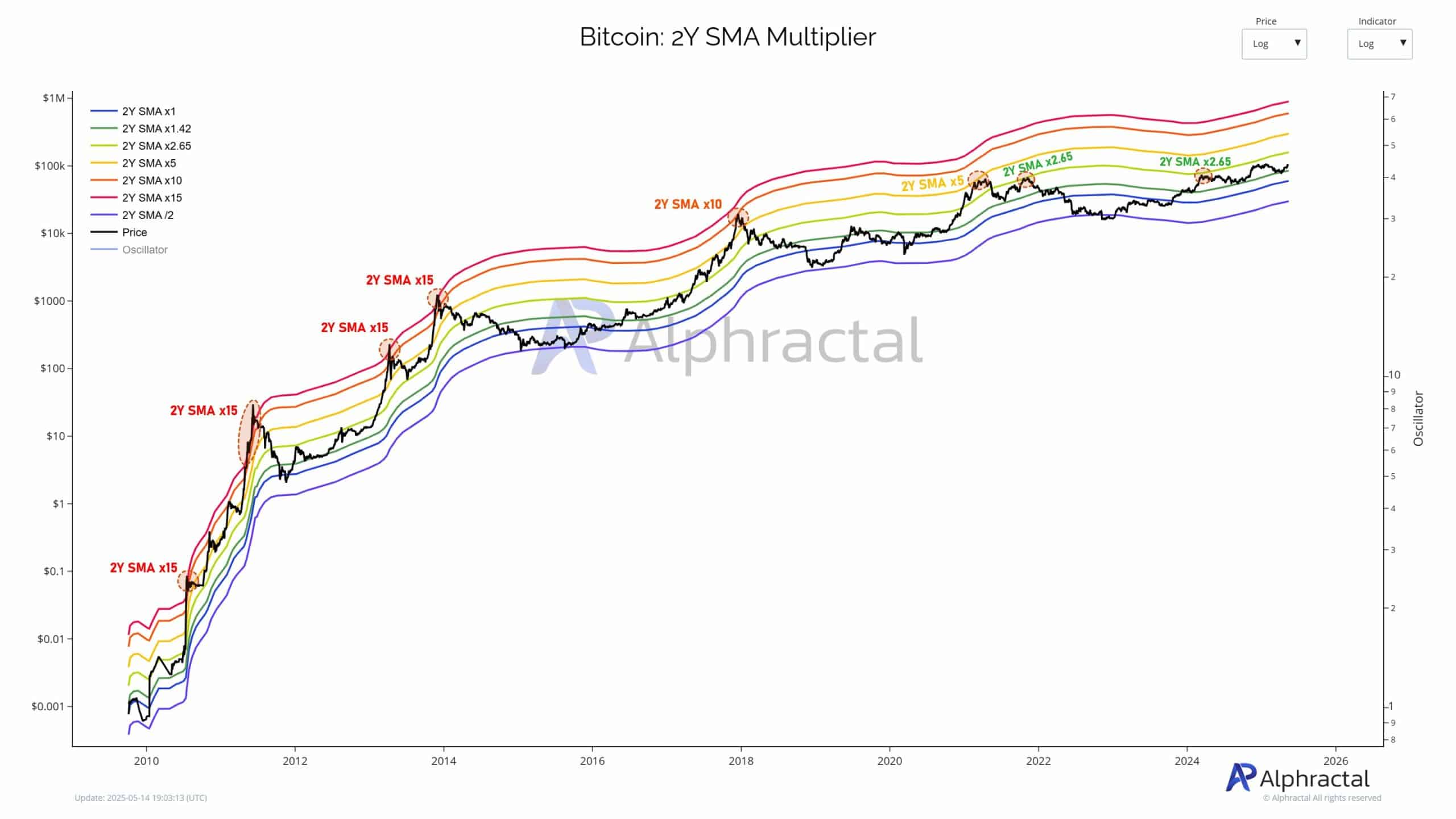

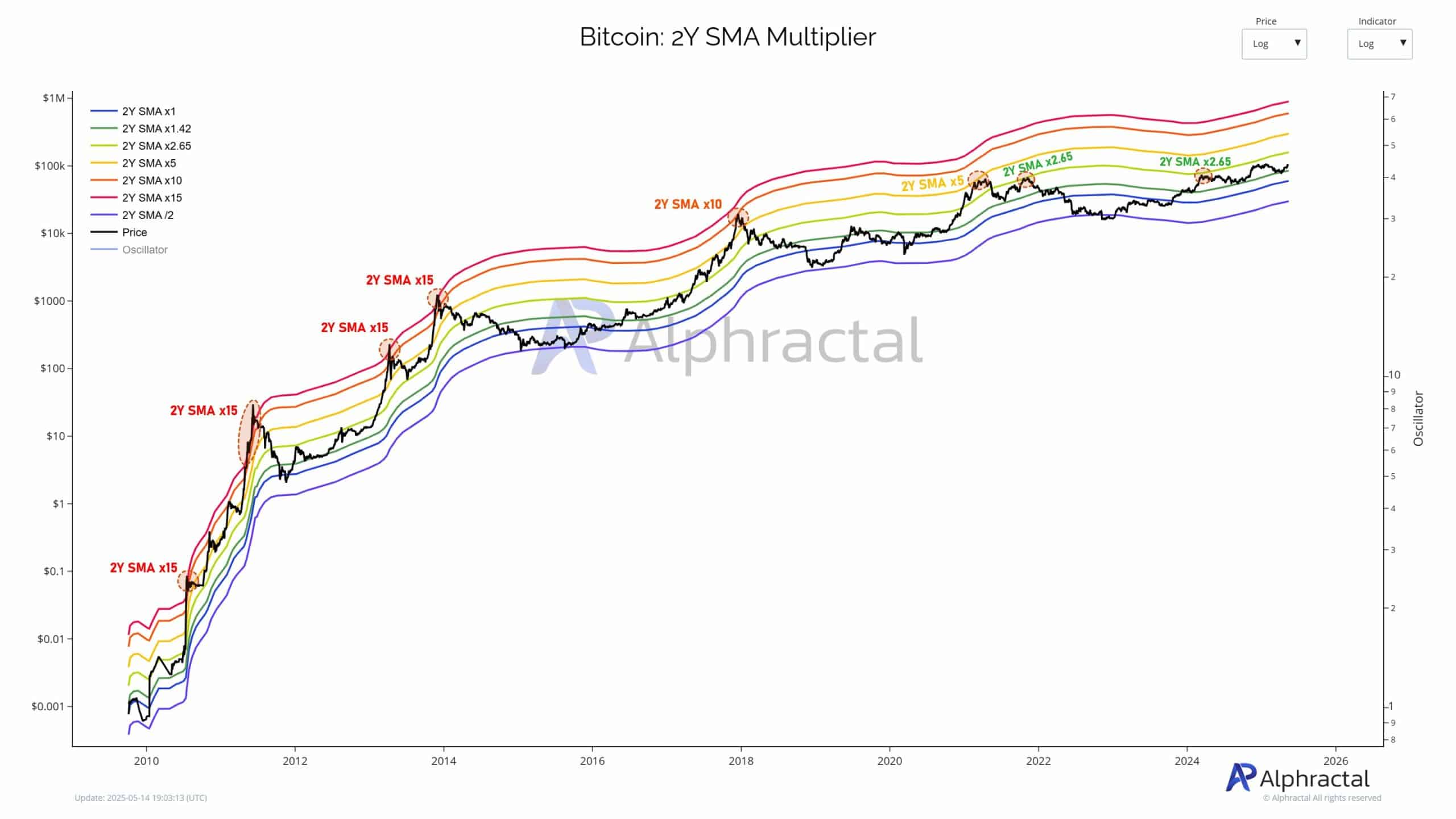

- Bitcoin cycles have fell steadily from 15 times to 2.65 × the 2-year-old simple advancing average.

- Despite multiples with a lower cycle, BTC shows signs of structural strength.

In the last eight years, Bitcoin [BTC] Has seen a huge shift in its price behavior as the market becomes mature.

With each cycle, BTC’s peak has formed on a lower multiple of its 2-year-old simple advancing average (2Y SMA), which reflects the shrinking volatility and a more stable market structure.

