- Bitcoin rose above $64,000 after the US Fed rate cut, but fell to $63,786 at the time of writing.

- Bitcoin’s MVRV ratio indicated undervaluation, with further upside momentum needed for a sustainable rally.

Since the United States announced its latest interest rate cut, Bitcoin [BTC] saw a gradual recovery in prices.

The cryptocurrency rose to a peak of over $64,000 on September 23 and has gained 8.5% in value over the past week.

However, following this rise, Bitcoin fell slightly to $63,786 at the time of writing – still up 0.2% in the past 24 hours.

The asset’s recent performance has caught the attention of analysts, especially given the resistance and support levels, which seem to indicate a coming momentum shift.

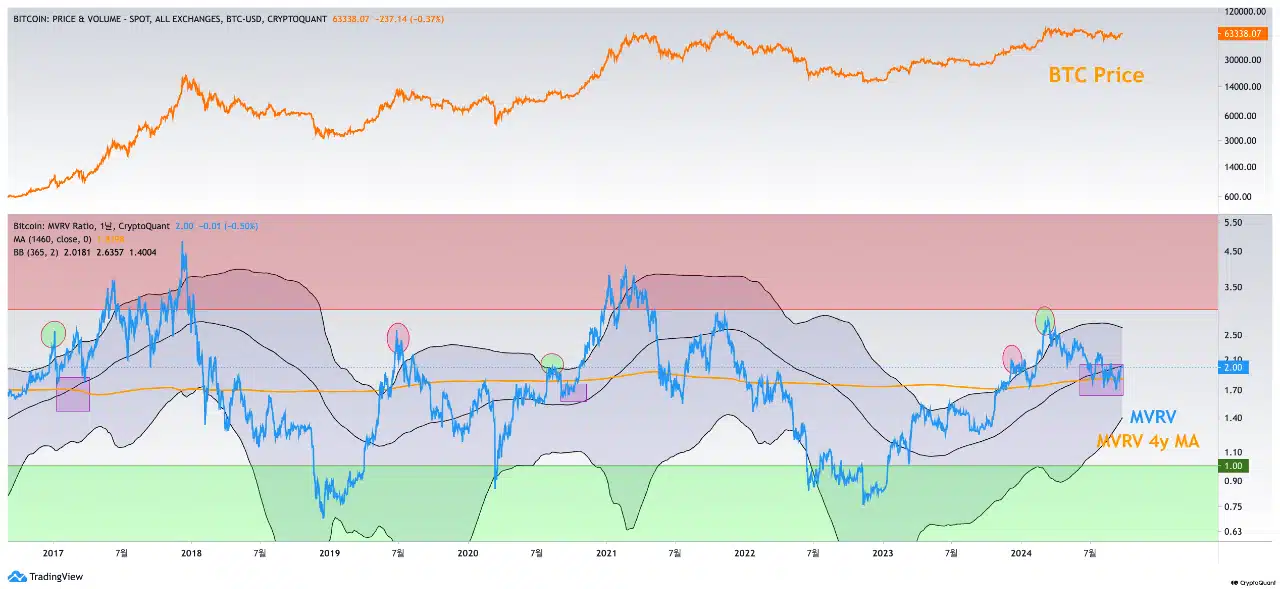

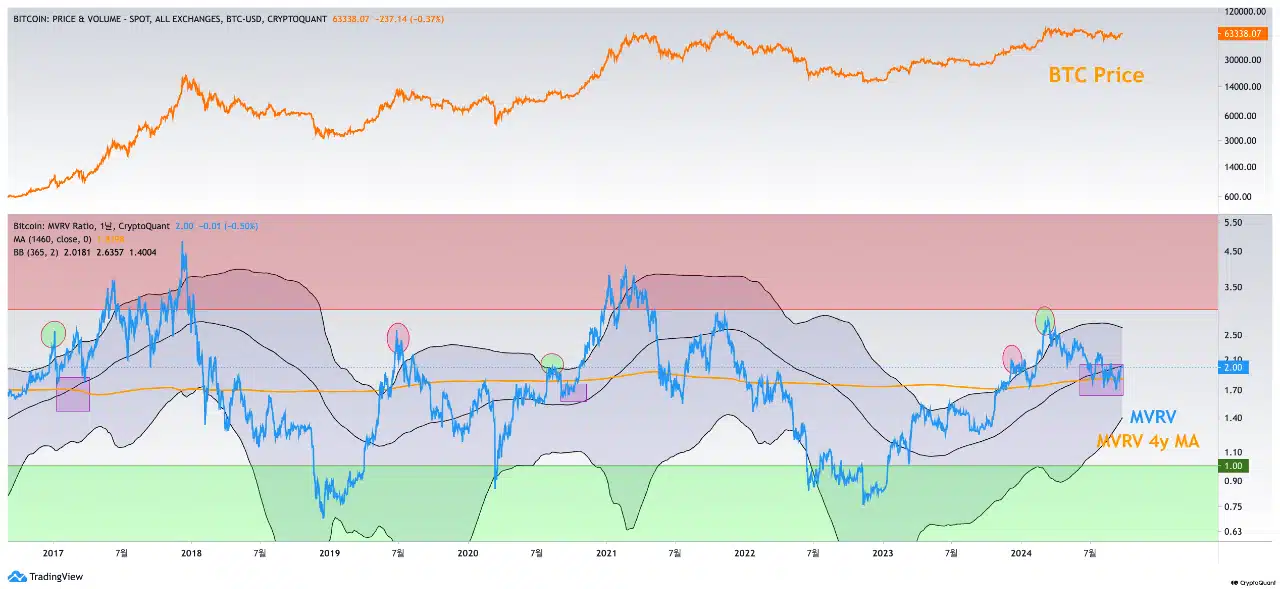

One such analyst, operating under the pseudonym CoinLupin on the CryptoQuant platform, pointed to Bitcoin’s market value to realized value ratio (MVRV) as a key indicator of the potential direction of the market.

The MVRV ratio compares Bitcoin’s market value to its realized value, allowing traders to understand whether the asset is overvalued or undervalued at a given point in time.

Important indicator for the trend of Bitcoin

In a recent analysis, CoinLupin explained that Bitcoin’s 1- and 4-year MVRV averages have historically served as critical resistance or support levels during various market trends.

According to the analyst

“The overall market flow tends to follow a similar pattern.”

CoinLupin highlighted that the MVRV ratio, especially during the recovery phases in 2023, provided valuable insight into Bitcoin’s price fluctuations.

Source: CryptoQuant

The current market scenario shows a departure from past trends.

After a brief period of ‘overheating’ during the recent recovery, Bitcoin’s price correction has been milder than expected, and the consolidation period has lasted longer than expected.

This extended consolidation period has caused Bitcoin’s MVRV ratio to fall below both its 1- and 4-year averages.

While this could be a signal that the market is undervalued, the analyst suggested that for Bitcoin to regain strong bullish momentum, the MVRV ratio must rise above its one-year average.

This could trigger a new bullish phase, leading to potential gains in the coming weeks.

Open interest and active addresses

In addition to the MVRV ratio, other important metrics are also worth examining to determine Bitcoin’s future price action.

