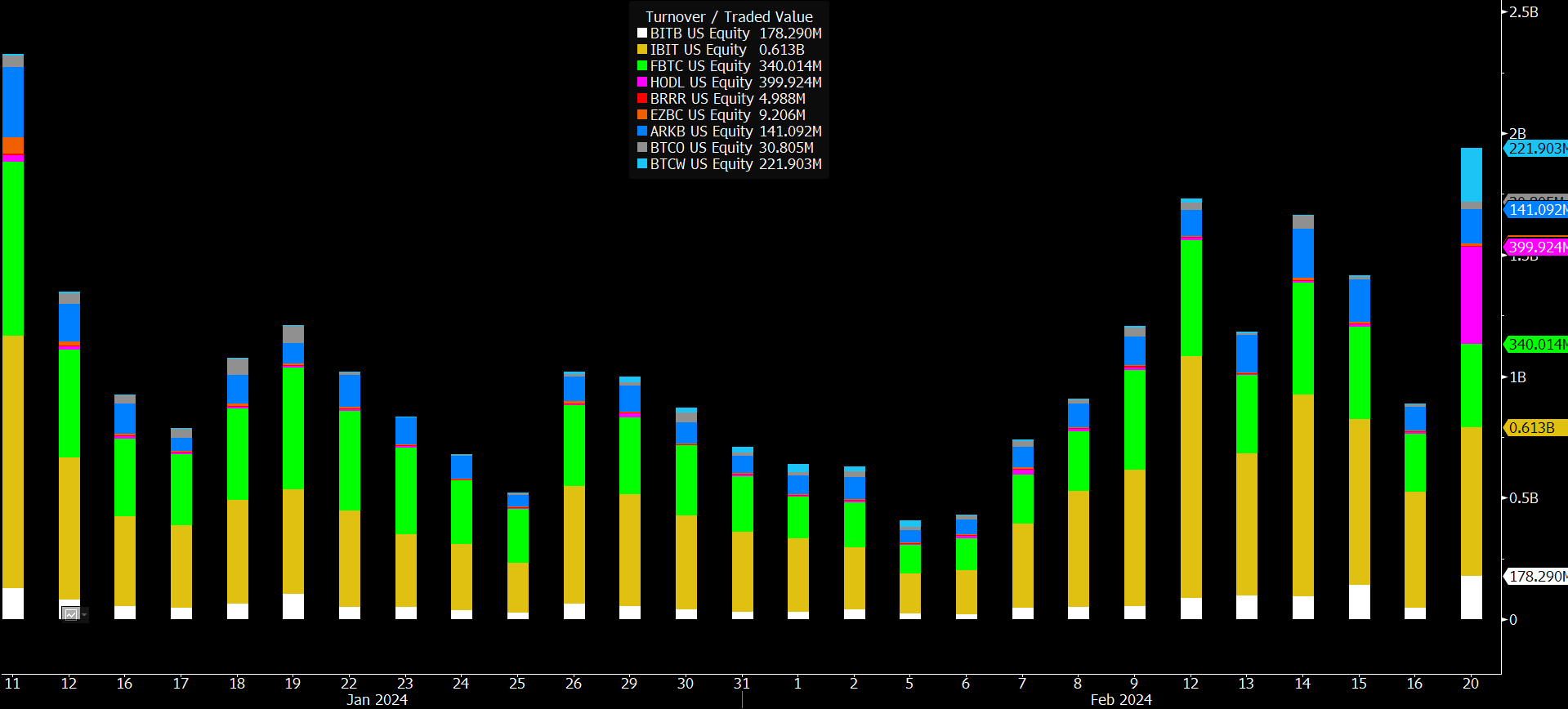

Bitcoin had a tumultuous day yesterday, with the price briefly reaching $53,000 before plummeting to a low of $50,820. Amid this price volatility, an unexpected phenomenon caught the attention of market analysts: a dramatic increase in trading volumes for certain Bitcoin ETFs.

Bloomberg’s Eric Balchunas provided one detailed account of this anomaly on He noted: “HODL is going wild today with $258 million in volume, a 14x jump from its daily average, and it’s not one big investor… but rather 32,000 individual trades, which is 60x its average.”

This level of activity was not only unexpected, but unprecedented and led to widespread speculation and analysis within the financial community. The unusual trading volume wasn’t just limited to HODL. Wisdom Tree’s Bitcoin ETF (BTCW) and BlackRock’s Bitcoin ETF (IBIT) also saw significant increases in trading activity, albeit to varying degrees.

Balchunas noted, “BTCW is also skyrocketing, $154 million transactions, 12x its average and 25x its assets through 23,000 individual transactions.” However, he noted that while volume growth at IBIT was high, it did not reach the “extraordinary levels” seen at HODL and BTCW.

What’s Behind the Sudden Spike in Bitcoin ETF Volumes?

