- The Bitcoin Rainbow Chart and other key metrics indicated “BUY” at the time of writing.

- Market experts expect a bullish Q4 and 2025: should you hold on or jump in?

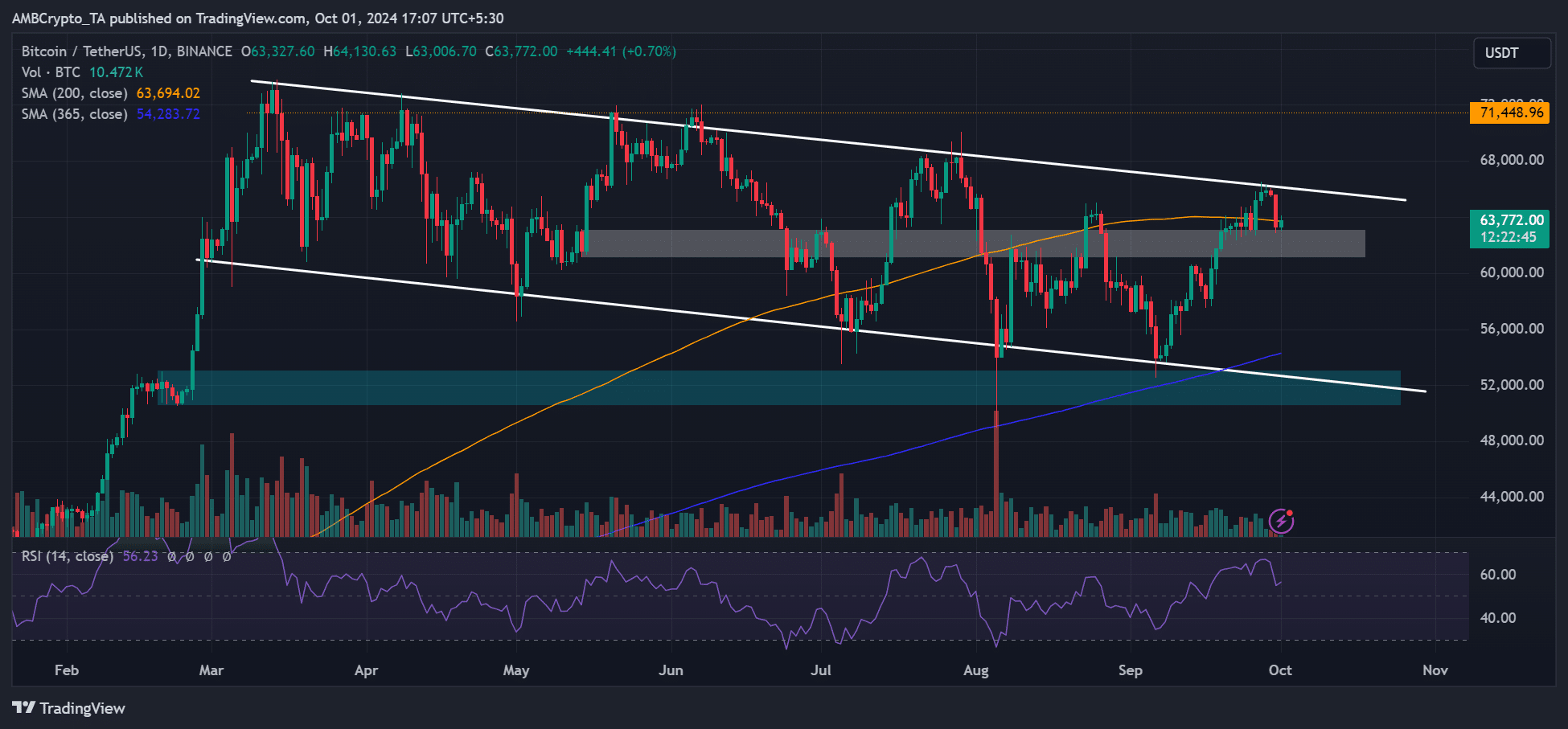

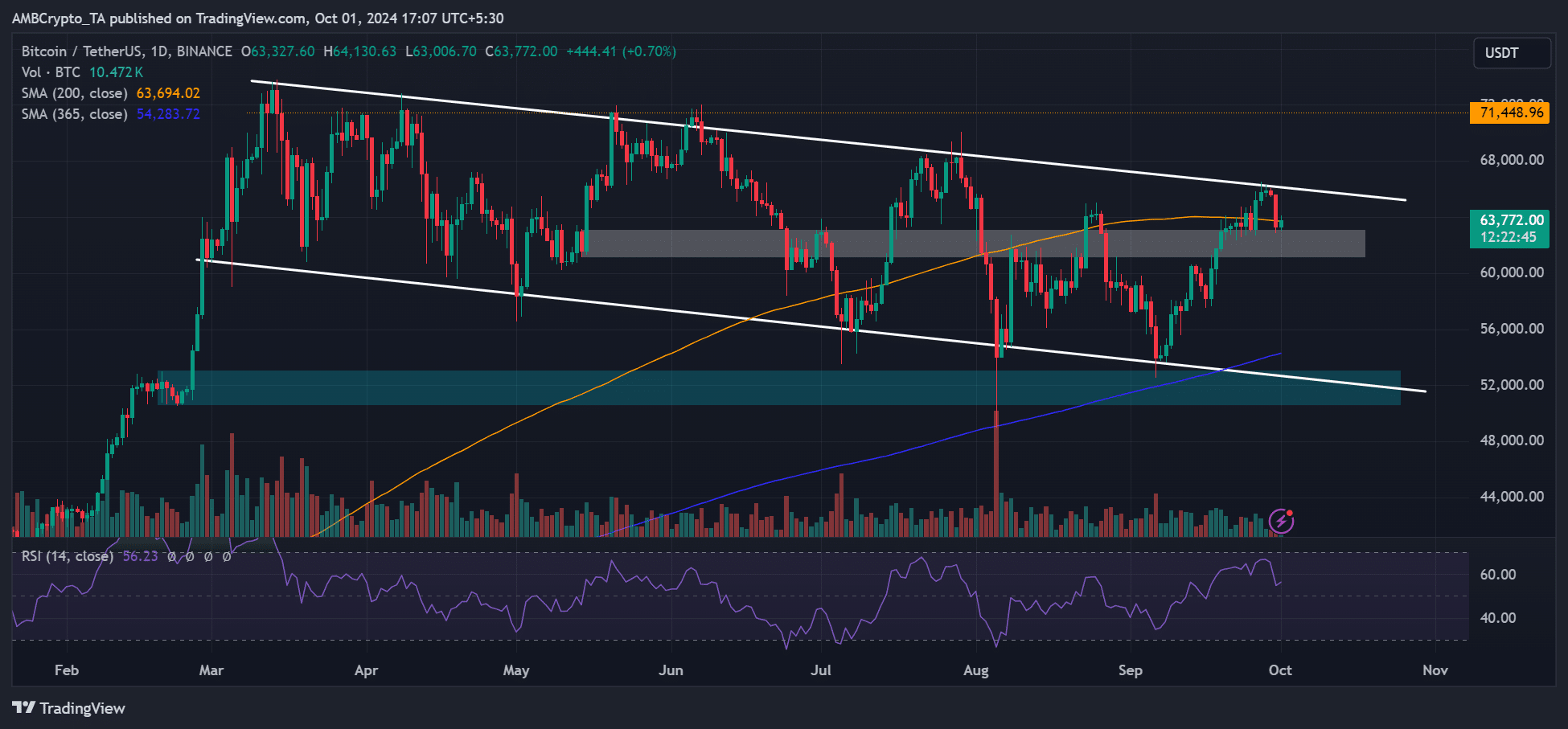

Bitcoin [BTC] has been consolidating between $60,000 and $70,000 over the past seven months. Despite the dull price action, the current BTC value was still a great buying opportunity ahead of a historically bullish fourth quarter.

