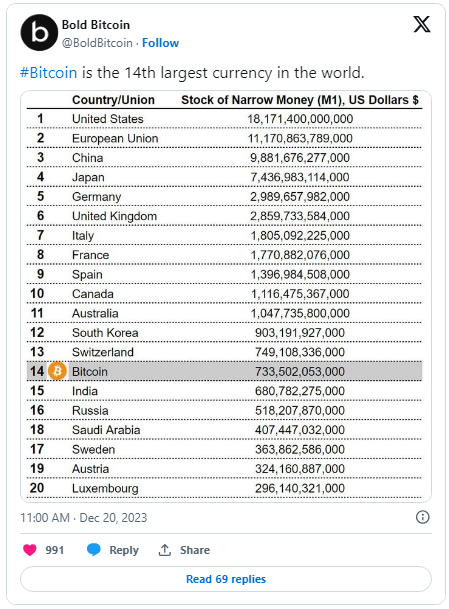

In a groundbreaking financial shift, Bitcoin, the world’s original and highly capitalized cryptocurrency, has quickly climbed the rankings and secured its place among the top 15 largest currencies worldwide. Bold, a Bitcoin credit card company, announced this remarkable achievement in December, highlighting Bitcoin’s uniqueness as the only cryptocurrency among the top 20 sovereign central bank currencies.

Examining the data from CEIC and CoinGecko paints a vivid picture of Bitcoin’s extraordinary rise. On the crucial date of November 19, Bitcoin’s market capitalization rose to over $835 billion, cementing its position among global financial giants.

Bitcoin’s Rapid Rise: Overtaking Global Currency

This milestone not only marked a significant leap forward for Bitcoin, but also propelled it past the Indian rupee, which stood at just over $693 billion in November.

The story of Bitcoin’s triumph doesn’t stop there. Bitcoin easily surpassed the national currency and continued its meteoric rise, even surpassing the venerable Swiss Franc.

By reaching a staggering market capitalization of $830 billion, Bitcoin demonstrated not only its financial prowess, but also its resilience in a landscape often defined by volatility.

Bold’s list places Bitcoin just behind the South Korean Won, with a market cap of $903 billion. However, FiatMarketCap positions Bitcoin as the 16th largest currency by market capitalization when all currencies in the list are considered.

#Bitcoin is the 14th largest coin in the world. pic.twitter.com/PvKqvYAtjx

— Bold Bitcoin (@BoldBitcoin) December 20, 2023

The month of December witnessed a palpable rise in Bitcoin’s value, driven by heightened anticipation surrounding spot ETFs. This burgeoning excitement not only increased Bitcoin’s market position but also enabled a notable milestone.

During this period of heightened anticipation, Bitcoin, with unwavering momentum, not only surpassed the valuation of the Swiss Franc, but went a step further and moved closer to the valued South Korean Won.

The strategic alignment of market forces, coupled with growing investor confidence, played a crucial role in this performance, demonstrating Bitcoin’s resilience and adaptability in responding to changing market conditions.

Bitcoin slides back into the $42K territory. Chart: TradingView.com

At the current trading price of $42,427, Bitcoin According to Coingecko data, the economy saw a slight decline of 0.7% and 1.1% respectively over the past 24 hours and seven days.

Bitcoin: Challenging Global Currency Standards

A fascinating perspective emerges when we consider Bitcoin’s potential. If its price rose above $919, the currency would exceed the US dollar’s money supply of $18 trillion, establishing itself as the largest global currency.

The debate over whether cryptocurrencies its real currency remains active. The American Association for the Advancement of Science suggests in a research paper published on December 22 that while digital currencies are an important development, they have yet to serve as a medium of exchange on a large scale.

In contrast, an article in the November 10 Geopolitical Monitor sees the potential for Bitcoin to become a major reserve currency, influencing the global monetary order.

‘Explosive’ future for the King Coin

Looking ahead, 2024 seems like one “very explosive” year for Bitcoin, with ETF expectations, legislative developments and regulatory shifts. Brandon Zemp, CEO of BlockHash LLC, anticipates the growth in the crypto industry, highlighting its cyclical nature and the resilience that has been shown despite the challenges of recent years.

Encouragingly, the crypto industry is firmly established, with an ongoing purge of malicious actors, raising awareness for improved practices and safeguards. Anticipating an upcoming bull market, there is optimism that this phase could exhibit greater stability and longevity, which can mainly be attributed to the systematic elimination of undesirable elements from the sector, as highlighted by Zemp.

“The good news is that crypto is here to stay and bad actors are continually being flushed out of the market,” he said.

Featured image from Shutterstock

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.