- Bitcoin reached $97,836 ATH, while Open Interest rose to $63.32 billion, indicating growing Futures activity.

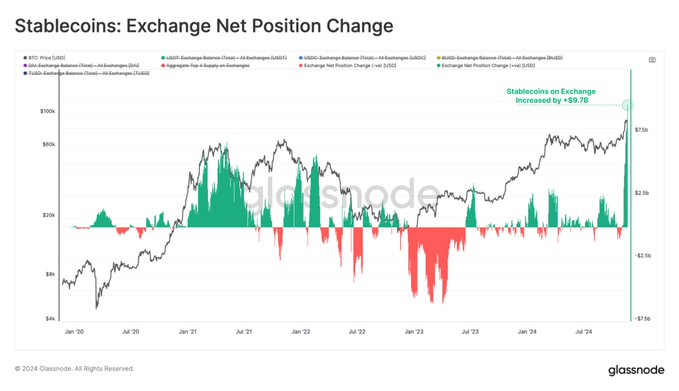

- Record inflows of $9.7 billion into stablecoins also boosted BTC buying demand.

Bitcoins [BTC] Has open interest reaches an all-time high of $63.32 billion, reflecting increased activity in the crypto futures market.

The milestone comes as the price of the king coin hit a record $97,836 earlier today, fueling speculation that the price could soon reach the $100,000 mark.

Source:

This increase indicated higher trading volume and growing market participation, driven by strong demand from retail and institutional investors.

Bitcoin’s trading volume in the past 24 hours reached $101.6 billion, reflecting a 4.46% price increase over the same period. Over the past week, BTC gained 7.48% per Coingecko data.

With a circulating supply of 20 million BTC, the market cap is $1.93 trillion.

The inflow of stable coins indicates increased demand

According to data, stablecoin inflows to crypto exchanges have reached a record $9.7 billion in the past 30 days. This marked the highest monthly inflows on record, indicating growing investor interest.

Stablecoins, which serve as a bridge between fiat currencies and crypto assets, are often used for trading and purchasing cryptocurrencies.

Leon Waidmann, head of research at The Onchain Foundation, noted,

“Stablecoin inflows to exchanges reached $9.7 billion in 30 days! The LARGEST monthly inflow EVER. Stablecoin liquidity is back. Speculative demand continues to explode!”

Source:

The increase in stablecoin activity indicated strong buying pressure, which could push King Coin closer to the $100,000 mark.

November has historically been one of Bitcoin’s most bullish months, further boosting optimism.

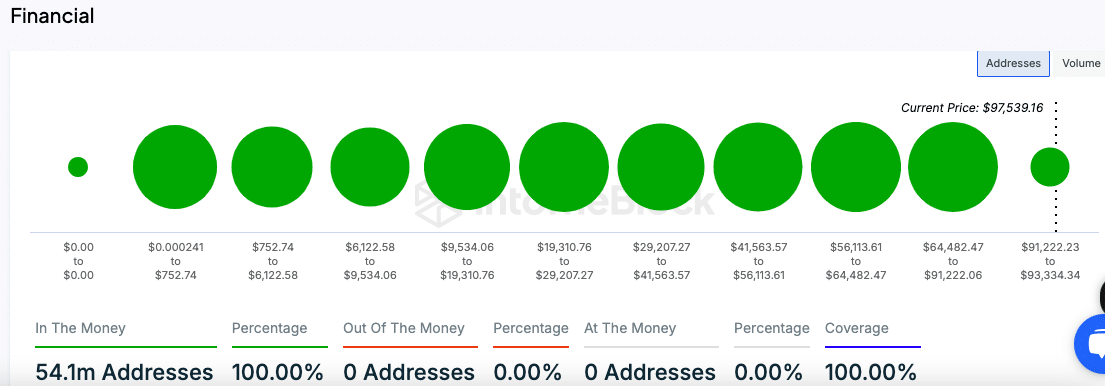

100% addresses in profit

Data from InHetBlok revealed that all 54.1 million tracked Bitcoin addresses were “in the money” at the time of writing, meaning the current price exceeded their average acquisition cost.

Not a single address kept Bitcoin at a loss.

Source: IntoTheBlock

As expected, the absence of addresses at loss or breakeven levels indicated robust market confidence.

Increased activity in the Bitcoin ecosystem

Other statistics showed increased activity within the Bitcoin network. The number of active addresses has reached 750,264 in the last 24 hours, reflecting increased participation.

Furthermore, Bitcoin transaction fees during this period amounted to $2.06 million, highlighting strong network usage.

Read Bitcoin’s [BTC] Price forecast 2024–2025

According to DeFiLlamaBitcoin’s Total Value Locked (TVL) in decentralized finance protocols is $4.321 billion. So in addition to price and trading activity, Bitcoin is also seeing growth in DeFi adoption.

If such bullish conditions continue, it won’t be long before Bitcoin reaches the coveted $100,000 mark.