- Retail investors in Bitcoin were gone as soon as they arrived.

- BTC is up 3.07% over the past week.

Since hitting $100,000 almost three weeks ago, Bitcoin’s [BTC] has struggled to break this barrier. As such, despite the recent price pump, Bitcoin has continued to trade sideways.

At the time of writing, Bitcoin was trading at $97,834, down 0.31% on the daily charts. Before this dip, BTC was moving higher, rising 3.07% on the weekly charts.

This volatility is largely related to declining retail interest as the market looks for stability while BTC moves from weaker hands to stronger hands.

Bitcoin’s retail investors are gone

According to CryptoQuantBitcoin’s retail investors disappeared from the market as soon as they arrived.

Source: CryptoQuant

Based on the 30-day variation in retail demand, as BTC approached $100,000, retail demand variations increased by more than 30%.

A surge in retail demand usually signals increased interest, enthusiasm or fear of missing out among smaller investors.

Historically, retail demand variation above 15% often precedes a local top. This is what happened after Bitcoin hit its new ATH of $108k.

After the market reached this level, a correction followed, followed by a 16% decline in retail demand. Retail investors are known to be emotional reactors and quickly exit their positions during corrections.

A drop below 10% indicates that private interest has fallen significantly. However, this decline creates a buying opportunity for large and experienced traders.

After such declines, the market has often experienced a bullish recovery as weak hands capitulate and stronger hands accumulate.

What it means for BTC

According to AMBCrypto’s analysis, Bitcoin is experiencing a shift in market activity from retail traders to smart money accumulation.

This drop in retail demand is a signal that markets are cooling off from a speculative frenzy. Therefore, BTC has gone from weak hands to stronger hands.

