This article is available in Spanish.

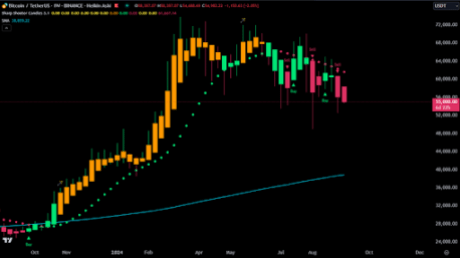

Crypto analyst Jesse Olson has highlighted the second consecutive Heikin Ashi signal on the weekly Bitcoin (BTC) chart. This despite the recent rise of Bitcoin as high as $58,000indicating that a bullish reversal may be in store.

What the Heikin Ashi Signal Means for Bitcoin

While to emphasize the second consecutive Heikin Ashi On Bitcoin’s weekly chart, Olson also noted that there was no positive trend, indicating that the downward trend is likely to continue. The crypto analyst had also previously explained how the absence of a fuse pointing upwards indicates a force in momentum down.

Related reading

Based on Olson’s accompanying chart, Bitcoin could experience further downside pressure and decline as low as $40,000. This bearish analysis comes amid Bitcoin’s recovery, as its price rose to $58,000 in the past 24 hours. While it remains to be seen whether this is a relief or a bullish reversal, Olson’s analysis suggests it is more likely a relief.

However, crypto analyst Daan Crypto has that suggested that Bitcoin needs to successfully break above $60,000 to achieve a bullish reversal and aim for new highs in this market cycle. Meanwhile, contrary to Olson’s bearish analysis, crypto analyst Mikybull Crypto has provided a more bullish outlook for Bitcoin.

In an X (formerly Twitter) afterthe crypto analyst stated that Bitcoin has completed the bullish diamond formation. In line with this, Mikybull Crypto noted that he believes the bottom has been reached for Bitcoin if the bull market still continues.

In another X messageMikybull Crypto highlighted a bullish divergence recently formed on the Bitcoin chart, similar to the one in September 2023. After the bullish divergence in September 2023, BTC experienced a significant rally, which ultimately paved the way for it to reach a new all-time record (ATH) in March earlier this year. As such, something similar could happen again if Bitcoin tries to reach new highs.

BTC’s price rally could start after September

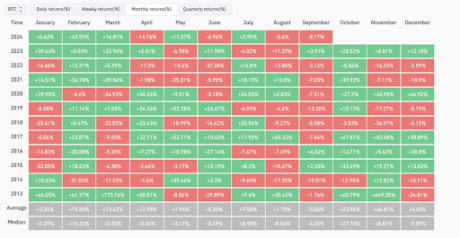

Whereas Bitcoin’s historical bearish trend in September, the crypto community is optimistic that BTC can begin its long-awaited price rise once this month is over. In a recent analysis crypto analyst Rekt Capital explained why the flagship crypto was likely to post huge gains in October.

Related reading

The crypto analyst noted that Bitcoin’s only monthly losses in October came in 2014 and 2018, when it posted monthly losses of -12.95% and -3.83%, respectively. He added that these were bear markets. However, Bitcoin is in a half yearhistorically, ushering in the bull market. As such, BTC could enjoy a bullish ride in October and even through the end of the year, especially with the upcoming US presidential elections in November.

At the time of writing, Bitcoin is trading around $56,600, up more than 3% in the past 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com