- Bitcoin is facing key resistance at the $63.9k level.

- Taking profits is a normal phenomenon during the price rise and does not necessarily mark the cycle top.

Bitcoin [BTC] has been showing a downward trend on higher time frame price charts such as the weekly one since April.

The daily time frames showed more volatility, such as the 22% price increase in July from $56,000 to $68,000 or the more recent increase from $55,000 to $64,000, a move of 17.5% in the past two weeks.

Has the Bitcoin Bull Been Run Over?

As a crypto analyst Axel Adler noted in one message on Xthe formal transition to a bull market is not far away. The 200-day moving average of $63.9k needs to be broken and turned into support.

Many market participants were convinced that the rally to $73.7k in March marked the end of the bull run and that Bitcoin’s halving might not usher in a new run as cycle dynamics have changed.

The chart above shows that the period October 2023 – June 2024 was a bullish trend, but was this also the real bull run? For example, in the previous cycle, Bitcoin saw a 157% increase in 10 weeks from the Covid crash to the 2020 halving in May.

Therefore, a significant price increase during the halving is not unprecedented. The length of the bullish period was quite long, extended by the adoption of the Bitcoin spot ETF. Every cycle has its differences.

The behavior of the holders showed that there was probably no market top yet

Another chart from the same analyst showed that periods of price increases are naturally accompanied by profit-taking by holders. This in itself does not mean that the bull run is over.

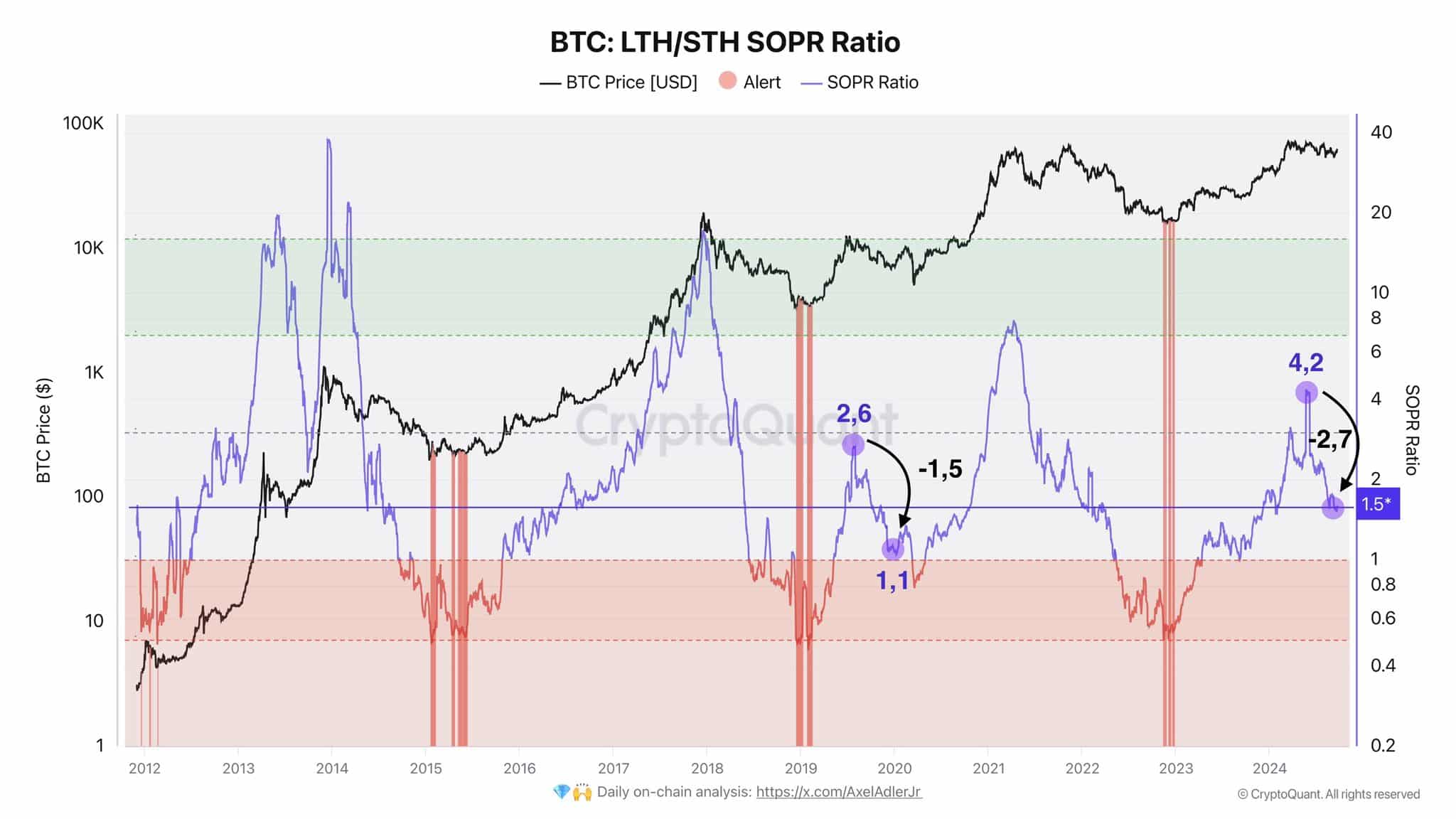

Furthermore, the ratio of long-term to short-term holders of issued output (LTH/STH SOPR) had not yet passed 7. This was a trend that marked the tops of the previous two cycles.

Read Bitcoin’s [BTC] Price forecast 2024-25

In the period before the previous bull run, there was a large price increase in 2019. This move was used to take profits. This caused the SOPR to go from 2.6 to 1.1. Similarly, selling pressure over the past five months saw the metric rise from 4.2 to 1.5.

Overall, the statistics still supported the idea of further Bitcoin price increases in the coming months.