In a remarkable surge, Bitcoin’s price has soared past the $41,500 mark, fueled by a confluence of factors ranging from market expectations for a Bitcoin spot ETF to broader financial trends. Here is a detailed analysis of the main reasons behind this rally:

#1 Discover Bitcoin ETF: the anticipation game

The buzz around the approval of a spot Bitcoin ETF likely remains the main driver of the recent price surge. Although there has been no specific update, market expectations are palpable and a FOMO effect is occurring. Last week, Bloomberg analyst James Seyffart suggested that a spot ETF will likely be approved between January 8 and 10, causing the market to react.

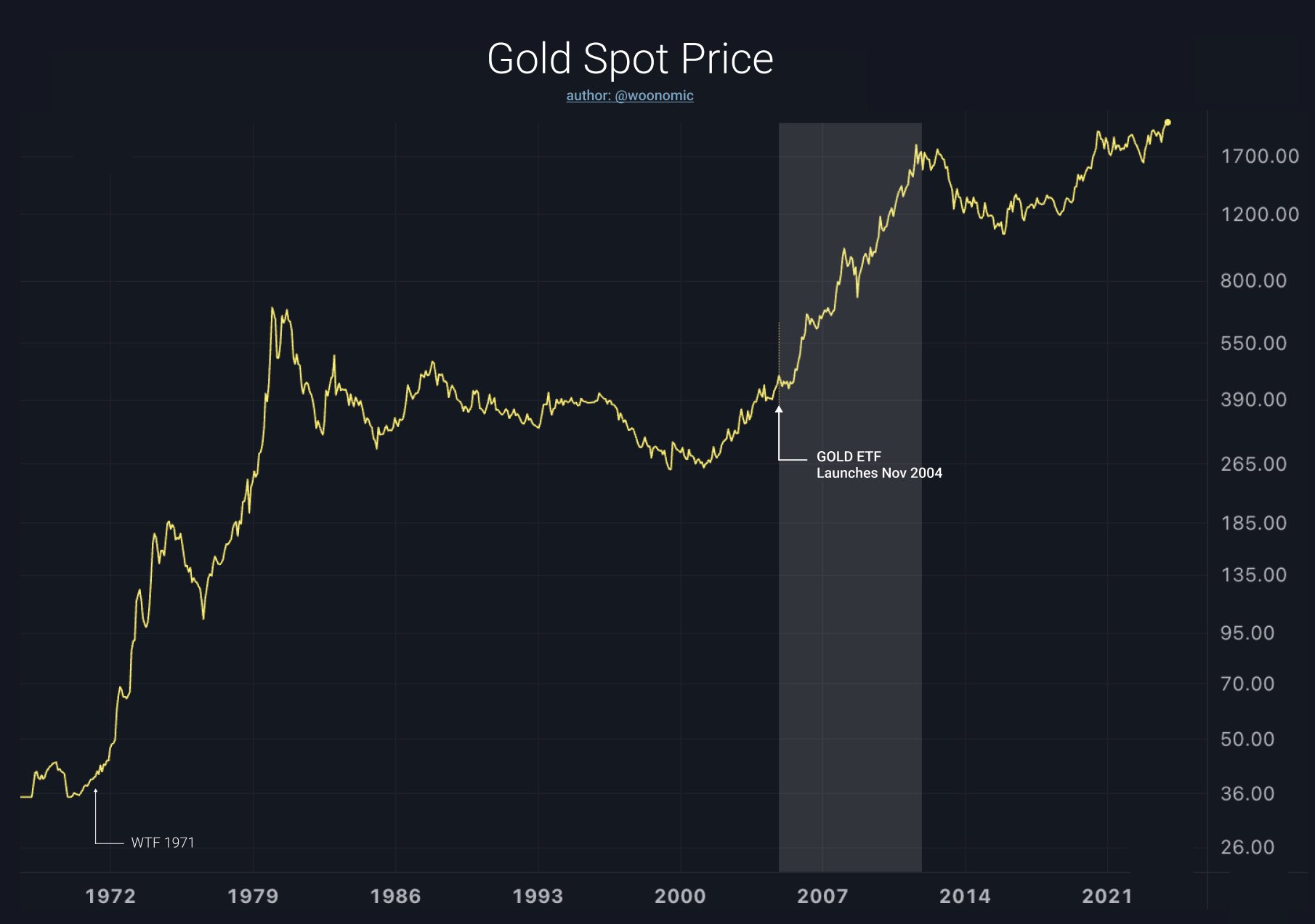

Renowned Bitcoin analyst Willy Woo reflected the expectation rack“It is very likely that we are on the eve of a Bitcoin spot ETF. The first commodity ETF was SPDR Gold Trust. It offered investors an easy way to access gold in their portfolio. When gold launched, it had an eight-year rally, without a single negative year between 2005 and 2012.”

