- The Bitcoin rally is approaching a pivotal point, testing the strength of the bulls.

- A short squeeze could be the catalyst needed to push Bitcoin to the next major level at $110,000.

The market is in extreme euphoria, just like Bitcoin [BTC] hits a new ATH of $93,490, and social media is on fire with price predictions over $100,000. Historically, peak sentiment hype often signals caution; Smart traders know that euphoria can mark a top.

Recently, a slight bearish divergence indicated a possible pause, as BTC briefly fell 0.57% and consolidated around $87,000. However, the bulls quickly regained control, leading to a 3% rally the next day, marking a new all-time high.

It was a pivotal moment: the bulls rallied with conviction, breaking through the market’s skepticism and setting their sights firmly on the legendary $100,000 milestone.

With BTC heading even higher, selling pressure is sure to follow. Therefore, the real test for the bulls lies ahead as inevitable pullbacks loom on the horizon.

Key resistance factors in Bitcoin’s rally to $100,000

As Bitcoin continues to rise, traders are sitting on significant price gains not realised gains, increasing the likelihood that the rally will stall and a price correction will occur.

Psychologically speaking, after reaching extreme price peaks, uncertainty tends to induce caution. With continued concerns about regulatory changes, many traders may choose to lock in their profits and minimize losses, which could put downward pressure on the market.

