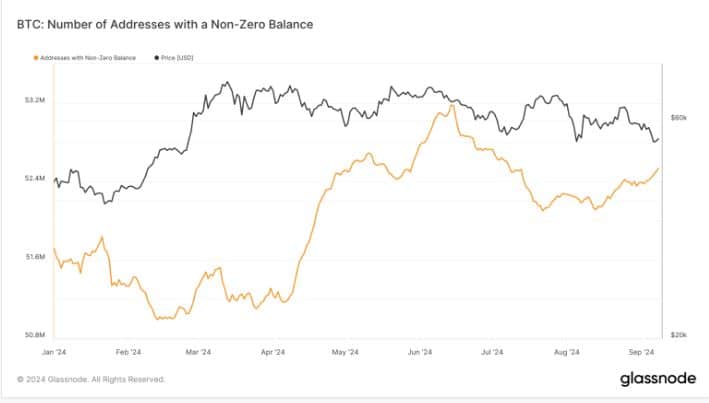

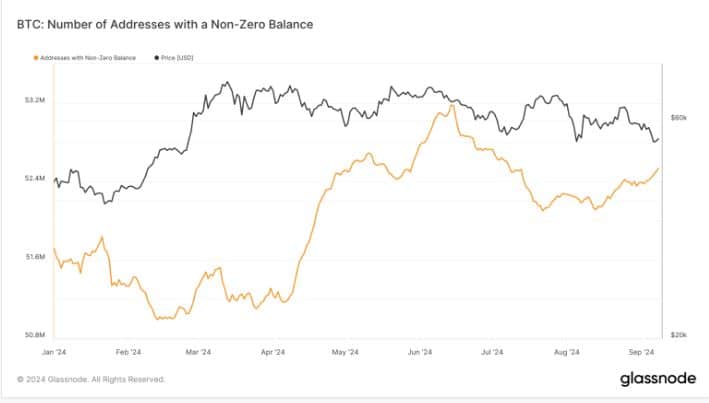

- Bitcoin addresses with any BTC balance continued to grow as buyers took advantage of the dips.

- Assessing the risk that Bitcoin’s price may fall below key levels.

Two large Bitcoins [BTC] stories have been dominant in recent months.

One is the prospect of a big rally, and the other is the possibility of Bitcoin’s rally being canceled and the price possibly falling below $50,000.

The two Bitcoin opportunities have offered whales and institutions the chance to profit from emotionally charged price swings. This has been the case for at least the past five months.

Bitcoin once fell below $50,000 thanks to a major panic selling in August.

The selling pressure incident was followed by rapid capitalization as traders moved in to buy at a discount. In the latest incident of downward pressure last week, the bears failed to break below $52,000.

Glassnode data confirmed a revival in accumulation.

Source: Glassnode

According to Glass junctionthe accumulation level of zero-balance addresses stood at almost 53 million addresses at the time of writing, a healthy recovery from the August low.

However, this was still significantly below the highs of early July, indicating that there was still some uncertainty in the market.

