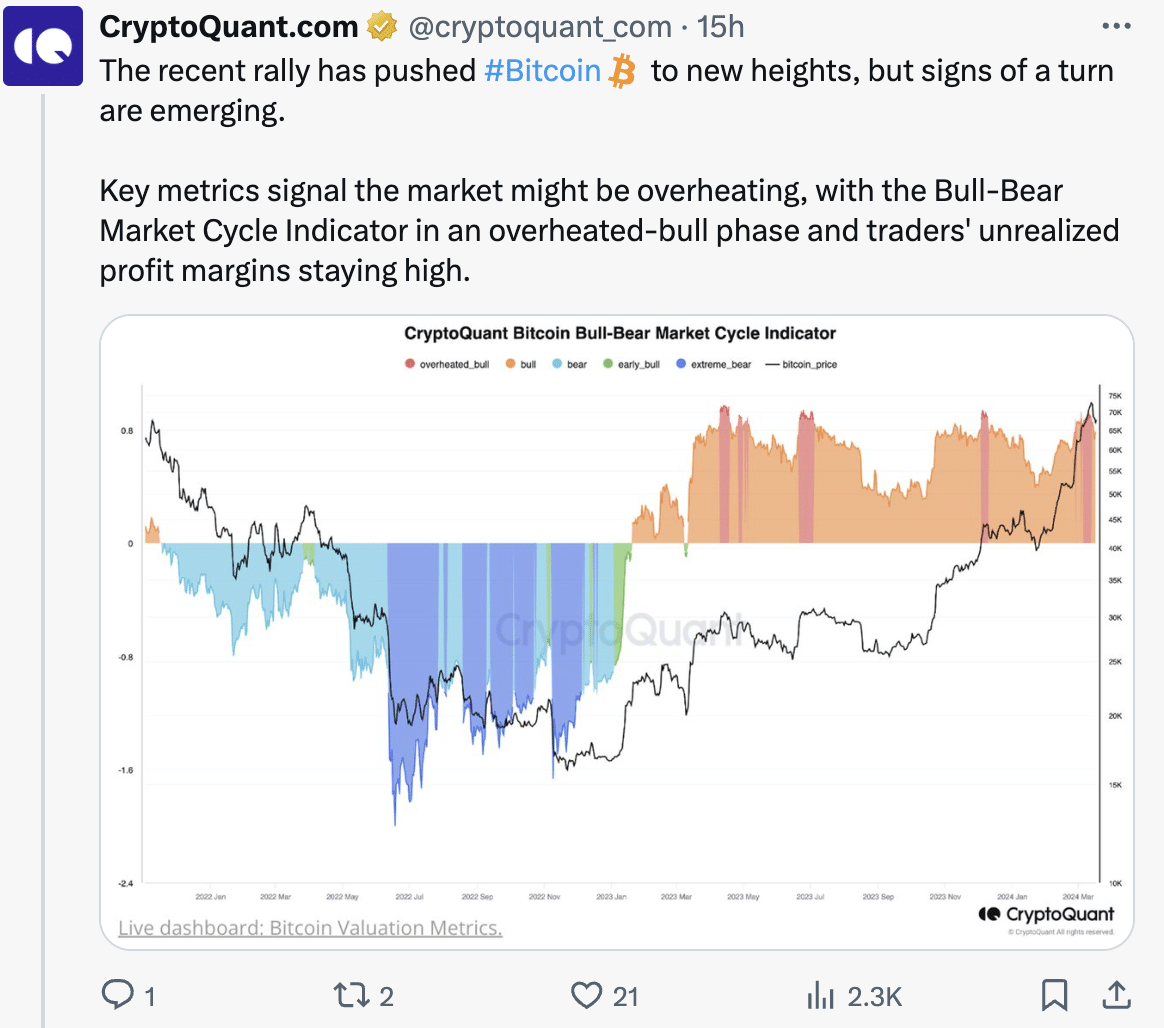

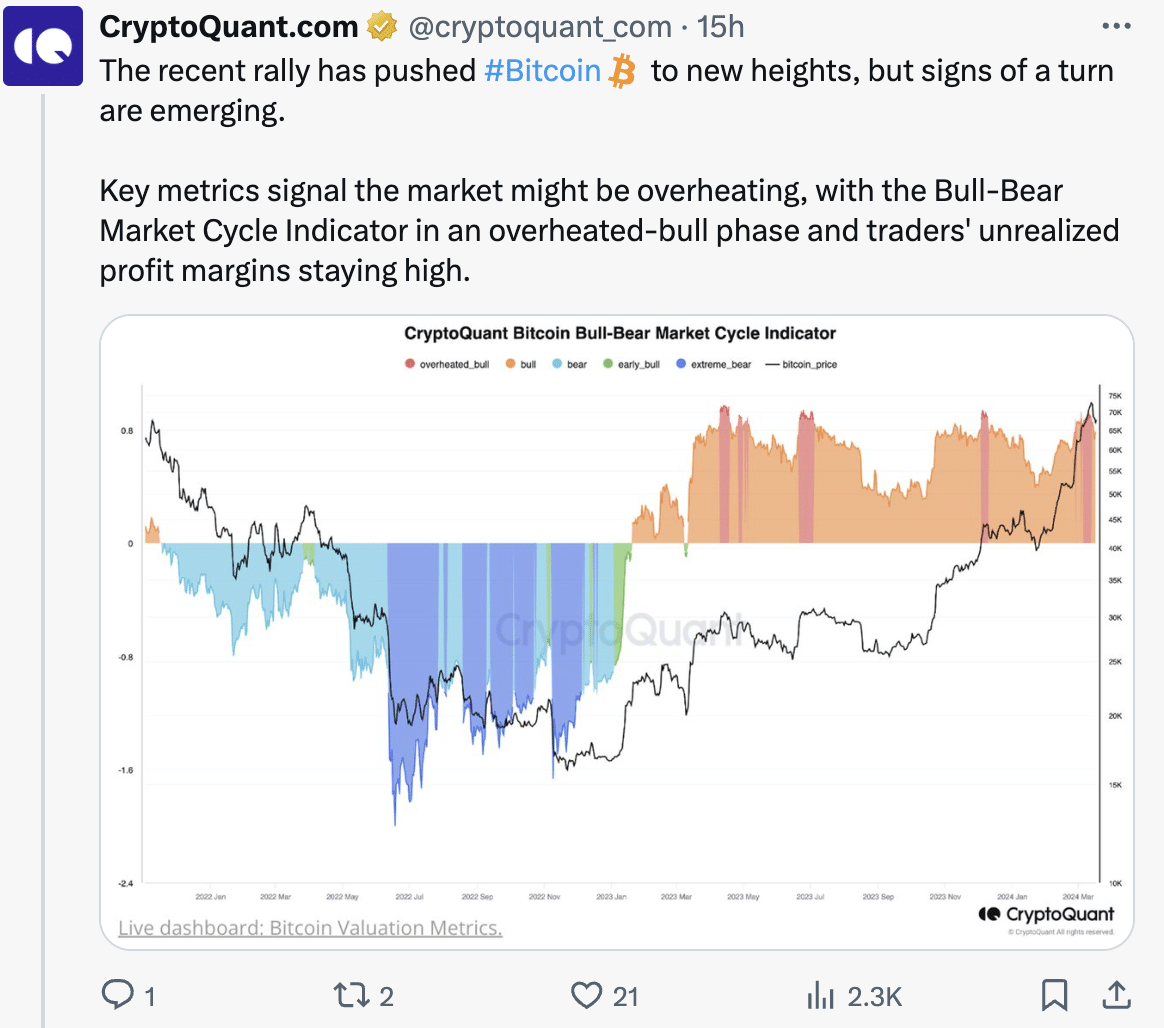

However, key figures indicated that the market may have overheated, as shown by the Bull-Bear Market Cycle Indicator. It entered an overheated bull phase and traders maintained high unrealized profit margins.

After this, selling began among BTC traders, taking advantage of these high profit margins. This sales scale had not been observed since May 2019.

Additionally, major Bitcoin holders intensified their selling activities, while miners also began divesting their holdings amid rising prices.

