Renowned crypto asset hedge fund manager Charles Edwards has made a bold prediction about the future price of Bitcoin. Edwards, founder of Capriole Investments, shared his story insights via

In his statement, Edwards referenced historical data and several key factors that could drive Bitcoin’s price to new highs. He started by comparing Bitcoin’s post-halving performance in 2020, saying, “If Bitcoin’s post-halving returns are the same as 2020, we’re looking at $280,000 Bitcoin next year.”

Bitcoin Price Could Cross $300,000 Next Year

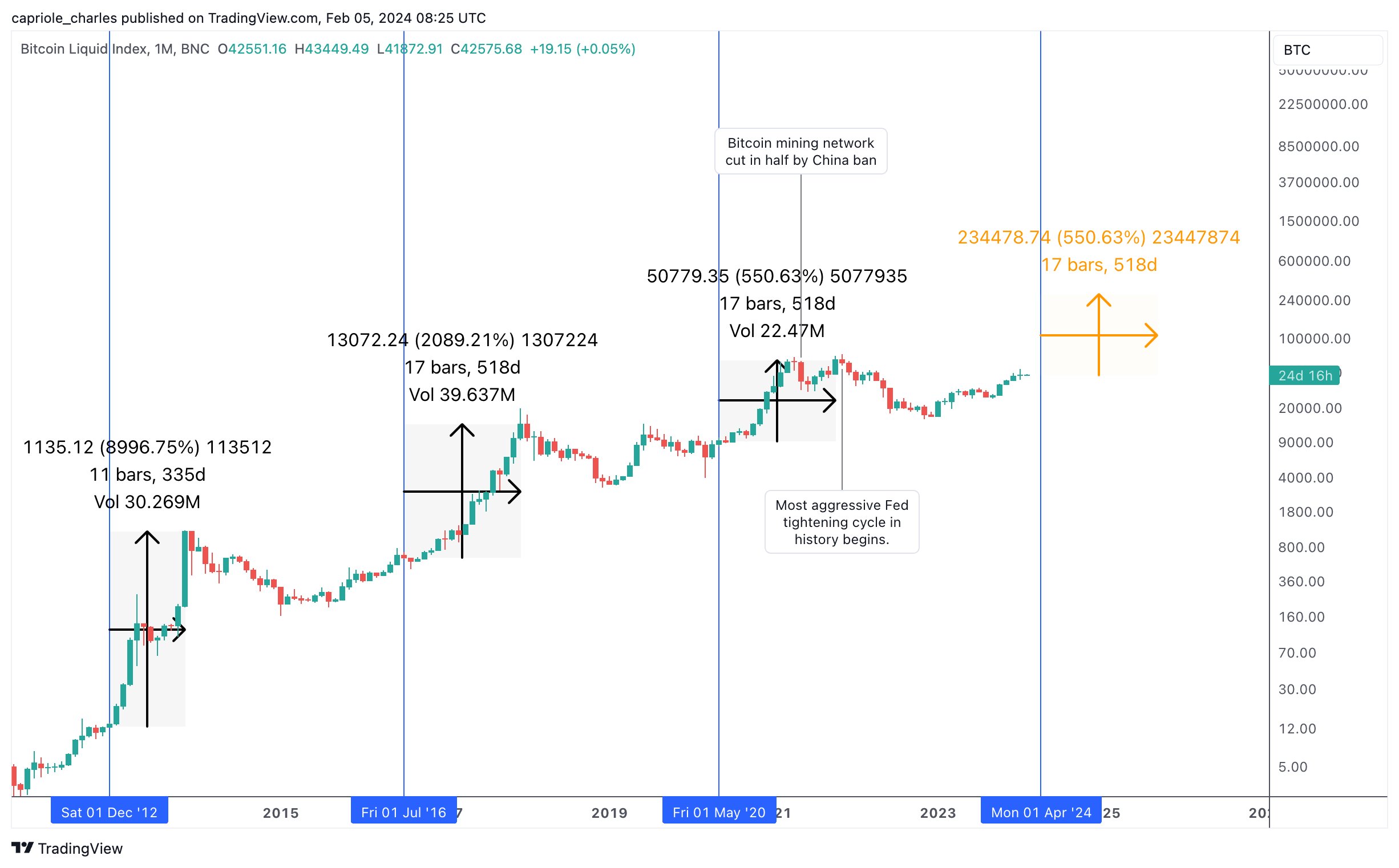

As Edwards’ chart shows, the third bull run in 2020 was quite muted compared to the previous ones. During the first bull market (halving cycle) in 2012, Bitcoin’s price peaked at $1,132, marking a dramatic increase of 8,996% over 11 months (335 days). The second bull run in 2016 ended in December 2017 when the price reached around $20,000, up 2,089% over a period of 17 months (518 days).

Edwards acknowledged that some might argue that profits decline with each cycle. However, he made a counter argument that the 2020 performance was stuck due to key factors. First, Edwards attributed the lackluster performance of the 2020 bull market to China’s decision to ban Bitcoin mining, which led to a 50% reduction in the hash rate and had a stifling effect on Bitcoin.

Second, he highlighted the Federal Reserve’s aggressive tightening measures, which negatively affected Bitcoin’s performance during that period, stating: “2020 was the worst Bitcoin bull market in history. I believe that overall performance was undermined by China’s -50% mining network destruction and the most aggressive Fed tightening cycle in history.”