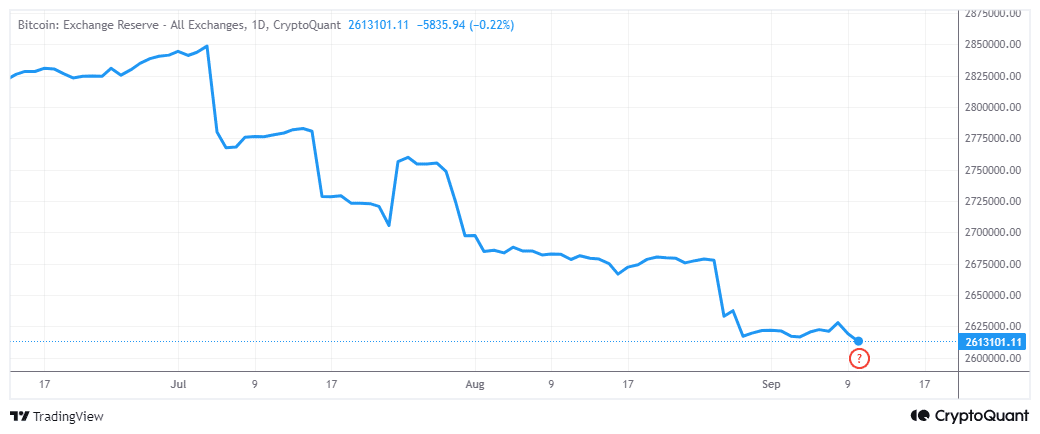

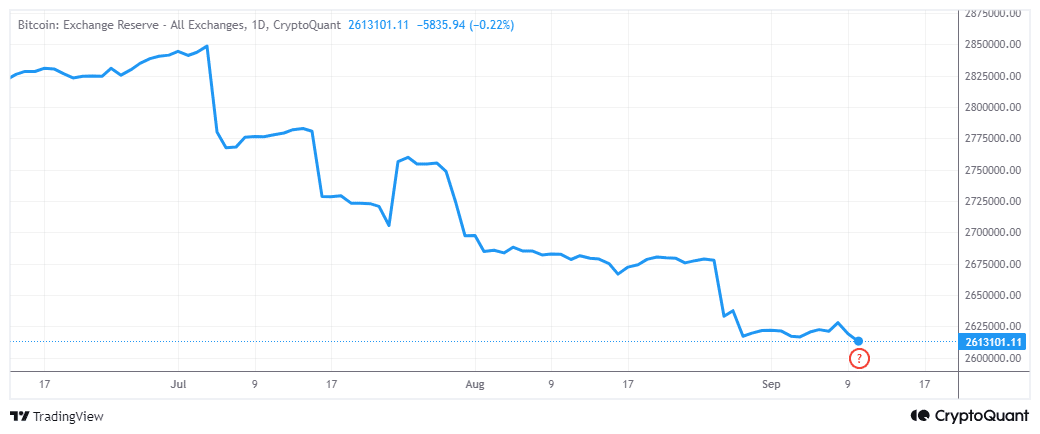

Also worth noting is that Bitcoin’s foreign exchange reserves were back on the downtrend. This confirmed that there were fewer coins available on the exchanges, in contrast to the slight upturn in early September.

Source: CryptoQuant

Lower foreign exchange reserves are good news for the bulls, and correspond with growing non-zero addresses. However, it is not a clear indicator of what whales and institutions have done.

