- Short -term holders withdraw and display a reduced speculative appetite and weak conviction in the short term.

- Liquidation clusters build nearly $ 80k, which increases the risk of sale of Cascade.

Bitcoin’s [BTC] The price floated just above $ 83k from April 4.

In fact, the entire cryptomarkt is sharp, with signs that indicate a possible decrease of less than $ 80k. If that happens, technical models suggest that a slide could follow to the $ 68k zone.

A Bitcoin rally that couldn’t last

In the case of BTC, it actively rose to $ 88,580 after President Donald Trump had announced radical rates. But the rally was short -lived.

The prices fell sharply because traders weighed the risks that were linked to the uncertainty of global trade.

Not to mention, markets responded quickly. The S&P 500 fell by 4% – the biggest daily loss since the Pandemic Lockdowns. About $ 3 trillion in value was wiped out over US shares.

Of course Crypto did not escape the panic, because Bitcoin fell to $ 82,220 the same day and has since had trouble recovering higher terrain.

Is $ 80k the new Maginot line?

Recent data show that buyers defend the $ 80k zone. But technical signals such as the Death Cross blink carefully.

Source: Glassnode

Another concern comes from realized price data.

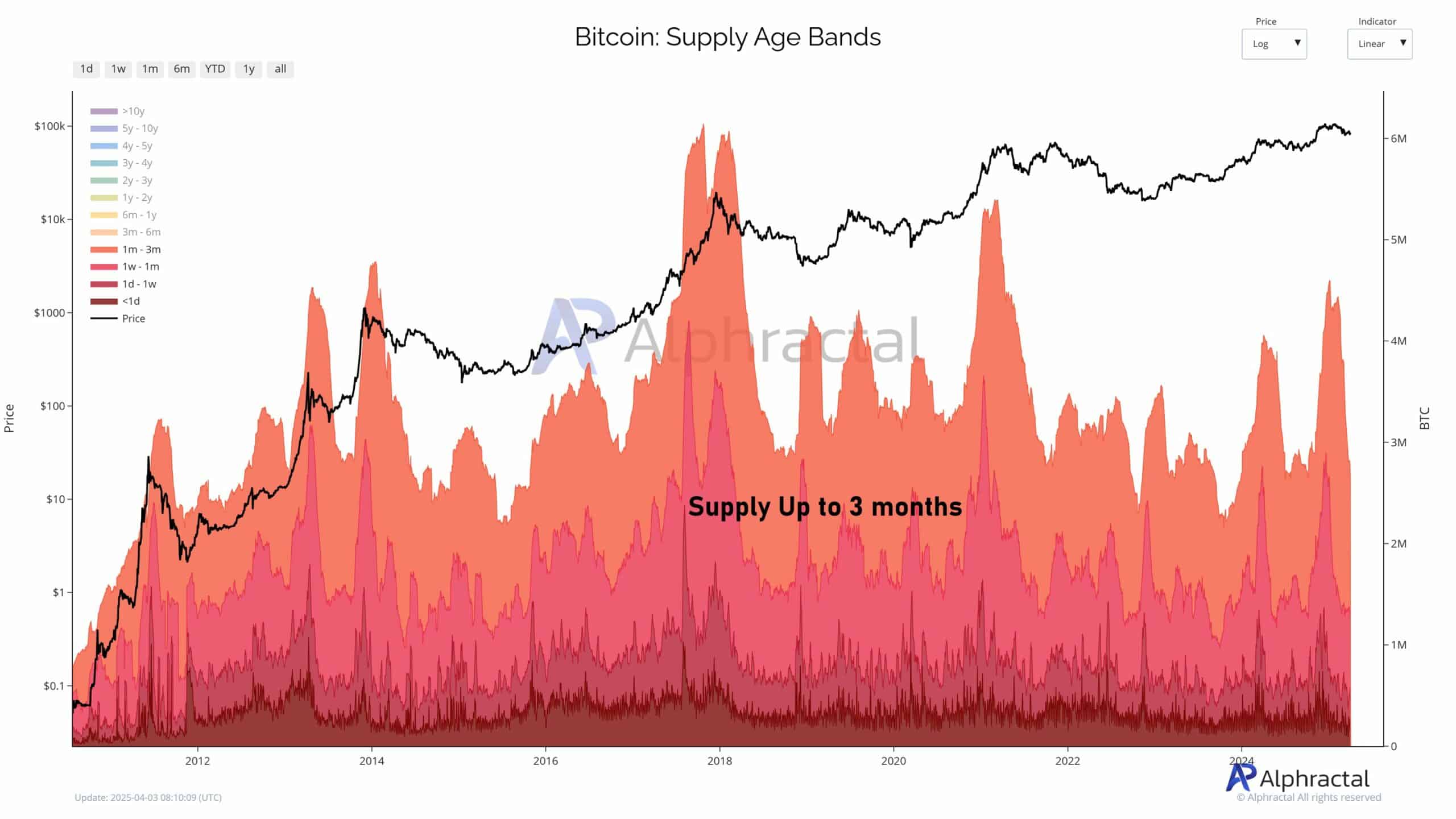

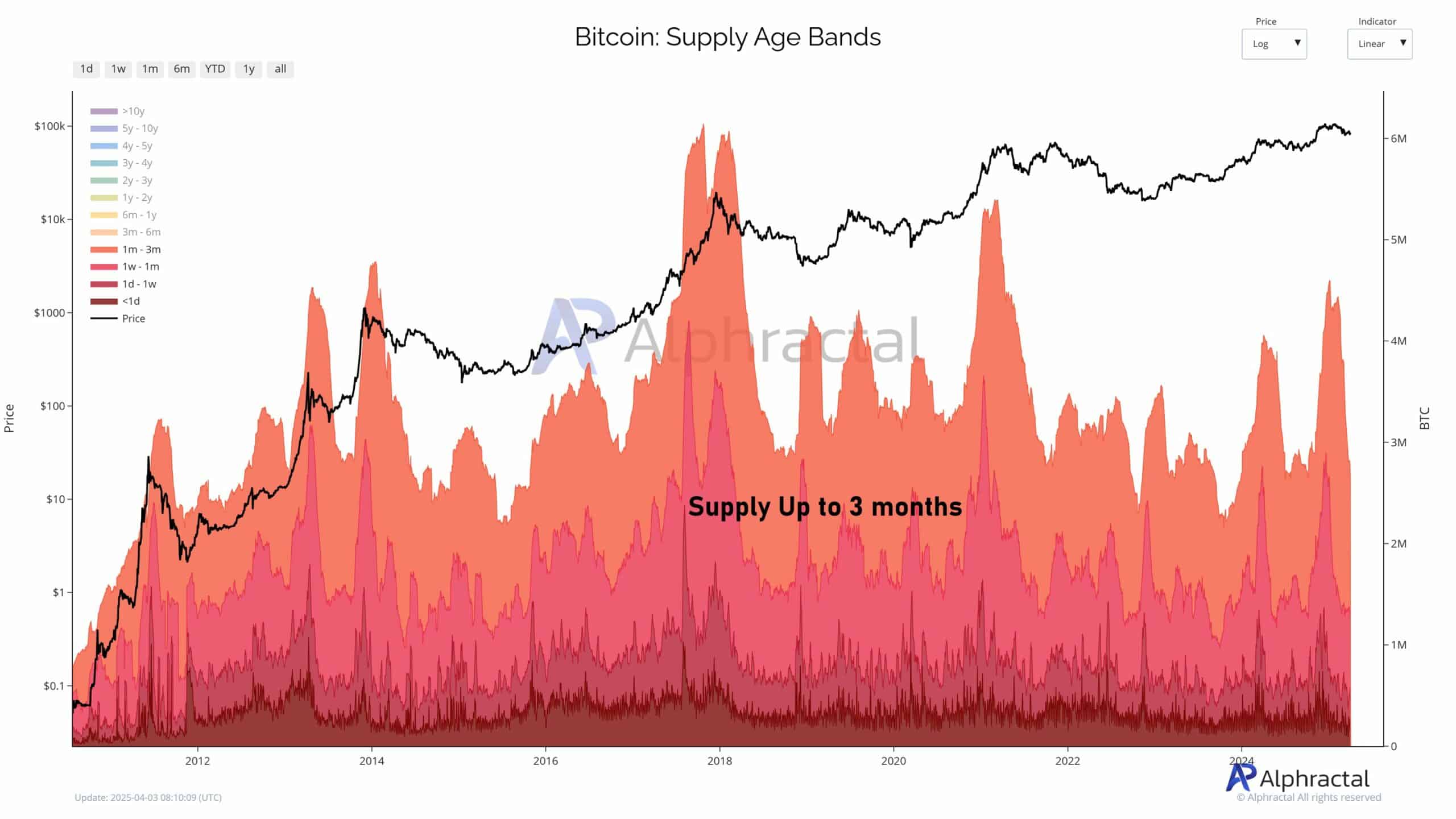

There is a steep fall in coins for less than three months. These short -term holders are historically bound to bullish phases. But at the moment their accumulation is fading.

In the past, Spikes led the largest Bull runs from Bitcoin in short-term holder.

At the time of writing, that figure had fallen below 15%. The deterioration suggests reduces speculative importance and reflects a wider market cooling.