From wild rallies to tempered peaks

Looking at earlier cycles, the early bull runs of Bitcoin were explosive, with tops that took place at 15x the 2Y SMA according to the Alfractal.

These explosive deliverers meant wild speculative growth, largely powered by a thin market and early adopters.

Source: Alfractaal

However, from 2017 the market started to change when Bitcoin reached the global market with widespread consciousness. The growth of the crypto, although amazing, was very modest.

During this time the top was reached around 10x the 2y SMA, which indicates high volatility in the midst of growing adulthood.

In 2021 the institutional money came in. Yet the peak of the cycle fell again, first hit 5 × and then turned around 2.65 × the 2y SMA.

This meant a structural shift: Bitcoin was no longer just an exchange – it became a macro -active.

2.65 × remains the brand – can BTC Moonshot up to $ 159k?

In the most recent cycle, Bitcoin did not succeed in exceeding the 2.65 × plural, which shows a narrowing of profit and indicates a more adult actively.

Currently, the 2Y SMA × 2.65 level reflects a lower volatility, deeper liquidity and an adult user base. That level is now around $ 159,000. If BTC makes a big revival, $ 159k will act as the next key resistance.

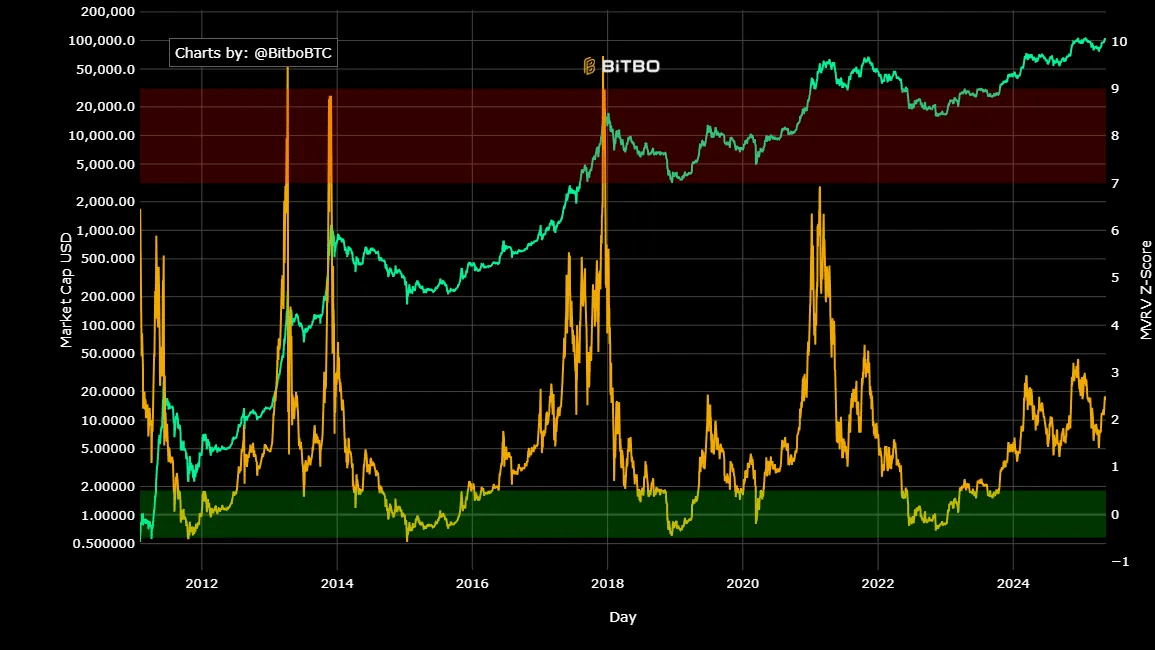

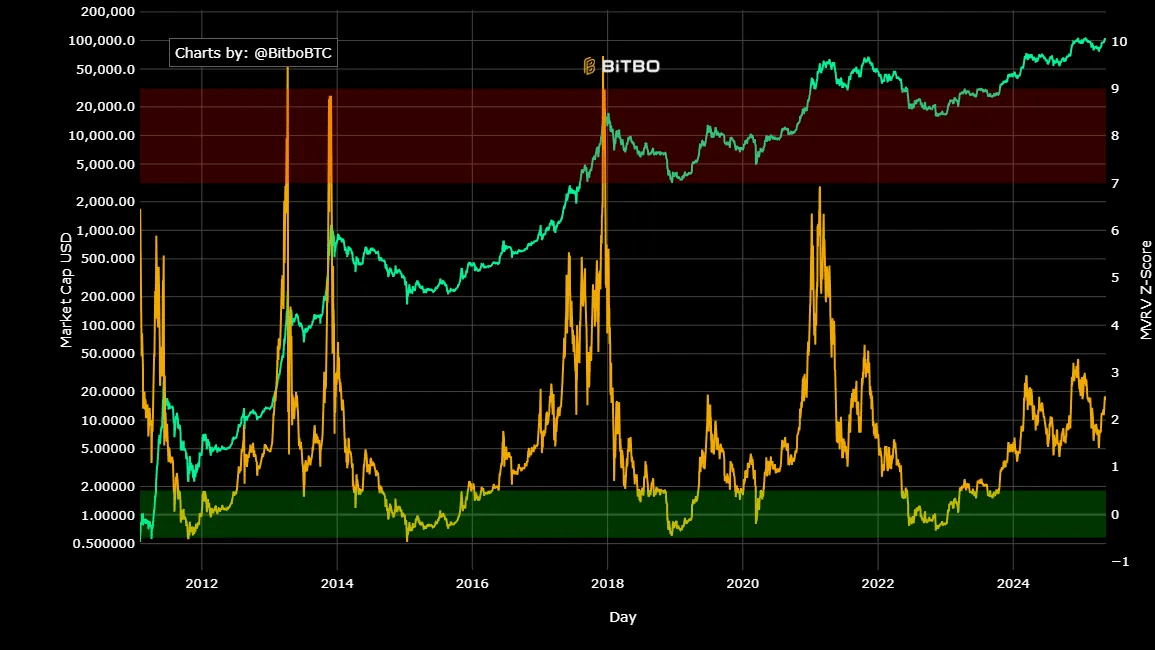

As observed above, although Bitcoin is currently experiencing decreasing cycles tops, there is even more room for growth.