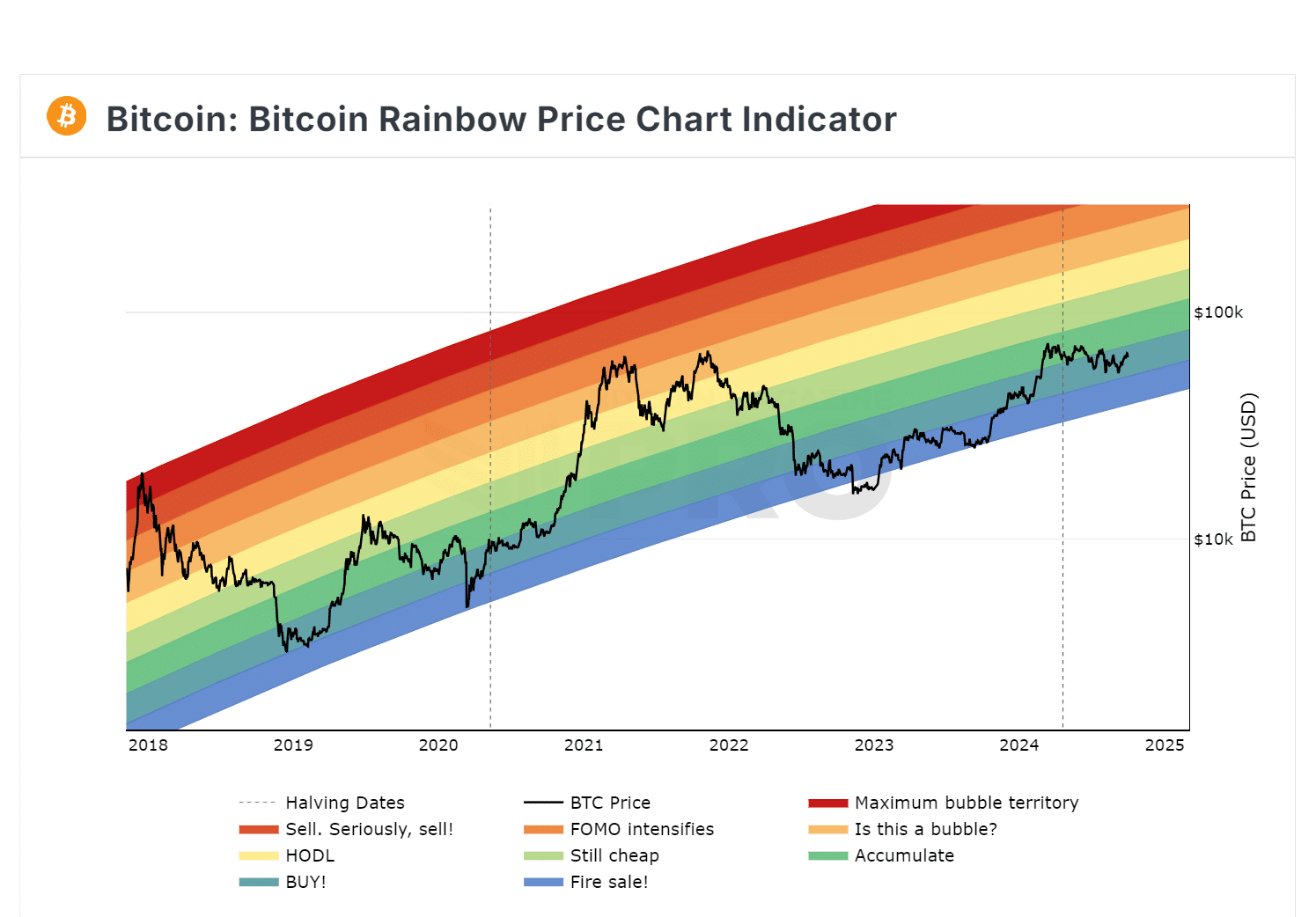

According to the Bitcoin Rainbow Chart, the current value of BTC was still within the buy zone.

Since March and the subsequent retracement, the asset has been firmly in the ‘accumulation’ and ‘buy’ zones.

Source: BM Pro

For context, the Rainbow Chart measures BTC’s appreciation based on historical prices, but is visually represented using rainbow colors.

Lower color bands indicate undervalued BTC, while higher bands indicate an overheated market and possible corrections.

Is BTC still discounted?

Other key valuation metrics also indicated that BTC was relatively “cheap” at the time of writing.