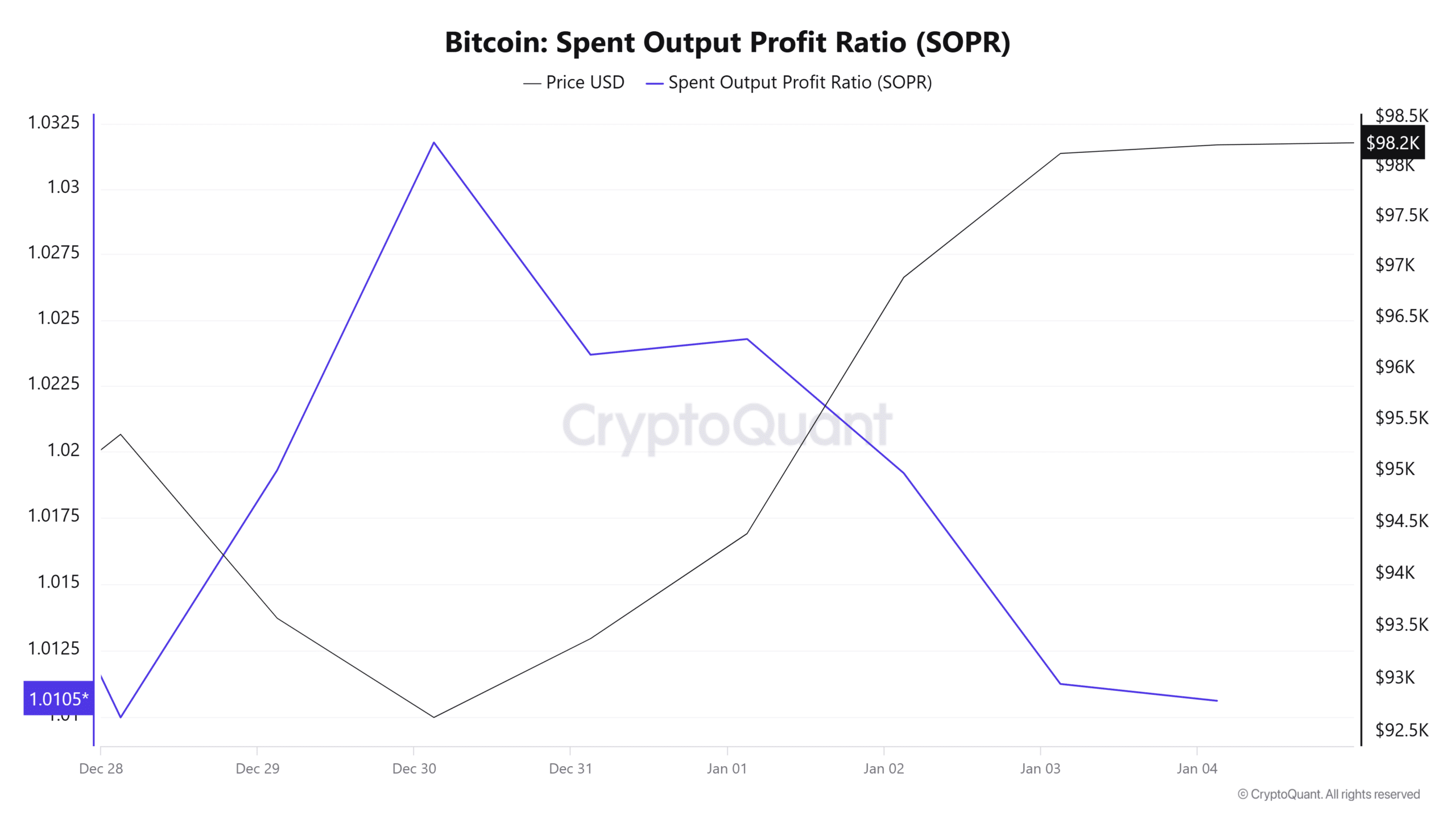

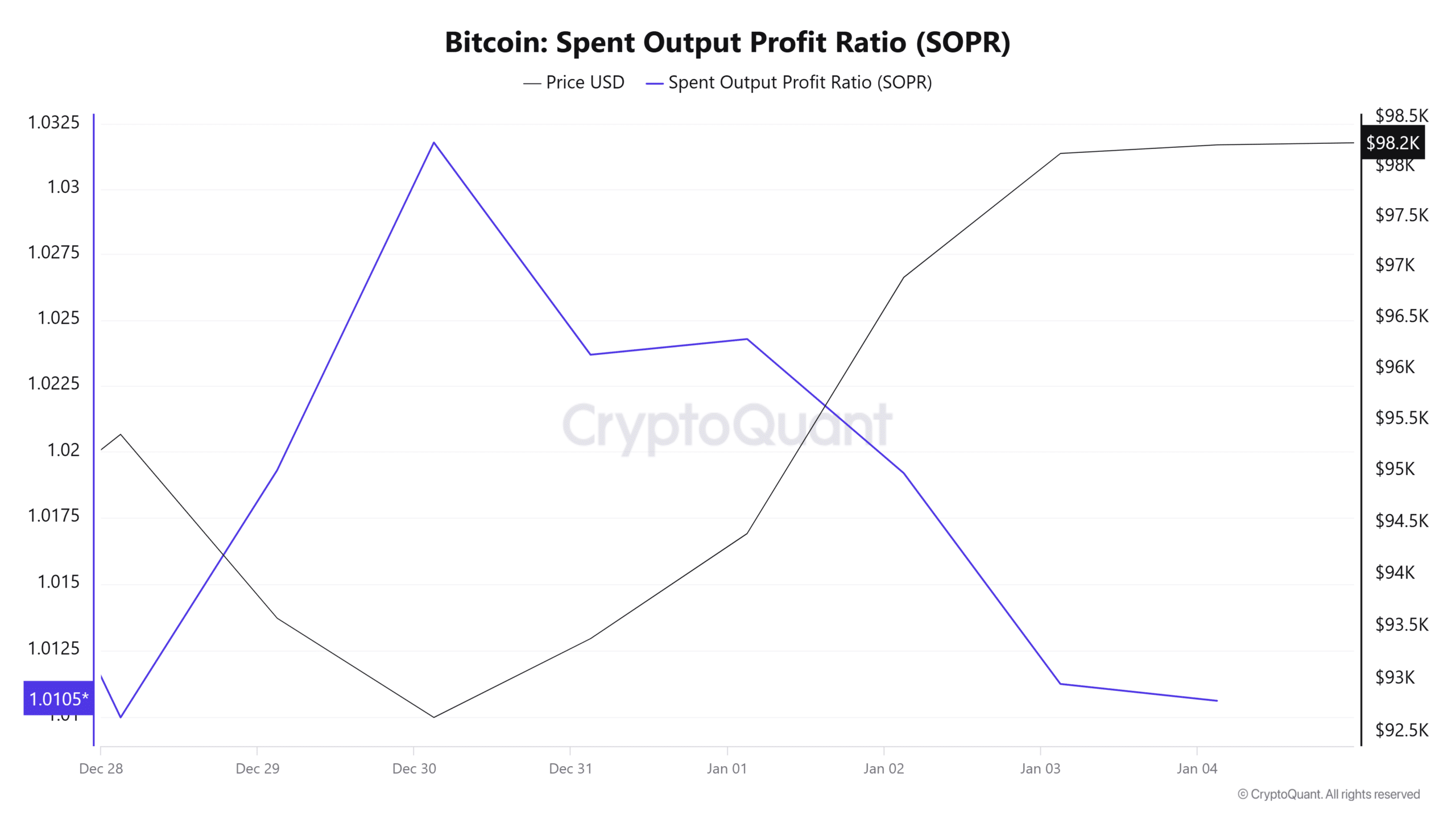

Source: CryptoQuant

The recent decline in the Spend Output Profit Ratio (SOPR) signals a shift in ownership and market activity. Despite the decline, the SOPR remains at 1.01, indicating that holders are unwilling to sell at a loss.