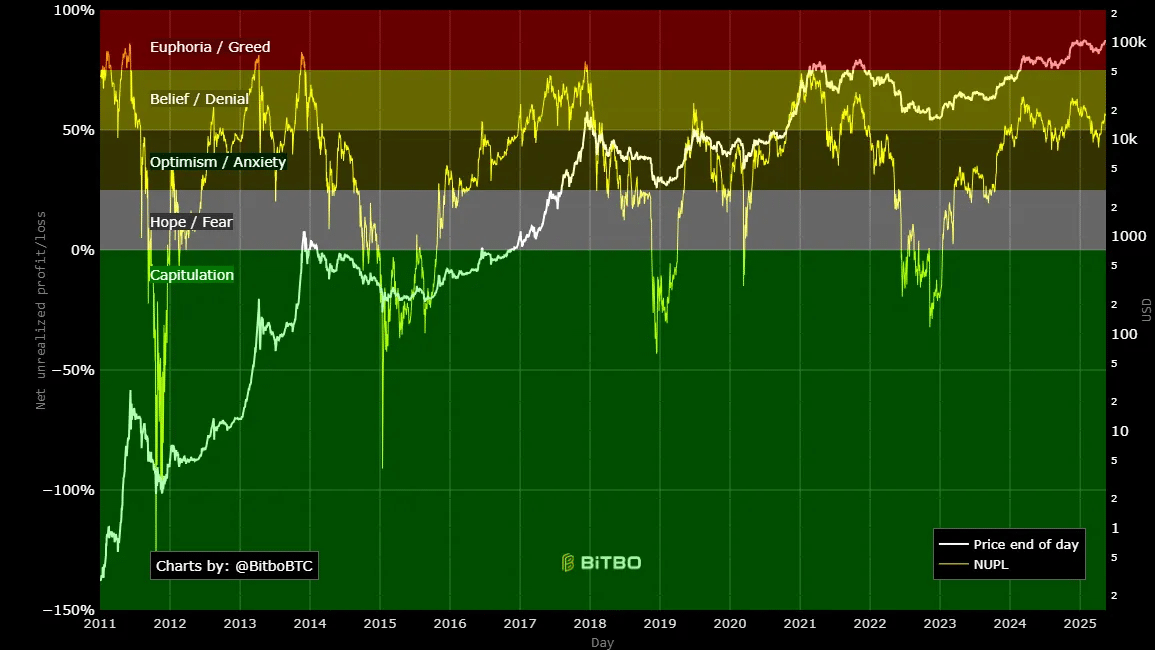

Looking at the MVRV of Bitcoin, it is currently around 2.4, which indicates that the market is still under the Euphoria territory.

Historically, Bitcoin tops have emerged approximately 3.5 to 4.0. So at the current level there is even more room for growth before the cycle is at the top.

Source: Bitbo

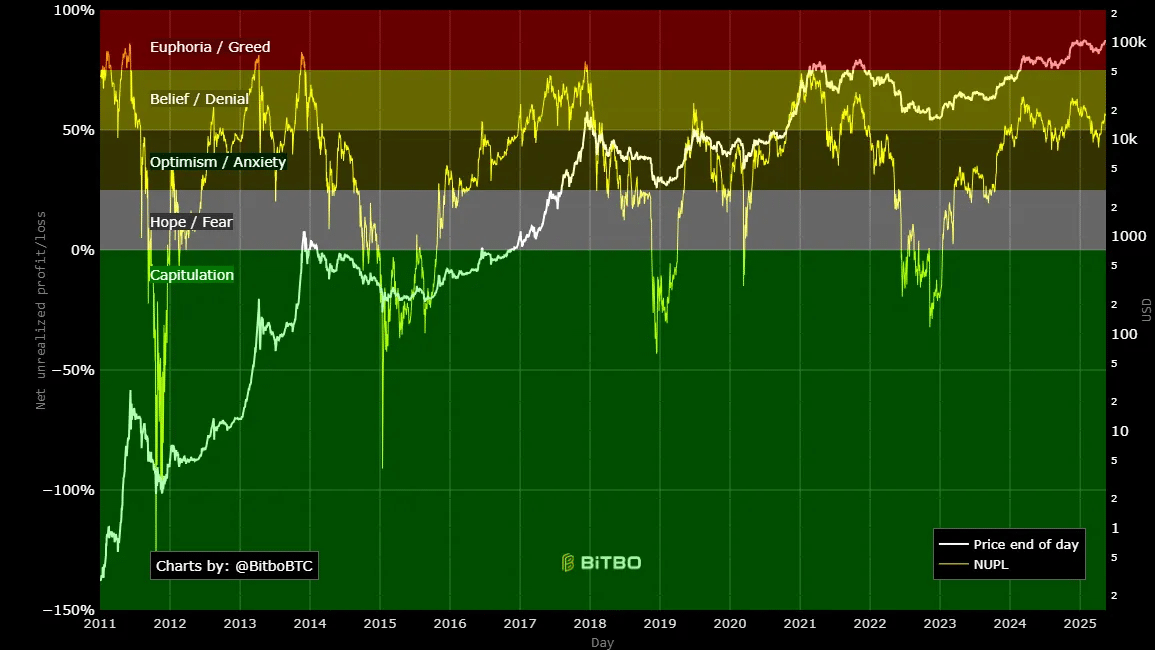

As an addition to this, NUPL (Net non -realized profit/loss) in the faith/denial zone – is not yet in greed or euphoria.

With considerable maturity in market behavior, the BTC holders will probably not use extreme profit at the moment, because they expect higher prices for the current cycle.

Source: Bitbo

Bottom Line

Therefore, although future cycles can no longer experience an increase of 15x, there is even more room for growth, whereby Bitcoin is more stable, less volatile and more reliable as an investment.

In the prevailing market, BTC still has more room for growth. If the momentum of the cycle applies and BTC surpasses $ 110k, we can see an increase of $ 159k levels.

However, this is unlikely in the short term, but because the market still has to reach a top, this level can be where markets cool down for the current cycle.