#2 The rapid rise of gold and its correlation with BTC

The unexpected rise in gold, which rose 3.5% in just 30 minutes to a new record high on a Sunday afternoon, may also have had an impact on Bitcoin. This rapid rise in gold’s value could signal more than just market fluctuations; it could reflect deeper economic shifts that directly impact Bitcoin.

Crypto analyst @TheFlowHorse noticed“Unless someone is executed now after shorting gold, this says something important. Gold doesn’t just rip randomly on a Sunday like this unless it means something.” Tom Crown, Founder and CEO of Crown Analysis, added, “Tomorrow something VERY BIG is coming. Gold just blasted past all-time highs on Sunday evening. Someone knows something.”

#3 Bitcoin short squeeze

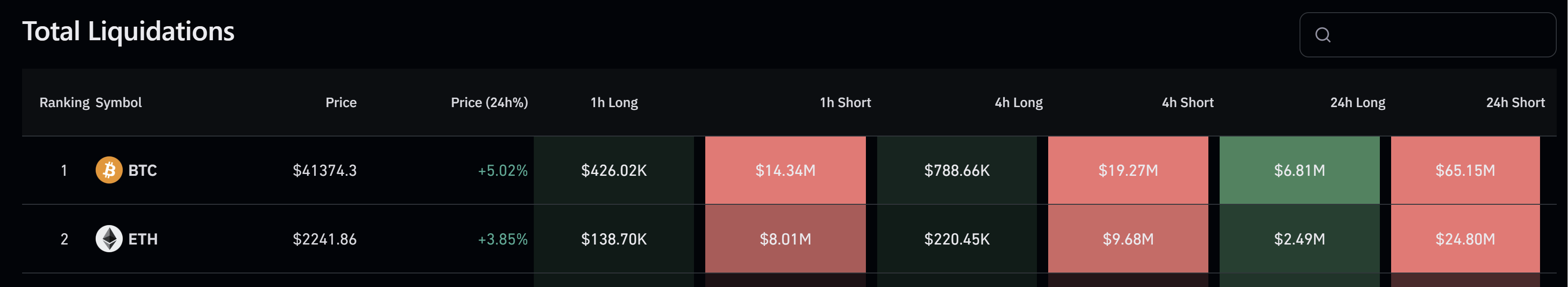

The liquidation of $65.15 million in Bitcoin short positions, according to Coinglass facts, has pushed the price of Bitcoin further up. The short squeeze, combined with strong spot market demand, was a key factor. Crypto analyst Skew noted“Another big short squeeze pushing the price above $40,000. A slight premium for Binance during the squeeze, indicating spot selling during the short squeeze.”

#4 Whales and institutional buyers

The current rise in the price of Bitcoin has been significantly influenced by whales and institutional buyers. Market analyst Skew pointed out their impact, saying: “Someone is still aggressively chasing the price here. What is more important is whether the large market entity actually allows some bids to be fulfilled or not. IF filled, they were expected to push the price higher. Clearly $40,000 is the price for institutional players.”

Keith Alan, co-founder of Material Indicators, further emphasized the role of these large holders, tweeting: “Bitcoin Whales just breached $40,000.” His statement underlines the significant influence whales have in driving up the price of Bitcoin. He added: “Some gains are being captured here. $42,000 is a high probability, but certainly not guaranteed.”

Additionally, GreeksLive, a trading tools provider, noted the broader market trend and stated, “Bitcoin broke through $41,000, Ethereum broke through $2,200… The giant whale once again showed a sense of smell for the market.”

In December, the price rose above expectations: bitcoin broke through $41,000, ethereum broke through $2,200 and continued to rise with virtually no retracement.

The giant whale again showed a sense of smell before the market, from last week to re-add positions to the block call,… https://t.co/EO6MddoNXX pic.twitter.com/ekD4LiLExs— Greeks.live (@GreeksLive) December 4, 2023

#5 Liquidity: the underlying strength

The rise in Bitcoin’s price is also significantly affected by global liquidity conditions, a factor that is often overlooked but crucial to understanding BTC and cryptocurrency market dynamics. Zerohedge highlighted the extent of this influence in a post: “In November, central banks added $350 billion in liquidity, the third largest increase since March.”

This massive injection of liquidity by central banks around the world plays a crucial role in the price movements of assets, including cryptocurrencies such as Bitcoin. David Marlin, CEO of Marlin Capital, pointed out Considering the significance of this trend in financial conditions: “U.S. financial conditions fell 90 basis points in November, the largest monthly easing on record (dating back to 1982).”

Adding to this story, cryptocurrency expert Charles Edwards commented on the historic nature of this easing, saying, “November saw the biggest easing in over 40 years!” Such a significant easing of financial conditions indicates a very favorable environment for investments in assets like Bitcoin, which are seen as a hedge against inflation and currency devaluation.

Arthur Hayes, founder of BitMEX, summed up the sentiment with: to report“An eye on the prize. RRP balances keep falling and BTC keeps pumping. Yachtzee!!!”

At the time of writing, BTC was trading at $41,505.

Featured image from Shutterstock, chart from TradingView.com