- Bitcoin’s price crossed $67,000, signaling a further bull rally

- Several metrics also seemed bullish for the cryptocurrency

While Bitcoins [BTC] Since the price was in a consolidation phase, short-term holders sold a significant amount of BTC on exchanges at a loss. However, the sudden sell-off could be good news for BTC as it could help spark a bull rally in the coming days.

Short-term holders sell Bitcoin

Alex, recently a popular crypto analyst shared an interesting development regarding short-term holders. According to the tweet, from March 19 to April 4, STHs sold 106.8k BTCs at a loss on the exchanges.

Here it is interesting to note that STH’s also sold BTC at a loss in January. When that happened, BTC’s price gained bullish momentum, ultimately leading Bitcoin to hit a new all-time high. Therefore, this is a hopeful sign for a price increase in the coming days.

However, it should also be noted that the number of BTCs sold by STHs in January was almost three times the number they sold between March and April.

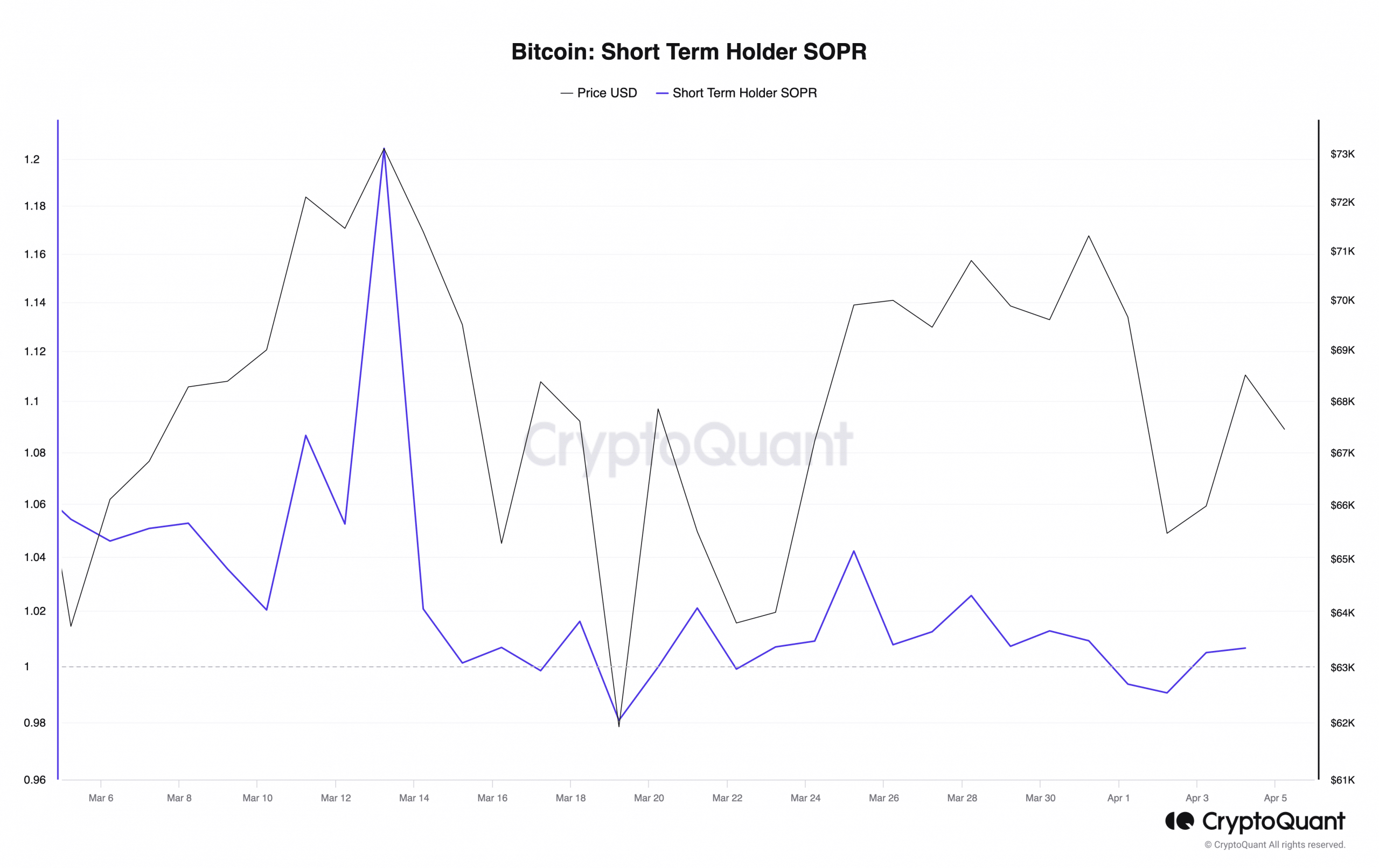

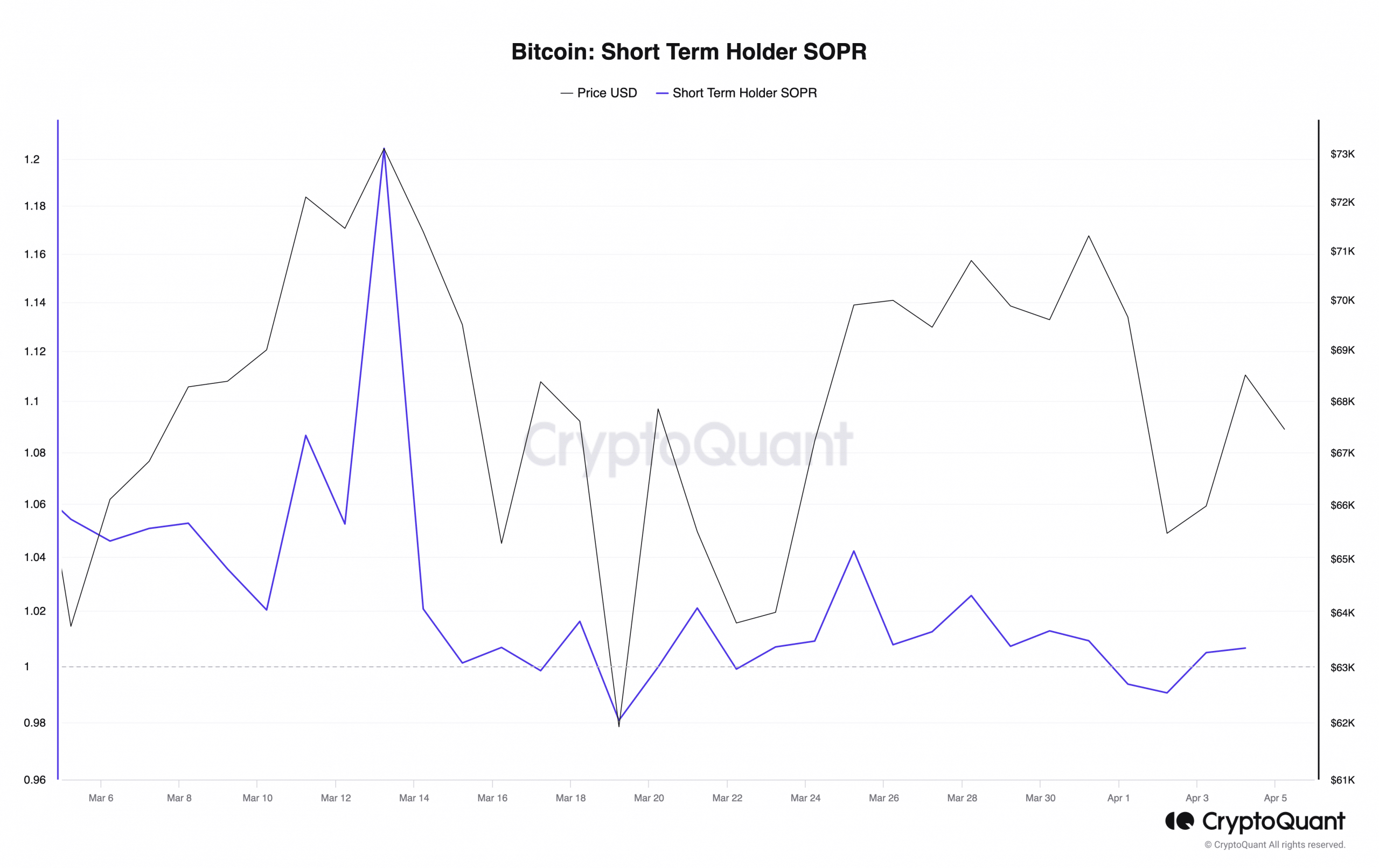

Additionally, AMBCrypto’s look at CryptoQuant’s data revealed that Bitcoin’s short-term holder SOPR registered a rise after falling on April 2. Historical data suggests that when these metrics rise, the price of BTC also follows a similar upward trend.

Source: CryptoQuant

At the time of writing, BTC price action was already showing signs of recovery as it crossed $67,000 – a psychological resistance level. It was up almost 2% on the charts in the last 24 hours alone.

