The Bitcoin price trajectory has taken another sharp upward turn, marking the $28,000 mark for the first time since its remarkable surge on August 29. This earlier jump was attributed to Grayscale’s win at the U.S. Securities and Exchange Commission (SEC). ) in their legal battle regarding the conversion of Bitcoin Trust (GBTC) to a spot ETF.

In a striking demonstration of Bitcoin’s notorious volatility, BTC experienced a price escalation of over $800 within a minuscule 5-minute span on Sunday evening, skyrocketing from $27,250 to a peak of $28,053 between 6:15 PM and 6:20 PM ET.

Why did the Bitcoin price rise today?

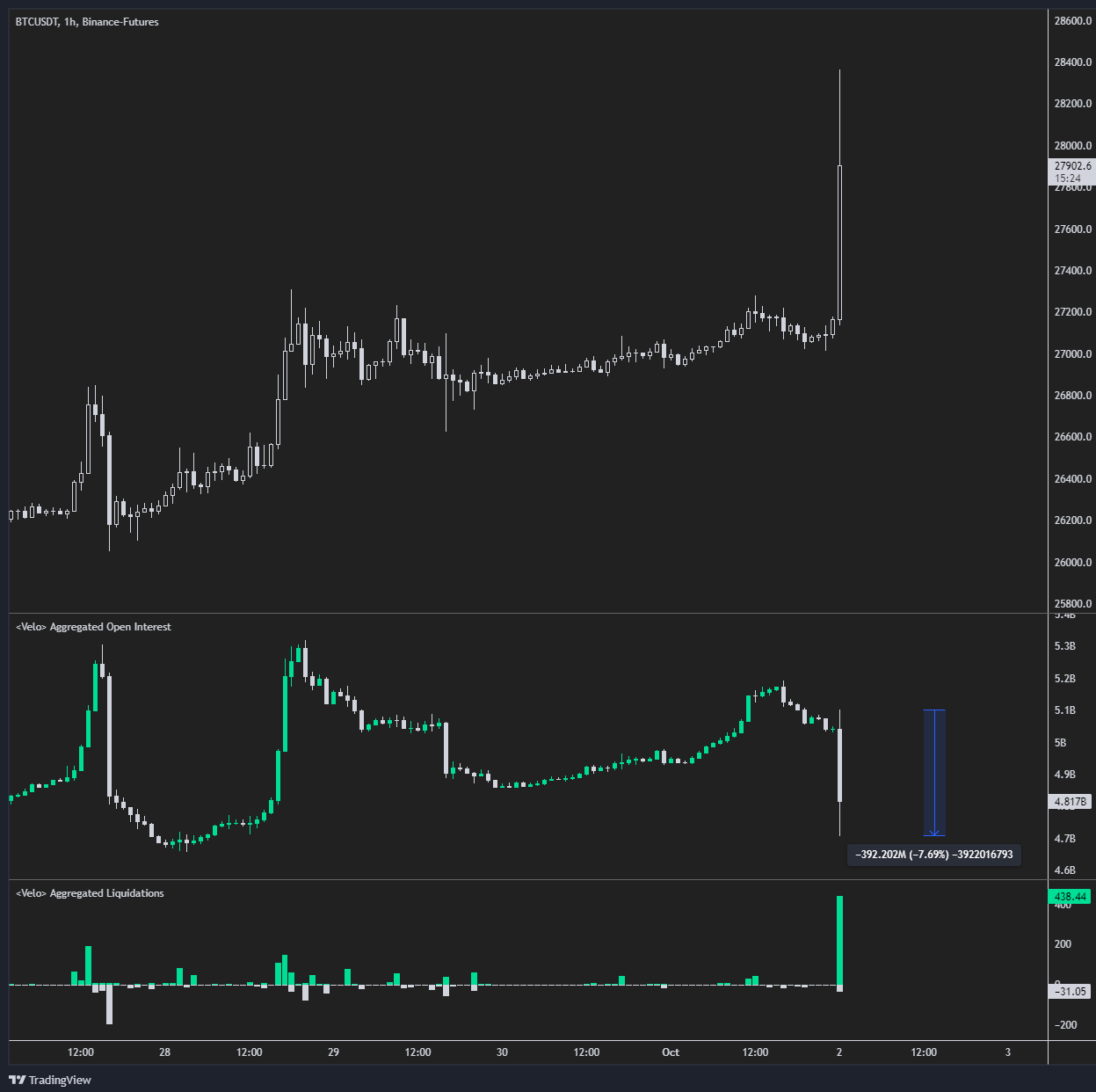

A primary catalyst behind this dramatic price movement is localized by esteemed crypto analyst Byzantine General, the phenomenon is known as a “short squeeze.” In futures trading, a short squeeze is characterized by a rapid increase in price, forcing traders who had bet against the asset’s price (short sellers) to buy it to avoid further losses. This reactive purchase can amplify the asset’s price appreciation.