Source: Alfractaal

BTC open interest sinks, and hope too

Moreover, the open interest rate has fallen by 37.5%from more than $ 80 billion to less than $ 50 billion since the end of 2024 – the Bitcoin slide is making $ 106k to $ 84k.

Without reducing leverage, price fluctuations shrink – but when liquidation clusters build, sharp movements can still occur.

Liquidation heat forces show where leverage works can relax. A recent 7-day Hittemap shows a heavy structure of long liquidations just below $ 80k.

Source: Alfractaal

If Bitcoin loses $ 80k with volume, a cascade to $ 68k is probably, according to analyst Joao Wedson.

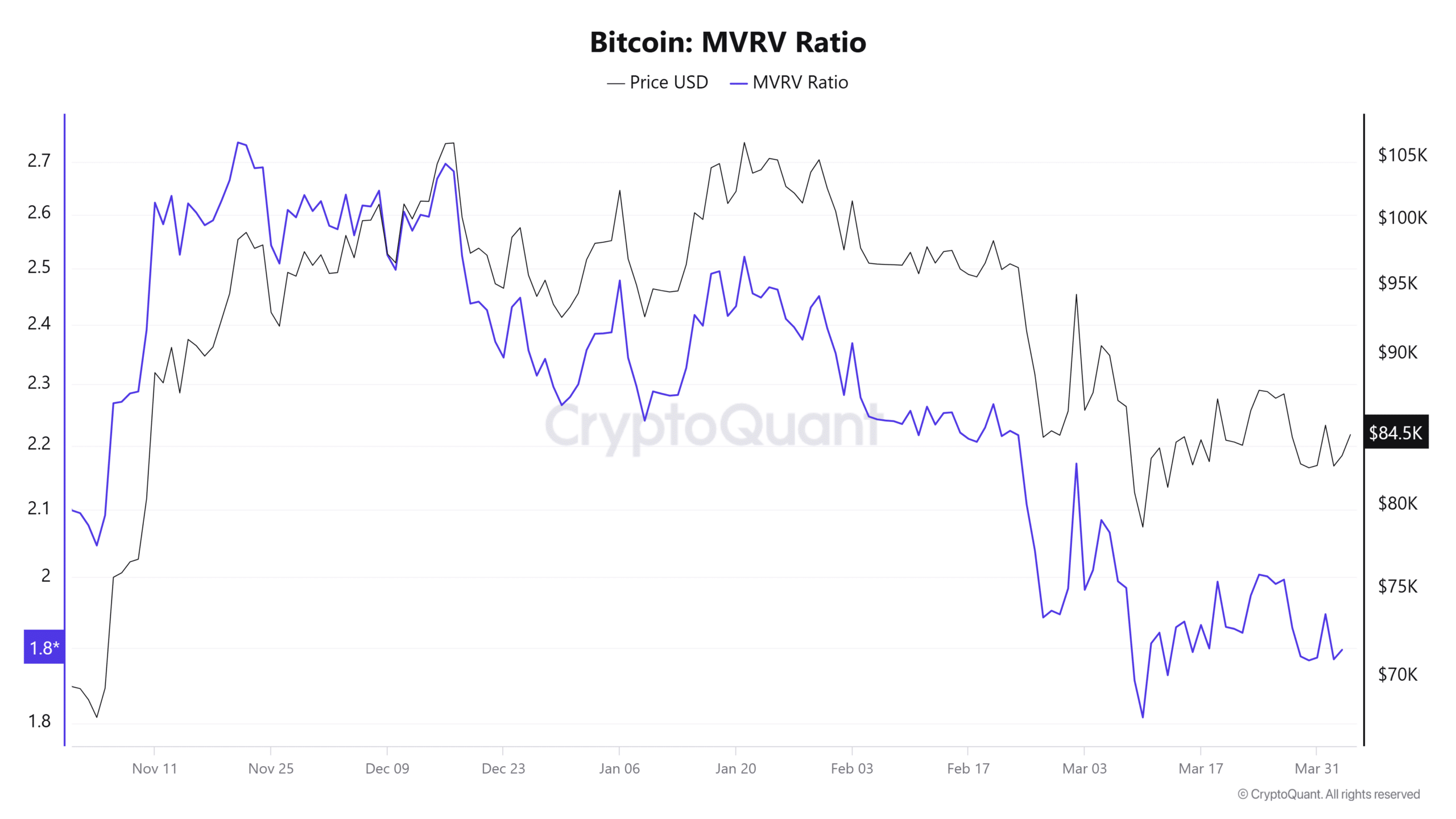

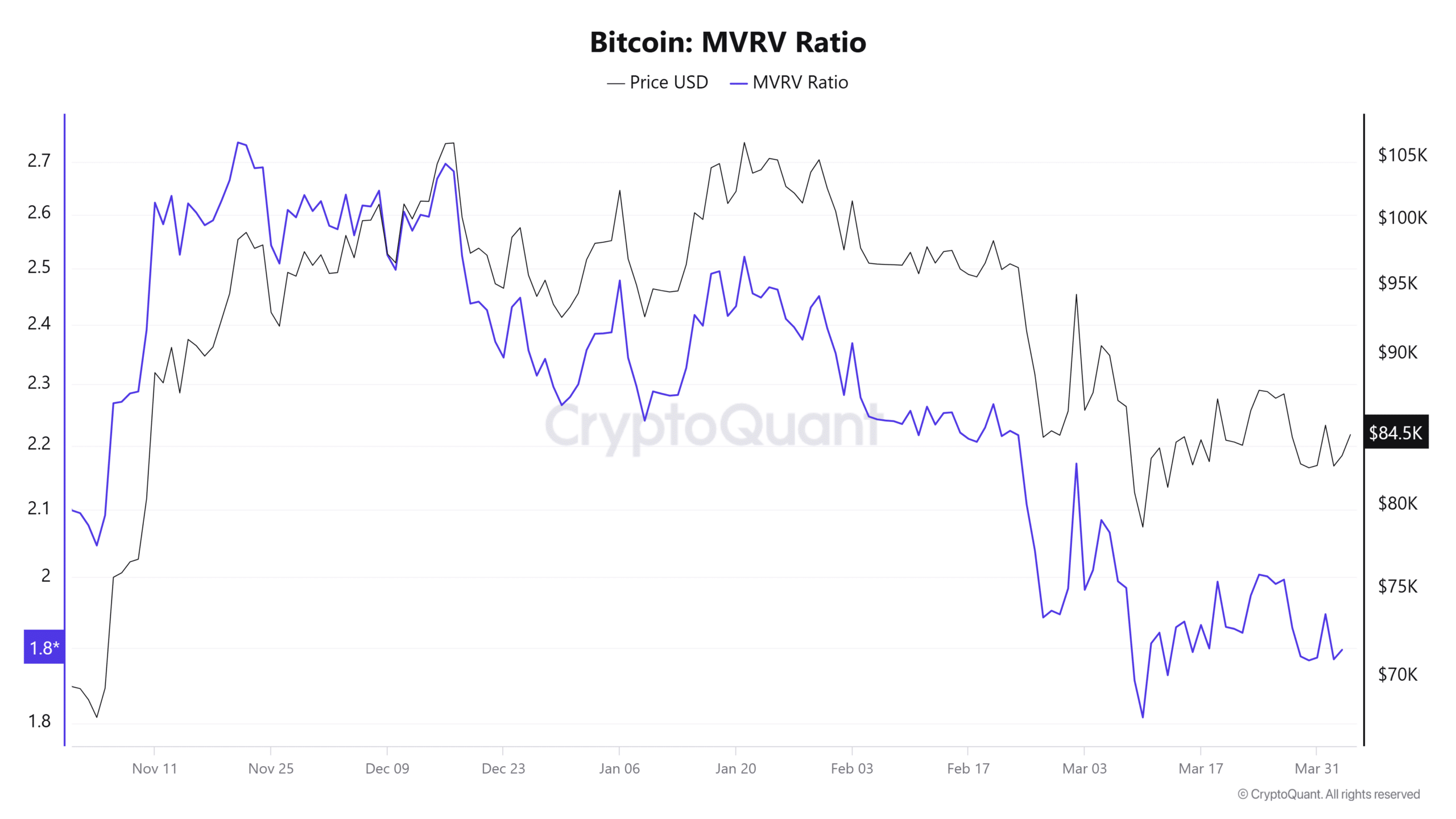

The MVRV Wake-Up Call

Another red flag is the MVRV ratio. It has fallen from 2.74 in November to below 2.0 in April, which indicates the speculation of fading and a shift to long -term property.

Source: Cryptuquant

Exchange Netflows even tell a similar story. Expand are extremely dominating, and that indicates that investors move coins to cold storage and not prepare for selling.

On 3 February alone, more than 60,000 BTC left fairs. That is one of the largest outsource with one day that has been admitted in months.

Source: Cryptuquant

The collection meals? Sellers do not necessarily rush to leave. But new buyers don’t get in either.

The position of Bitcoin above $ 80k is fragile. If that level breaks, a switch to $ 68k can follow as Bearish signals.

With leverage blurring and macro risks increasing after the Tariff, it can decide in the coming days whether this is a short-term dip or the start of deeper consolidation.