Is there a bull rally around the corner?

AMBCrypto’s analysis of CryptoQuant facts revealed that BTC’s foreign exchange reserve has also fallen, meaning overall selling pressure is low. The coin’s binary CDD was green, meaning that long-term holders’ movements over the past seven days were lower than average.

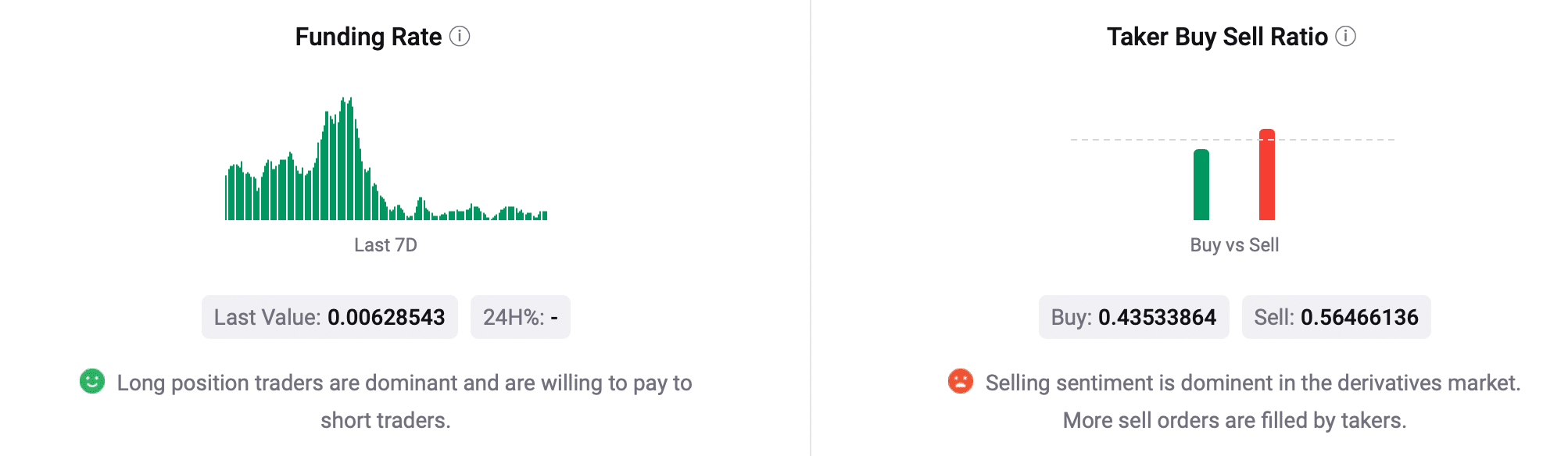

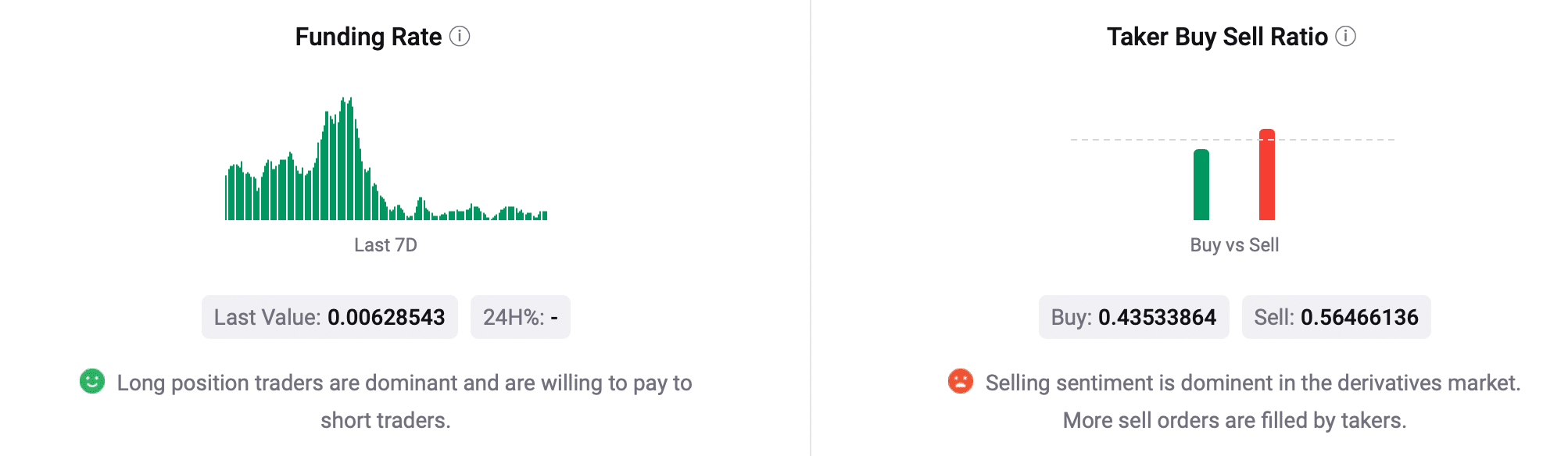

Everything also looked optimistic on the derivatives side. BTC’s funding rate went up. However, Bitcoin’s buy/sell ratio raised a red flag as it suggested that selling sentiment was dominant in the derivatives market.

