- There is a clear correlation between Bitcoin and the S&P 500

- Bitcoin miners’ reserves may also be worth keeping an eye on

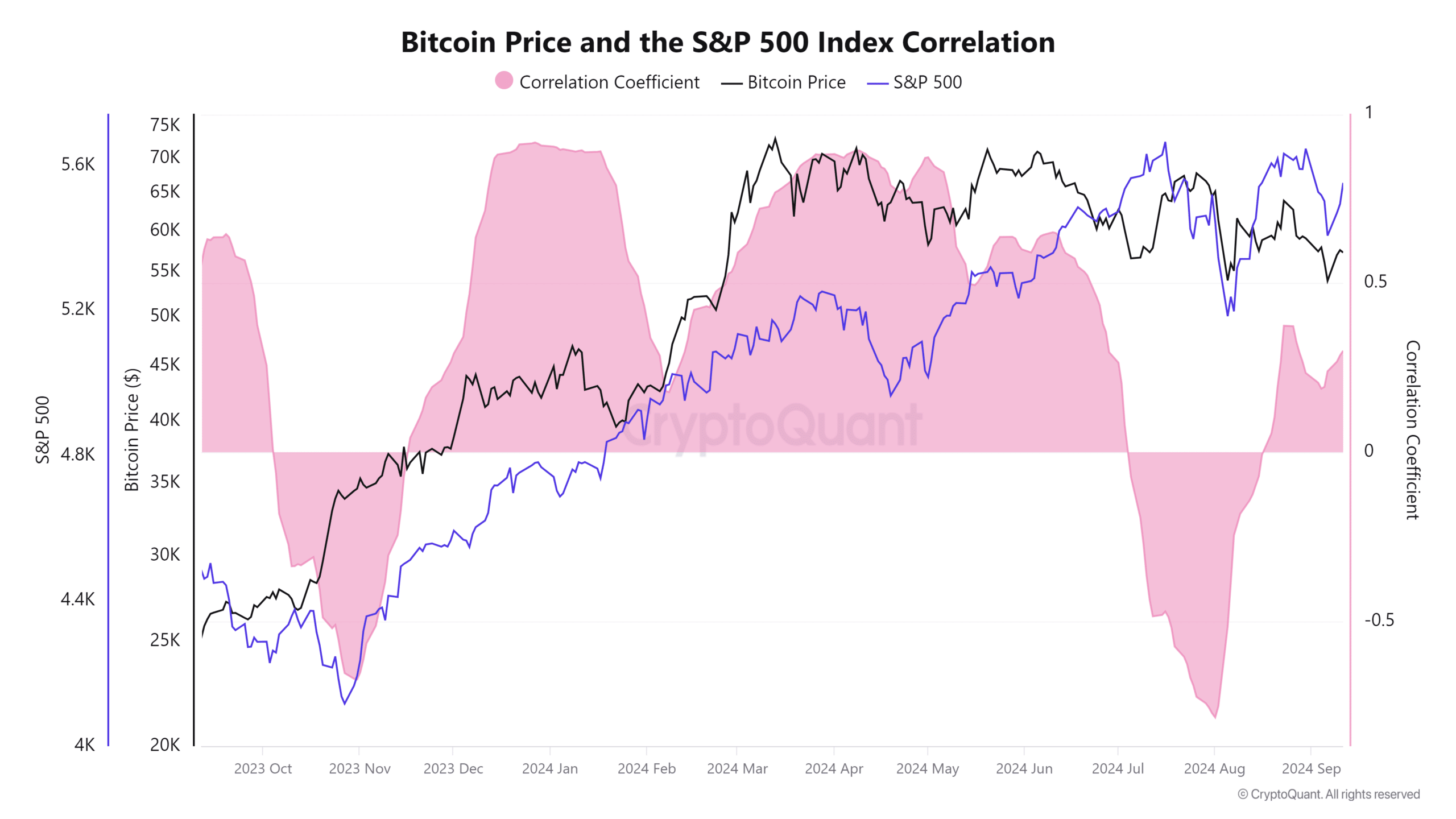

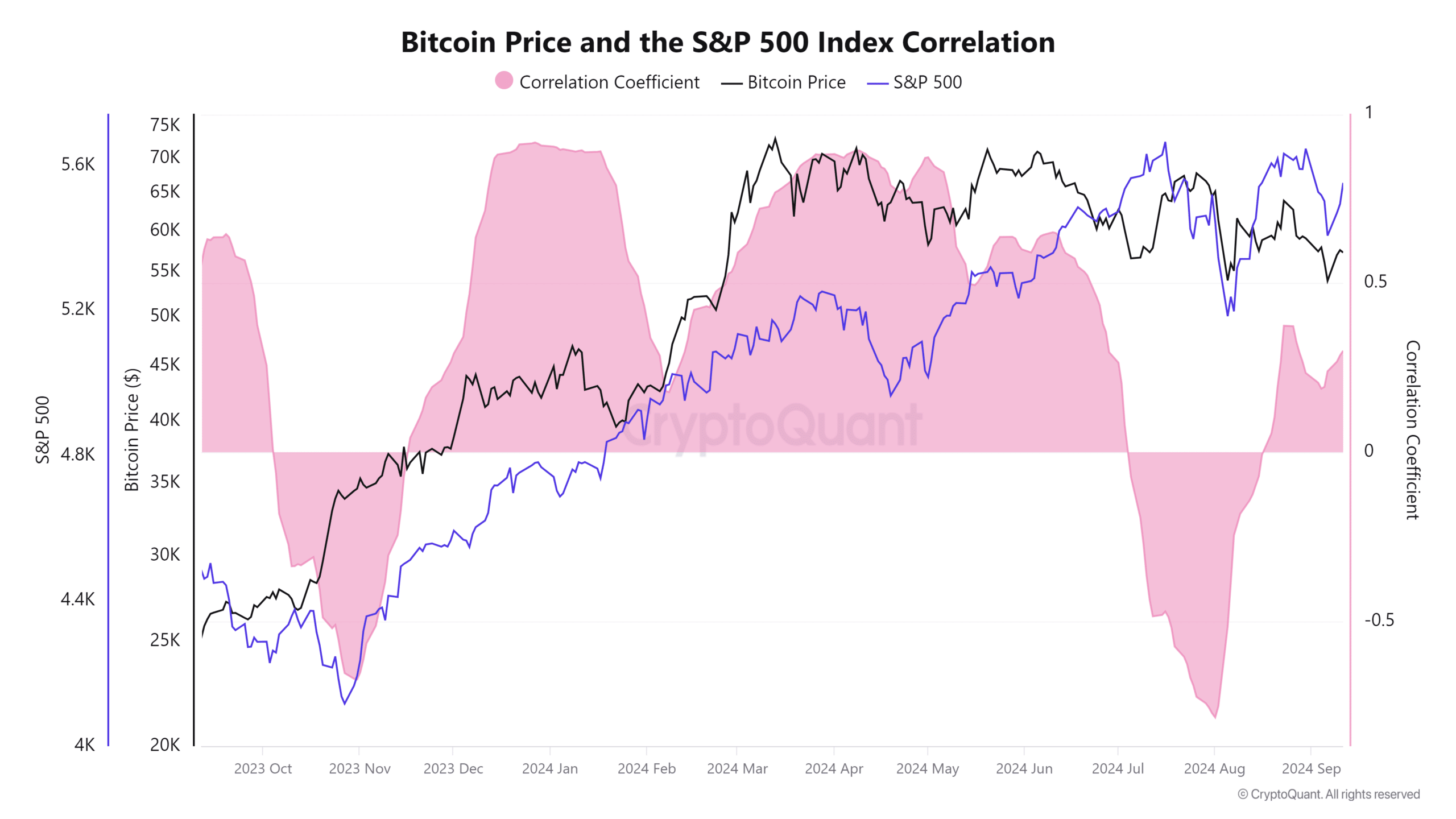

Bitcoin is often classified as a risky asset, a term reinforced by the way people invest in it. The most notable feature of this classification is that Bitcoin has historically shown a correlation with the S&P 500.

The correlation between Bitcoin and the S&P 500 generally underlines investors’ diversification in the risk category. However, there are cases where Bitcoin has lost its correlation with the stock market. This was clearly visible in June and July, phases marked by several factors such as Bitcoin’s involvement in politics.

However, according to the latest data, Bitcoin is once again moving in tandem with the stock market. The correlation coefficient recovered from its low in early August and became positive in mid-August.

Source: CryptoQuant

Expectations about interest rate cuts are the common denominator of this correlation. The US Federal Reserve will hold its next FOMC meeting in four days. Expectations tended mainly towards a significant interest rate cut. Such an outcome would be beneficial for the risk-on segment, which includes both equities and crypto.

