- Long-term Bitcoin holders have accelerated selling activity as BTC hits consecutive new highs.

- Spot Bitcoin ETFs absorb the sell-side pressure, giving BTC room to extend its rally.

Bitcoin [BTC] continues to surpass altcoins with consecutive record highs. At the time of writing, BTC was trading at $97,350, with a market cap of $1.92 trillion. Since the start of the fourth quarter, BTC is up 52%.

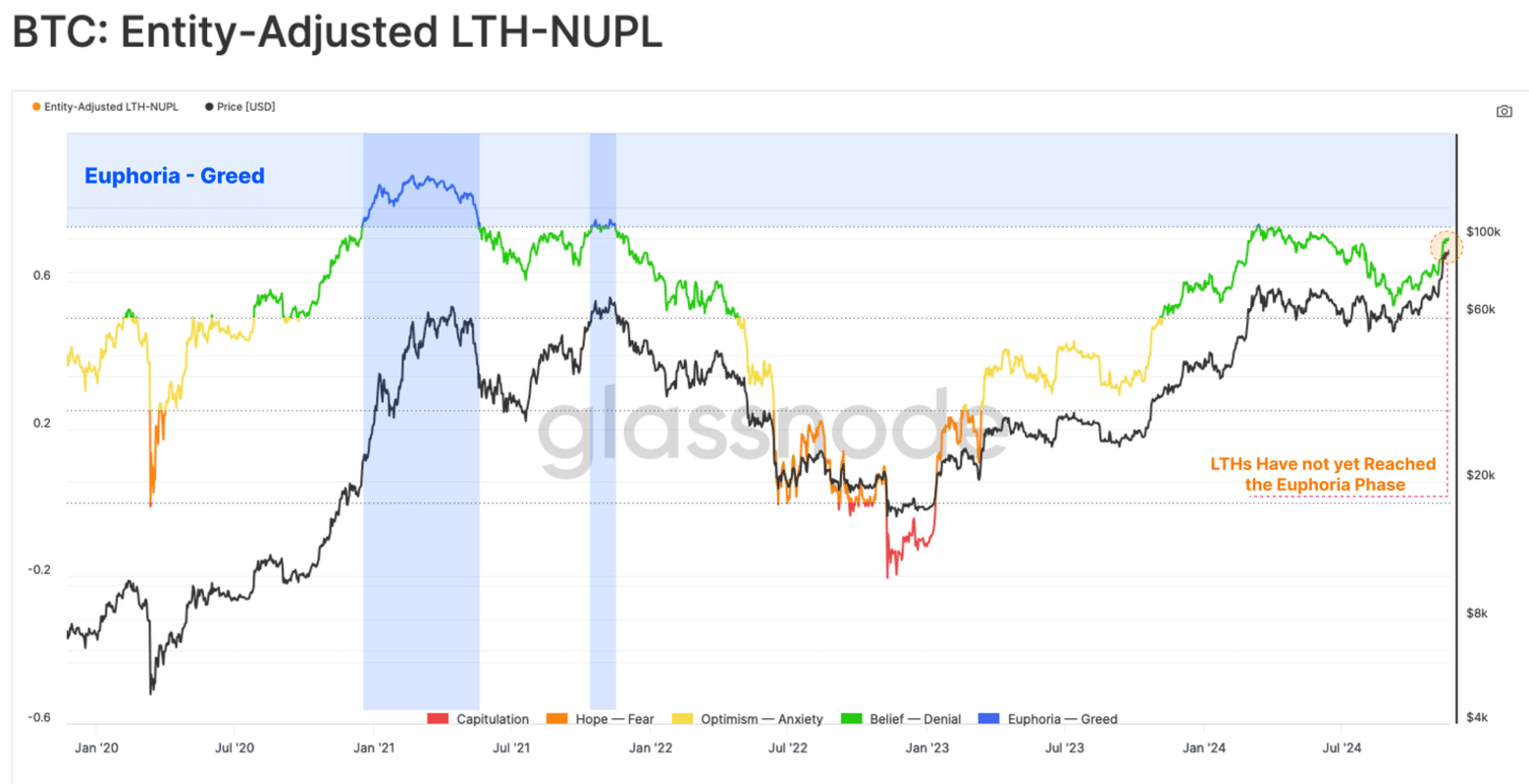

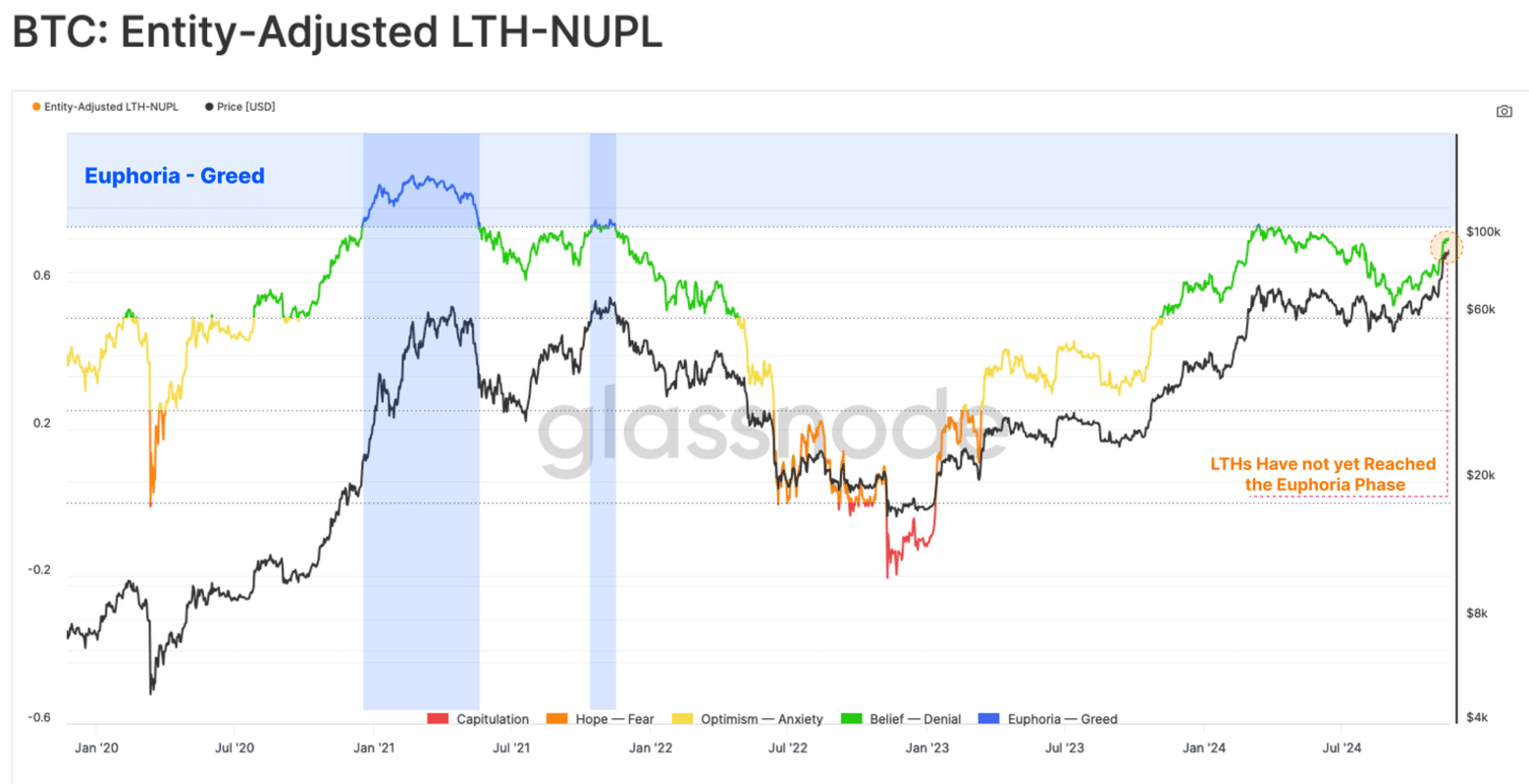

In its weekly on-chain report, Glassnode noted that all long-term Bitcoin holders are now making a profit. However, the net unrealized gain/loss (NUPL) measure for these holders was 0.75, indicating that they have not yet reached the euphoria or greed stage.