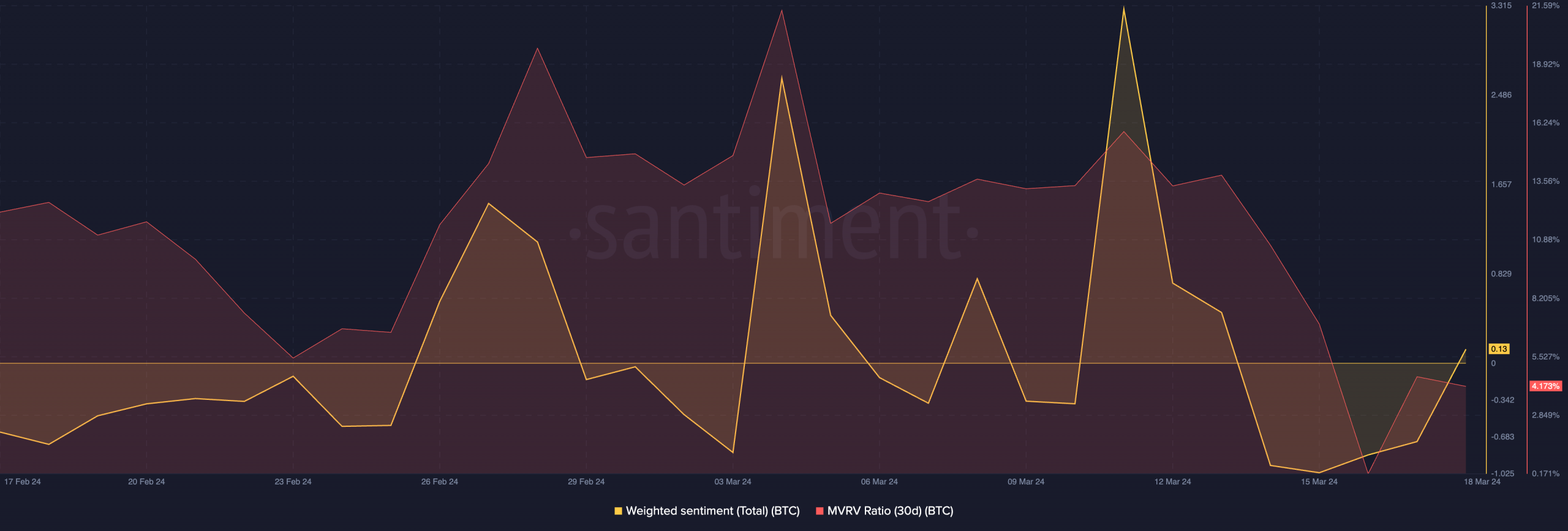

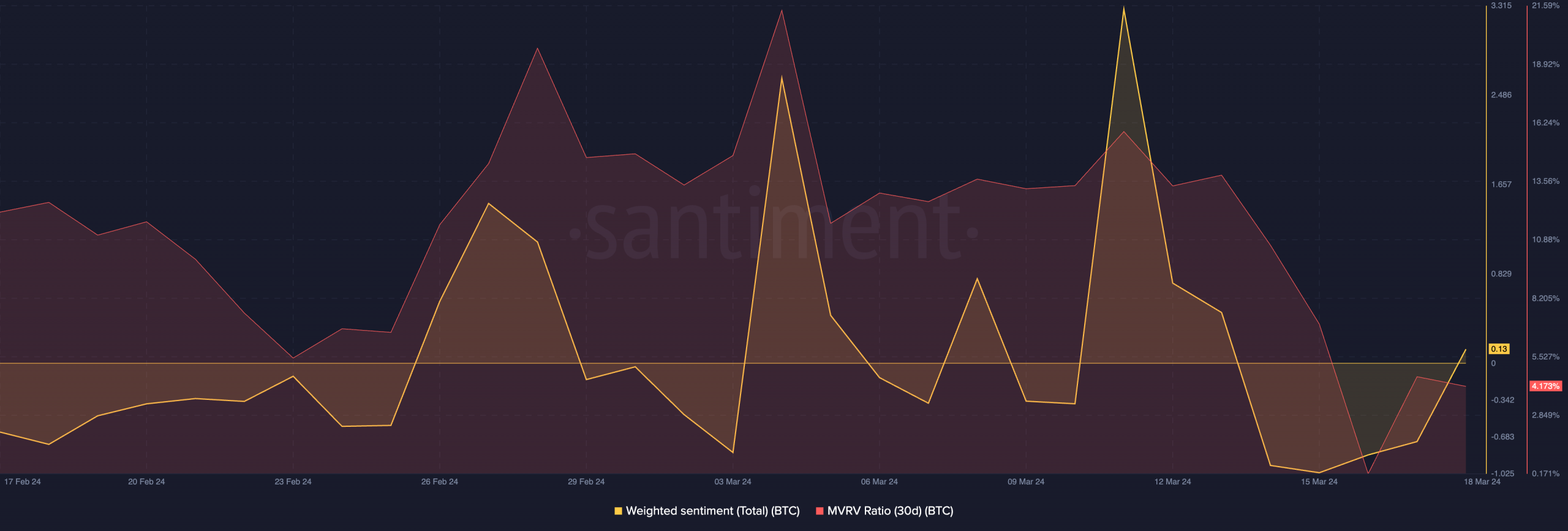

Source:

These factors could negatively impact BTC’s journey past the $70,000 mark. At the time of writing, BTC was trading at $64,749.87 and the price had fallen 3.44% over the past 24 hours.

Realistic or not, here is the market cap of BTC in ETH terms

Interestingly, the MVRV ratio had remained low, meaning many holders were still unprofitable. The low MVRV ratio suggested that the current price increase may have been driven by new entrants who have yet to see any gains.

This makes it much more likely that BTC will reach $70,000 as profits will not be possible at current levels. However, sentiment could change as prices rise above $70,000 and the likelihood of a correction would also increase.

Source: Santiment