Nearly every Bitcoin investor expects continued price appreciation as the crypto continues to trade around the price of $70,000. Data from the chain has shown that much of this increase can be attributed to the accumulation by large whales.

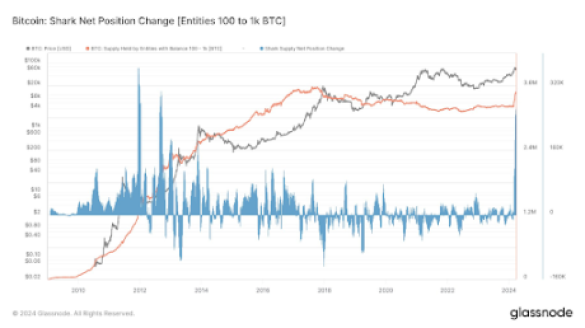

Bitcoin is undoubtedly home to many of these whale addresses with hundreds of millions of dollars and transactions that can move the market. However, on-chain data has further shown that the accumulation trend has also filtered down to the next cohort of traders. These traders, also known as ‘Sharks’, are addresses that hold between 100 BTC and 1,000 BTC. According to data from Glassnode, Shark Wallet addresses have accumulated 268,441 BTC in the last 30 days, which is the largest net position change since 2012.

Increased accumulation of BTC

According to a Glassnode diagram shared on social media by crypto analyst James Van Straten, Bitcoin accumulation by shark investors skyrocketed in 2024 to reverse a multi-year consolidation since 2020. As a result, these addresses increased their holdings by 268,441 in 30 days, roughly converting to $18 billion.

Although these sharks do not have as much individual power over price movements as very large whales, their collective behavior is still worth monitoring because they are also linked to the sentiment among investors. Consequently, this large accumulation trend could lead to more purchases, which would indicate a continued price increase for Bitcoin.

Source: Glassnode

The increase in accumulation is not really surprising considering the launch of Discover Bitcoin ETFs in the US has led to a larger wave of accumulation sentiment among all cohorts of Bitcoin investors. As another analyst on social media noted, this shark accumulation could be due to ETFs buying huge amounts of Bitcoins from Coinbase OTC desks.

Bitcoin whales (addresses holding more than 1,000 BTC) have also increased their activity in recent days, indicating strategic positioning in the market. Several transaction alerts from Whale Alerts have shown strategic movements from whale addresses.

Notably, the crypto whale transaction tracker revealed that $1.3 billion worth of BTC was exchanged between whale addresses in the last 24 hours. Among these major BTC moves was a notable transfer of 3,599 BTC worth $252 million between two unknown wallets. Another notable transaction was the transfer of 3,118 BTC from an unknown wallet to Coinbase Institutional.

Bitcoin to $100,000?

Data from IntoTheBlock has also echoed this accumulation trend with the net transfer trend from exchanges. Data from the ITB platform shows an outflow of $16.18 billion from the stock markets, compared to an inflow of $15.76 billion in the last seven days. Bitcoin is now trading at $67,931 and has failed to stabilize above $70,000 again.

The accumulation of whales and sharks, increasing interest from institutional investors through Spot Bitcoin ETFs, and the is approaching halving all point to the possibility of a substantial price increase to $100,000.

BTC price at $70,000 | Source: BTCUSDT on Tradingview.com

Featured image from BBC, chart from Tradingview.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.