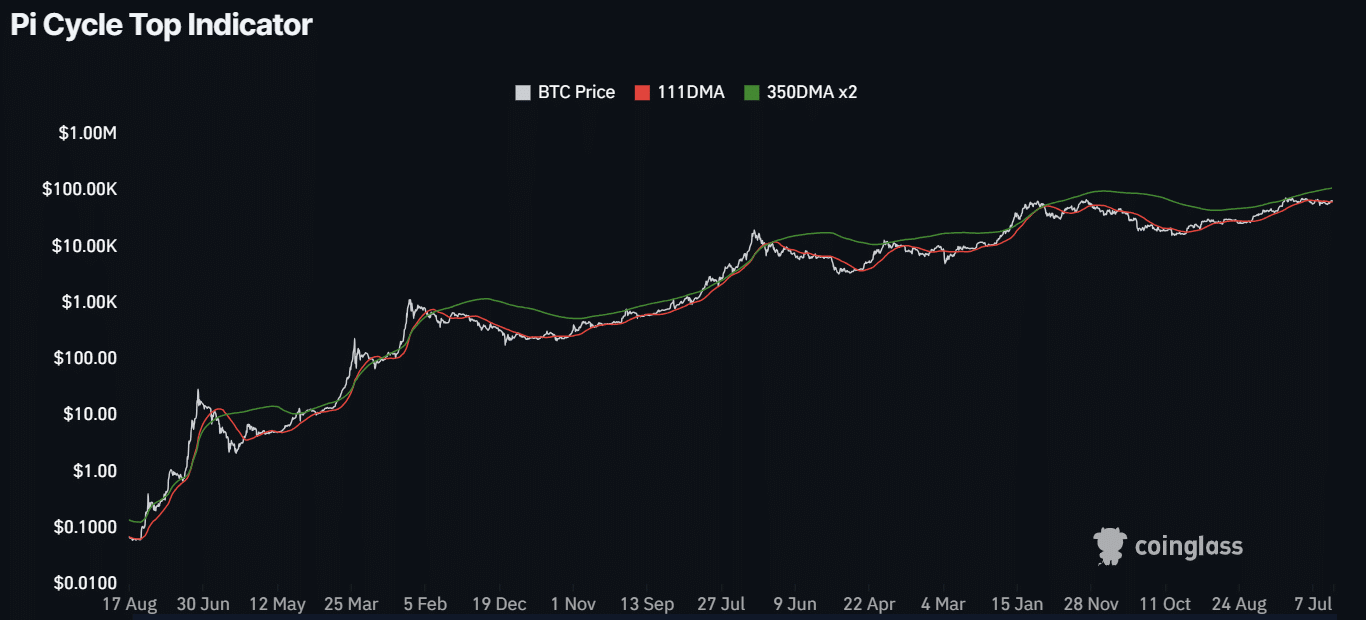

According to the Pi Cycle Top indicator, BTC is far from reaching the top of this cycle, as evidenced by the large gap between the 111-day MA (Moving Average) and the 350-day MA multiple (350 DMax2).

Source: Coinglass

For the unfamiliar, the Pi Cycle Top metric has effectively captured BTC cycle tops with 3-day accuracy. Historically, bike tops were hit after 111 DMA hiked and 350DMAx2 passed.

The large gap at the time of writing meant that of BTC running of the bulls could extend.

