The Bitcoin and crypto market eagerly observed the expiration of the quarterly BTC and ETH options today (at 8:00 AM UTC / 4:00 AM EST). It was the second largest in history with a volume of 159,000 BTC options and 1.25 million ETH options with a total value of almost $7 billion.

The market expected a sharp increase in volatility, but it failed to materialise. In the run-up period, BTC price briefly spiked to $31,300 before seeing a pullback towards $30,700. The event has thus become a bit of a no-brainer.

Options analysts at Greeks.Live confirmed a few minutes ago that the quarterly expiration has been completed, with more BTC block calls being traded in recent days, mainly to close and roll over positions at the end of the quarter, with ETH mainly in the order book, add:

As the quarter progressed, the market has seen the release of positions built up over the past few months, and options could see a bigger shift if the market supports it in July.

While volatility has increased this month and market makers are eager to actively buy positions, the downtrend in key term IV is clearly visible amid strong selling pressure from quarterly deliveries.

What’s next for Bitcoin?

Today’s daily close could become extremely important for Bitcoin price. Today marks the end of the month, the end of the quarter and the Personal Consumption Expenditure (PCE) price index, the US Federal Reserve’s favorite inflation gauge, will be released at 8:30 am EST (12:30 pm CET). On Tuesday, the US market is closed for July 4, Independence Day.

The Personal Consumption Expenditure (PCE) price index is preferred by the Fed because it provides broader coverage of consumer spending, includes chain weighting to accurately track changes in behavior, accounts for the substitution effect, and uses extensive data sources. The PCE is therefore considered a more flexible and representative inflation indicator compared to other indices such as the consumer price index (CPI).

While aggregate CPI data has looked extremely good in recent months, core inflation has proven to be very sticky. Much attention will therefore be paid to core PCE today. PCE inflation is expected to be 3.9% and core PCE 4.7% year on year. A surprise on the downside can give a positive boost to both the traditional financial market and the Bitcoin and crypto markets.

