- Bitcoin gained attention with bullish momentum as analysts predicted a potential surge to $135,000

- Key metrics point to strong fundamentals, although risks remain.

Bitcoin [BTC] is back in the spotlight, fueled by renewed bullish momentum that has traders and analysts eyeing ambitious price targets.

As the cryptocurrency market recovers, BTC’s trajectory has drawn comparisons to its meteoric rise in late 2020, prompting speculation of a similar cycle.

Analysts Chart Bitcoin’s Path to $135,000

Popular crypto analyst Ali Martinez recently drew a parallel between BTC’s current price action and the December 2020 rally.

Source:

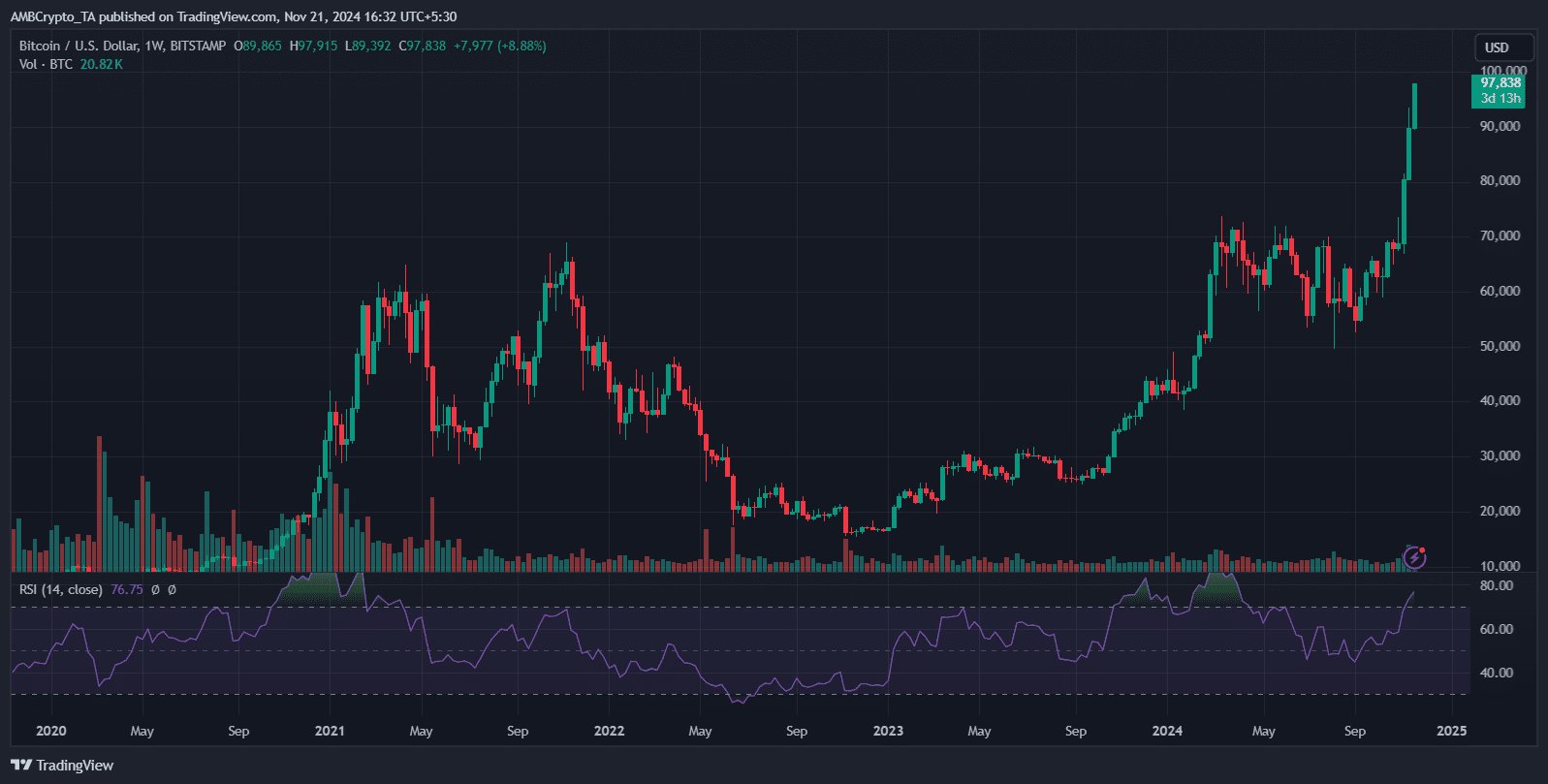

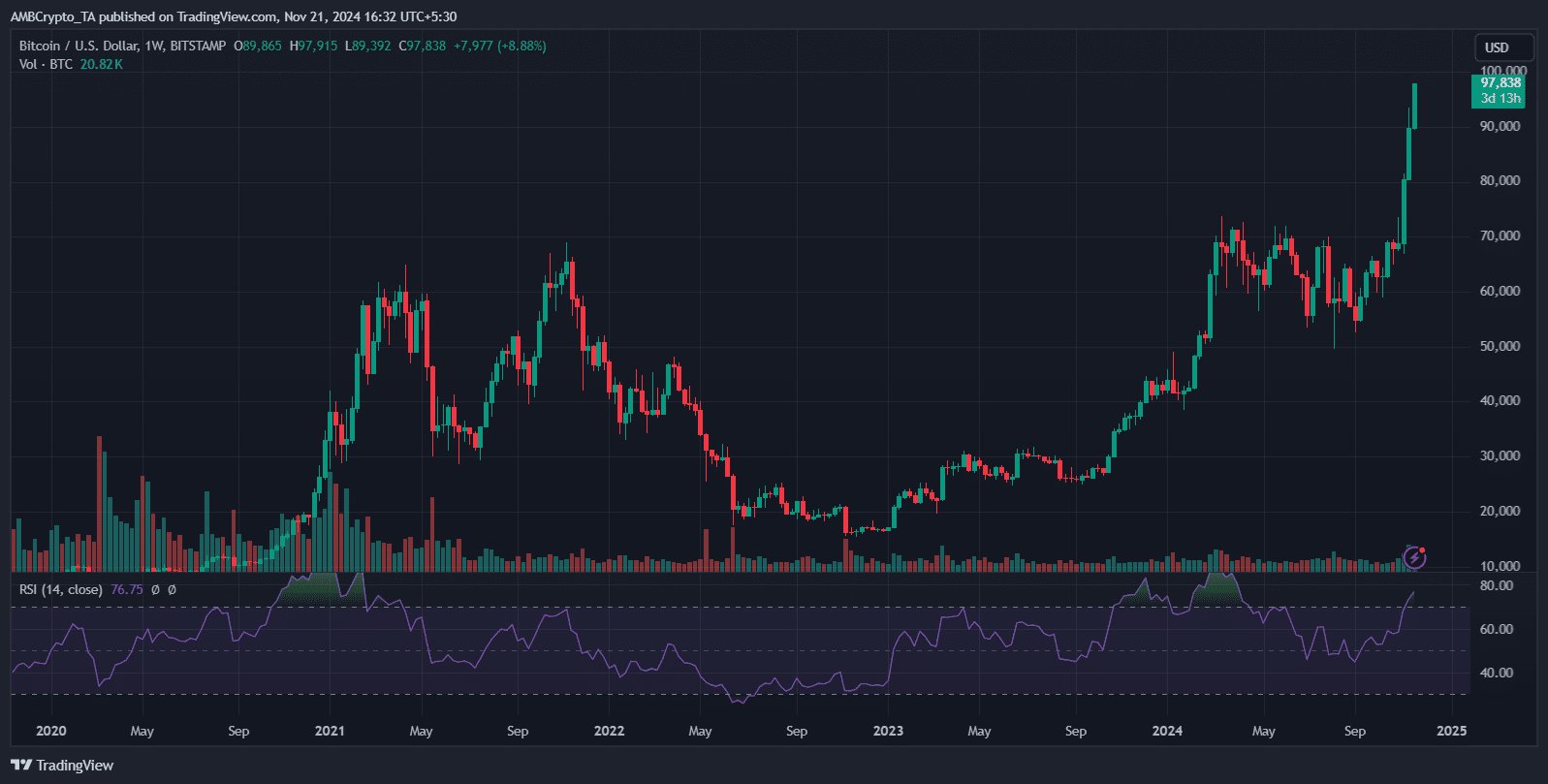

Highlighting the near-identical alignment of Bitcoin’s price trajectory and RSI levels, Martinez proposed a potential roadmap for Bitcoin.

According to his projection, BTC could rise to $108,000, experience a pullback to $99,000, and finally rise to $135,000. The comparison to 2020 highlights the cyclical nature of Bitcoin’s market behavior, reinforcing the possibility of history repeating itself.

Parallels with 2020 and key statistics

Source: TradingView

Current Bitcoin price action mirrored the December 2020 breakout, with both periods seeing consistently higher highs and stable RSI levels reflecting increasing bullish momentum.

In late 2020, Bitcoin went from $20,000 to over $40,000 in just a few weeks, driven by institutional adoption and increased retail FOMO.

Likewise, Bitcoin’s current surge, which has surpassed $97,000, is showing an acceleration fueled by renewed interest from institutional investors and macroeconomic uncertainty.

The similarity in trajectory hinted at the possibility of a multi-stage rally, with consolidation phases likely along the way. However, current market conditions include higher volatility and a more diverse crypto ecosystem, which could shape the outcome differently.