However, Edwards expressed optimism about the future, pointing to a contrasting economic landscape in 2024. He stated: “In fact, 2024 marks the opposite of 2021. QE has resumed and the Fed has begun easing, with Fed Chair Powell expecting three cuts. this year. A weaker dollar = a stronger Bitcoin.”

He also compared the upcoming launch of Bitcoin ETFs in January to a “second halving,” highlighting the potential market impact, saying: “Furthermore, I view the January launches of Bitcoin ETFs as equally powerful as a ‘second halving’.”

Drawing parallels to the gold market, Edwards highlighted that Bitcoin’s current market cap of approximately $800 billion is significantly smaller than the market cap of gold when the GLD ETF launched in 2004.

He noted that gold saw a parabolic rise of more than 300% in just seven years after the ETF’s launch. year. Bitcoin’s market cap is currently just over $800 billion. Smaller assets are generally capable of delivering larger upside returns.”

Additionally, Edwards highlighted Bitcoin’s rapid growth, claiming that it is currently surpassing the adoption rate of the Internet, saying, “Bitcoin is growing faster than the Internet right now.”

The hedge fund manager concluded by summarizing his prediction, stating:

A 500% return over the 18 months after the halving would not be unusual for Bitcoin historically. An additional 300% return over the next two to five years based on the ETFs alone would be a conservative assumption. When you take the two most important factors for Bitcoin this cycle and add them up, you can easily arrive at a conservative Bitcoin price of $300,000 over the next few years.

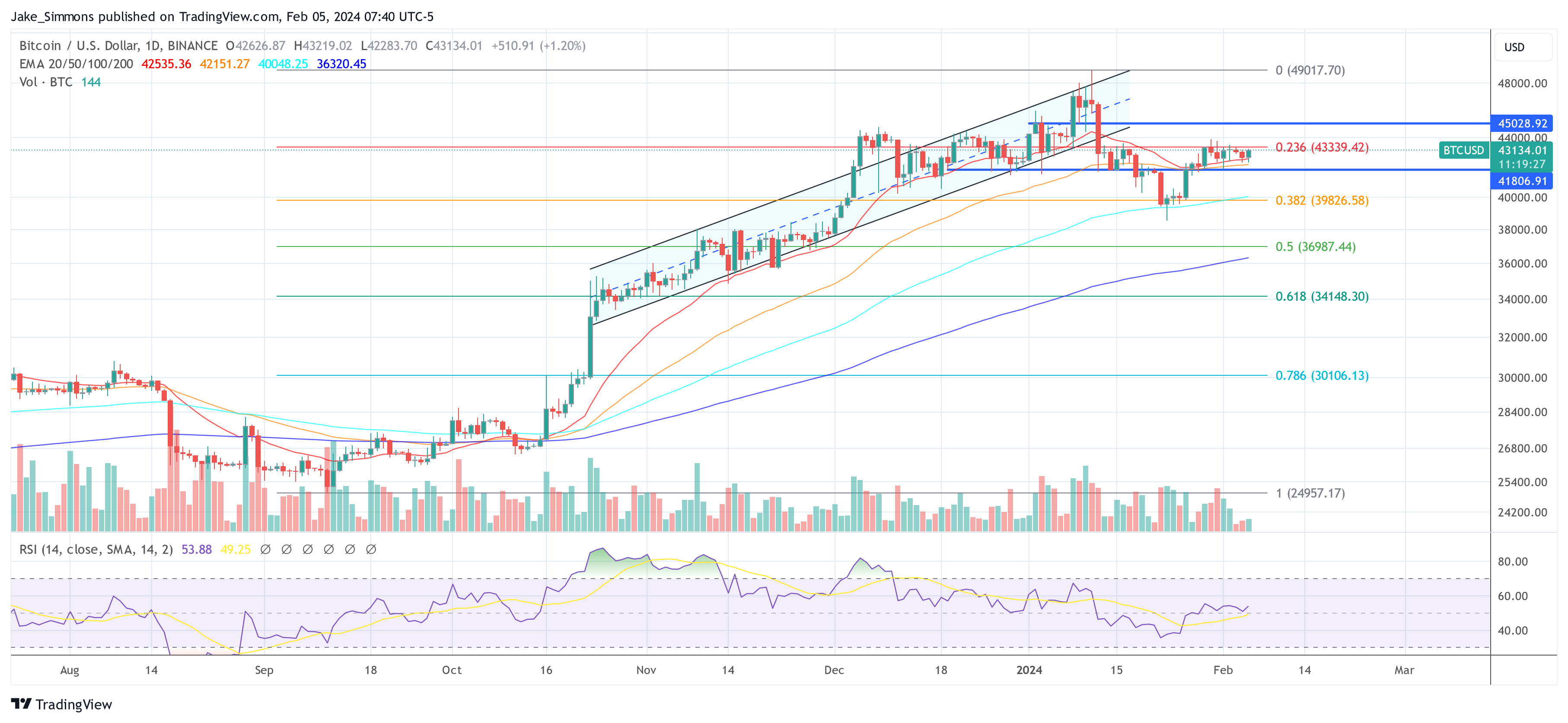

At the time of writing, BTC was trading at $43,134.

Featured image from YouTube/Blockworks, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.