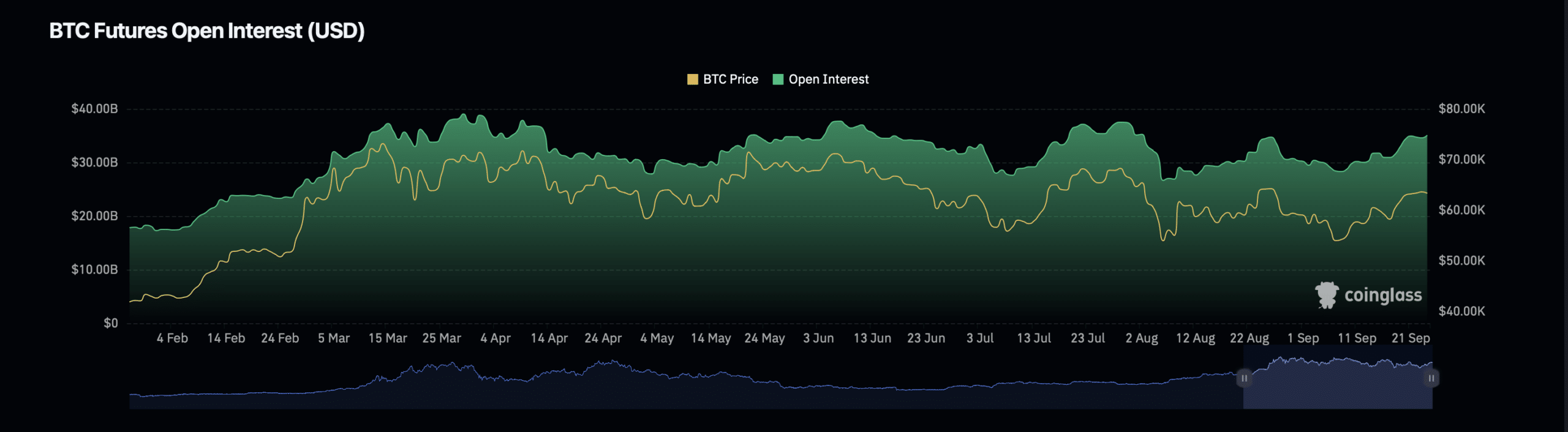

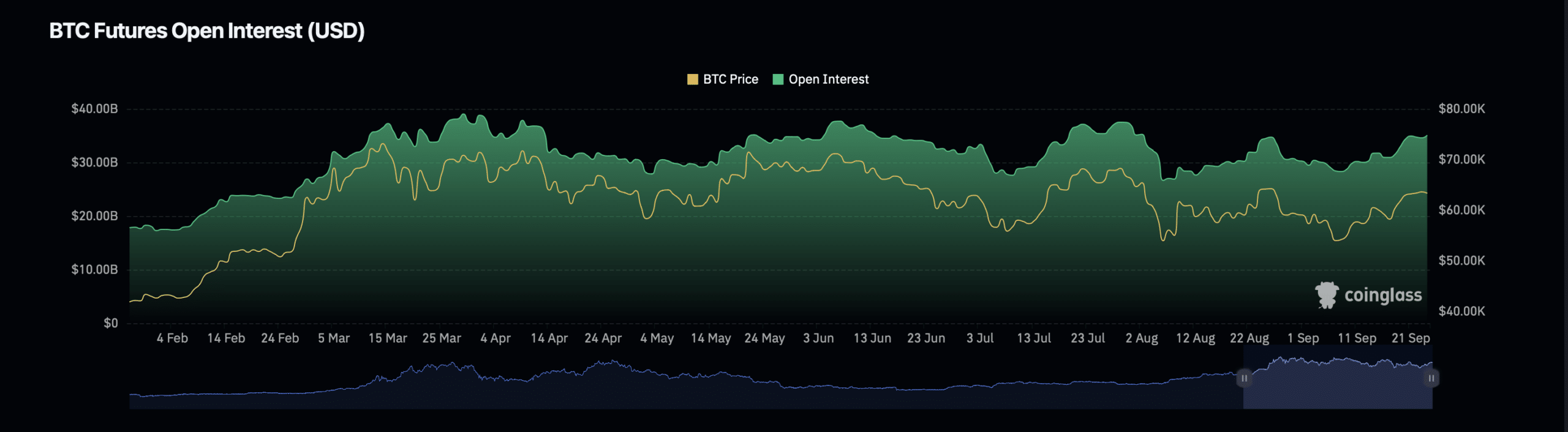

According to facts According to Coinglass, Bitcoin Open Interest – an indicator of the number of open Futures contracts on the asset – has fallen 0.85% to a current valuation of $34.78 billion.

Source: Coinglass

This decline in Open Interest suggested that market participants may be closing out their positions, possibly indicating caution or uncertainty among traders.

Additionally, Bitcoin Open Interest volume, which tracks the total value of active contracts, fell 20.86% to $45.77 billion.

A sharp drop in Open Interest often indicates reduced participation in the market, which could dampen price movements.