Source: CryptoQuant

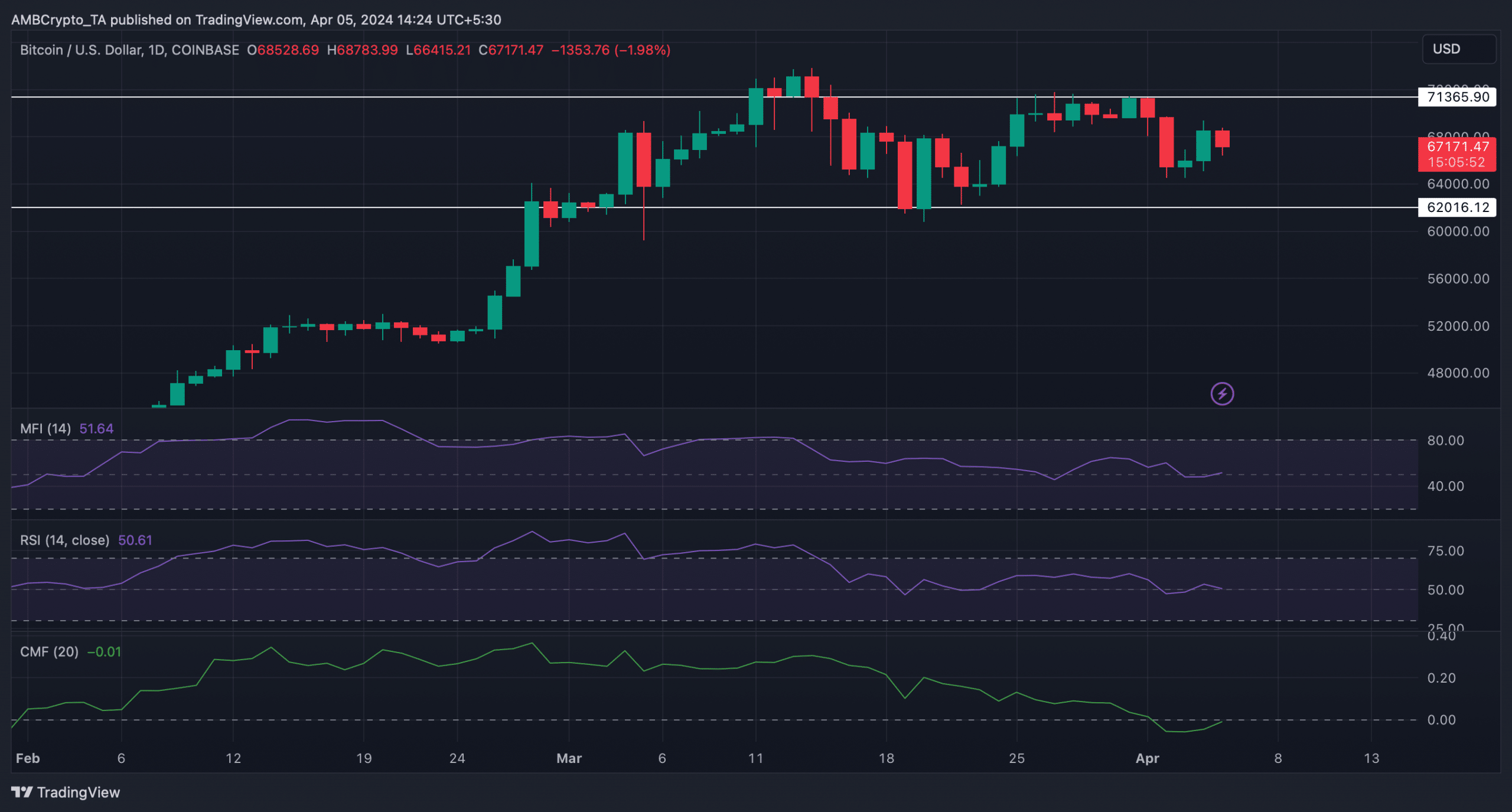

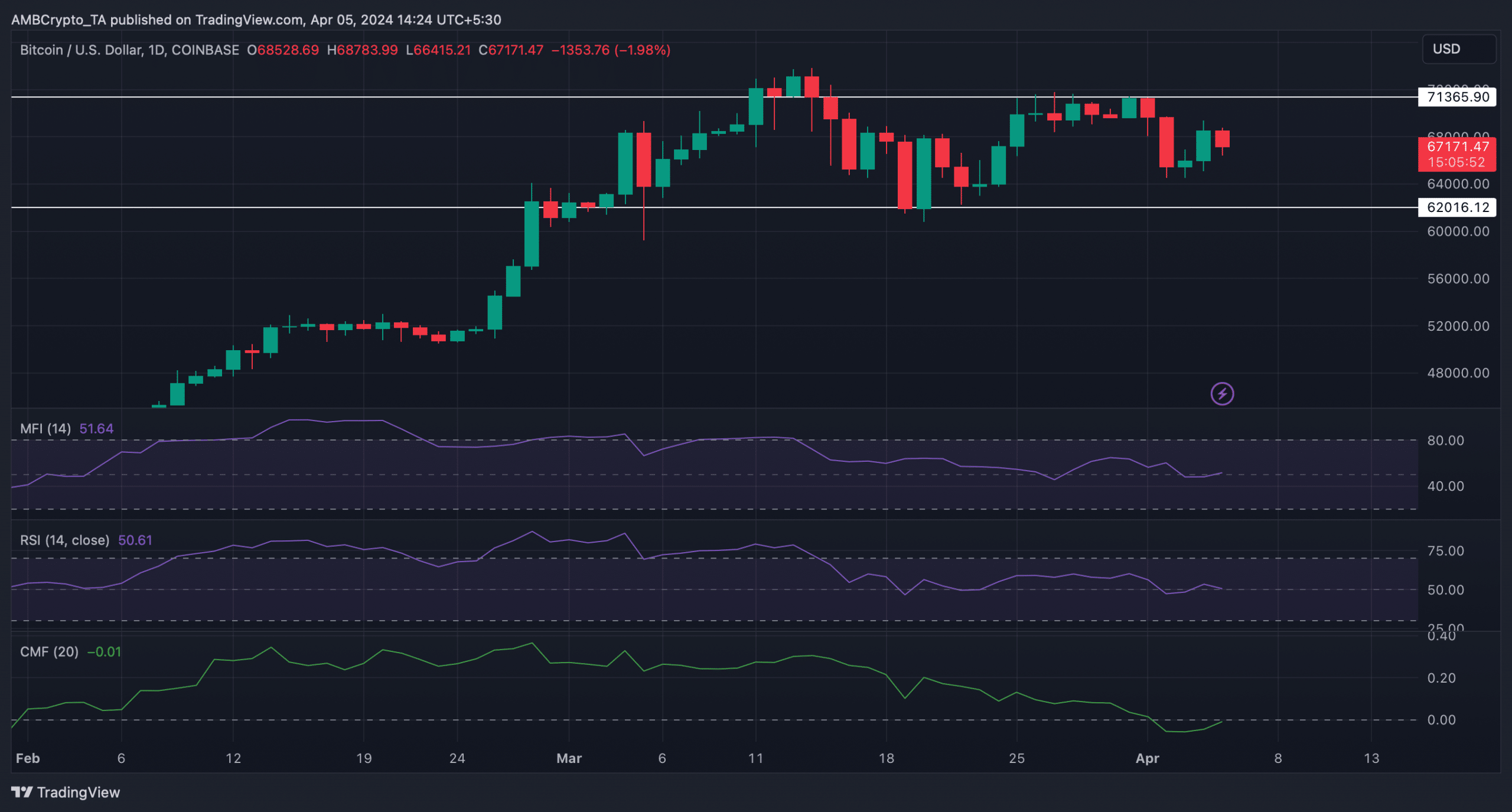

To better understand whether a rally is possible, AMBCrypto analyzed BTC’s daily chart. Our analysis showed that both BTC’s Chaikin Money Flow (CMF) and Money Flow Index (MFI) registered a slight increase, indicating that there were chances of northward price movement.

Read Bitcoins [BTC] Price prediction 2024-25

If a bull rally occurs, it is important that BTC crosses $71,000 before it targets its ATH. Nevertheless, the Relative Strength Index (RSI) remained in favor of the sellers while declining in recent days.

Source: TradingView