Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

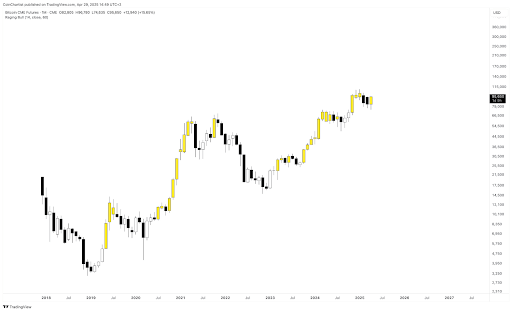

Bitcoin remains Shows signs of resilience In the region of $ 95,000, pushing higher from recent lows and tries to reclaim his bullish structure after a fleeting April. The monthly candlestick for April on the CME Futures graph currently presents a strong bullish -flooding formation, which, if maintained in the weekly closure, could offer the market with a Bullish Momentum to close May with another Bullish Kaars.

The potential of this Bullish Close is sufficient Bring the sentiment Beerarish proponents, according to Crypto analyst Tony “The Bull” Severino.

Raging bull tools blink signal on cme futures

Bitcoin’s price promotion In the past two weeks Has been positive and a different decreasing bullish sentiment has slowly crued between crypto traders. Interestingly, this price promotion has even seen Bitcoin’s network volume Become positive For the first time in a while. Although the trend is still at an early stage, the renewed strength is already starting to mitigate some of the more bearish prospects, especially when important indicators start to run.

Related lecture

Tony “The Bull” Severino, a good crypto analyst, recently unveiled Social Media Platform X that has returned its own “Raging Bull” indicator. However, this indicator is only switched on on the Bitcoin CME Futures graph, not on the spot BTC/USD graph.

The divergence between CME -Futures and the spot diagram, with only the first to flash this bullish signal, has added complexity to the current prospects of Bitcoin. The Raging Bull Tool, which uses weekly price data, is designed to identify early stages of powerful upward movements. According to Severino, the appearance of this signal, despite its bearish attitude, can develop a meaningful shift in the market structure. However, he quickly added that a confirmed weekly close is still necessary before any fixed conclusions can be drawn.

Breaking above this level is the key

The monthly graph shared by the analyst, the bullish -flooding candlestick is clearly visible after a sharp rebound from the LOS points of April under $ 83,000. Bitcoin started the month of April with around $ 83,000, but a rapid decline in the first few days Pushed the price down until it set out at around $ 75,000. However, the current April candle not only knew the losses of March, but also indicates an increased interest in Bitcoin of institutional traders on the CME platform.

Related lecture

Nevertheless, despite the encouraging candlestick formation, Bitcoin has to break decisively above the region from $ 96,000 to $ 100,000, where previous uptrends have been stuck. This level acts as a ceiling that can determine whether the recent bullish momentum continues or stalls. A non -close to this range, on the weekly or monthly period, can make the furious bull’s signal invalid.

In addition, the Raging Bull -indicator must reverse the spot BTCUSD card to attach a strong bullish outlook. This can only be done if Bitcoin manages to break considerably above $ 96,000.

At the time of writing, Bitcoin acts at $ 94,934.

Featured image of Pixabay, graph of TradingView.com