- Bitcoin has seen two major outflows from Coinbase in the past week.

- There has been a corresponding spike in the stock market’s premium index.

Bitcoin on April 1 [BTC] recorded the second-largest outflow from leading cryptocurrency exchange Coinbase, CryptoQuant data showed.

According to the data provider, 17,000 BTC worth approximately $1 billion was removed from the exchange on that day. Previously, on March 28, outflows from Coinbase totaled 16,800 BTC.

High outflows from Coinbase often indicate that large institutional investors are moving significant amounts of their BTC investments.

This can be for several reasons, such as investment diversification or allocation to other investment vehicles.

CryptoQuant analyst Burak Kesmeci shares the same view: noted that the recent spike in BTC outflows from Coinbase “could be related to institutional purchases or Spot ETF.”

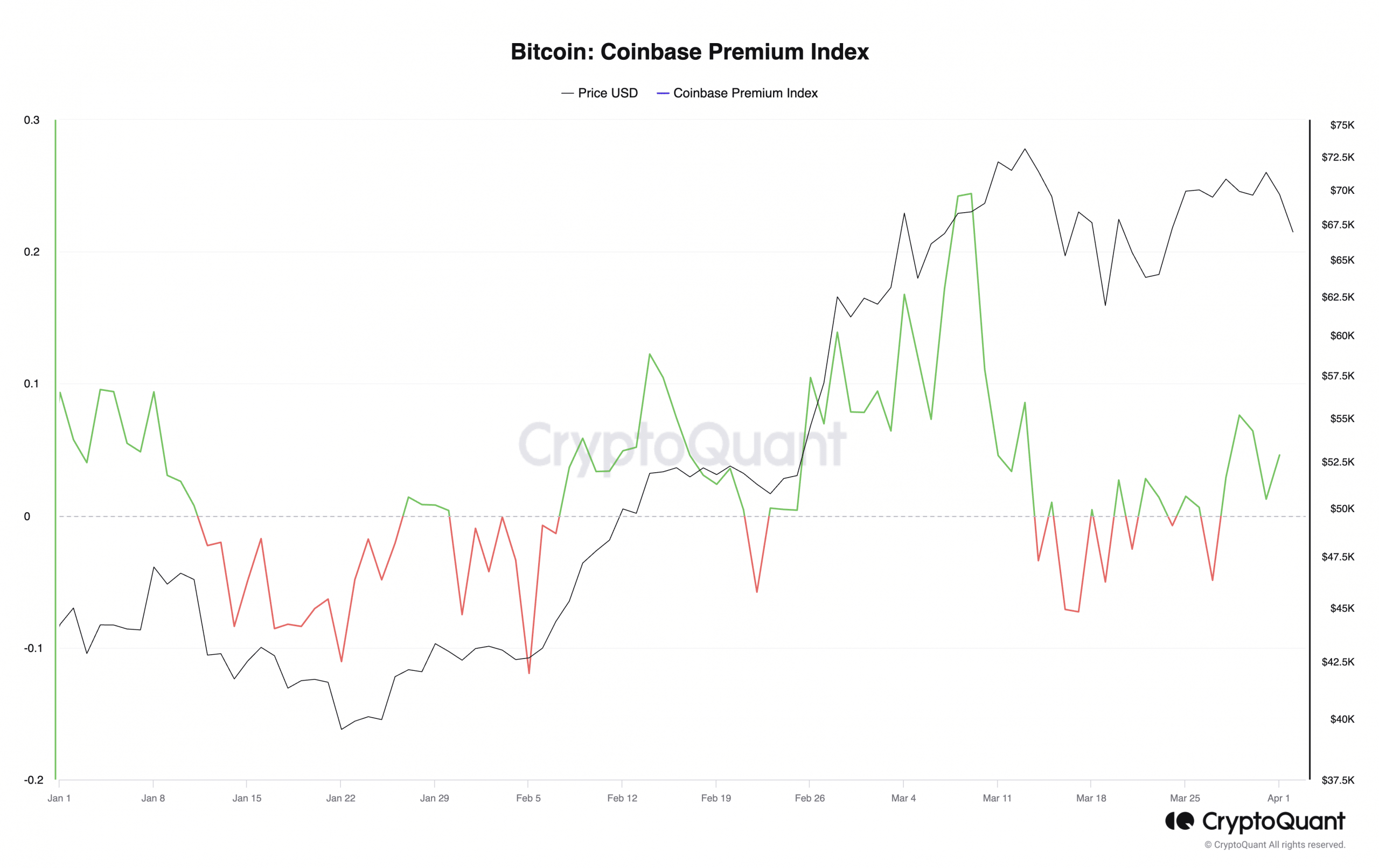

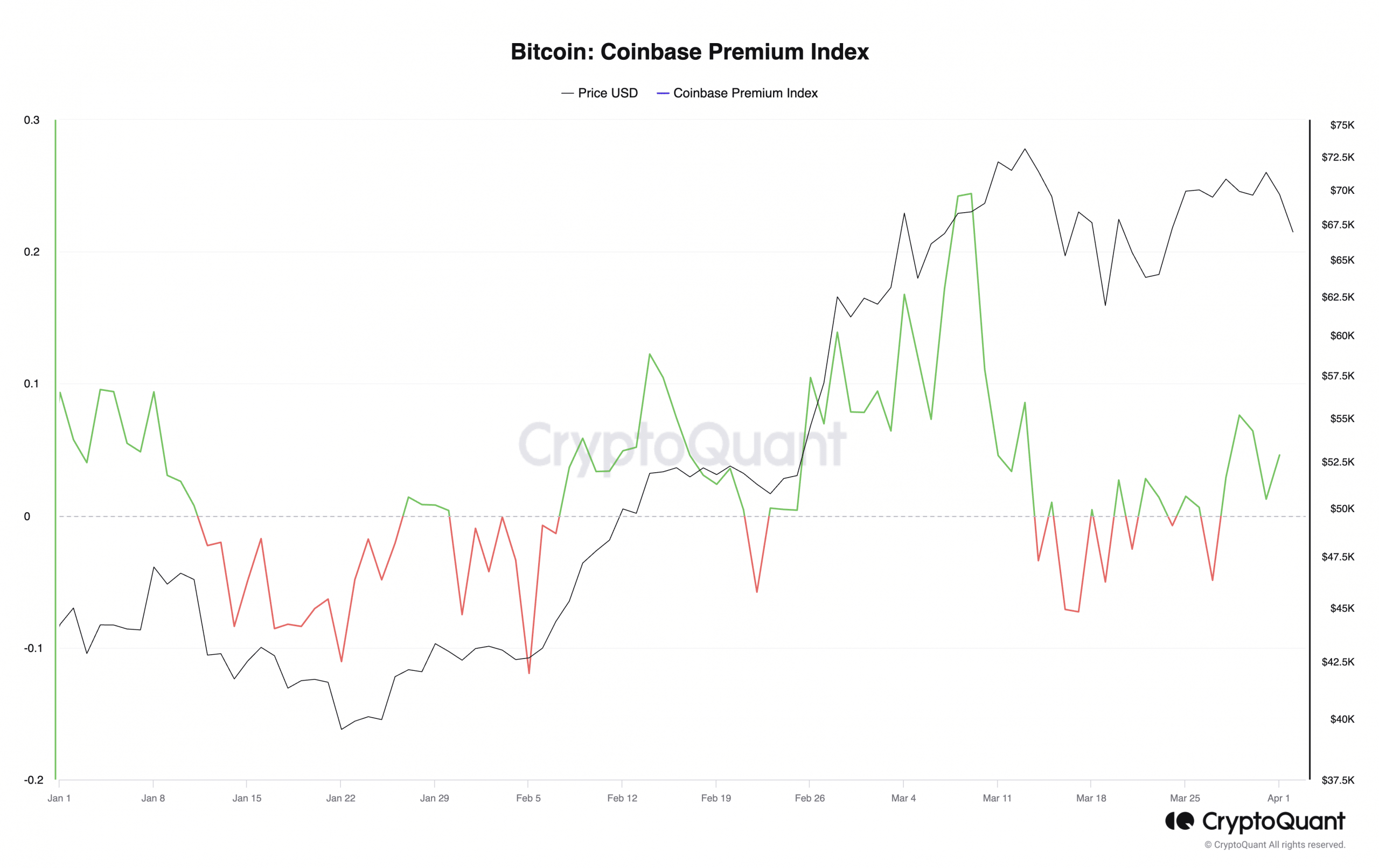

Coinbase premium retracements

The large number of BTCs removed from Coinbase on April 1 coincided with a reversal in the coin’s Coinbase Premium Index (CPI).