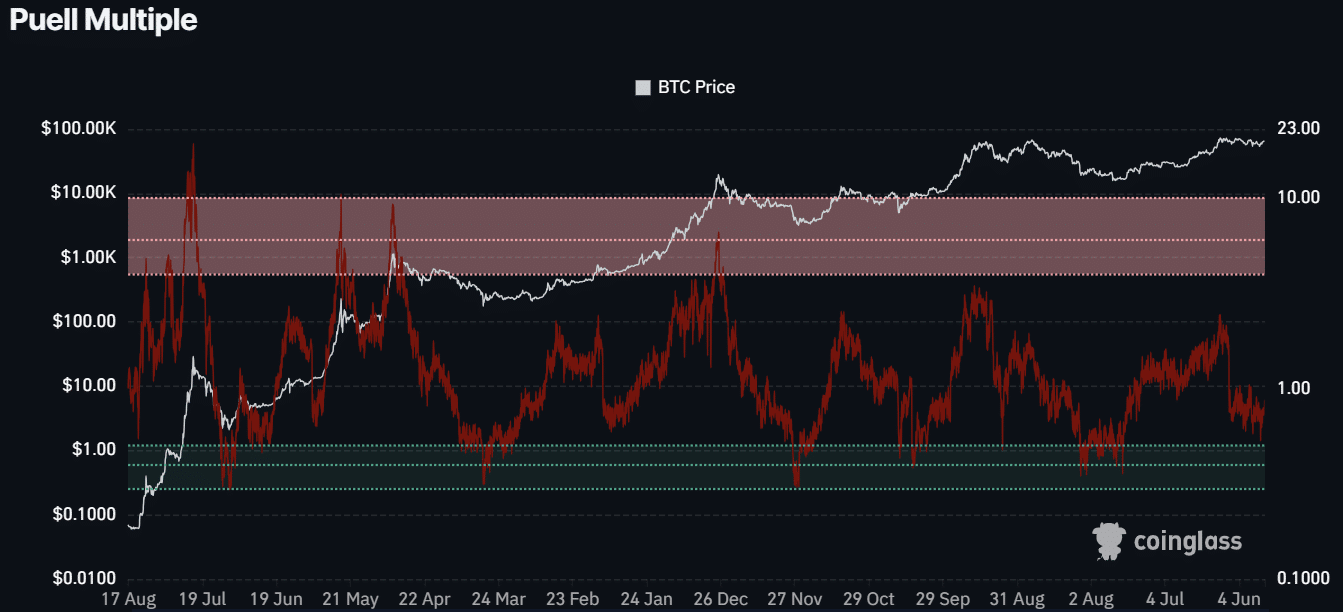

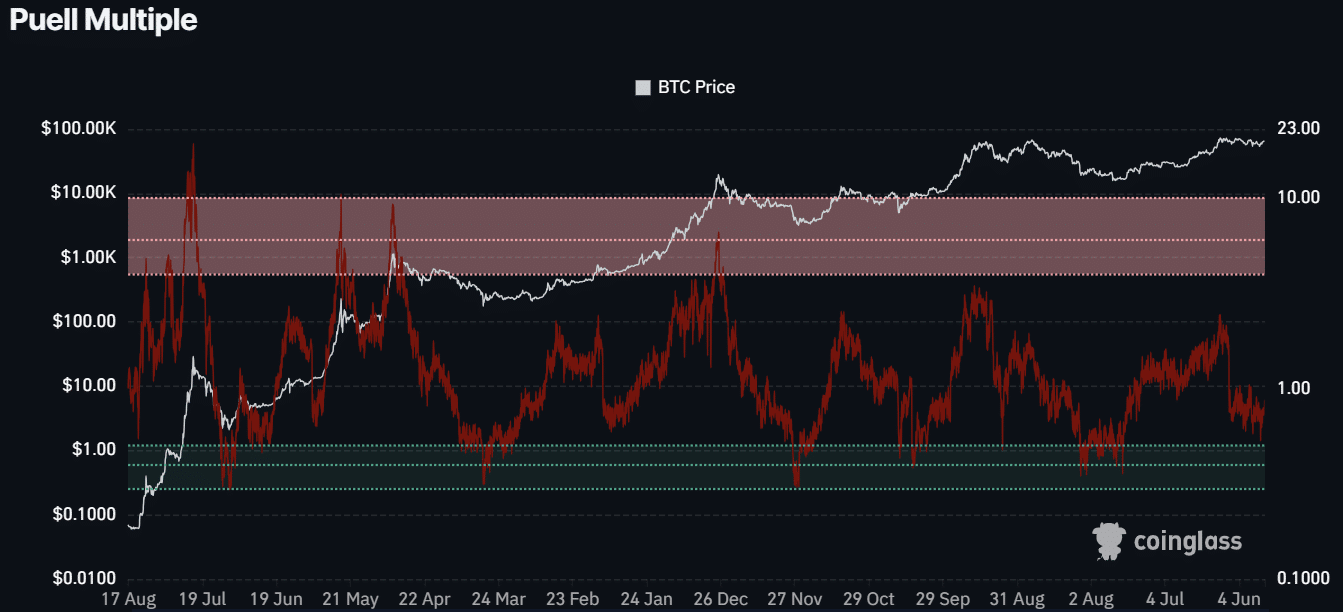

In short, BTC was relatively undervalued at the time of writing. A similar prospect was illustrated by the Puell Multiple, which evaluates whether BTC is overpriced based on the profitability of BTC miners.

The green zone is synonymous with undervalued BTC, while the overhead zone signals an overheated market.

At press time, 0.73, BTC was grossly undervalued, suggesting a great buying opportunity for investors.

Source: Coinglass

In addition to the above valuation figures, key industry figures and companies have set high BTC price targets for late 2024 and 2025. Standard Chartered Bank predicted that the asset could reach $250,000 by 2025.

For his part, CK Zheng, founder of crypto-focused hedge fund ZX Squared Capital, BTC would achieve an ATH in the fourth quarter of 2024 regardless of who wins the US elections.

The executive cited high U.S. government debt and budget deficits as reasons why BTC would become more lucrative amid Fed rate cuts.

If the predictions come true, the fourth quarter of 2024 and 2025 would see huge BTC returns, potentially rising above the seven-month price range. If so, the current BTC value can be considered heavily discounted.

Source: BTC/USD, TradingView