Addressing theories that the increase in ETF volume fueled Bitcoin’s price decline, Balchunas offered a rebuttal: “To the ‘bruh volume must be selling bc btc is dumping’ crowd: a) that doesn’t make sense given how little these ETFs held in existing assets. shareholders b) plus you never see much outflow in brand new ETFs that are in rally mode c) there are so many other holders of BTC besides ETFs! d) how can you call it ‘dumping’ when it is down 1% after a 20% rally in two weeks?”

However, the source of this sudden and explosive increase in trading volume remains a mystery, with Balchunas speculating: “I still haven’t figured out what happened. Nobody knows. Considering how sudden and explosive the increase in transactions was… I wonder if a certain type of Reddit or TikTok influencer recommended them to their followers. Feels retail army-like.”

He also considered the possibility of market makers trading with each other, but found this an unlikely explanation given the liquidity of other Bitcoin ETFs such as IBIT and BITO.

The trading day concluded with “The Nine” achieving a record-breaking volume day, thanks to significant contributions from HODL, BTCW and BITB, all of which shattered their previous records. Balchunas emphasized the importance of this trading volume, stating: “In context, $2 billion in trading would put them in the Top 10 among ETFs and in the Top 20 among stocks. It is much.”

As the dust settles on this unprecedented trading day, the Bitcoin community continues to grapple with the implications of this surge in volume for Bitcoin ETFs and its potential impact on the market. The exact catalyst behind this phenomenon remains elusive, with analysts and investors alike eagerly awaiting further developments.

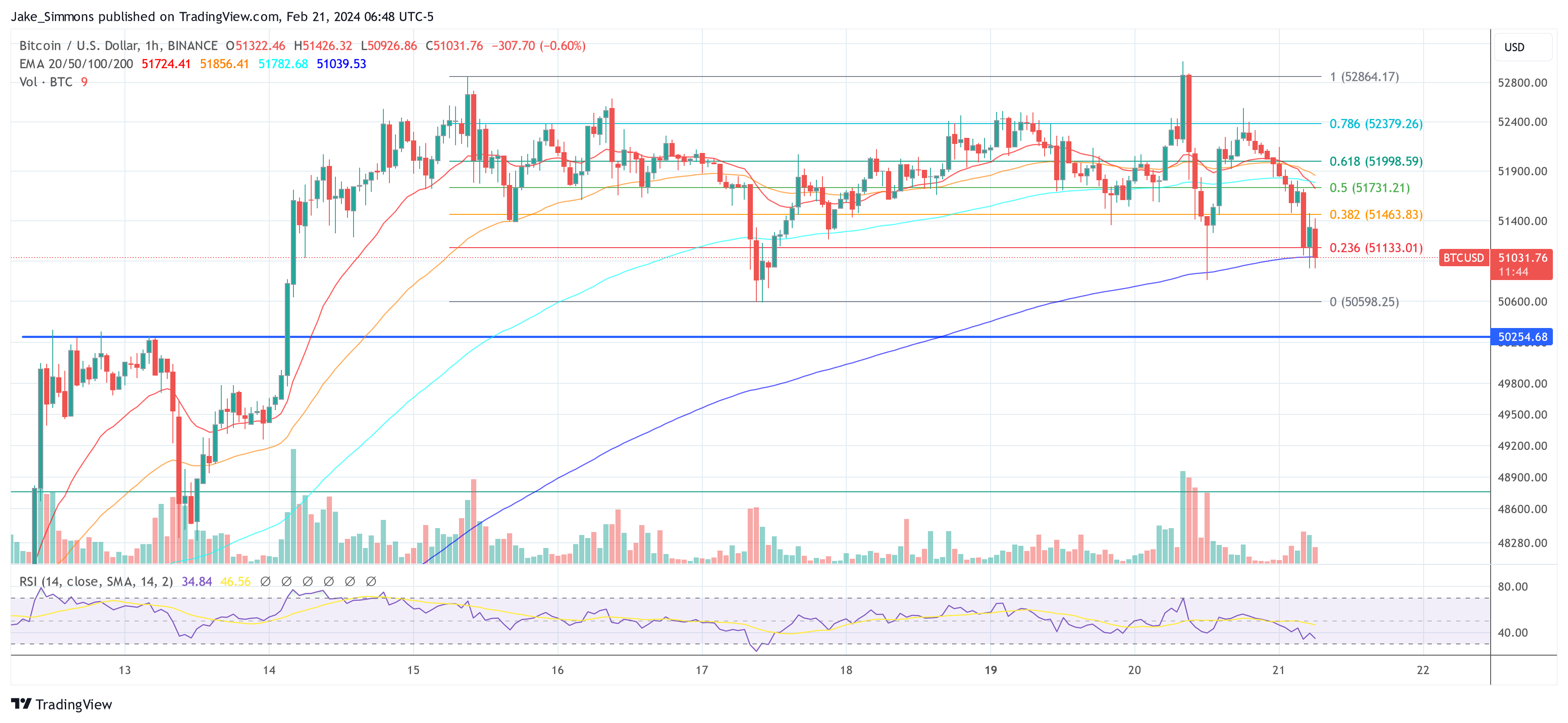

At press time, BTC fell below $51,000 again and initially found support at the EMA100 on the 1-hour chart.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.