- Inflows into new ETFs offset outflows from GBTC.

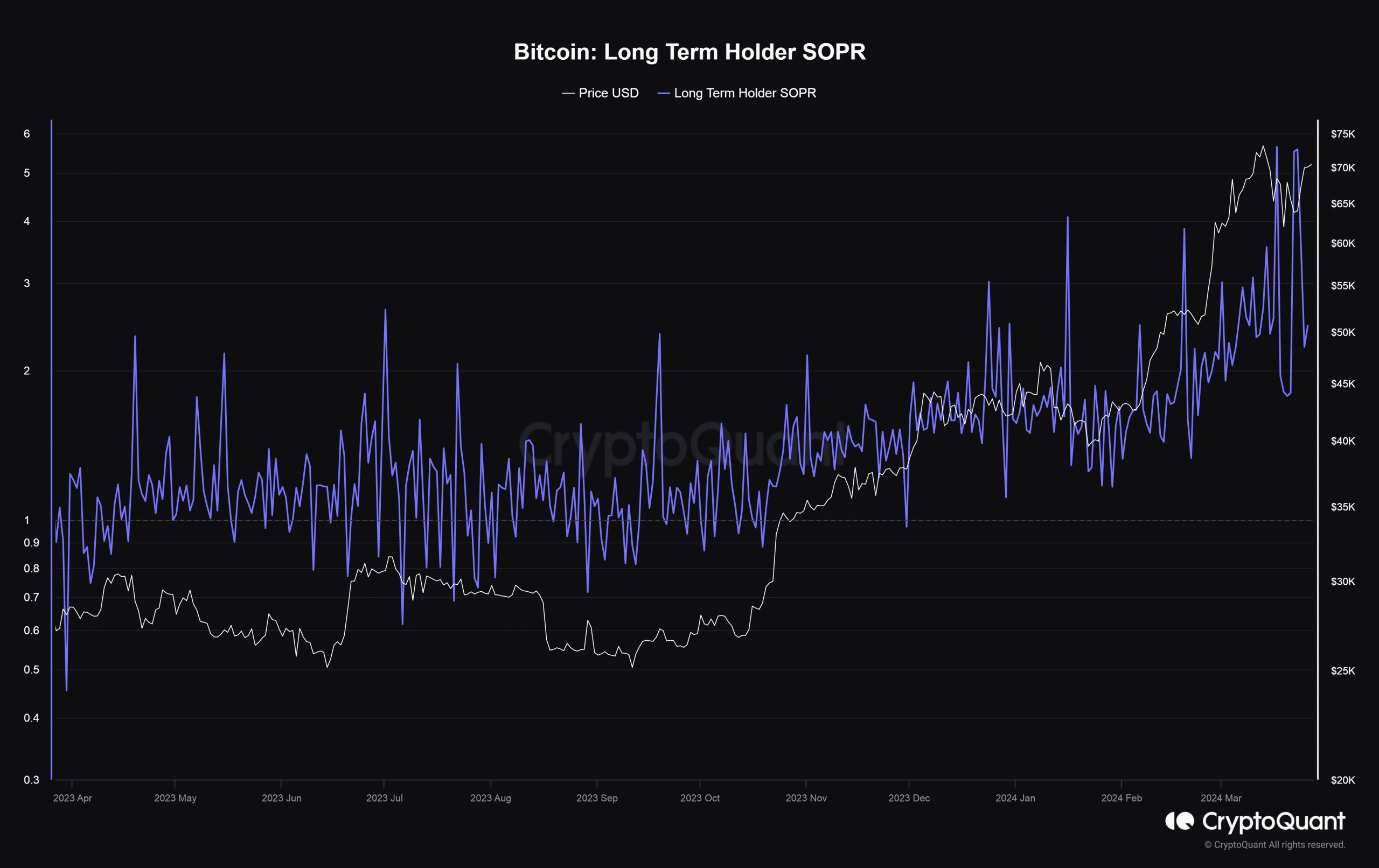

- Bitcoin continued to experience selling pressure from long-term holders.

In a remarkable turnaround, Bitcoin [BTC] Spot exchange traded funds (ETFs) in the US attracted significant inflows on Tuesday after a disappointing performance last week.

A strong net positive day

According to AMBCrypto’s analysis of SoSo value According to data, about 6,000 BTCs worth $418 million net flowed into these investment opportunities, marking the strongest wave of inflows since March 14.

With the latest influx, the total value of Bitcoins backing the spot ETFs reached $57.2 billion, representing 4.20% of the crypto’s total market capitalization.

Source: SoSo value

Fidelity’s spot ETF (FBTC) led the inflows chart, with $279.10 million worth of Bitcoins, followed by BlackRock’s IBIT fund with $162 million inflows.

Total inflows from the nine newly launched ETFs helped offset $212 million in outflows from the incumbent issuer Grayscale Bitcoin Trust (GBTC).

Last week, grayscale outflows exceeded inflows, resulting in five consecutive net negative days.

A fascinating note: The amount collected by new ETFs included all newly mined Bitcoins on that day, the equivalent of Grayscale’s outflows, and another 5,092 coins from other sellers, venture capital firm HODL15Capital noted.

Bitcoin fails to rise

Despite a strong wave of inflows, Bitcoin remained stuck around $70,000, according to the report CoinMarketCapimplying that significant sales were still taking place.

Much of this sell-off can be attributed to long-term holders of the coin. According to AMBCrypto’s research into CryptoQuant data, this cohort has been increasingly selling their assets for profit lately.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price forecast 2024-25

While these types of events slow the asset’s rise, they bring previously inactive coins into the liquid supply. This could potentially lead to more demand and volatility.

According to Bitcoin’s latest update, there was a sentiment of “extreme greed” in the market Fear and Greed Index. This could lead to continued buying pressure in the coming days, pushing Bitcoin further north.