- In the last 24 hours alone, BTC has fallen more than 4%.

- Some statistics suggested that BTC might witness a trend reversal.

Bitcoin [BTC] remained bearish as there were multiple price corrections. While there must be several factors at play causing the price drop, one of the main reasons is high selling pressure. Will this cause the value of BTC to drop further?

Investors sell Bitcoin

Bitcoin’s price action turned the entire market bearish as the king of crypto’s value fell by more than 14% last week. In the last 24 hours alone, the value of BTC fell by more than 4%.

At the time of writing, BTC was trade at $61,396.57 with a market cap of over $1.2 trillion. In the meantime, tugbachain, an analyst and author at CryptoQuant, posted a analysis highlighting Bitcoin’s foreign exchange reserve.

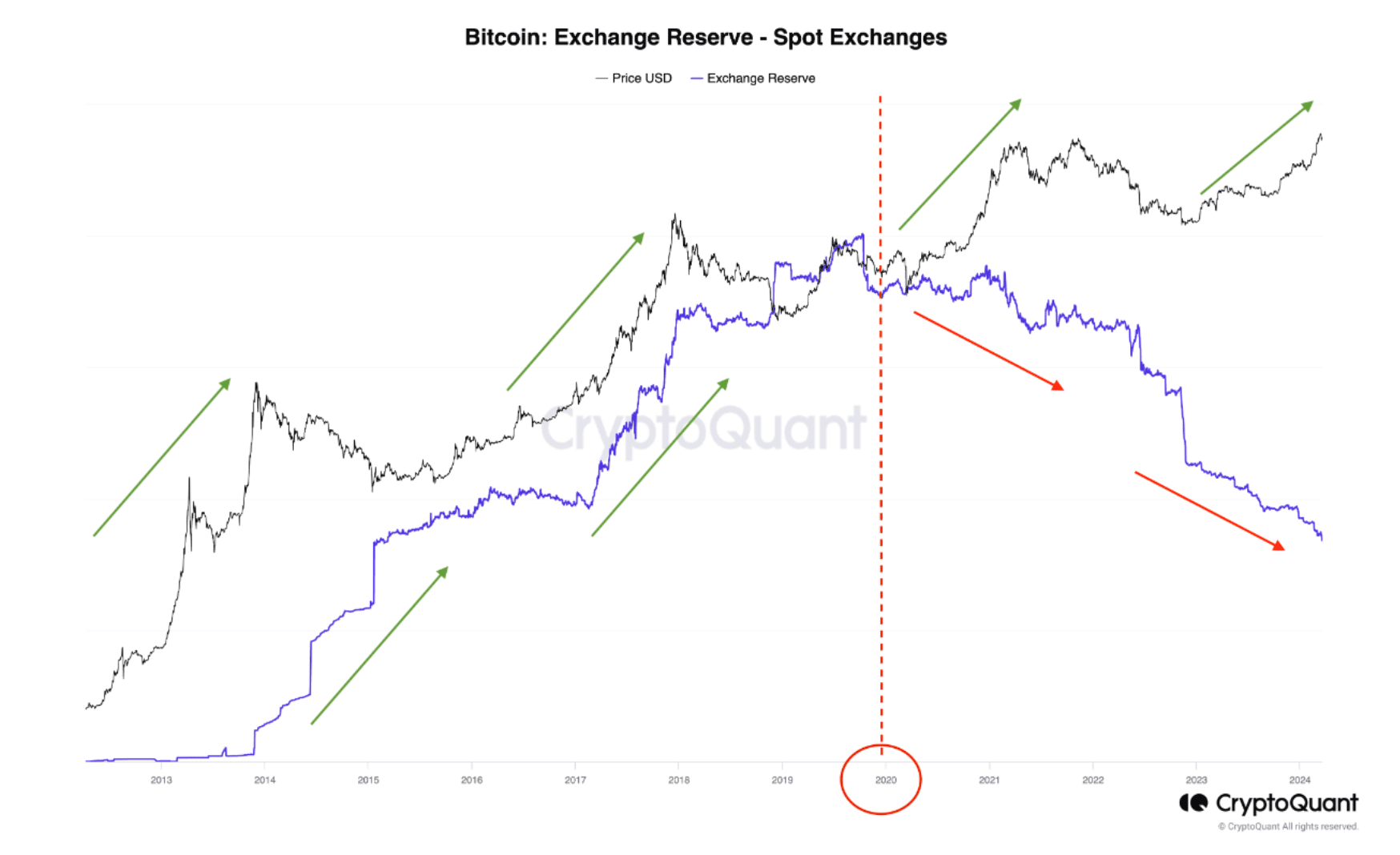

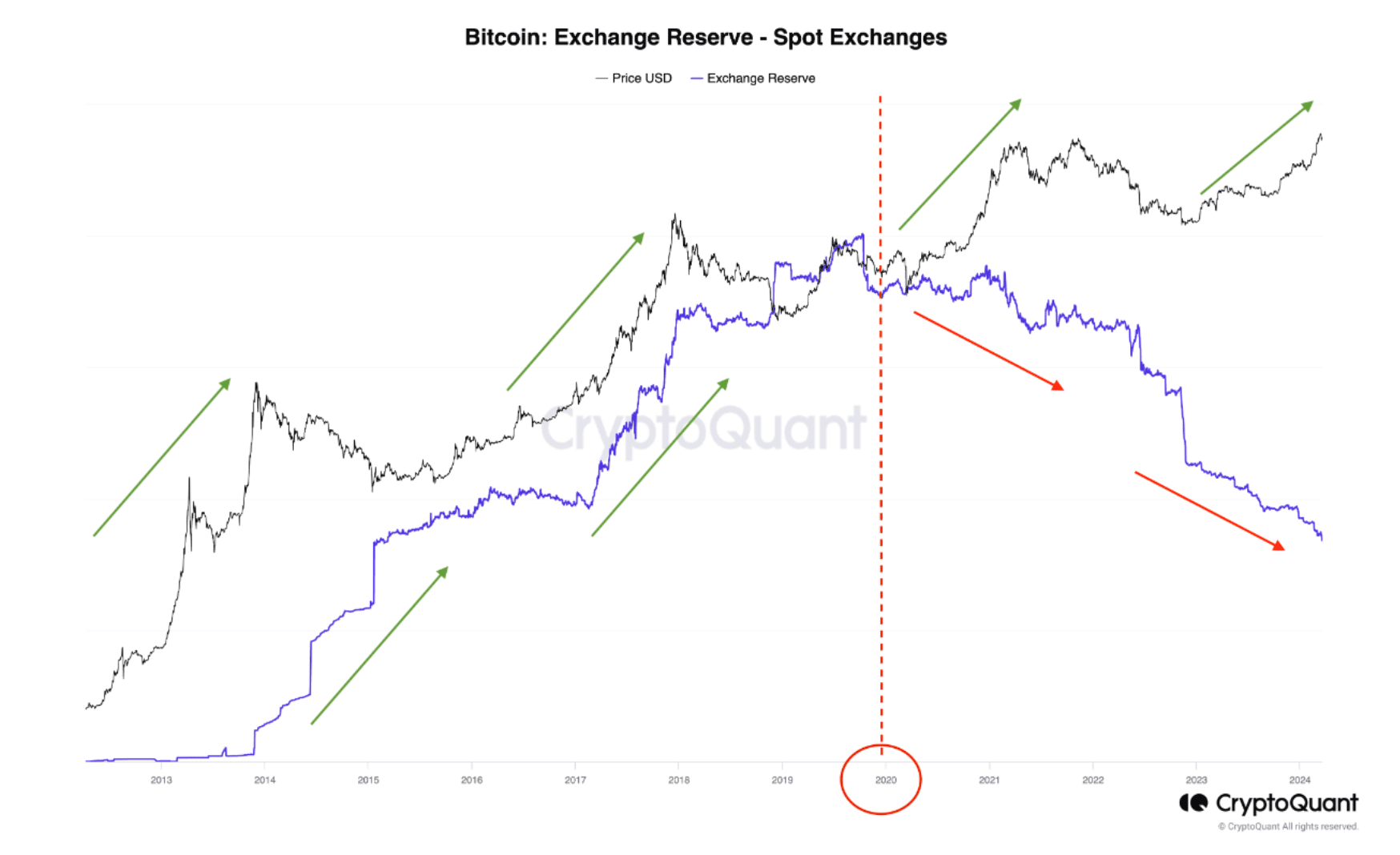

Source: CryptoQuant

According to the analysis, foreign exchange reserves have continued to decline consistently since 2020, regardless of whether prices have fallen or risen.

The analysis stated: “This suggests that Bitcoin will be exposed to more supply shocks in the upcoming bull run compared to previous periods, which will contribute positively to the price.”

To better understand whether selling pressure on BTC was high, AMBCrypto checked other related metrics. We found that the net deposit of BTC into the exchanges was high compared to the last seven days, further showing that investors were selling.

