- Long-term holders have started distributing their coins.

- Data from the chain suggested that Bitcoin was overheating.

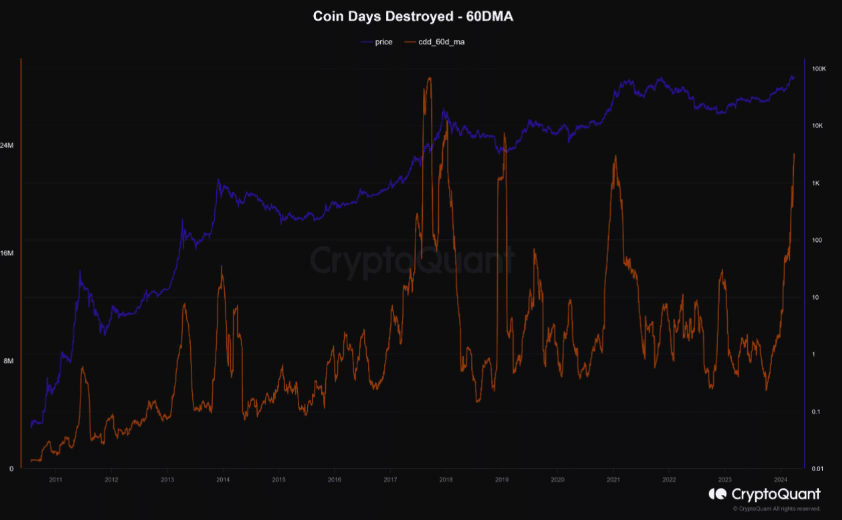

Bitcoins [BTC] Coin Days Destroyed (CDD) has hit a five-year high, according to data from CryptoQuant. Maartunn, author of the on-chain analytics platform, also discussed this in a recent piece.

Coin Days Destroyed measures the number of days Bitcoins have been inactive multiplied by the volume traded.

Historically, when the CDD peaks at the 60-day moving average (MA), it means long-term holders are distributing their coins.

Source: CryptoQuant

When this happens, Bitcoin experienced a significant correction. Maartunn, also in his post admitted it says,

“This pattern indicates that a distribution of older coins is taking place during the bullish phase. In historical contexts, it could take up to five months for Bitcoin to reach its peak.”