On that day, the currency’s CPI, which was about to enter negative territory again, changed course and went up.

Source: CryptoQuant

This metric measures the difference between the prices of BTC on Coinbase and Binance. When its value grows, it indicates significant buying activity from US-based investors on Coinbase.

Conversely, when the price falls and enters negative territory, it indicates less trading activity on the US-based exchange. At the time of writing, BTC’s CPI was 0.045.

This increased by more than 250% between March 31 and April 1.

Confirming a resurgence in activity from US-based coin holders, BTC’s Coinbase Premium Gap is also up more than 200% in the 24-hour period.

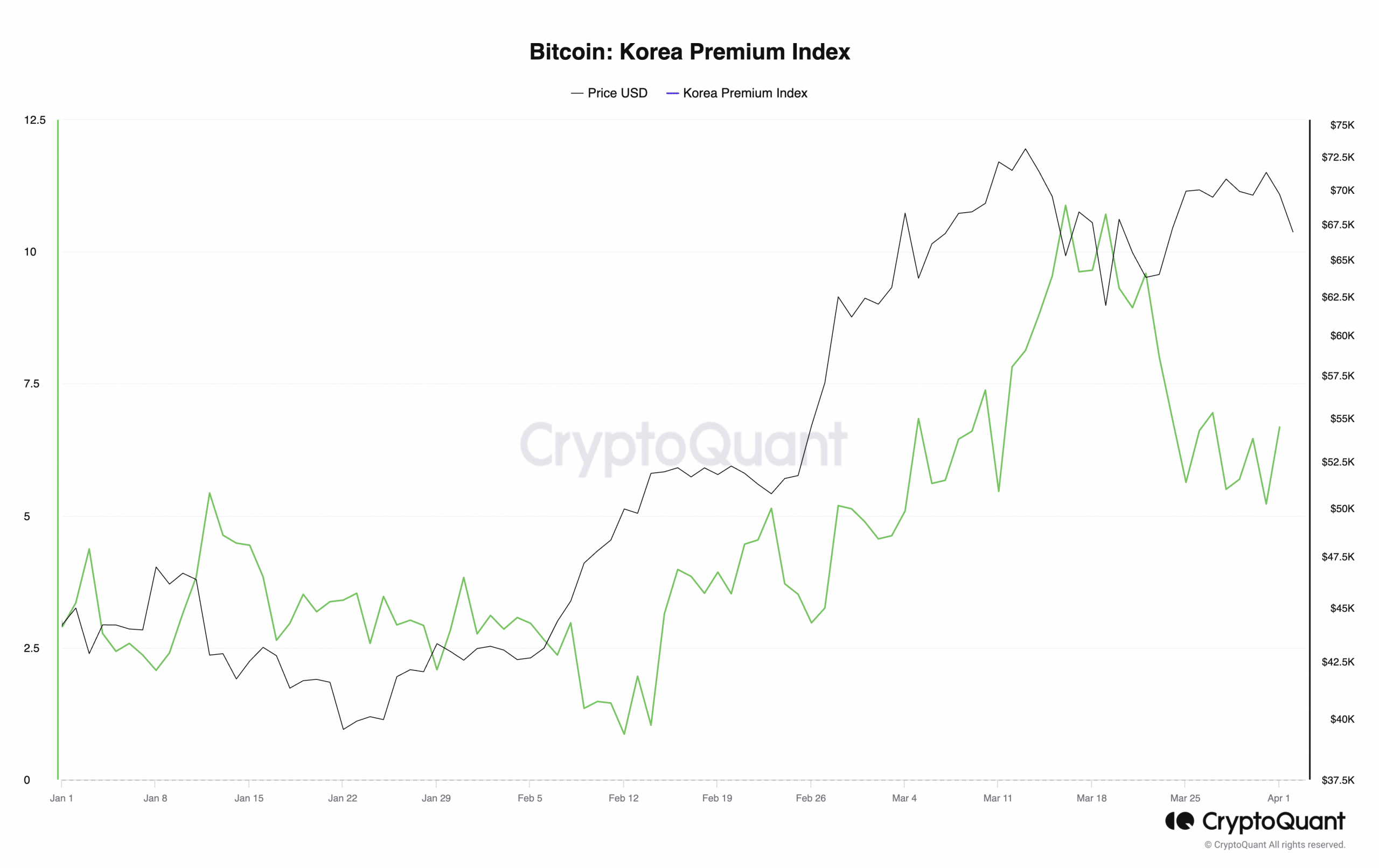

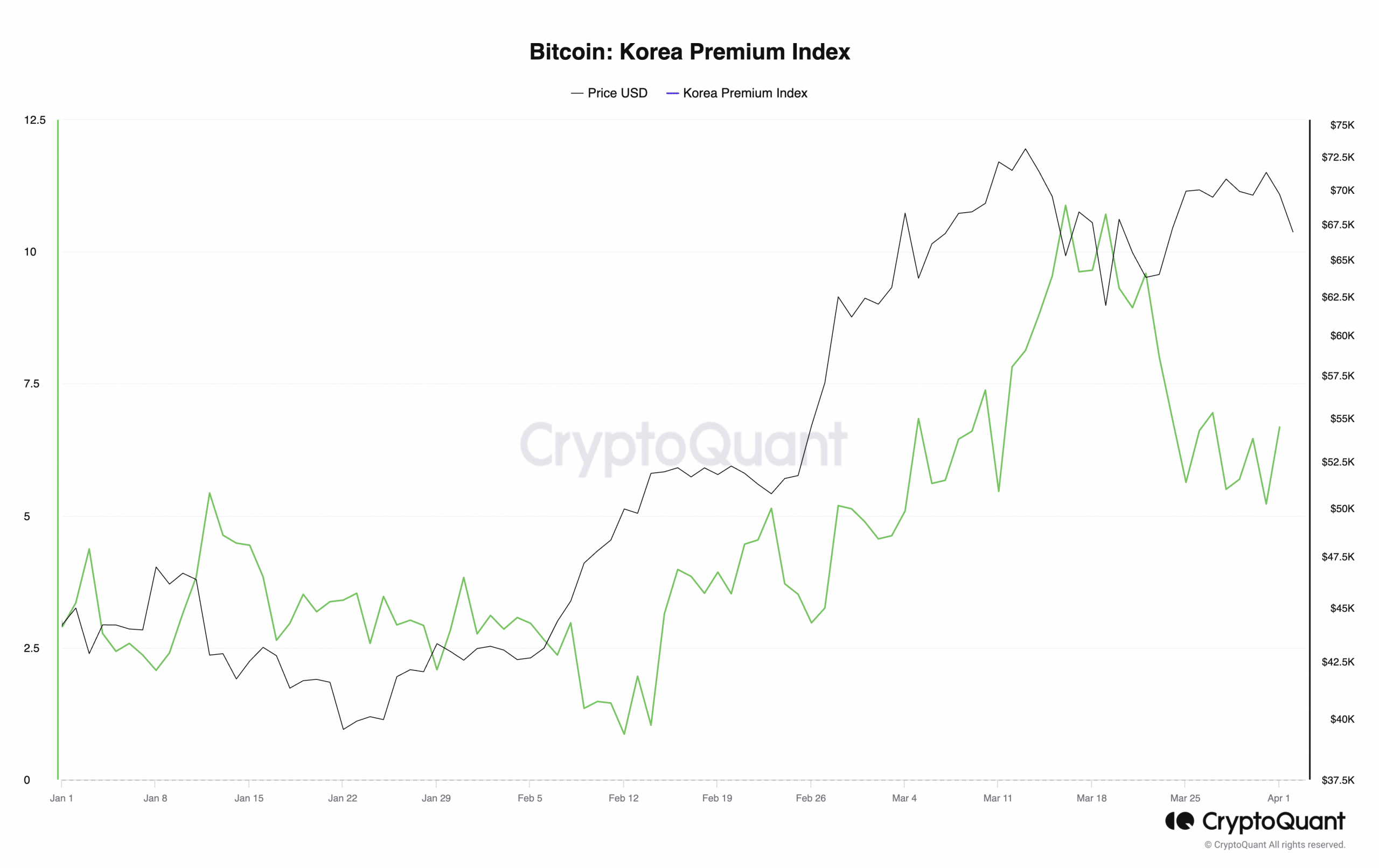

While Asian markets followed a similar trend during the period under review, a review of BTC’s Korean Premium Index (KPI) found that it has remained positive in 2024 despite multiple pullbacks.

At the time of writing, BTC’s KPI was 6.68.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price forecast 2024-25

This metric measures the price difference of BTC between South Korean exchanges and other global exchanges.

When the value of the index is positive, it indicates increased demand for Bitcoin within the South Korean market compared to other markets.