- The price of BTC rose by more than 6% last week, but the daily chart turned red.

- A few data sets suggested that selling pressure on Bitcoin was high.

After a week’s rally, Bitcoins [BTC] Price action has been slow, declining marginally over the past 24 hours. This happened at a time when one of the key indicators registered a sharp increase, signaling a further price decline in the days that followed.

Bitcoin price going to crash again?

The king of cryptos had a promising start to the new year as its price rose more than 6% over the past seven days. But the profit spree came to an end in the recent past when the price fell marginally.

According to CoinMarketCapBTC is down 0.11% in the past 24 hours. At the time of writing, BTC was trading at $45,161.20 with a market cap of over $884 billion.

While that was happening, a key BTC metric recorded consistent increases. Ali, a popular crypto analyst, recently pointed out in a tweet how open interest in Bitcoin was increasing.

Of #BitcoinWith Open Interest approaching $11.5 billion, the market may be entering a busy trading zone.

This increase in open interest does indicate an increase $BTC trading activity, could also indicate market volatility. Go long #BTC now bears risks, especially if the market… pic.twitter.com/kgzxhhnaCb

— Ali (@ali_charts) January 2, 2024

While the spike in open interest indicates increased BTC trading activity, it could also be a sign of market volatility. That’s why AMBCrypto took a closer look at the current state of Bitcoin to better understand whether a price correction was coming.

AMBCrypto reported rather that the number of BTC investors with losses exceeded the number of investors with gains, which already raised alarms. When checking on CryptoQuant’s factswe found that sales pressure increased BTC increased as the foreign exchange reserve increased.

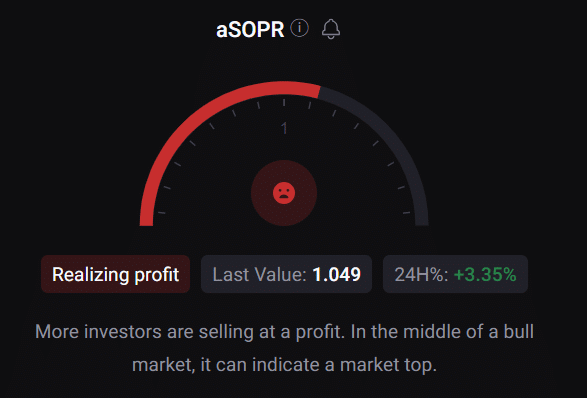

The coin’s aSORP was red, meaning more investors were selling their holdings for a profit. In the middle of a bull market, this usually signals a market top.

Additionally, Bitcoin’s Net Unrealized Profit and Loss (NULP) indicated that investors were in a “belief phase” where they were in a state of high unrealized profits.

Source: CryptoQuant

However, AMBCrypto’s look at Santiment’s data revealed a different story.

The supply of BTC on the exchange continued to decline, while the supply outside the exchange increased. This suggested that buying pressure on the currency was high. Positive sentiment around BTC was also high, reflecting investor confidence in the king of cryptos.

Source: Santiment

Read Bitcoins [BTC] Price prediction 2023-24

What market indicators suggest

AMBCrypto then planned to take a look BTC‘s daily chart to see what the key market indicators had to say. The MACD showed a bullish crossover.

Bitcoin’s Relative Strength Index (RSI) also maintained its upward movement, increasing the chances of a price increase in the coming days. However, one bearish indicator was BTC’s Chaikin Money Flow (CMF), which has been moving south in recent days.

Source: TradingView