During yesterday’s surge, a whopping $392 million worth of Bitcoin shorts, or about 7.7% of the market’s total open interest, were quickly liquidated. Byzantine General further elaborated on the market’s resilience, noting that Bitcoin open interest quickly bounced back with a $350 million surge, humorously suggesting the market’s willingness to embrace such a volatile maneuver again: “The whole market was basically like, ‘I’m fucking doing it again.”

Crypto analyst Fabian D. deepened the analysis by pointing out the complicated trade-off between driving out short sellers and the potential for further Bitcoin appreciation. He indicated that Bitcoin’s upward trajectory from this point will depend on two primary factors: the arrival of spot buyers driven by fear of missing out (FOMO) and whether short sellers decide to restore their positions.

Fabian also alluded to the absence of institutional buying activity in the week leading up to this surge, but underlined the importance of monitoring premium rates on platforms like Coinbase and CME as the market opens today. To further add to the complexity of the market landscape, Fabian flagged two impending events: the anticipation surrounding the inflow of Ethereum Future ETFs, and the court hearing over the Celsius platform, which could potentially refocus attention on payouts to creditors.

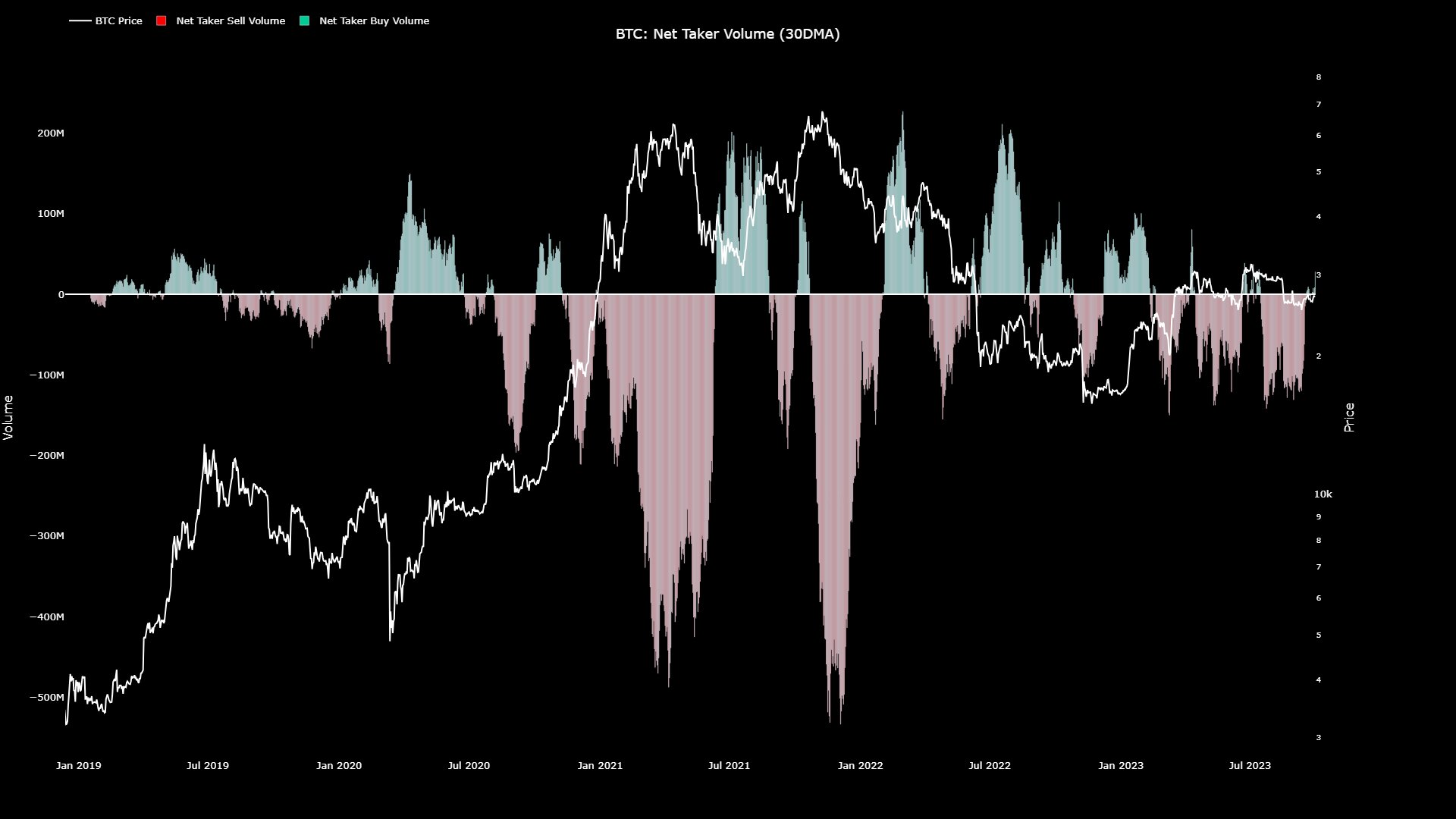

By drawing insights from on-chain data, analyst Maartunn introduced a new layer of optimism: noticing that “Net Taker Volume has entered the green zone, indicating that buyers are in control. The last time was four months ago.”