Cut in the middle

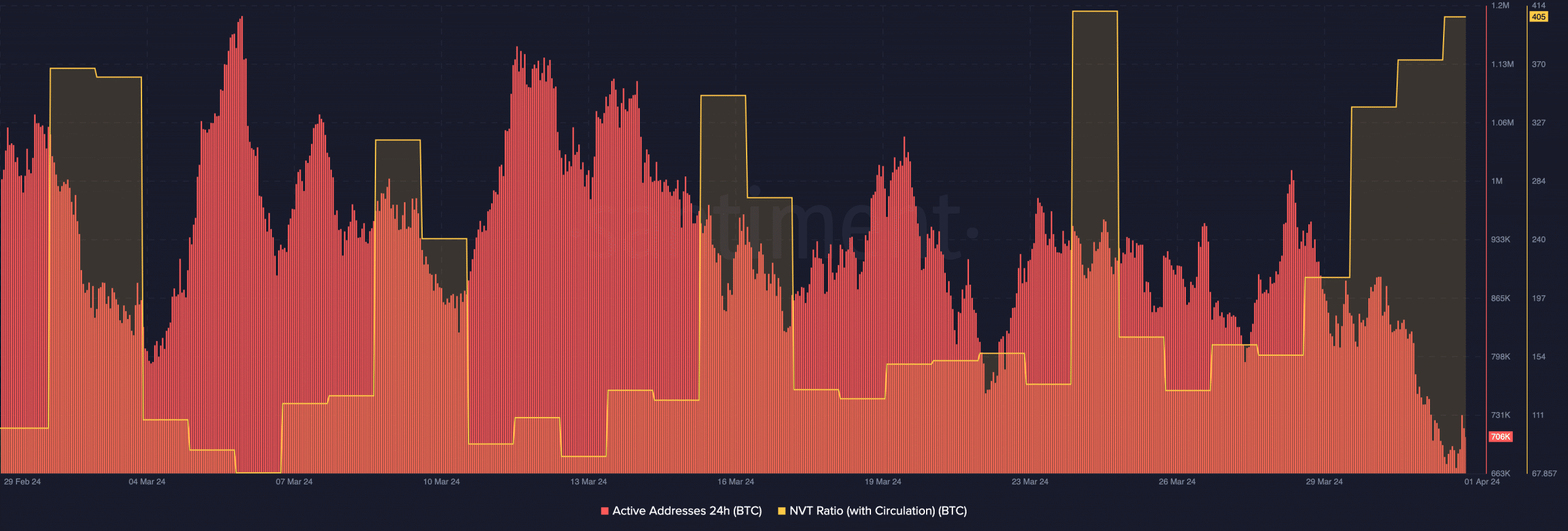

At the time of writing, BTC was changing hands at 69,663, indicating that the coin has been moving sideways over the past 24 hours. Further insights into Bitcoin’s on-chain status showed that activity on the network had decreased.

At the time of writing, there were 706,000 24-hour active addresses. A few days ago the value was above 1 million. Therefore, the recent decline implies that BTC’s successful trades have declined.

If the network does not have impressive activity, the price may be affected as demand may be low. If this is the case, Bitcoin’s price could fall below $69,000.

In addition to the active addresses, also AMBCrypto watched based on the Network Value to Transactions (NVT) ratio. This metric indicates whether an asset is overvalued or undervalued, depending on its coin trading capacity.

A low NVT ratio indicates that transaction volume is growing faster than market capitalization. In this case, investor sentiment could be called bullish.

Source: Santiment

However, Bitcoin’s NVT ratio was high at 405, indicating that investor sentiment was bearish. This relatively high network ratio was a sign that BTC was overvalued given current market conditions.

It’s here or there

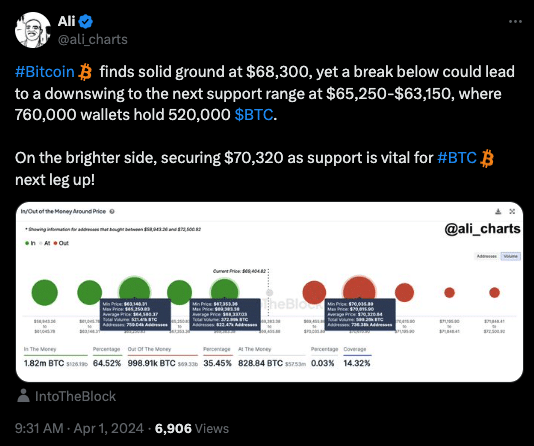

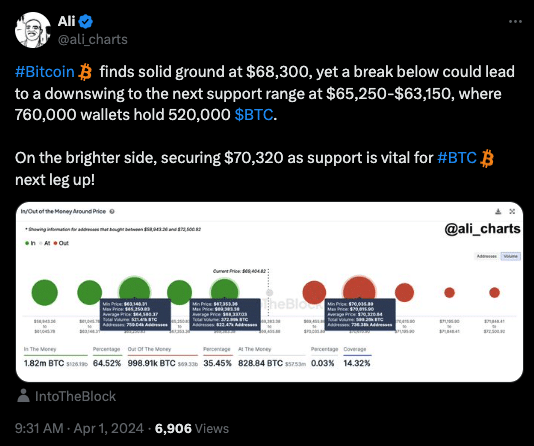

Crypto analyst Ali Martinez also shared his short-term view on Bitcoin in a post on X (formerly Twitter).

According to Martinez, the price of the coin could drop to $63,150 if the bulls fail to hold the $68,300 support.

On the other hand, the analyst said Bitcoin’s price could move higher if the coin retests $70,320.

Source:

It appears that Bitcoin’s price could fall before the halving, which takes place on April 19. History has it that the coin experiences high volatility as the halving approaches.

Is your portfolio green? Check out the BTC profit calculator

This time may be no different. But it looked like Bitcoin was almost done with its pre-halving rally, and a recession could be next.

In the meantime, BTC could surpass the $70,000 region this cycle. However, current circumstances suggest that this could not happen until after the four-year event.