The price of Bitcoin has been rising rapidly in recent days due to the BlackRock news. The big question is whether the bulls can continue to push the price upwards, or whether they are slowly running out of steam. With this in mind, there is currently a striking resemblance in BTC’s 1-day chart to the mid-March 2023 rally.

At the time, the BTC price suffered a more than 22% pullback after hitting a one-year high of $25,200. News from the macro and crypto environment was extremely bearish after USDC lost its peg to the US dollar and another banking crisis loomed. However, due to rumors of a Silicon Valley Bank (SVB) bailout, BTC started up 46%. Remarkably, this happened in a double pump with a day vent.

Fast forward to today, Bitcoin could be in that position again. When the Bitcoin price fell below $25,000 on June 14, the news was extremely bearish (Tether FUD, SEC lawsuits and more). Once again, however, BTC was saved by bullish news: BlackRock’s application for a Bitcoin spot ETF.

Since the news, BTC is up more than 20%. Yesterday, the price took a breather. The million dollar question: will the second part of the pump come today, as it did in March, or has Bitcoin already experienced the double pump (see yellow circles). In this case, June 18 could have been the equivalent of the rally’s one-day breather in March.

Data supports Bitcoin Bulls, but caution is advised

According to Greeks.live analysts, BTC options could become important today. A total of 31,000 BTC options expire today with a put-call ratio of 0.73, a maximum pain point of $27,000, and a notional value of $930 million. Boosted by the rise in BTC, the value of BTC option positions rose nearly 50% this week.

“The current BTC and ETH each major term IV inversion is obvious, now cross-currency IV arbitrage is very cost-effective, long-term BTC IV higher than the ETH is not sustainable,” the analysts said. remark.

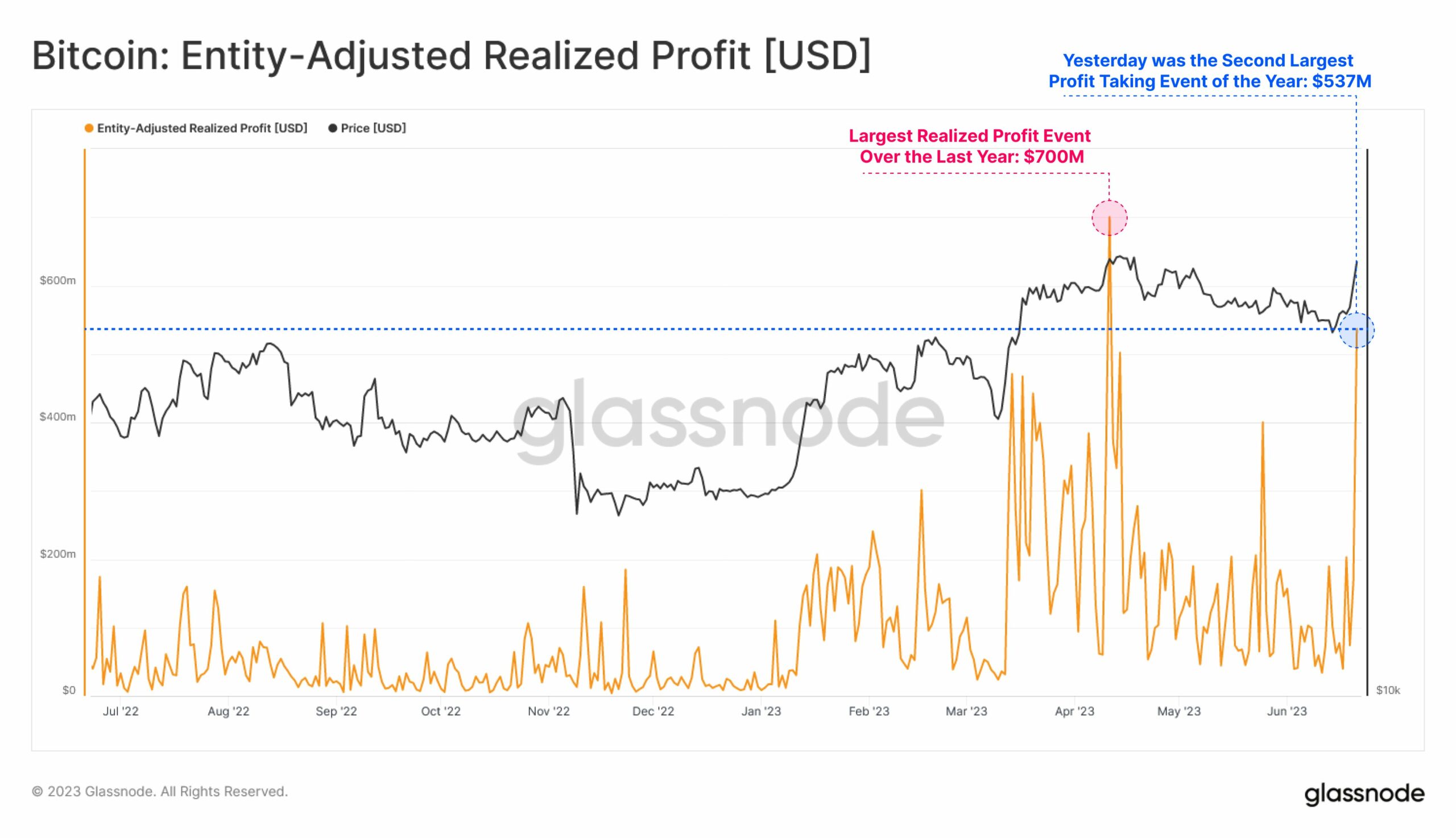

Meanwhile, the on-chain experts at Glassnode mention yesterday that following the recent Bitcoin price rally, market participants posted a nontrivial gain of $537 million, the second largest profit-taking in the past year.