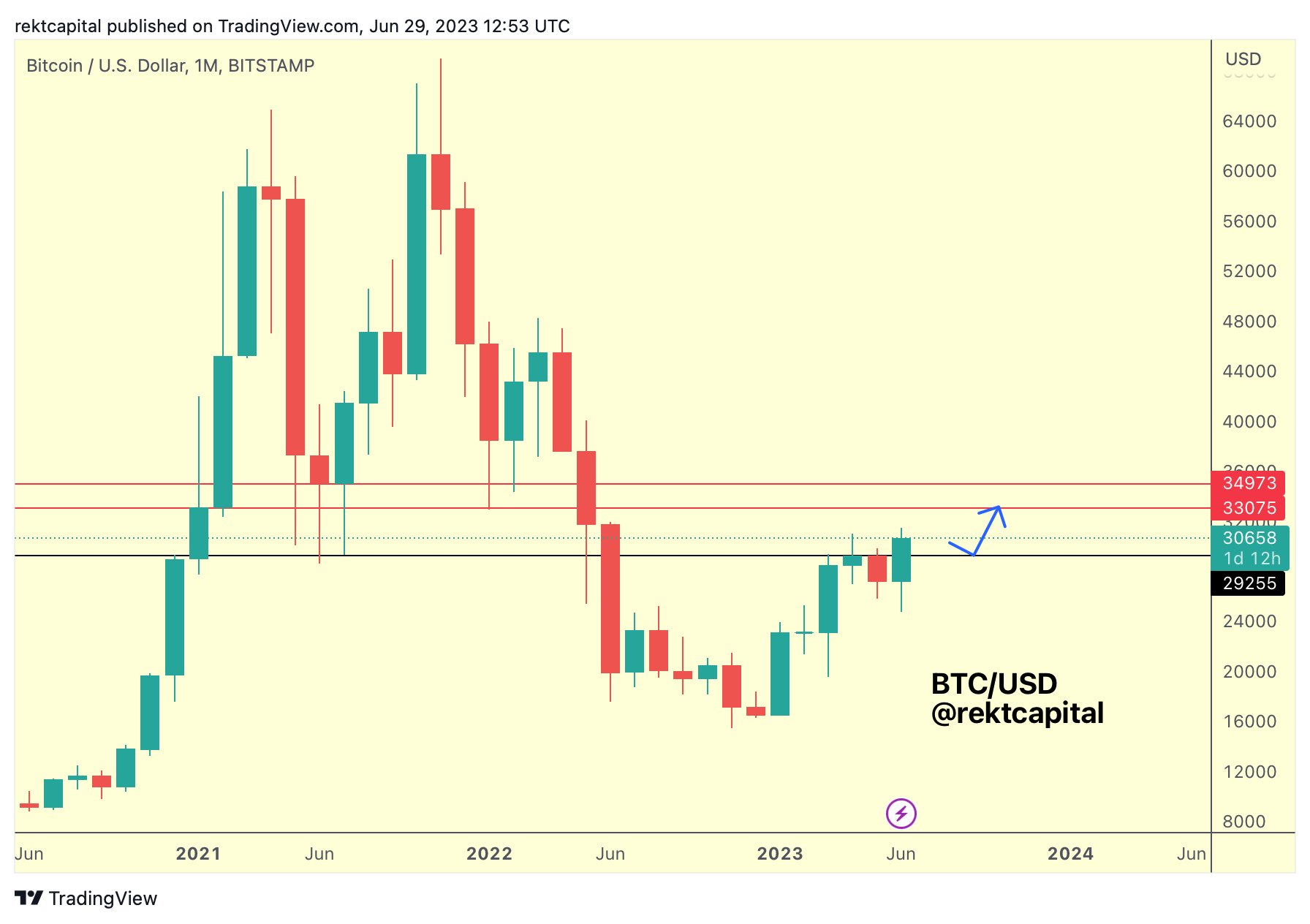

As renowned analyst @rektcapital writes via Twitter, BTC is positioning itself for a monthly close above a resistance that the price had been rejecting for the past three months. Currently, BTC is holding above the same level (black). So the month and quarter close could be an extremely bullish prelude to July.

Is the best time to buy next Monday?