Source: Santiment

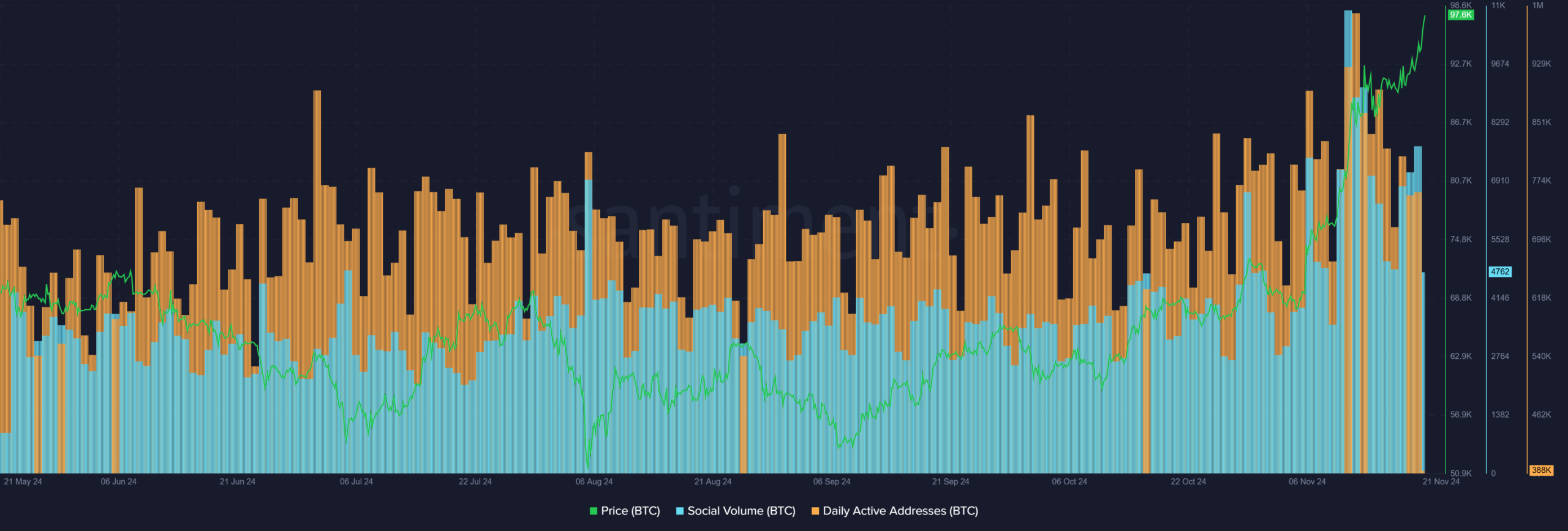

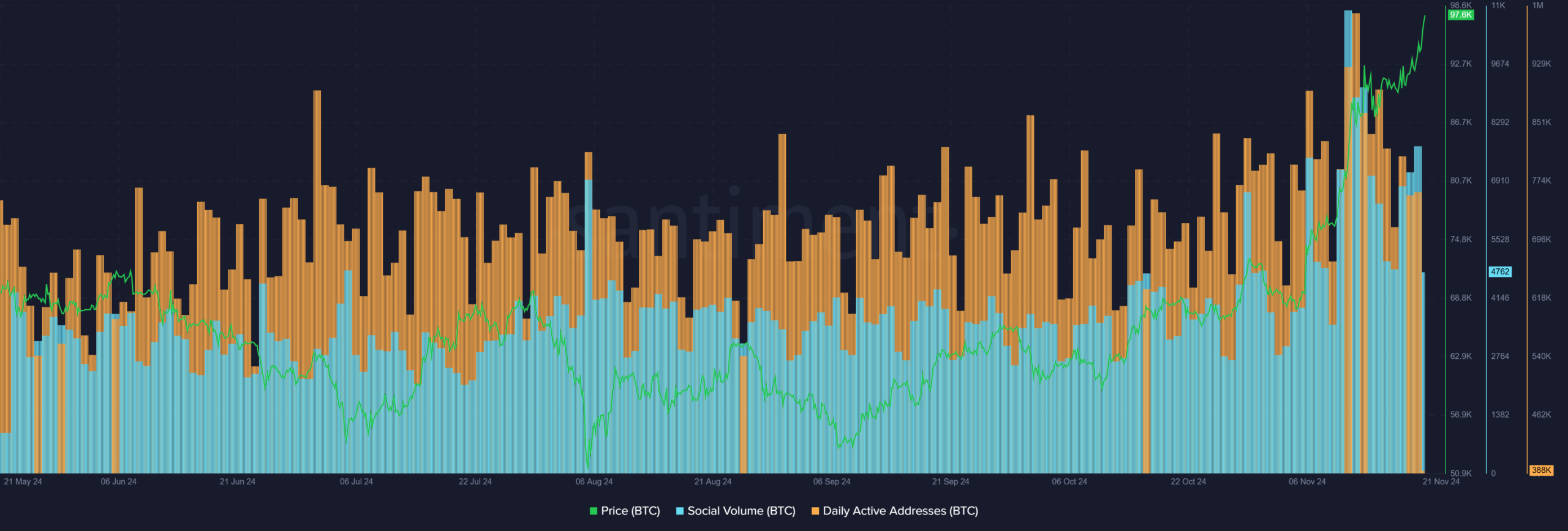

BTC’s daily active addresses have surpassed 476K, indicating consistent network growth. At the same time, social volume remained high at 388,000, reflecting strong market engagement.

These numbers reinforce Martinez’s projection, as increasing adoption and community activity align with historical patterns of sustained price momentum.