Source: Glassnode

Long term holders usually sell at the top and buy when prices are low. A repeat of this pattern is underway after their holdings fell by more than 200,000 BTC when Bitcoin broke past $75,000 two weeks ago.

Long-term holders own 14 million BTC per Glassnode. As such, accelerated profit-taking could slow Bitcoin’s rally.

However, two factors prevented Bitcoin from succumbing to sell-side pressure: the anticipation of higher prices and the institutional demand that absorbed the coins sold.

Spot Bitcoin ETFs Absorb the Selling Pressure

Institutional demand for Bitcoin, through spot Bitcoin exchange-traded funds (ETFs), has absorbed the selling pressure exerted by long-term holders.

Data from SoSoValue shows that weekly inflows into these ETFs averaged between $1 billion and $2 billion last week.

According to Glassnode, between October 8 and November 13, Bitcoin ETFs absorbed 93% of the coins sold by long-term holders. This played a key role in stabilizing prices.

However, over the past week, long-term holders have accelerated selling activity, with this sell-side pressure exceeding demand from ETFs. If there is an imbalance between supply and demand, it can lead to price volatility.

Are Bitcoin holders also taking profits in the short term?

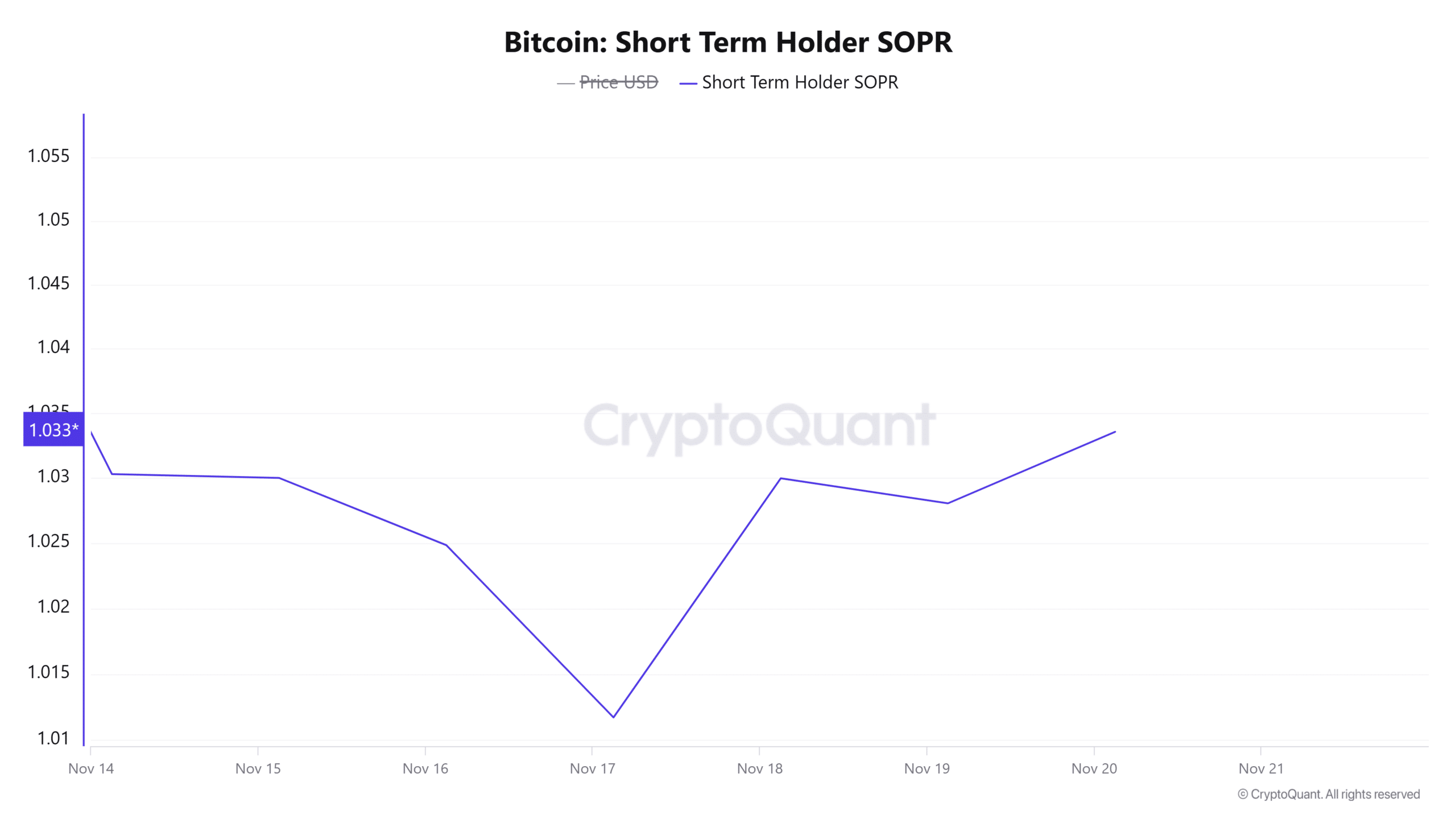

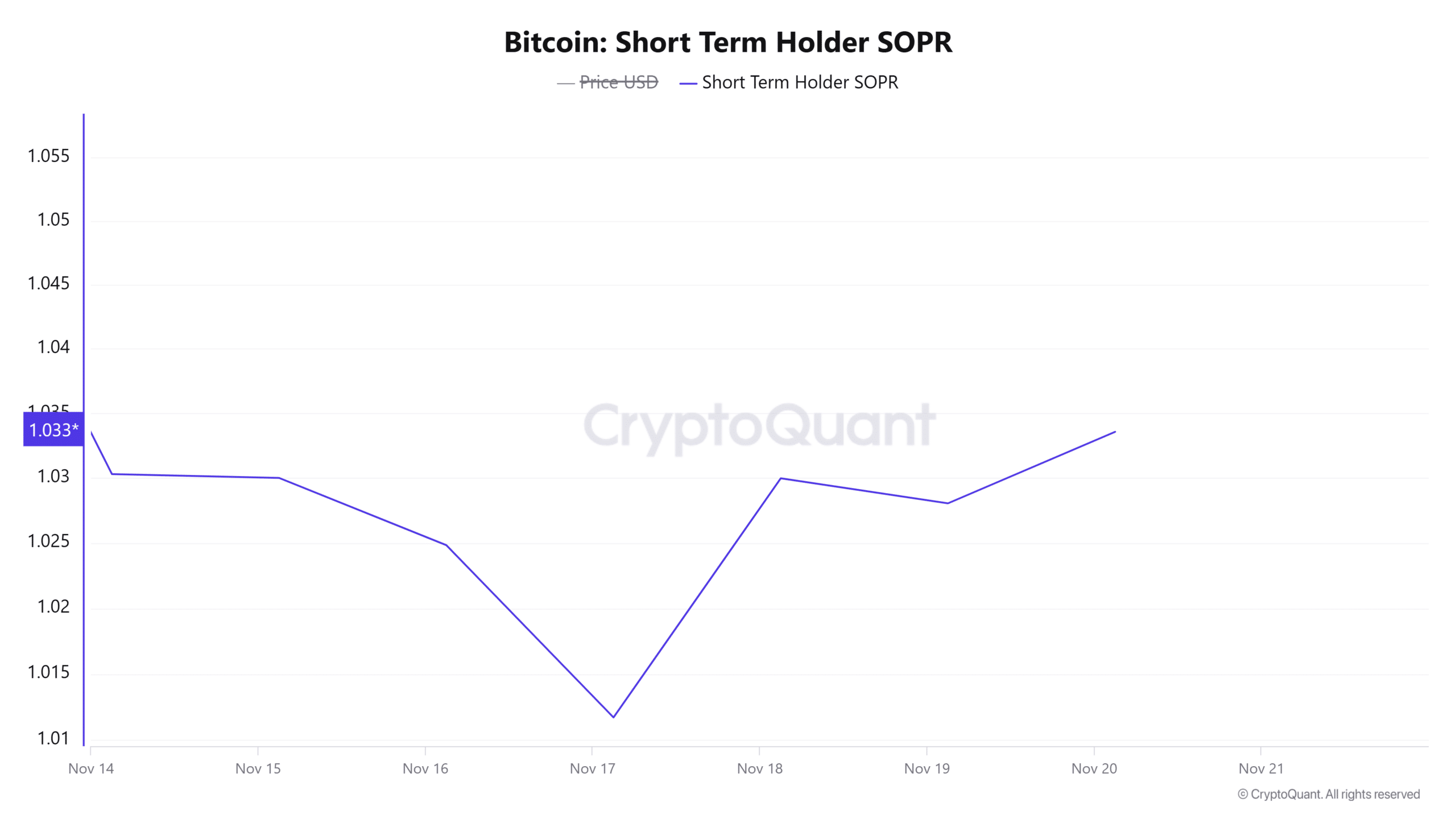

Data from CryptoQuant shows that the short-term Spent Output Profit Ratio (SOPR) has risen to its highest level in a week.

Source: CryptoQuant

The SOPR ratio of 1.03 shows that the coins moved by these traders are valued 3% higher than their purchase price. This suggests that short-term holders have not yet reached extreme levels of profitability, which could deter profit-taking as they eye further price increases.

