- According to the Puell Multiple, Bitcoin could be on the verge of a new rally.

- Bullish optimism and extreme greed can signal a possible reversal.

The bullish Bitcoin [BTC] The momentum we saw in October and the first half of November appears to be fading. But what’s next for the king of cryptocurrencies as 2024 draws to a close?

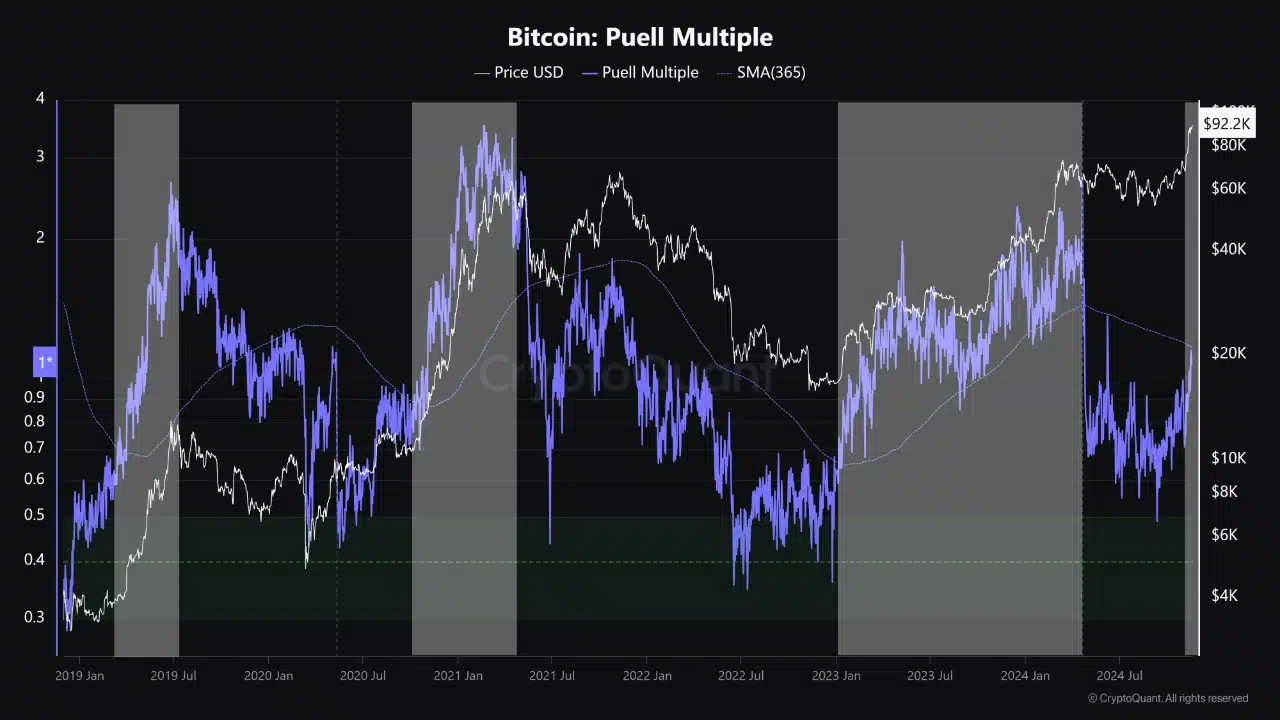

A recent one CryptoQuant Analysis reveals some insights regarding Bitcoin’s next potential move based on the Puell Multiple. The latter evaluates mining revenues in relation to market movements.

According to the analysis, the Puell Multiple has recently moved closer to its 365-day moving average.

Source: CryptoQuant

If the Puell Multiple crosses the moving average, it could signal the start of another major bull run. This analysis was based on similar observations in the past, when the same indicators interacted.

Should Bitcoin Holders Expect More Upside Potential?

The CryptoQuant analysis suggests that Bitcoin could regain momentum in the coming days or weeks. However, it is only one indicator and market dynamics may change in the coming days.

For example, miner revenues have historically been a reliable indicator of market sentiment.