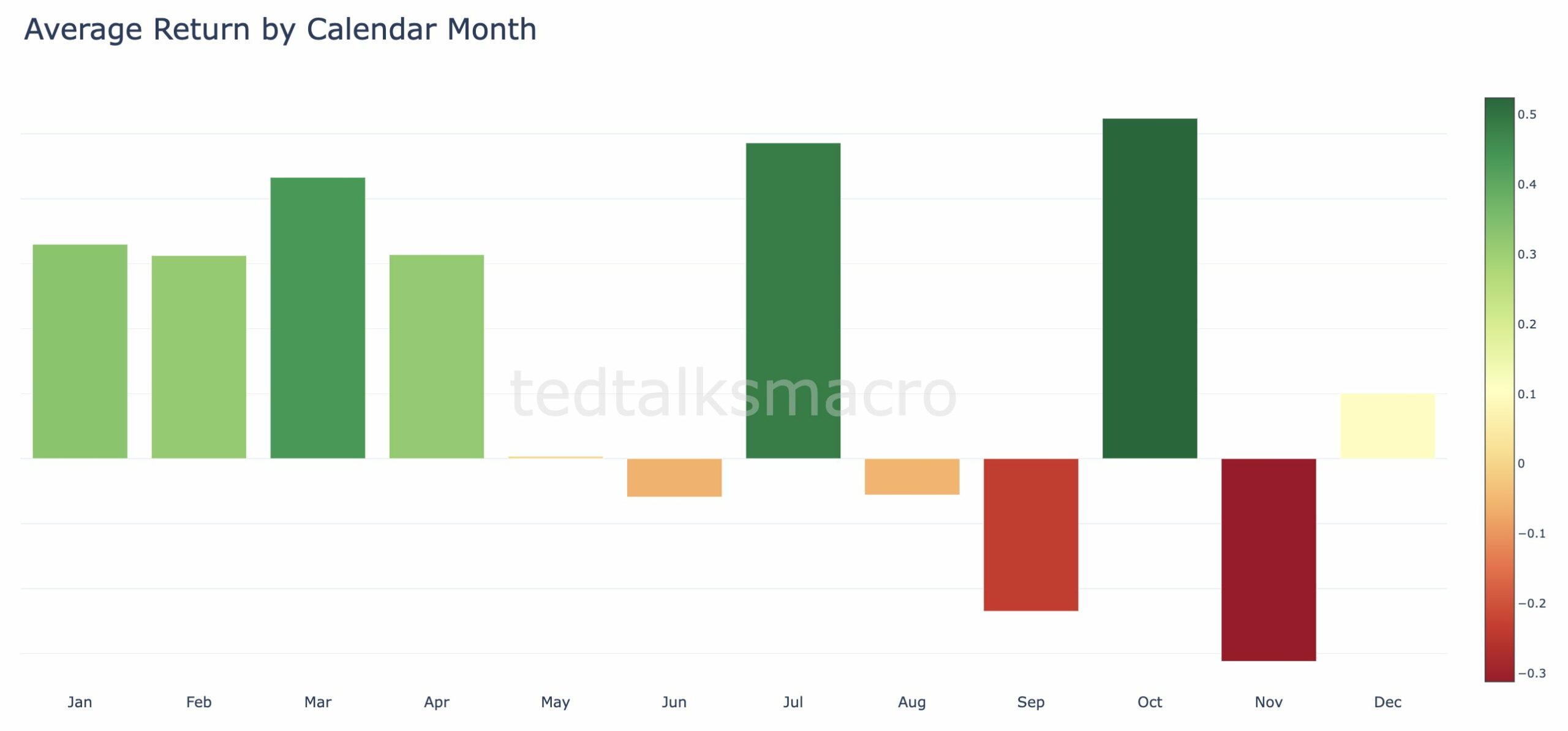

Analyst @tedtalksmacro recently published an analysis on Bitcoin’s historical performance via Twitter. The result could suggest that next Monday, July 3, is the best option for a Bitcoin purchase, at least historically.

As the analyst noted, July is the best performing month since October 2009. However, the data is skewed by a 10x in July 2010. Taking just the data from the last five years, October is the best performing month, closely followed by July .

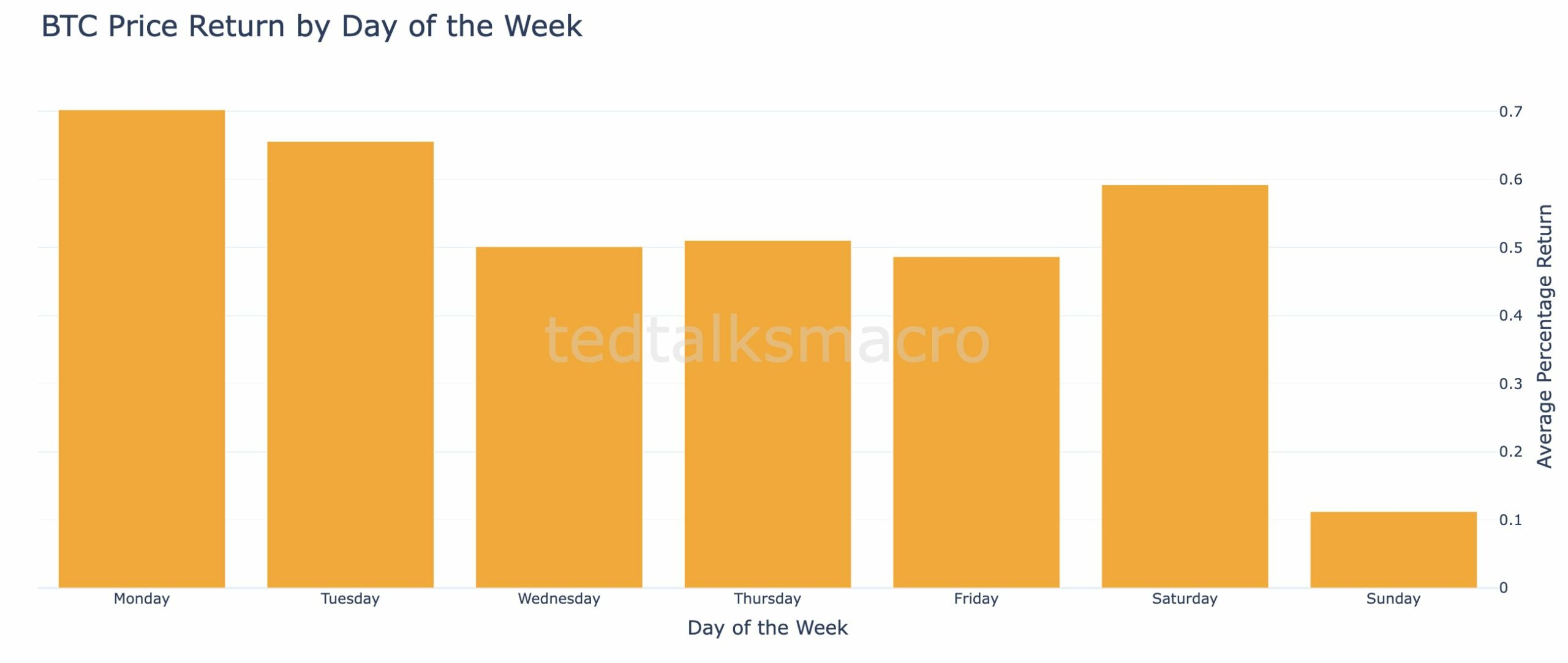

Weekly, Monday is the best day to buy and hold BTC. This assumes that buyers do not own BTC on any day other than the nominated, as the analyst evaluated.

At the time of writing, Bitcoin price was hovering below the $31,000 resistance zone and trading at $30,856.

Featured image from iStock, chart from TradingView.com