Matt Dines, the Chief Investment Officer at Build Asset Management, has done just that identified a classic ‘Cup and Handle’ pattern on the Bitcoin (BTC) price chart, which he believes could be a signal of an impending rally to $75,000. This technical formation is often considered a strong bullish signal and is closely watched by market analysts and traders.

Bitcoin price validates cup and handle pattern

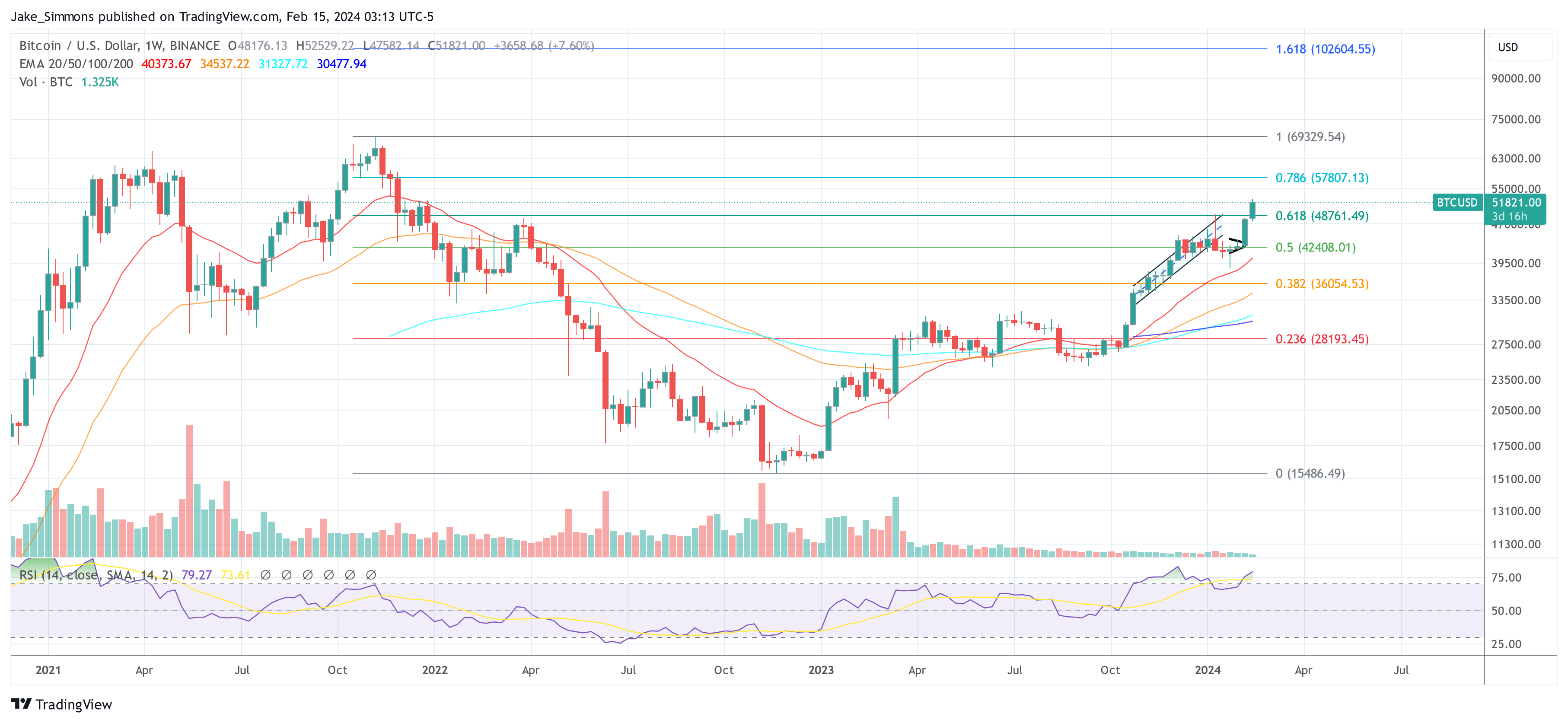

The ‘Cup’ portion of the pattern, which resembles a bowl or round bottom, began forming in March 2022 when the price fell below $48,000 and entered one of the longest Bitcoin bear markets. The pattern bottomed at around $17,600, marking a strong support level for Bitcoin.

The left side of the pattern shows a rounded bottom that resembles a ‘cup’. It occurs when the price initially falls, then consolidates, and finally begins to rise again. Since hitting this low, Bitcoin’s price has made a steady recovery, mimicking the right side of the cup, indicating a bullish reversal from the previous downtrend.

“The saucer or ‘head’ indicates a consolidation period, a pause in the downtrend, before price begins to rise again towards the test resistance levels,” Dines explains. The recovery to the initial resistance line completes the ‘cup’ portion of the pattern. The Bitcoin price completed this step in early January this year.

The subsequent ‘Handle’ is represented by a moderate retracement after the recovery, which represents a small dip or pullback from the peak. This handle is characterized by a slight downward trajectory and is considered the last consolidation before a breakout.

BTC’s price drop to $38,600 in late January marked the bottom of the pullback. With the breakout above $48,000, Bitcoin price confirmed the cup-and-handle pattern.

Set a BTC price target

Dines also addressed the placement of the vertical projection from the bottom of the handle and clarified its basis: “It’s totally arbitrary and in the eye of the beholder. But a longer answer: Traders look for formations on the charts.”

The vertical target line, or ‘stick’ on the right, is projected from the bottom of the handle. The height of the cup – from the low around $17,600 to the resistance line at $48,000 – forms the basis for the price target.

Dines added: “Many traders will use the height of the bowl (from the bottom of the bowl to the top of the resistance line) to determine their price target. Just add that high to the bottom of the handle… that’s a good estimate of where we would see the longs making the breakout to set their price target.”

Based on the chart, the high from the cup low to the resistance level is approximately $31,973, which marks the increase in the price of Bitcoin from the low to the current level when the chart was produced. Projecting this high from the handle formation indicates a target near $75,000.

Dines further adds that the collective behavior of market participants will indeed drive price movement: “Many of those longs would put a tradeback at ~$75k when they close out their W. If enough participants set up this transaction, it will determine the dominant position. price action…they win and it will make the chart real. I know it sounds ridiculous, but in the real world this is how markets discover price.”

At the time of writing, BTC was trading at $51,821.

Featured image created with DALLE, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.