Arthur Hayes, the founder of BitMEX, has provided an in-depth analysis of the current financial landscape and its potential impact on Bitcoin, especially in light of the recent challenges facing New York Community Bancorp (NYCB) and the broader banking industry.

Hayes’ analysis is based on the complex interplay between macroeconomic policy, the health of the banking sector and the cryptocurrency market. His comments are particularly illuminating given the recent developments at NYCB. The bank’s shares plunged 46% due to an unexpected loss and a significant dividend cut, mainly attributed to a tenfold increase in loan loss reserves, which easily exceeded expectations.

This incident has raised warnings about the stability and exposure of US regional banks, especially in the real estate sector, which is known to be cyclically sensitive and vulnerable to economic downturns. The stock market reacted negatively to these developments, with regional US bank stocks also falling following NYCB’s performance.

Weekend rally ahead for Bitcoin?

Hayes explicitly declared“Jaypow [Jerome Powell] and Bad Burl Yellen [Janet Yellen] will be printing money soon. NYCB posts a ‘surprise loss’ caused by a 10x increase in credit reserves versus estimates. I don’t think the benches have been repaired yet.’ This comment underlines the continued vulnerability of the banking sector, which is still reeling from the shocks of the 2023 banking crisis. He added: “The 10 and 2 year yields fell, signaling that the market is in some sort of renewed bailout for the bankers expected to fix the rot.”

In addition, Hayes highlighted the upcoming completion of the Federal Reserve’s Bank Term Funding Program (BTFP), which was introduced in response to the 2023 banking crisis. The BTFP was a critical tool in providing liquidity to banks, allowing them a broader range could use collateral for loans.

Hayes expects that market turbulence will lead to the Fed potentially reinstating the BTFP or introducing similar measures. In a recent statement, he noted: “If my prediction is correct, the market will allow a number of banks to fail within that period, forcing the Fed to cut rates and announce the resumption of BTFP.” This scenario, he argues, would create a liquidity injection that could boost cryptocurrencies like Bitcoin.

In his last post on predicts a similar trajectory, indicating a short dip followed by a significant rally:

Expect BTC to swoon a bit, but if NYCB and a few others dive into the weekend, expect another bailout soon. Then BTC is off to the races, just like the March ’23 price action. […] I think it might be time to get back on the train, fam. Maybe after a few US banks bite the dust this weekend.

During the March crisis, Bitcoin’s value rose more than 40%, a response attributed to Bitcoin’s perceived role as digital gold or a safe haven amid financial instability. Over a longer time horizon and with the Great Financial Crisis of 2008 in mind, he further argued: “What did the Fed and Treasury do last time when US real estate prices plummeted and banks worldwide failed? Money printer Go Brrrr. BTC = $1 million. Yachtzee.”

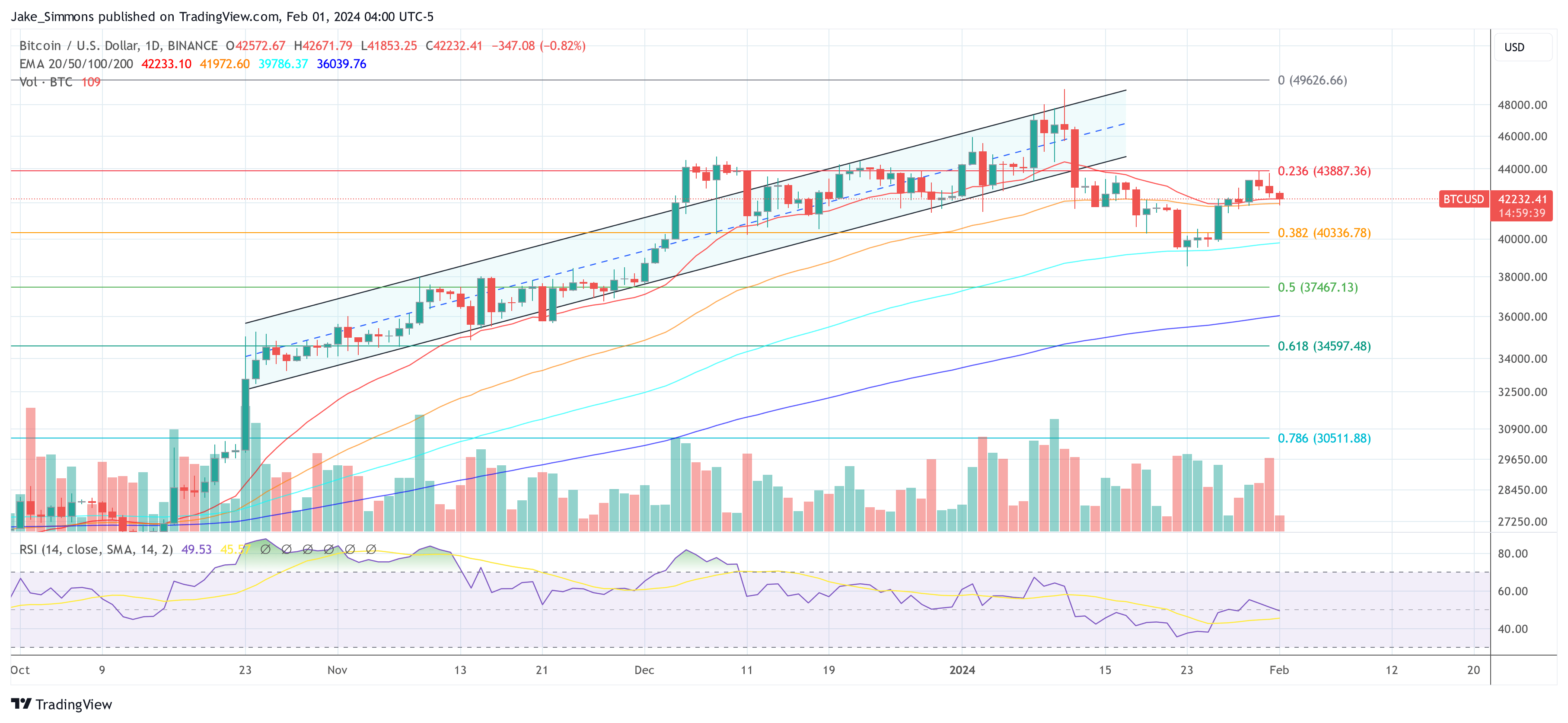

At the time of writing, BTC was trading at $42,232.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.