The other extreme of Bitcoin

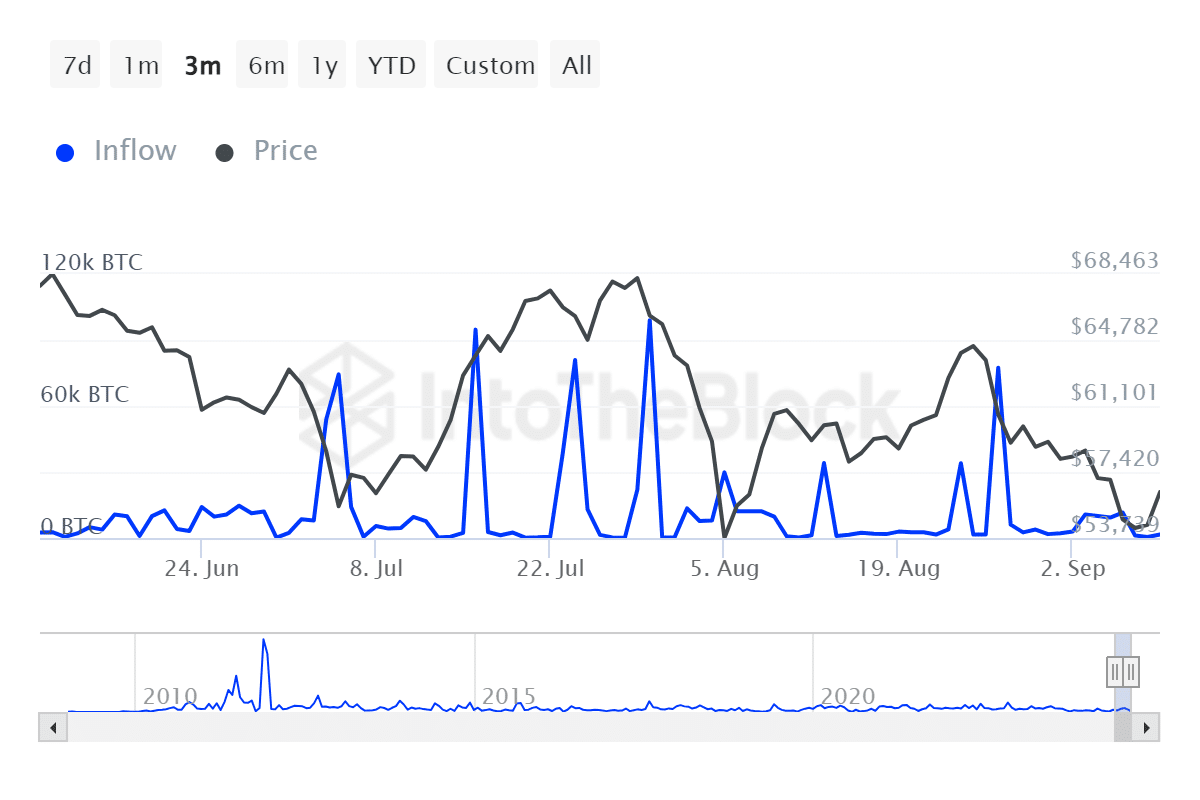

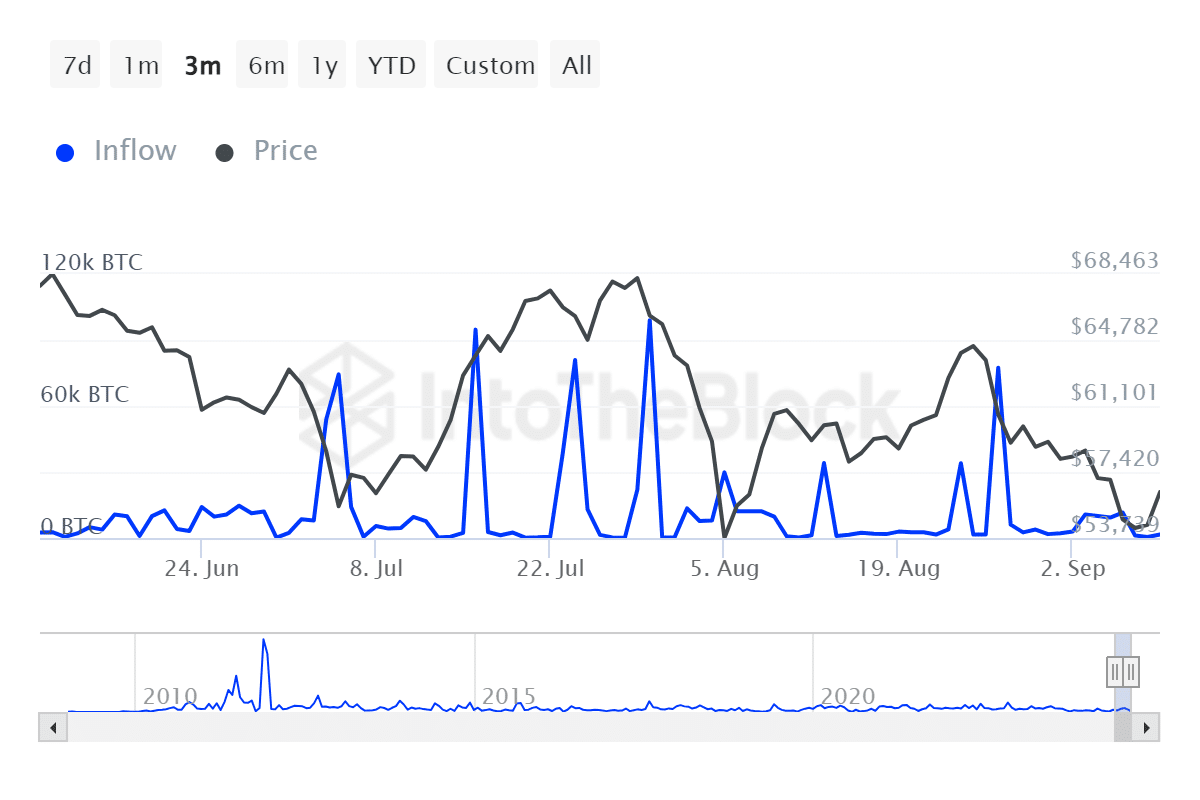

As for whales, we have found that whales are less active in September than between June and August so far. Whale influx data indicated a slowdown over the past two weeks.

Source: IntoTheBlock

The low participation in whales coincided with low demand for Bitcoin ETFs, judging by the dominant outflows. This further aligned with the observation that Bitcoin’s trend appeared to be down over the past five months.

BTC has reached lower highs every time the bulls have attempted, confirming the lower bullish confidence.

Read Bitcoin’s [BTC] Price forecast 2024–2025

In other words, there is still significant risk that Bitcoin could potentially slide towards $50,000 or possibly lower. On the other hand, many currently sidelined whales would likely benefit at a reduced level.

It’s also possible that many savvy traders will wait for clearer market data from the Fed next week before making any major moves.