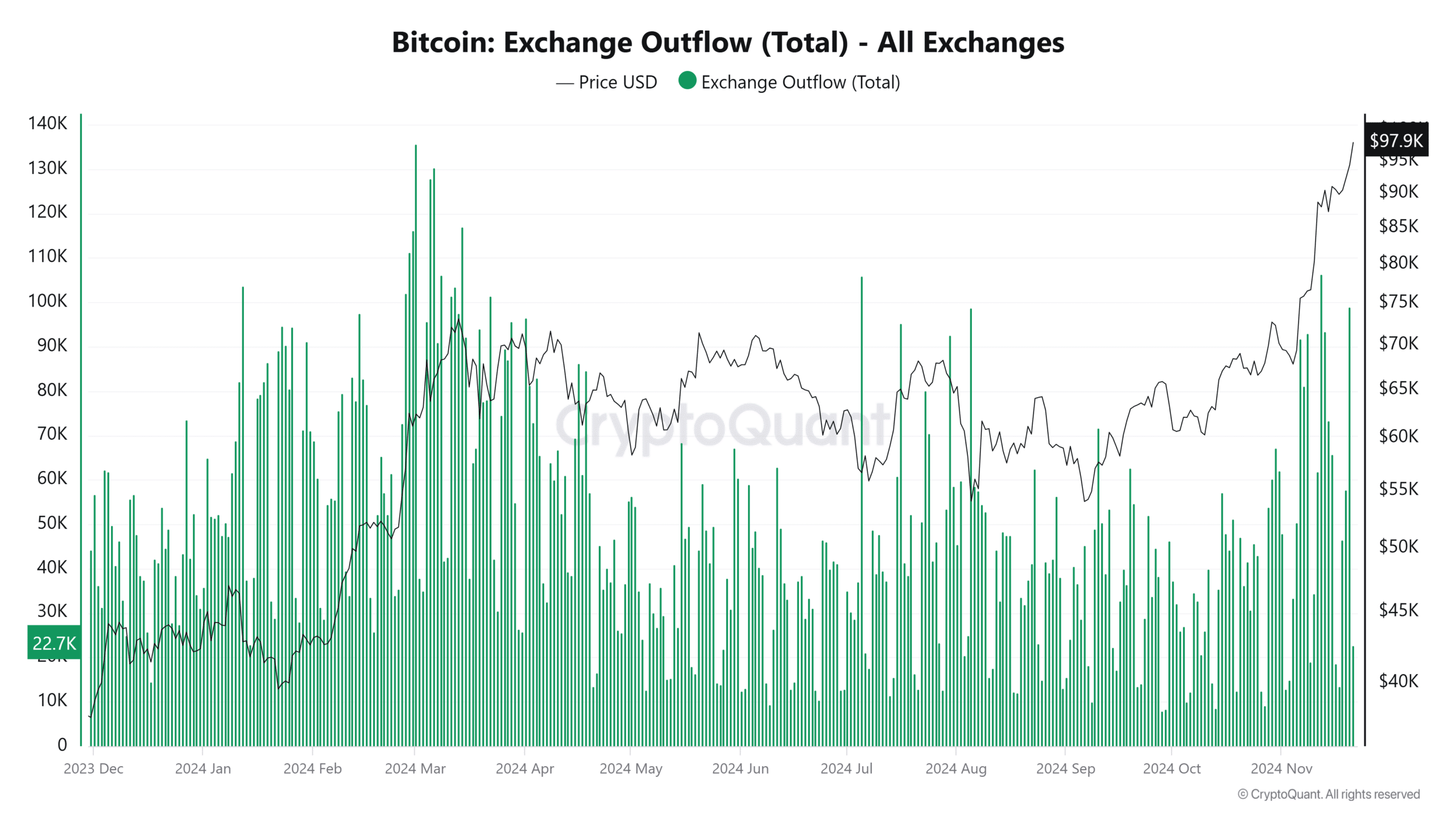

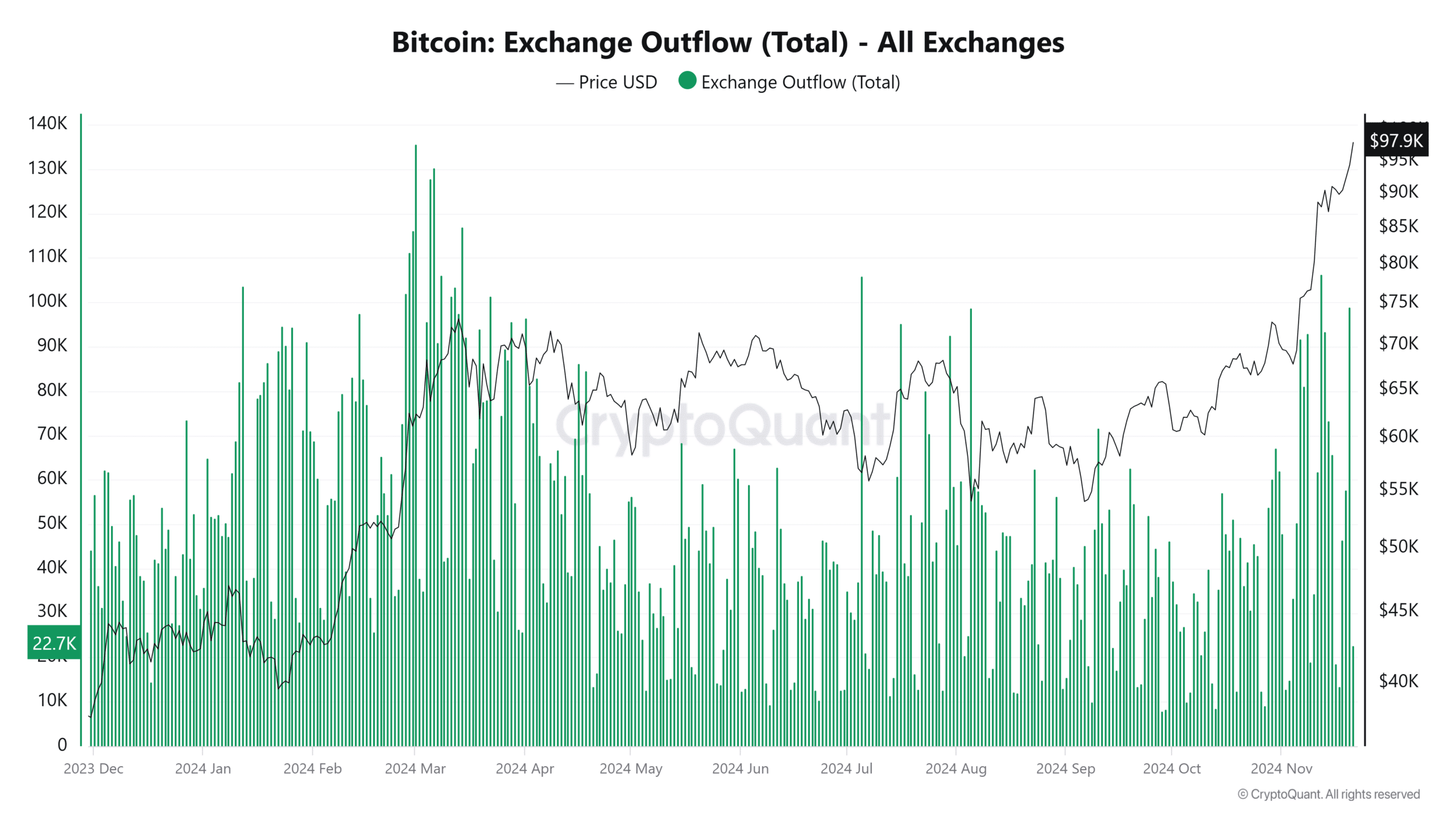

Source: CryptoQuant

The increase in currency outflows indicated strong accumulation as investors removed Bitcoin from exchanges, reducing available supply – a historically bullish indicator.

