Bitcoin market dynamics have recently taken an interesting turn, suggests Alex Thorn, Head of Firmwide Research at Galaxy. According to his recent wire at

“Bitcoin option market makers are increasingly short-gaming as the spot price of BTC rises. […] This should amplify the explosiveness of any near-term upward move in the near term,” Thorn notes.

This implies that as Bitcoin’s spot price rises, these market makers will have to buy back more cryptocurrency to maintain their positions, a phenomenon that could potentially amplify price increases.

The biggest show in the world: Bitcoin

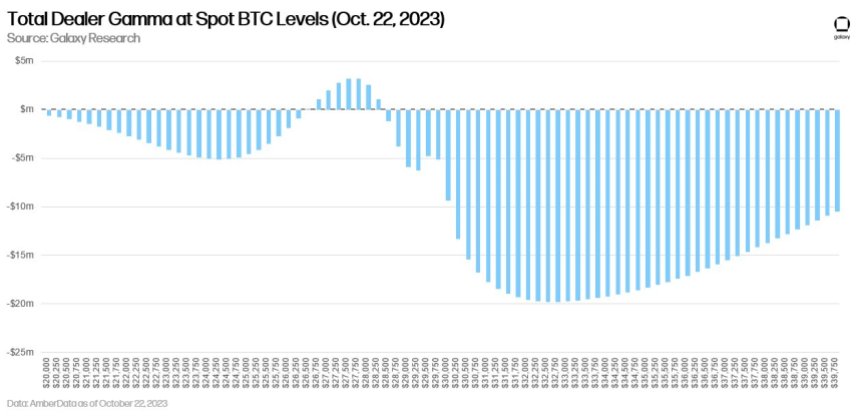

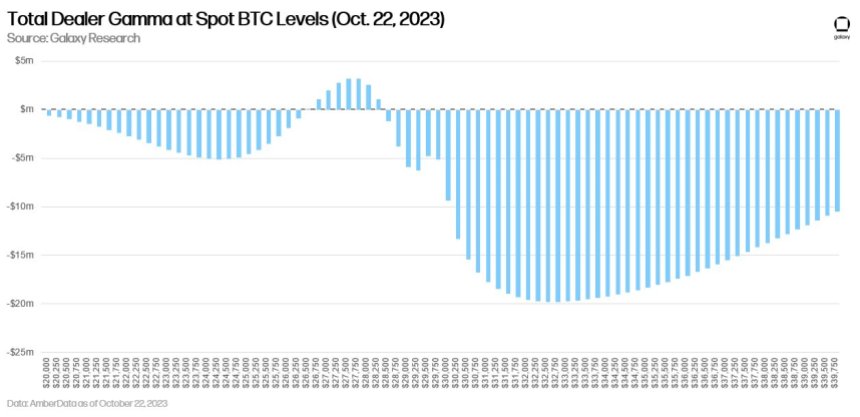

Furthermore, he highlighted that data from Amber indicates that dealers are increasingly turning to short gamma positions, especially when the BTC price is above $28.5k. In more explicit terms, Thorn explains: “At $32.5,000, market makers must buy $20 million in delta for each additional 1% increase.” Such positioning suggests that market makers may need to make significant purchases of Bitcoin as the spot price continues to rise.

However, it is not only upward movements that are affected. Thorn also sheds light on the other side of the coin. “Dealers are long range in the $26,750-28,250 range. If your long gamma and spot decline, you also have to buy back spot to remain delta neutral,” he notes. This means that any small downward price adjustment could be met with resistance as options traders make the necessary purchases to realign their positions.

For bullish investors, this dynamic presents an attractive landscape. Thorn explains: “This is a great setup for bulls because if the spot is moving a little higher, a short gamma cover can see it move a lot higher quite quickly, but if it is moving lower, a long gamma cover can provide some support and keep the limit short-term disadvantages. ”

Highlighting potential catalysts that could move the Bitcoin spot price, Thorn pointed to the growing anticipation surrounding Bitcoin ETF approvals. Recently, renowned personalities and institutions such as Cathie Wood, Paul Grewal, JP Morgan and several Bloomberg Intelligence analysts have expressed positive sentiments about the chances of approval.

Eric Balchunas and James Seyffart of Bloomberg predict that the chance of a spot Bitcoin ETF is 75% by the end of this year and 95% by the end of 2024. Additionally, Thorn mentions the recent rise in Bitcoin’s price above $31,000, suggesting it has crossed the line. last month’s highs following the fake news of an ETF approval.

In addition to market sentiment and speculation, fundamental supply and liquidity dynamics also play a role. Thorn mentions, “Bitcoin’s currently limited supply and liquidity could also serve to amplify upside moves.” Notably, Bitcoin currency balances have fallen to levels not seen since 2018.

At the same time, smaller entities are accumulating Bitcoin, while larger holders, often referred to as ‘whales’, appear to be unwinding their positions. He underlines the strength of the Bitcoin community with a comment about hodlers: “70% of supply hasn’t been traded in over 1 year, 30% in over 5 years… ATHs both.”

With all these dynamics at play, Thorn aptly summarizes the current state of the Bitcoin market: “The next few months will be very interesting – Bitcoin is the greatest show on earth.”

At the time of writing, BTC was trading at $30,676.

Featured image from LinkedIn, chart from TradingView.com