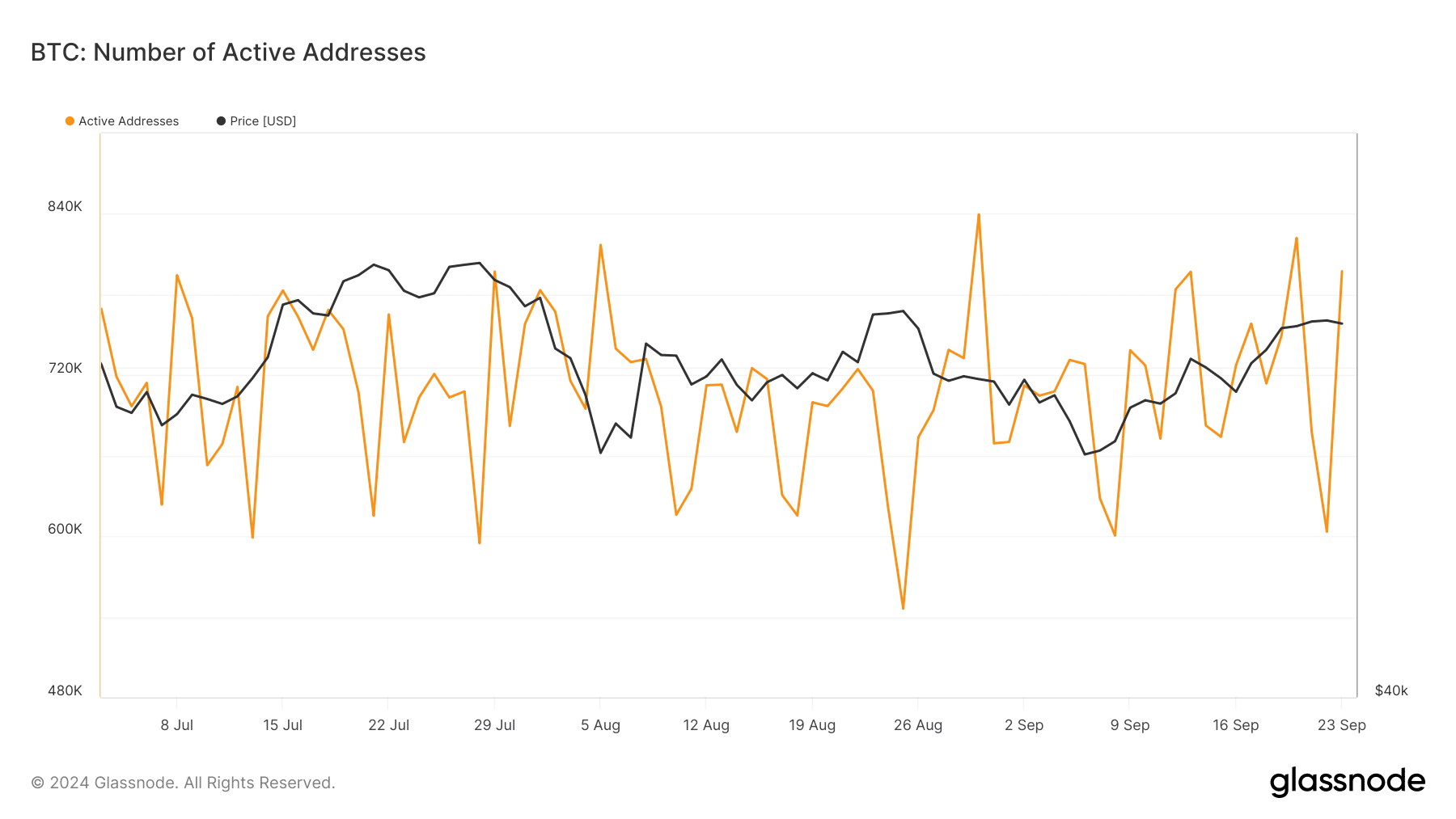

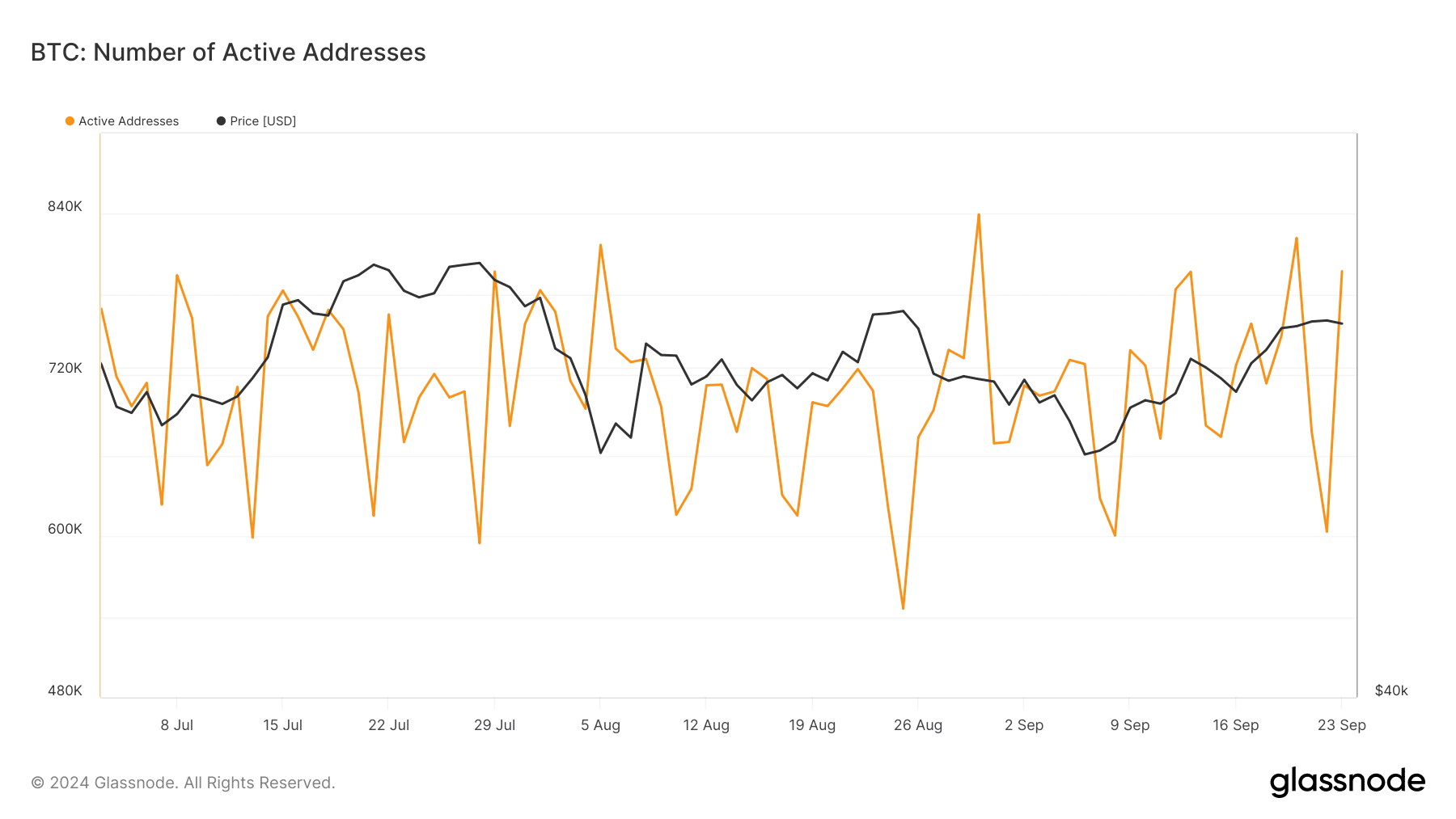

On the other hand, facts from Glassnode revealed a positive development in Bitcoin’s active addresses, which saw a significant recovery after a steep decline earlier this month.

Bitcoin active addresses

Read Bitcoin’s [BTC] Price forecast 2024–2025

The number of active addresses – an indicator of network activity – has increased from 600,000 to 797,000 as of today.

This increase in the number of active addresses could indicate a renewed interest in Bitcoin and could potentially point to stronger price movement in the future, especially as more participants engage with the network.