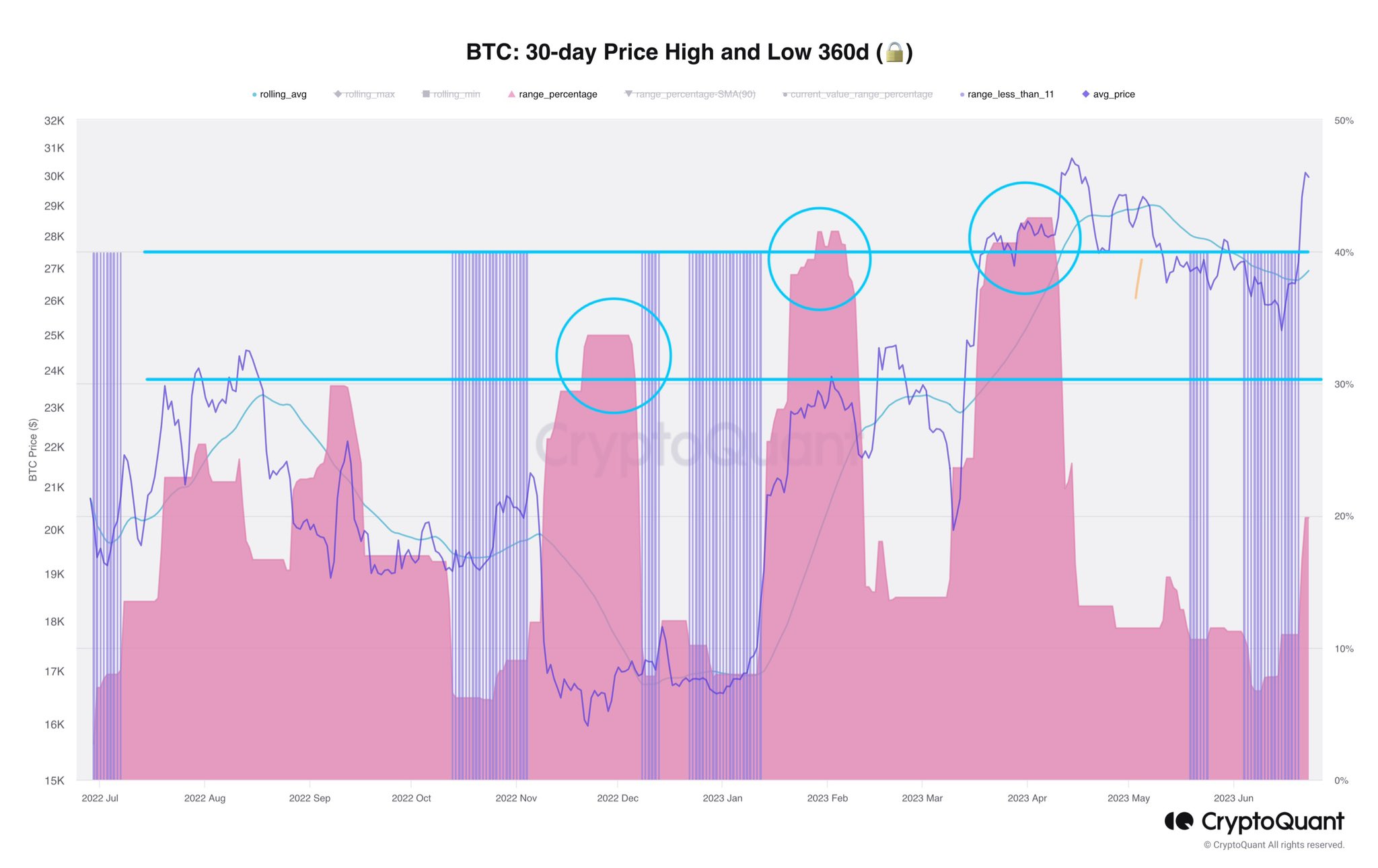

Other on-chain data presented by analyst Axel Adler Jr. however show that there is still potential for a second leg up. Like Adler writes, periods of low volatility (blue peaks) have traditionally been followed by rapid price movements (pink). These rallies have been larger than BTC’s in recent days. Adler noted:

In the past year, such fluctuations have reached 30-40%. We are currently experiencing another pink peak!

[UPDATE: 10:40 am EST]: The expiration date of the BTC options is out of the way and did not have a major impact on the price.

Featured image from iStock, chart from TradingView.com