Bitcoin’s price rose to $48,000 after the hacked SEC account tweet. BTC has pared all gains, but upside support is still intact around $45,200.

- Bitcoin spiked towards the resistance levels of $47,800 and $48,000.

- The price is trading above $45,500 and the 100 hourly Simple Moving Average.

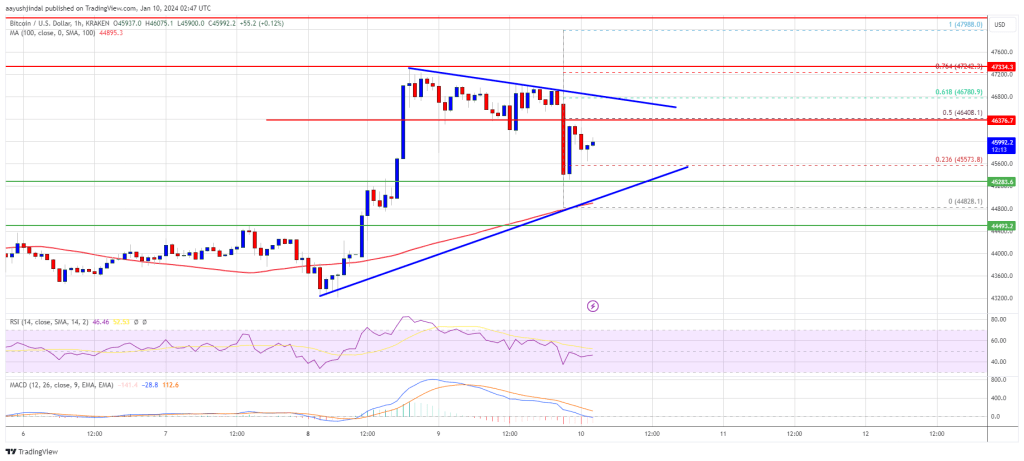

- A large contracting triangle is forming with resistance near $46,800 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to rise towards the $48,000 level unless there is a close below $45,000.

Bitcoin price is rejected

Bitcoin price started a new rise above the USD 45,500 resistance zone. BTC gained bullish momentum above the $46,000 and $46,500 levels after the hacked SEC account tweeted about the ETF approval.

After clarification, there was a sharp rejection near the $48,000 zone. A high was formed around $47,988 before the price started falling again. There was a move below the USD 47,000 and USD 46,500 levels. The price fell towards the $45,000 support.

A low was formed around $44,828 and the price is now rising. It is back above the 23.6% Fib retracement level of the recent decline from the $47,988 swing high to the $44,828 low.

Bitcoin is now trading above $45,500 and the 100 hourly Simple Moving Average. A major contracting triangle is also forming with resistance near $46,800 on the hourly chart of the BTC/USD pair. On the upside, immediate resistance is around the $465,400 level. It is close to the 50% Fib retracement level of the recent decline from the $47,988 swing high to the $44,828 low.

Source: BTCUSD on TradingView.com

The first major resistance is $46,800. A clear move above the USD 46,800 resistance could send the price towards the USD 47,200 resistance. The next resistance is now forming around the $48,000 level. A close above the USD 48,000 level could send the price rising further. The next major resistance is at $49,250.

Lose more in BTC?

If Bitcoin fails to rise above the USD 46,800 resistance zone, it could start a new decline. The immediate downside support is near the USD 45,550 level.

The next major support is $45,200. If a move occurs below USD 45,200, the price could gain bearish momentum. In the mentioned case, the price could fall towards the support at USD 44,800 in the short term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major support levels – USD 45,500, followed by USD 45,200.

Major resistance levels – $46,400, $46,800 and $47,200.

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.