- BTC STHs can be panic-sold In response to the recent news about the Bybit -Hack.

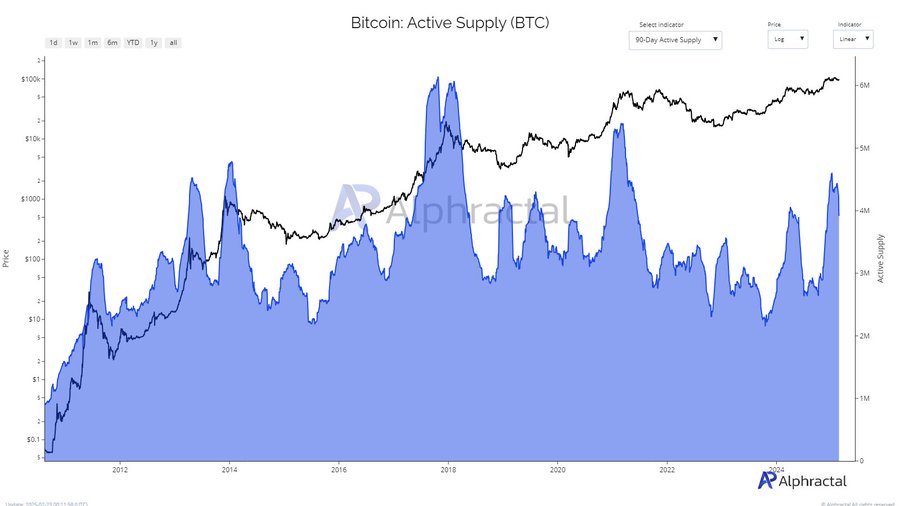

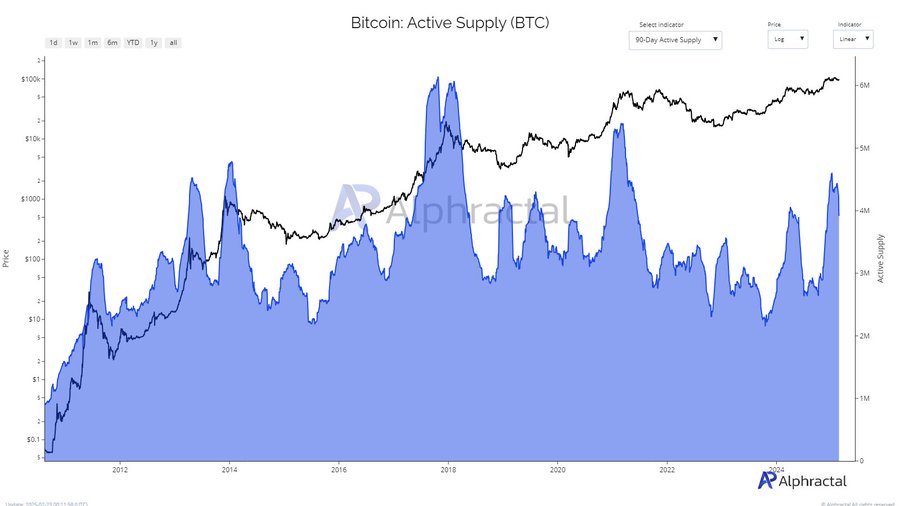

- Analysis of the active diet of 90 days reflected a remarkable decrease in recent months.

In the last 24 hours, Bitcoin [BTC] Experienced remarkable volatility. Short -term holders (STHS) realized substantial losses, probably driven by panic sales after the Bybit Hack News.

BTC’s 4-hour graph also showed significant bearish indicators in the past 16 hours.

The exponential advancing average (EMA) Cross showed a bearish crossover, in which the EMA of 9 periods under the EMA of 26 periods fell around hour 14, which a downward momentum indicates in the short term.

This was tailored to the price fall from BTC to $ 96,259.9, which marked a decrease in a -0.12% compared to the previous period.

Source: Coinglass

The relative strength index (RSI) was 46.05 and reflected a neutral but somewhat bearish prospect.

This RSI level suggested that BTC remained in a consolidation phase, without clear overbought or over -sold circumstances. If it returns above 50, Bullish sentiment can return, to support price repair.

The cumulative volume -delta (CVD) also showed a net volume delta of -94.67K, which reflects a strong sales pressure in the last 8 hours.

These signals jointly intelligate capitulation, in which STH’s BTC discharged, which may formed a local soil in the short term as the sales pressure decreased.

Panic sales peaks: What is the turning point?

The profit and loss of the short -term holder (P&L) to exchange the Somgraphic for the past 24 hours also emphasized considerable losses in STHs.

The dominance of red bars, which peaked at -43.9k BTC, indicated that heavy panic was sold at around $ 90k to $ 95k after the Bybit Hack News.

Source: Cryptuquant

The STH profit line remained minimal and strengthened the idea that few traders saw profit in the short term. Similar trends took place in the early 2022, where highly realized losses preceded the short -term prices.

This data suggested a potential local soil, because a needy sale often exhausts down momentum, creating a possible purchase window for traders.

BTC’s liquidity change

Analysis of the 90-day active food diagram for BTC, with 2012 to 2025, reflected a remarkable decrease in recent months. From the beginning of 2025, the active food floated around 4m BTC, by the end of 2024 against 6m BTC.

Source: Alfractaal

This metric indicated a decrease in commercial activity. Normally, increasing active offer suggests a higher demand and bullish sentiment, while the signal distribution and reduced interest rates decrease.

The current trend implied StHs was largely abandoned, which may reduce the sales pressure.

This pattern reflected 2018, when the falling active diet preceded price stabilization, to support the capitulation hypothesis and to strengthen soil formation in the short term.

A sign of strength or further deterioration?

Deep analysis showed that BTC Netflow -graph for aggregated fairs brought to light in the past 24 hours in the last 24 hours in the last three months in the past three months in the past three months in the past three months.

This was a significant reversal of the average inflow of the +226.57 BTC last week and the average of 30 days of +1.29 K BTC inflow.

Source: Intotheblock

A sudden negative Netflow usually indicates that holders BTC withdraws to Off-Exchange portfolios, which suggests that a reduced sales pressure.

This pattern seemed like mid-2021, when large BTC outflows preceded price rebounds. In addition, the 24-hour Netflow change of +269.71 BTC renewed purchase interest suggested.

Concluding, capitulation events, such as heavy loss of holders in the short term and falling exchange rate network flows, prior to short-term recovery prior to short-term.

Although volatility remains in the short term, long -term indicators suggest a possible shift to recovery as the sales pressure decreases.