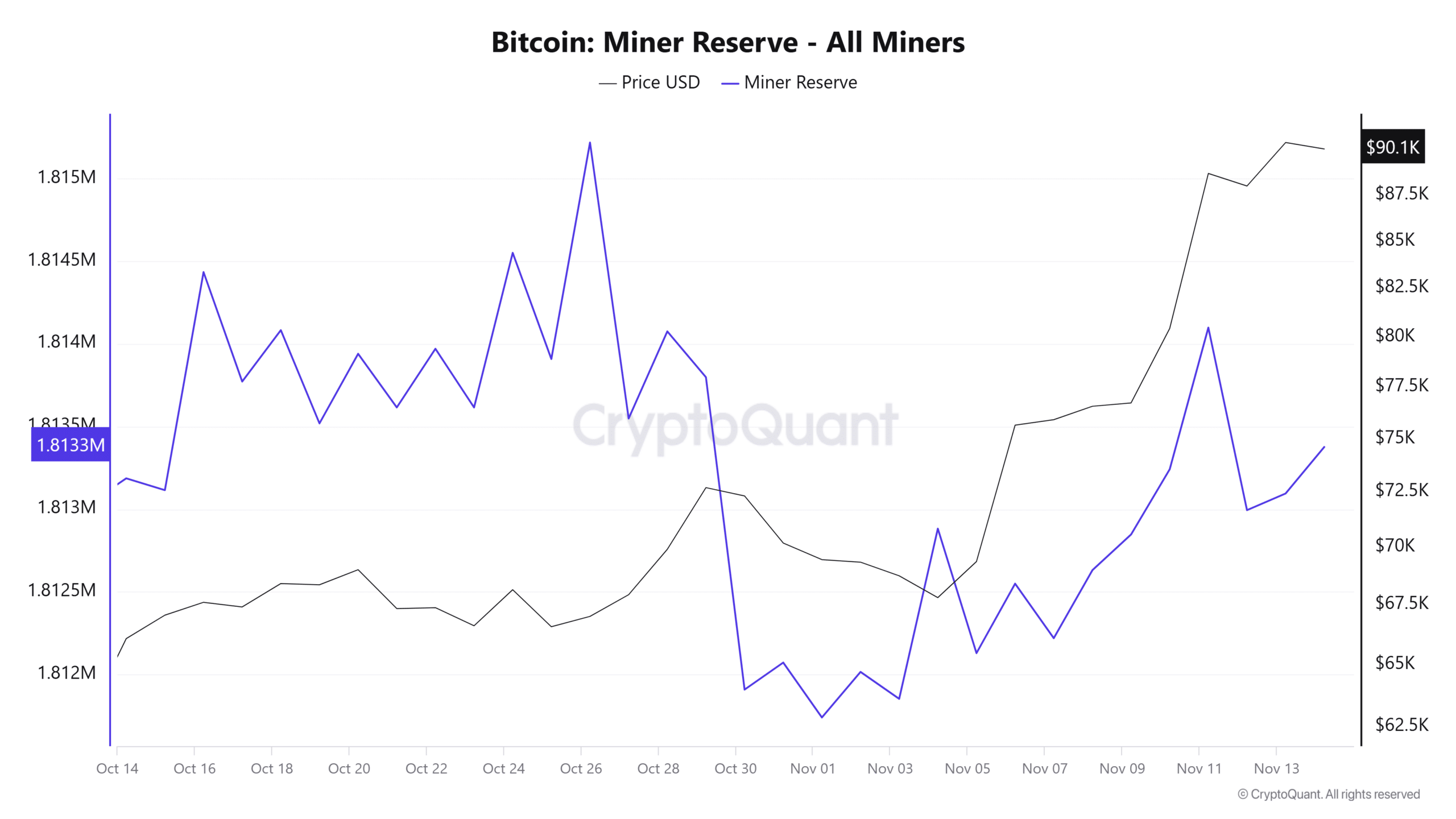

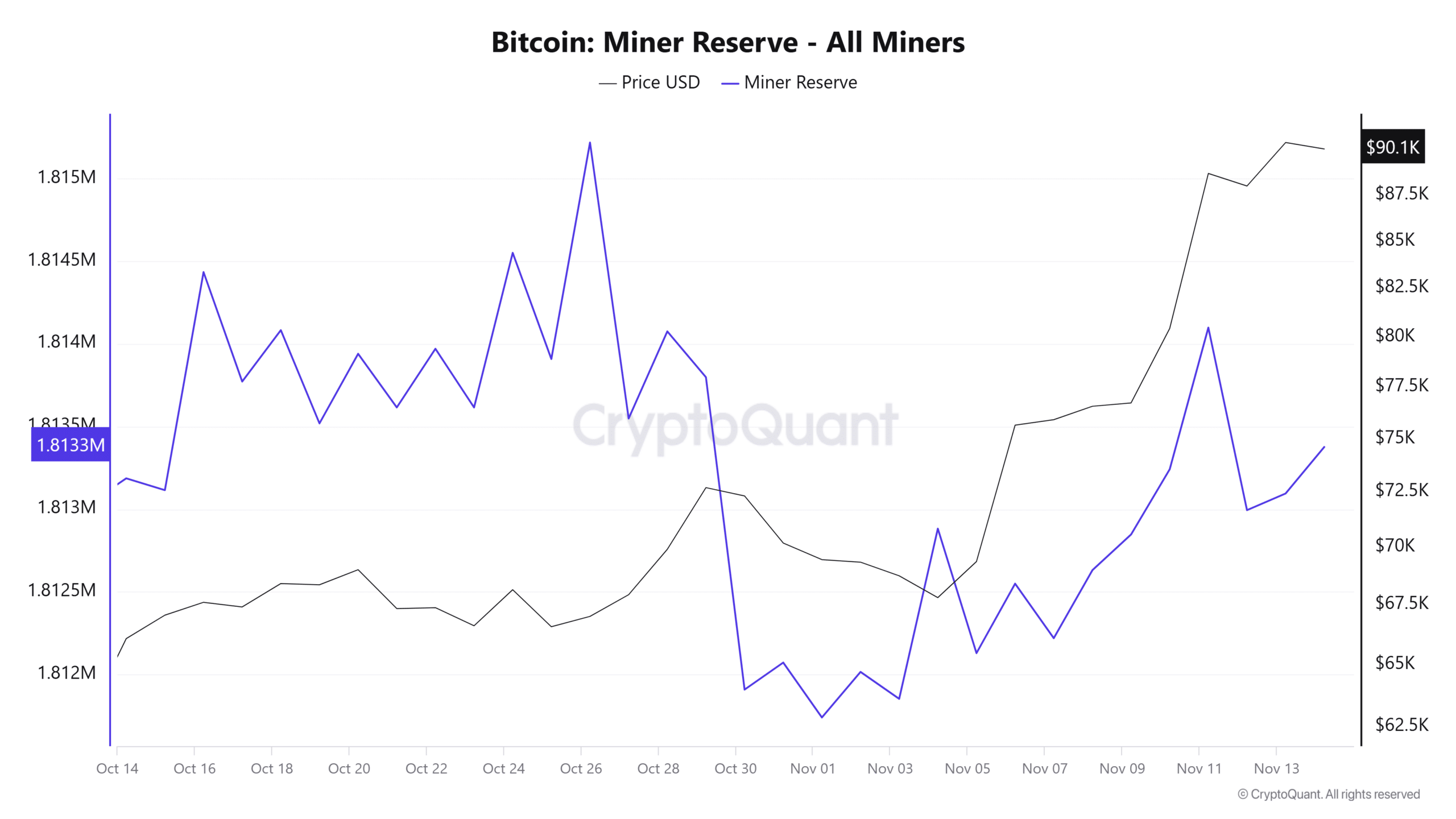

A classic example of this is Bitcoin miners losing their assets.

On the same day, the rally stalled for the first time in this post-election cycle, with Bitcoin falling to a low of $82,000, after posting a new ATH of $87,000 the day before, miners saw an extreme outflow of 25,000 BTC.

Source: CryptoQuant

Simply put, miners may be unsure whether Bitcoin will reach $100,000. As a result, they may want to take advantage of current high prices and lock in profits – especially to break even on their expenses – before market volatility sets in.