Furthermore, with market sentiment showing signs of extreme greed, short-term holders, who typically benefit from short-term price movements, may choose to hold or accumulate more coins in the short term.

Read Bitcoin’s [BTC] Price forecast 2024-25

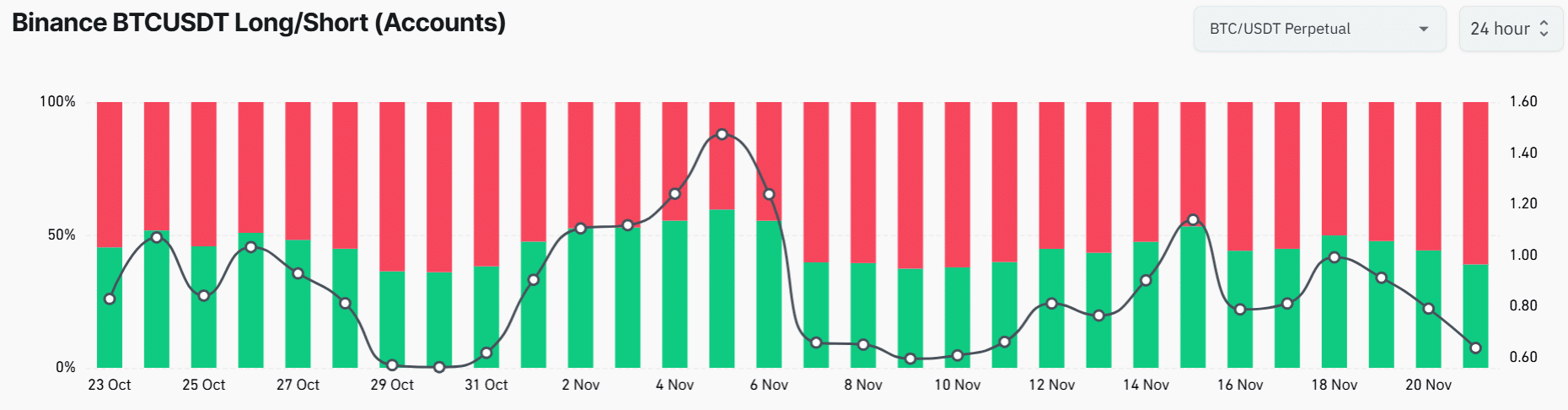

Bitcoin short sellers are re-entering the market

The long-term distribution phase has had an impact on the Bitcoin futures market. On Binance, 61% of traders have opened short positions on BTC, which is the highest percentage of short positions in more than a week.

Source: Coinglass

The increase in the number of short positions suggests that traders view $100,000 as a strong resistance level for Bitcoin. However, if BTC breaks past this price, a short squeeze could lead to forced buying, which will extend the price rally.