Bitcoin has seen a pullback, but not to the extent that bears expected. Nevertheless, as a result, many traders suffered huge losses as Bitcoin staged another unexpected recovery. Loss volumes have risen rapidly to $190 million in one day as uncertainty remains the order of the day.

Crypto liquidations reach $190 million

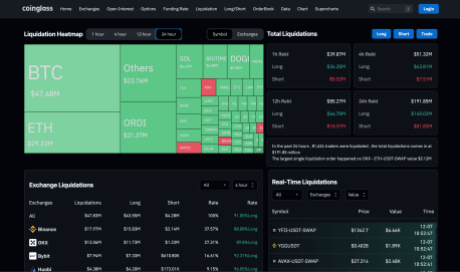

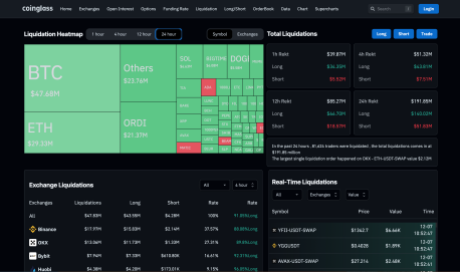

According to facts from Coinglass, 24-hour crypto liquidation volumes quickly rose above $190 million as Bitcoin completed a shakeout. This started with the price drop to the $43,600 area. And then a quick rise back to $44,000 completed the move.

After this, traders on both sides quickly found themselves taking losing positions, and liquidations piled up. In total, more than 81,000 traders ended up in the red, leading to more than $190 million in losses. Interestingly, the majority of these came from long trades, betting on the price to continue to rise.

Source: Coinglass

Coinglass estimates that 73.74% of the past day’s total liquidations came from long traders, meaning around 45,000 traders were long this time around. The largest liquidation event was recorded on the OKX crypto exchange for the ETH-USDT-SWAP pair, which was valued at $2.12 million at the time of liquidation.

There was also a newcomer in the top 3 in terms of liquidation volumes. Naturally, Bitcoin and Ethereum led the pack with liquidation volumes of $47.12 million and $29.16 million. However, ORDI came in third with $21.64 million in liquidations in 24 hours.

Long Traders in Trouble as Bitcoin Tanks

Long traders have continued to be hit hard by the liquidations over the past day, and the tide has yet to turn against the bears. Now that Bitcoin’s price has briefly dipped below $43,000 and rebounded towards $43,400, long liquidations are still piling up.

As of this writing, short liquidations made up 91.05% of the approximately $47.83 million in liquidations recorded in the past four hours. This four-hour liquidation trend is also led by the same top three, including Bitcoin, Ethereum and ORDI, all of which have seen a lot of volatility over the past week. If Bitcoin’s recovery continues to exhibit high volatility, these liquidation volumes will continue to rise.

The majority of liquidations occurred on both the Binance and OKX exchanges at $82.56 million and $60.51 million respectively. ByBit Exchange ranks third with $27.05 million in liquidations in the past day.

Bitcoin is currently struggling to hold support above $43,000, which explains why the liquidation trend has increased in recent hours. However, the bulls are still ahead and continue to dominate as sentiment is still firmly in greed.

BTC exhibits high volatility | Source: BTCUSD on Tradingview.com

Featured image of Coin Culture, chart from Tradingview.com