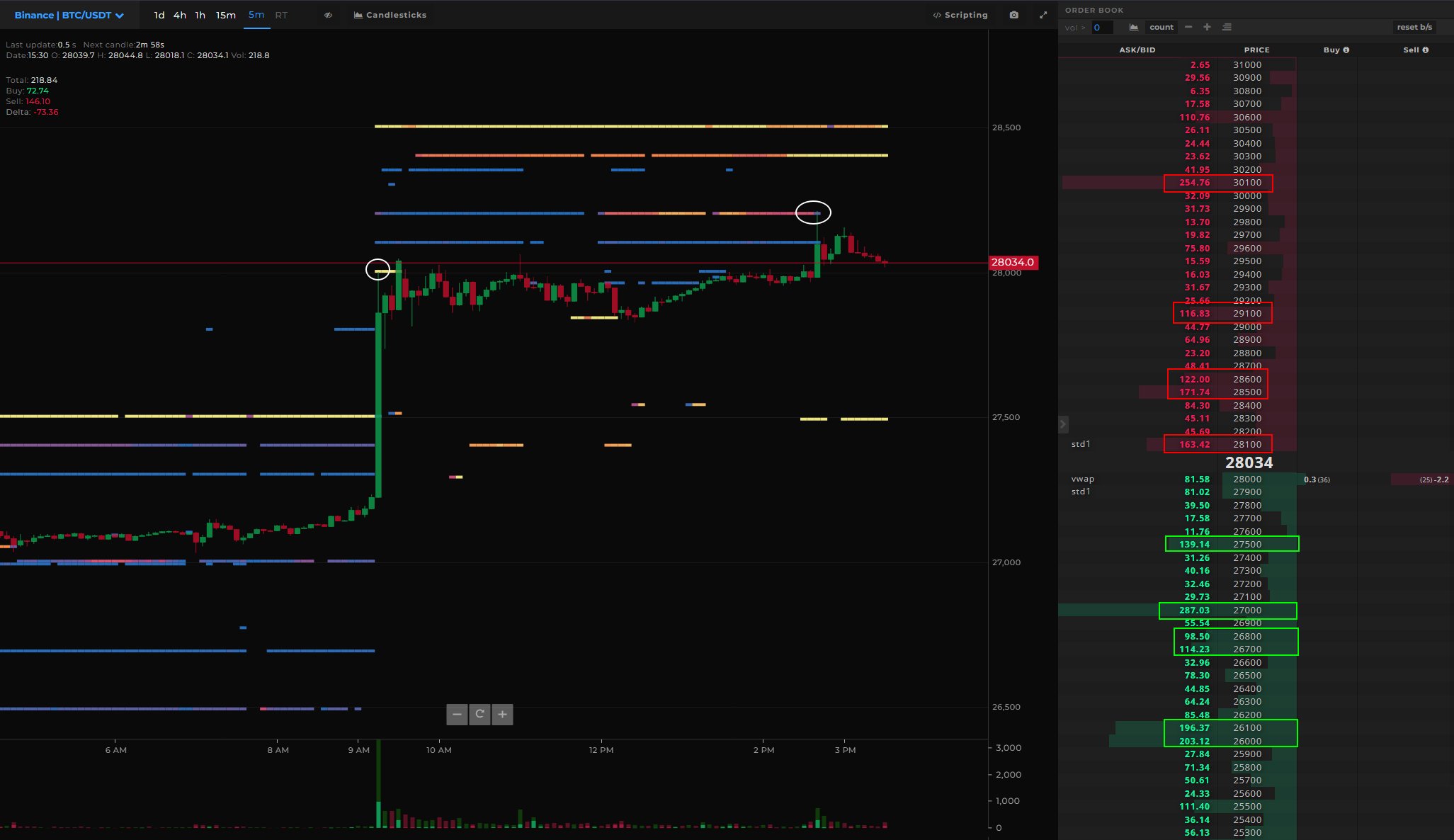

Quanttrader Skew delves into detailed analyzes and sheds light on the dynamics at play on platforms such as Binance and Bybit. He emphasized that the recent price surge was not entirely unforeseen, especially given the noticeable shift away from short positions and the robust perpetual bidding that led to the peak.