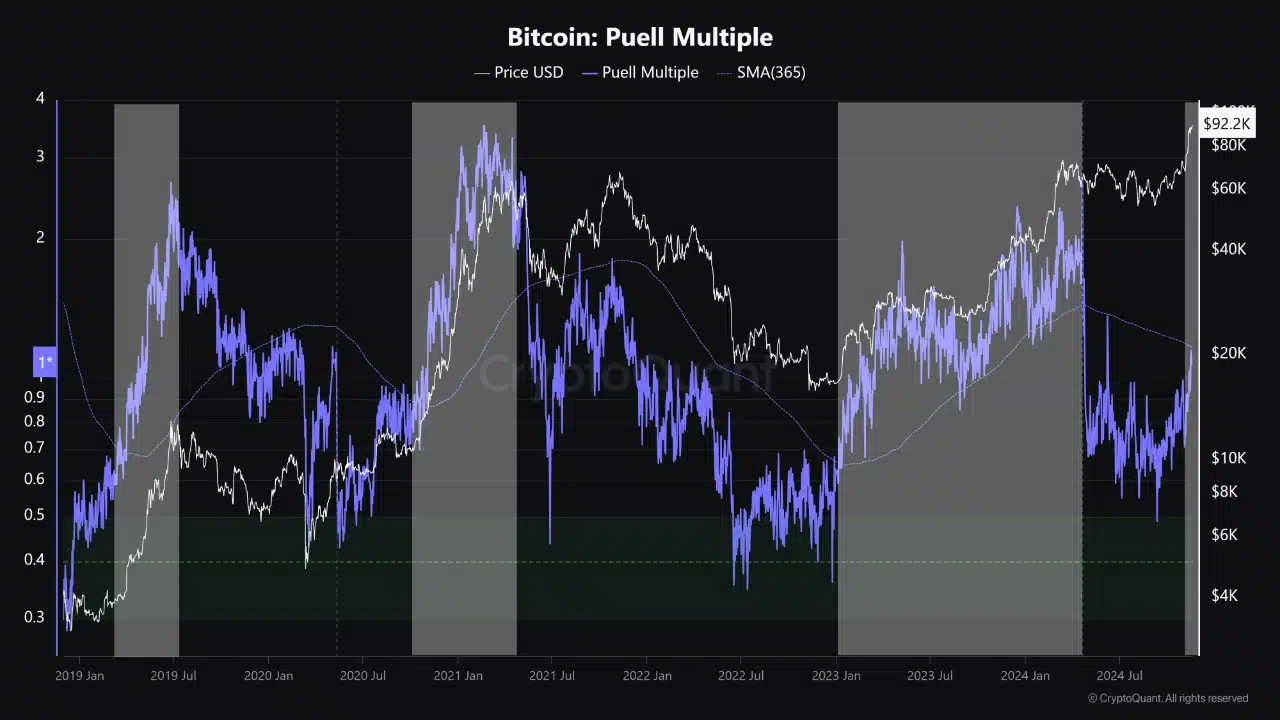

Miner reserves tend to rise when miners expect higher BTC prices so they can HODL and sell higher. The latest data on miner reserves shows reserves fell to a 2024 low on November 18.

Source: CryptoQuant

Miner reserves may indicate a lack of strong incentives for HODL. However, it is worth noting that Bitcoin is hovering near its ATH, which could encourage miners to sell some of their coins.

The risk of an unexpected sell-out

Another possible reason why miner reserves are near bottoming could be that there are expectations of a significant pullback after the recent rally. In other words: uncertainty is growing about BTC’s next step.

Bitcoin fear and greed index was at age 90 or in extreme greed, which is the highest level in months. Major pullbacks have historically occurred in scenarios of extreme greed, hence the concern that this could lead to a significant retracement in an unexpected way.

On the other hand, optimism remains high, especially in light of changing global liquidity conditions as interest rates fall. The recent US elections also provided optimism for the crypto market, as the country ushers in a pro-crypto government.

Read Bitcoin (BTC) price prediction 2024-25

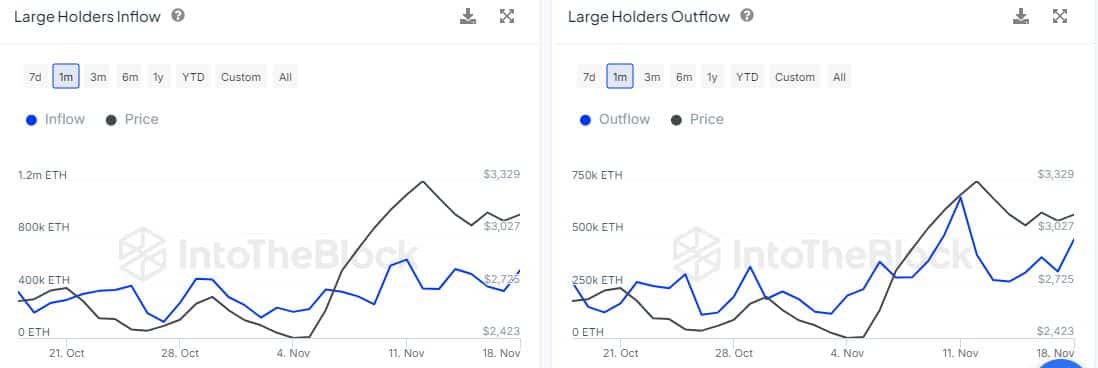

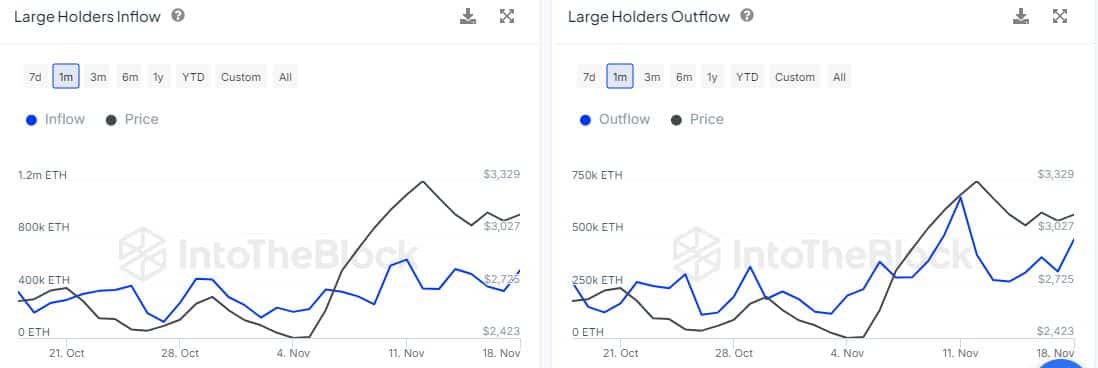

These factors indicate that the rally may not come close to a cycle peak. Whales are still gathering signals that they could be preparing for another big step.

Source: IntoTheBlock

Inflows into large holders’ accounts spiked to over 516,000 BTC in the past 24 hours. Outflows from whale addresses were lower, at just over $471,000.