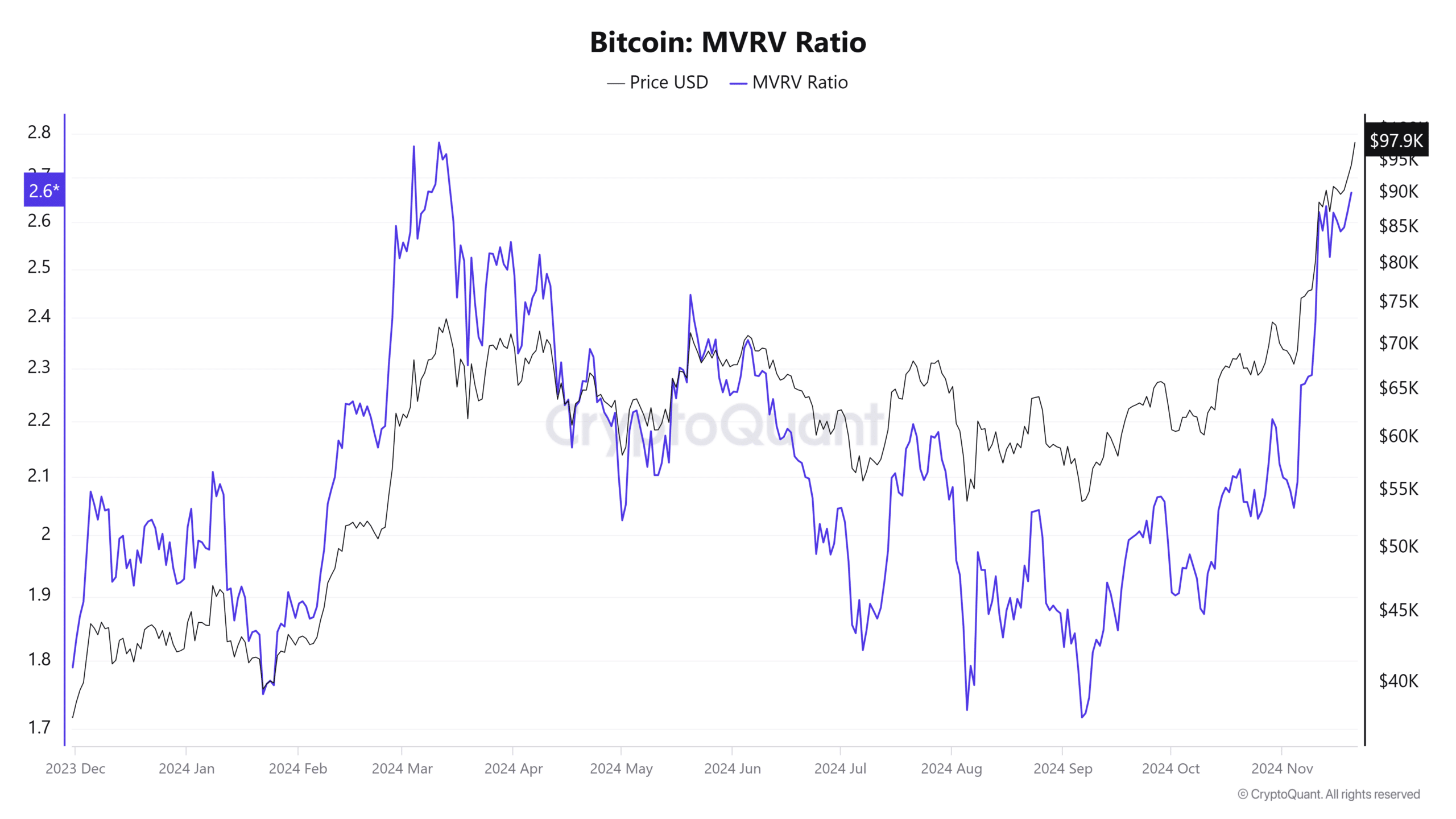

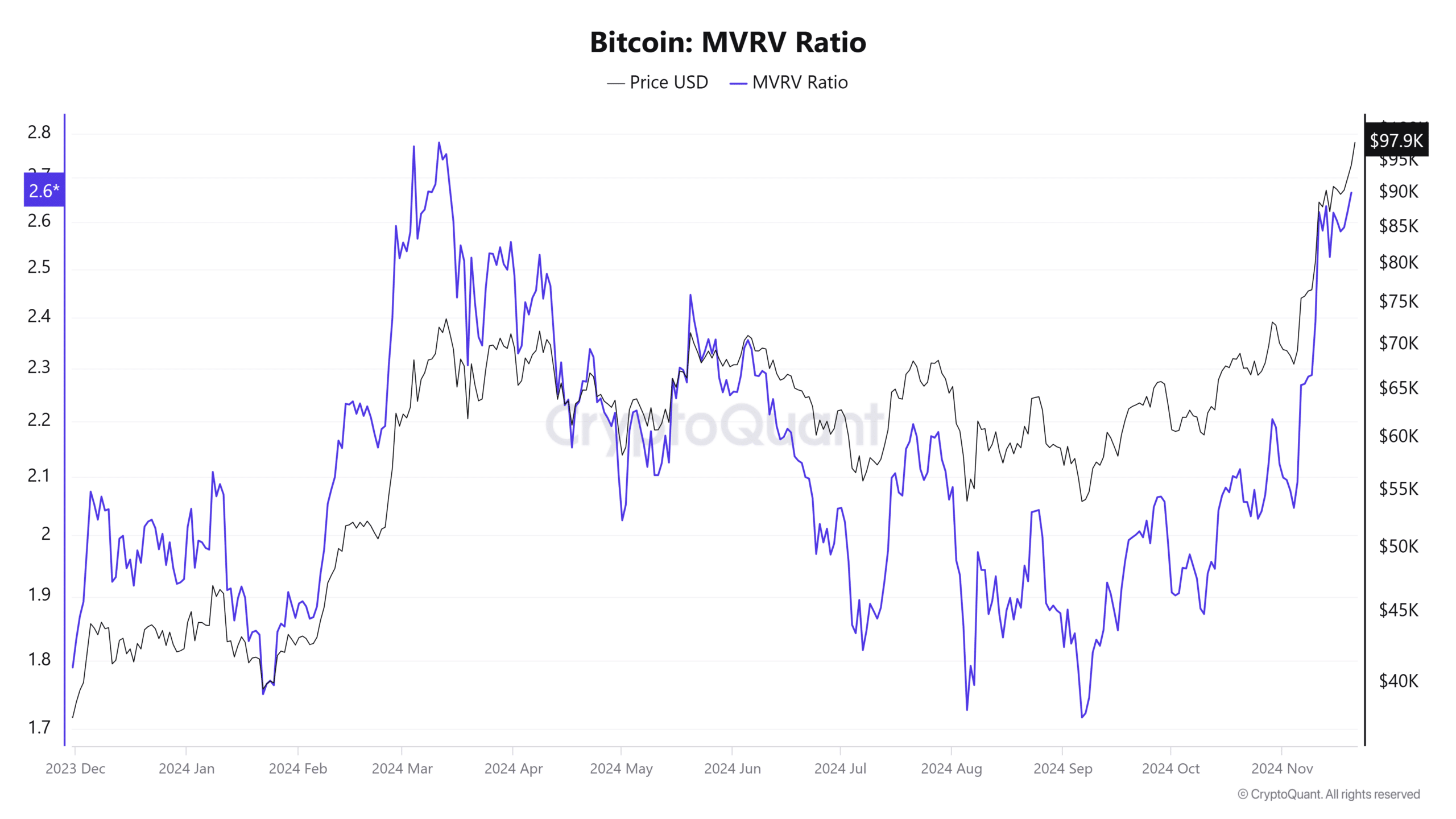

At the same time, the MVRV ratio of almost 2.6 reflected growing unrealized gains but remains below the peak of euphoria from previous cycles, indicating room for further upside potential.

Source: Cryptoquant

This reduced selling pressure, combined with increased demand, creates a supply shock scenario. Such dynamics, previously observed in late 2020, drove rapid price increases, reinforcing the feasibility of Martinez’s $135,000 target.

Read Bitcoin’s [BTC] Price forecast 2024-25

Challenges and Risks for Bitcoin’s $135k Journey

While Martinez’s projection is compelling, investors should consider several risks. Bitcoin’s increased volatility and unpredictable macroeconomic factors could disrupt its expected trajectory.

Furthermore, the diverse crypto ecosystem introduces competing assets, potentially diluting Bitcoin’s dominance.

The MVRV ratio is approaching overbought territory and also increases the risk of sharp corrections. Market sentiment can change abruptly, increasing downward pressure.

As with all projections, cautious optimism and disciplined risk management are essential when navigating Bitcoin’s volatile market.