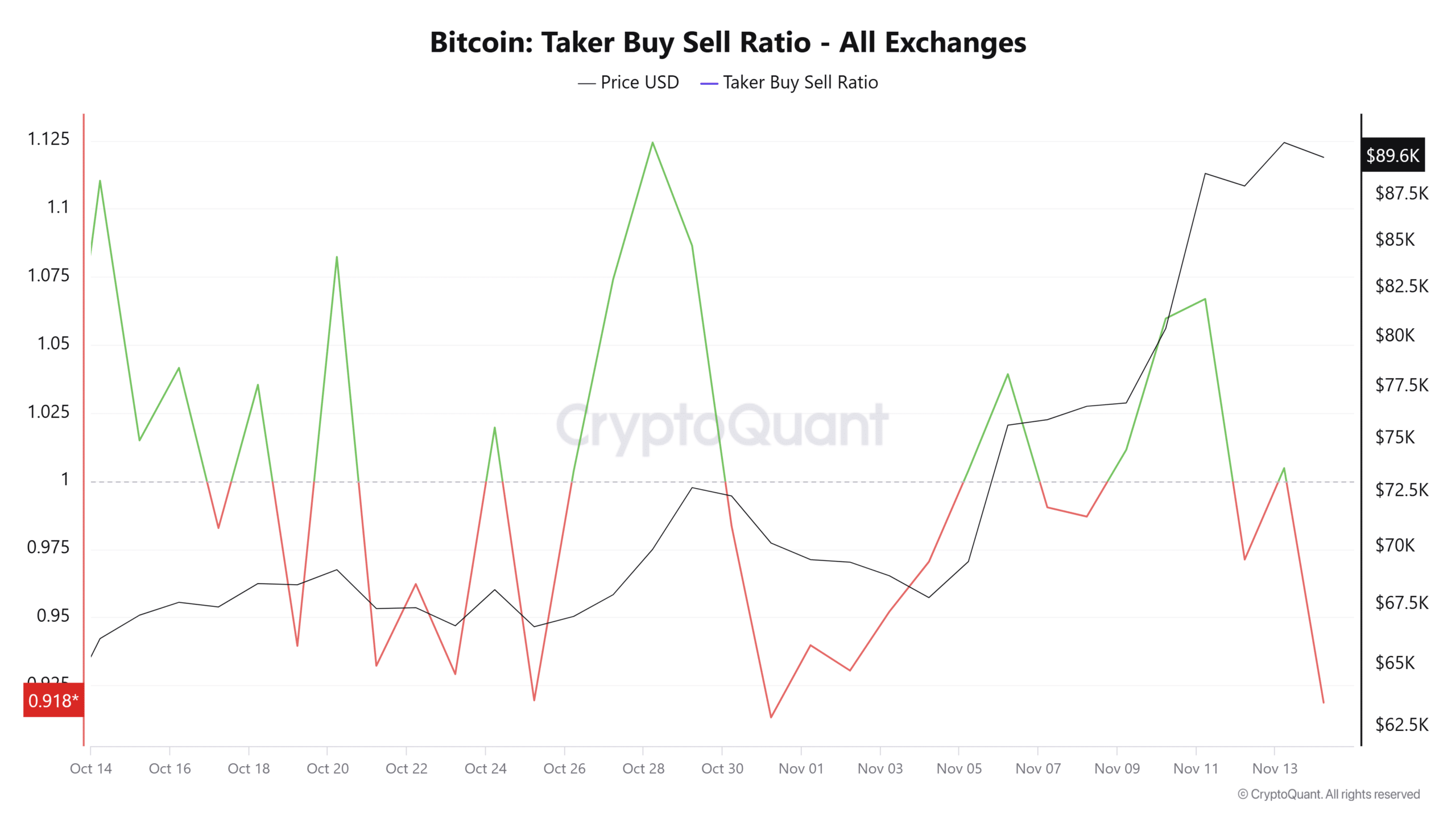

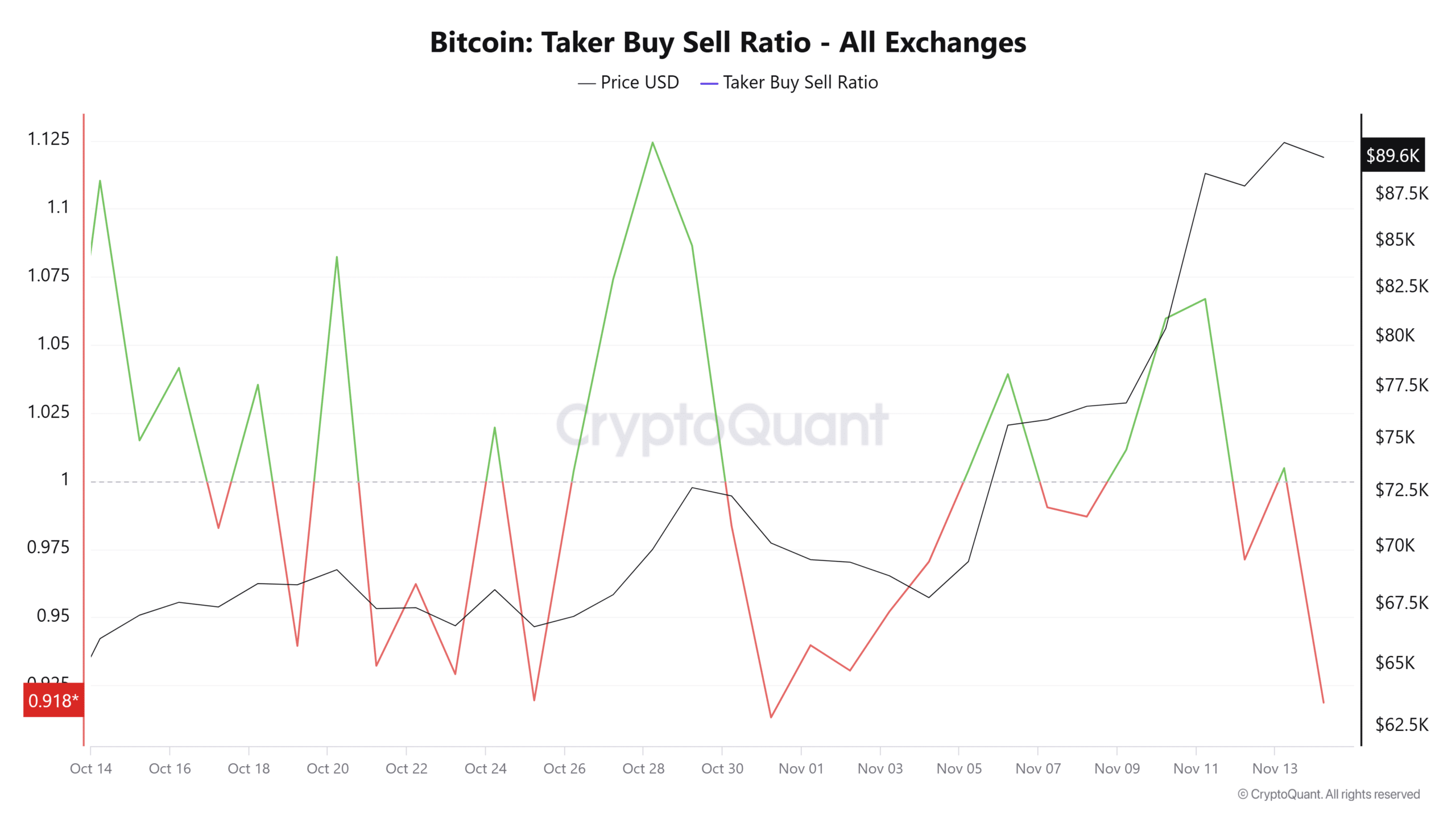

Aside from the volatility caused by miners, the derivatives market is also showing a shift in dominance, with high sell orders gaining popularity. This is evident from the striking red stick that points south.

Source: CryptoQuant

To keep the Bitcoin rally unchallenged, reversing this trend will be crucial. As mentioned earlier, resistance is inevitable as selling pressure increases in various areas.

The key, however, will be to watch for a possible parabolic run, which is looking increasingly likely. The recent 3% increase suggests that the bulls have countered the pressure by engaging in heavy accumulation.

$100,000 seems inevitable, what’s next?

Given current market sentiment, it appears to be bullish for several key reasons. The bulls saw the $82,000 dip as an ideal buying opportunity and prevented a stop near $100,000.

Plus there are whales to cling 62% of long positions in the perpetual futures market, indicating strong institutional confidence.

Moreover, private investor ask has risen to a 52-month high, with a notable 30-day increase, indicating robust interest from both major investors and retail traders.

As a result, the $100,000 benchmark appears within reach, with minor pullbacks along the way. What’s interesting now is what happens after the goal is achieved.

Source: Ali/X

Historically, whales have tended to go against the crowd, buying when others are fearful and selling when they are exuberant. Over the past week, whales have amassed 100,000 Bitcoin, worth more than $8.60 billion, according to a prominent source. analyst.

Read Bitcoin (BTC) price prediction 2023-24

From a psychological perspective, once Bitcoin reaches the $100,000 mark, there will likely be panic selling across several metrics, combined with bears attempting to initiate a long squeeze.

This will be the real test for the bulls. As short sellers seize the opportunity to bet against Bitcoin and FOMO begins to fade, the bulls will need to stay strong. If they succeed, a massive short liquidation could occur, potentially paving the way for a Bitcoin rally towards $110,000.