Looking at Bitcoin’s total CVDs and delta, he further noted: “For now, I only see the selling pressure in the perps. Price drop with Perp CVD drop and Perp sales delta rise. The next move that will determine the fate of this entire move is mockery.”

Skew emphasizes evolving market dynamics pointed out that the BTC Binance Spot showed a remarkably broad order book with a significant amount of available and resting liquidity. He concluded that such a design could lead to more pronounced price responses.

Highlighting the evolving market dynamics, Skew noted that BTC Binance’s spot market exhibits a remarkably broad order book with a significant amount of available and resting liquidity. He concluded that such a setup could lead to a new pronounced price reaction. “Increasing demand liquidity on spot order books; implies spot takers need higher volume to clear $28,000 – $29,000 (market structure shift),” he warned.

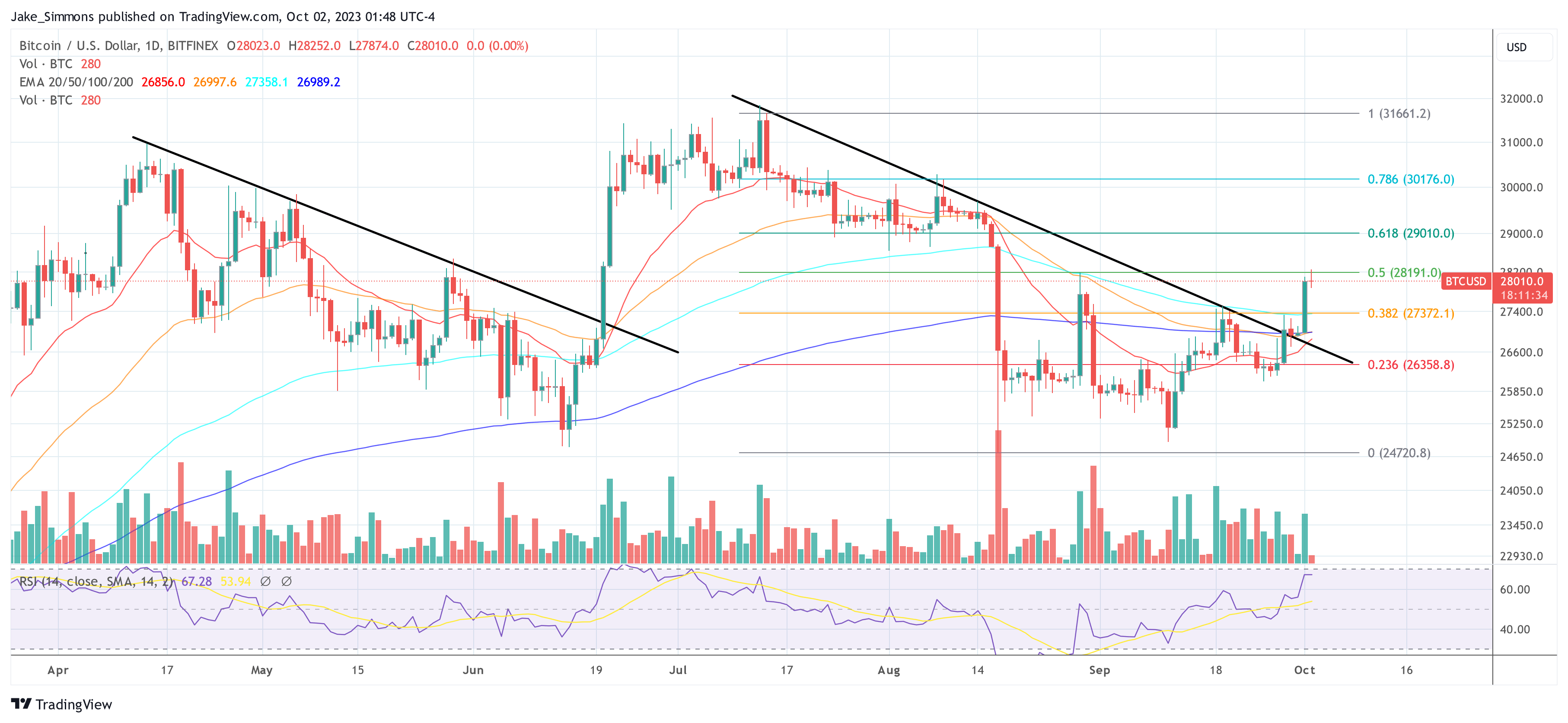

It is also interesting to note that the price movement was already clearly visible in the 1-day chart. As explained in the latest Bitcoin price analyses, last Thursday the price broke through the (black) downward trend line established in mid-July. While the successful retest of the trendline took place on Friday and Saturday and confirmed the bullish momentum, the expected rebound took place yesterday.

Featured image from Shutterstock, chart from TradingView.com