This market behavior indicates stronger hands in the market, indicating that investors are confident in holding their positions even during market corrections.

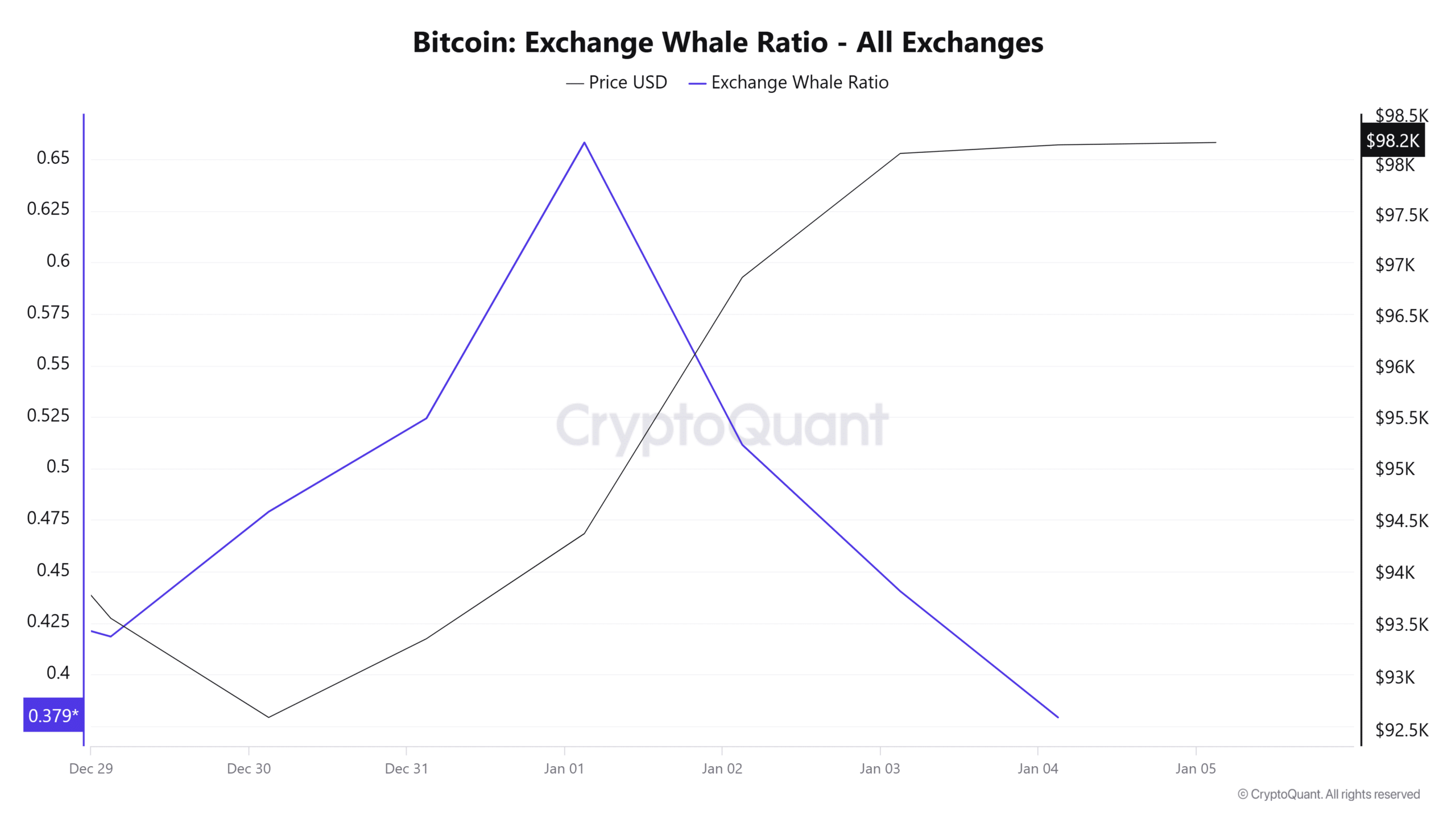

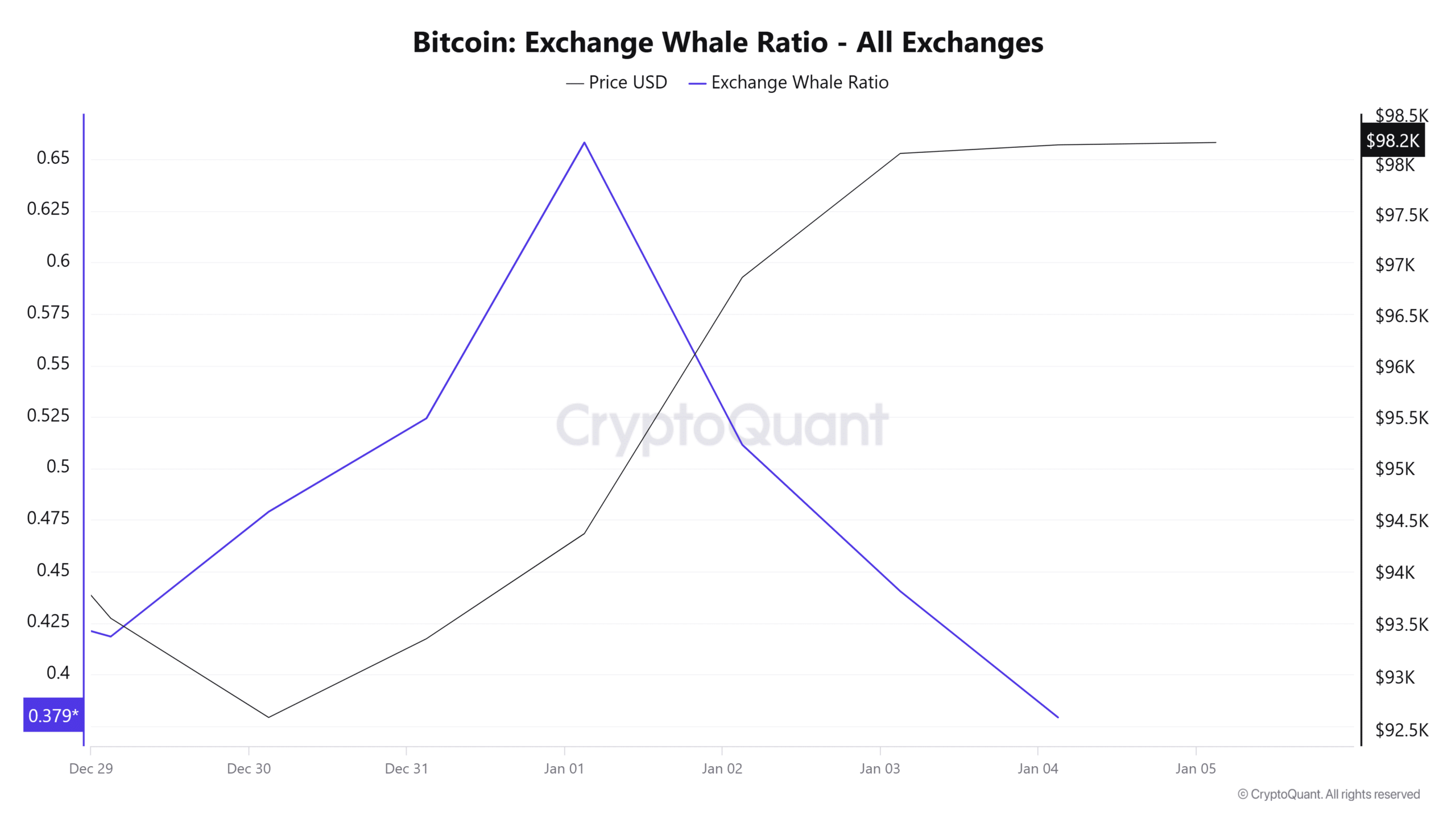

Source: CryptoQuant

This accumulation trend is further evidenced by the decline in the whale ratio. The supply of whales on the exchanges has fallen to 0.37, indicating HODL behavior.

Whales are sending their BTC tokens to private wallets, indicating bullish sentiment as they expect further gains.

Read Bitcoin’s [BTC] Price forecast 2024-25

Simply put, the decline in retail demand has given large holders the opportunity to accumulate BTC at lower prices. These conditions position Bitcoin for more future gains. Therefore, if current market conditions persist, BTC will recover $98,700.

A move above this level will strengthen Bitcoin to regain $100,000. Conversely, another market correction could see BTC drop to $96,100.