Both Bitcoin and the stock market are expected to react to the announcement. In fact, most analysts agree that a bullish outcome is very likely if the Fed decides to implement aggressive rate cuts. Here it is. It’s worth noting that the correlation could be lost further down the line, especially if Bitcoin takes off aggressively.

All eyes on the Bitcoin miners offering

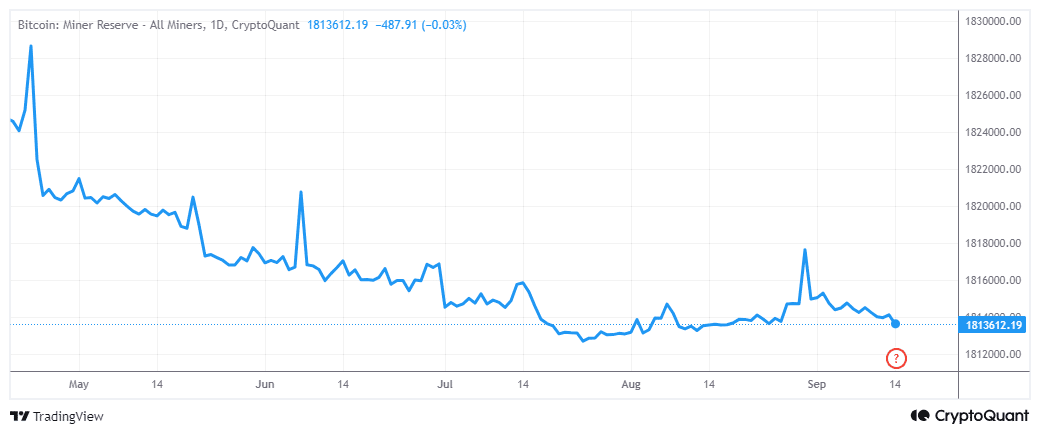

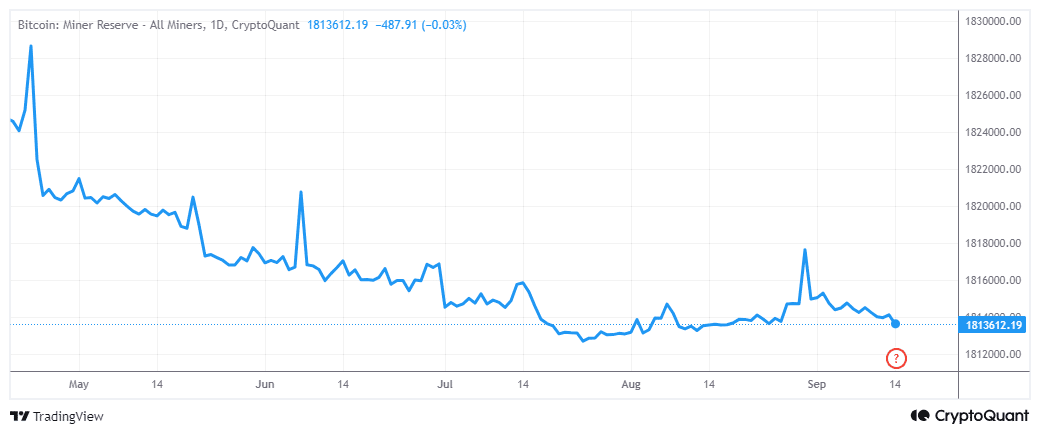

Speaking of bullish expectations, the market is currently looking for signs of a major rally. In fact, a recent Santiment after pointed out that mining portfolio balances can provide a powerful signal when the next big rally begins.

“Bitcoin and Ethereum mining wallets have seen declining supply since the first half of 2024. With this latest mild recovery, we can look forward to a jump in their combined supply as a strong signal that the next bull run is approaching.”

So investors should keep a close eye on miner reserves based on this assessment. The miner reserves statistic showed that Bitcoin miners’ balances have fallen since April. Growth showed some recovery in July, but quickly reversed in favor of outflows.

Source: CryptoQuant

Based on the above analysis, we can see that the miner flows were within the 2024 bottom range. This means there is a significant chance of a turnaround from this level, especially as the fourth quarter approaches.

A combination of rate cuts and the US election could provide the right mix of catalysts to spark another major market move. A shift in the monitoring of Bitcoin miners’ reserves, especially in favor of a sharp increase, can be seen as ample confirmation of when the next bull run will begin.