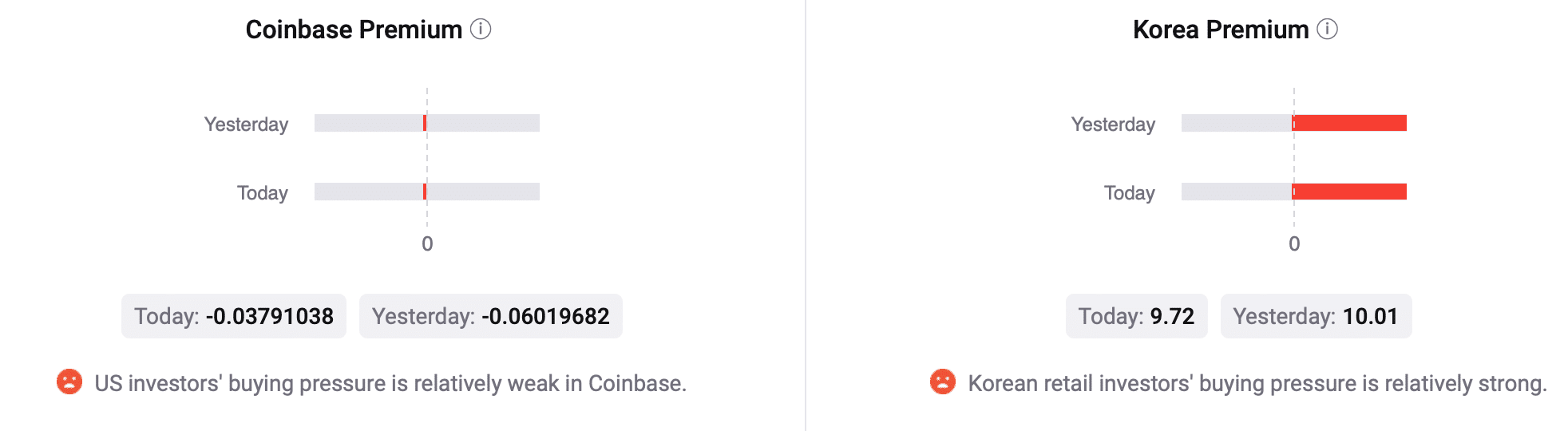

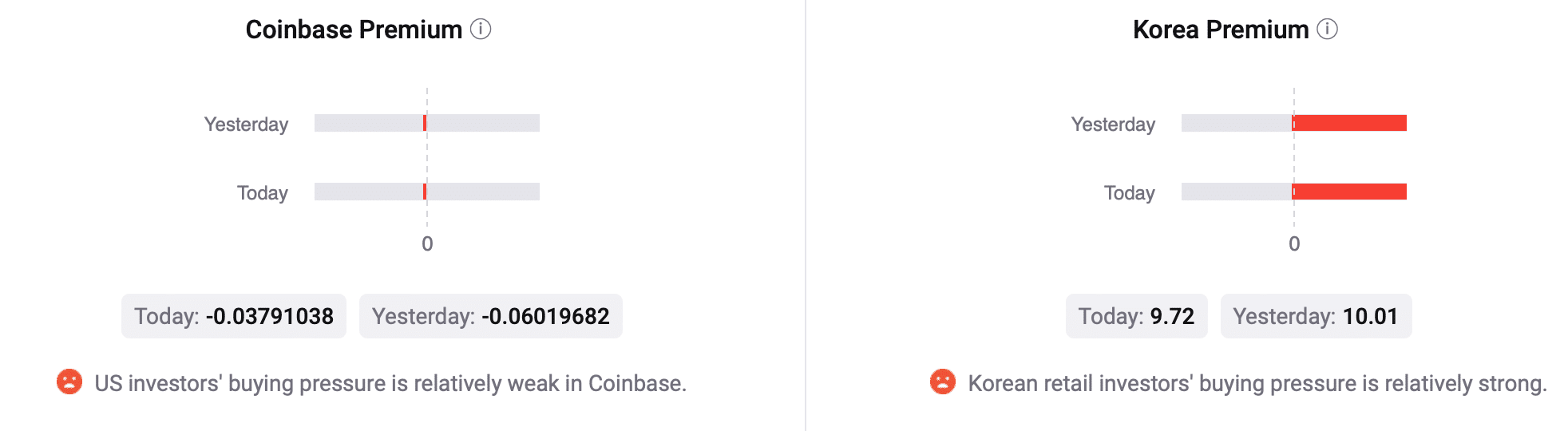

Furthermore, both BTC’s Coinbase premium and Korea premium were in the red, meaning selling sentiment was dominant among US and Korean investors.

Source: CryptoQuant

Will Biotcoin Witness a Trend Reversal?

With selling pressure high, a continued short-term downward trend seemed likely.

Ali, a popular crypto analyst, recently posted one tweet indicating important support zones for BTC. The tweet mentioned that BTC has strong support near $61,100. If BTC fails to test that support, its value might as well fall to $56,000.

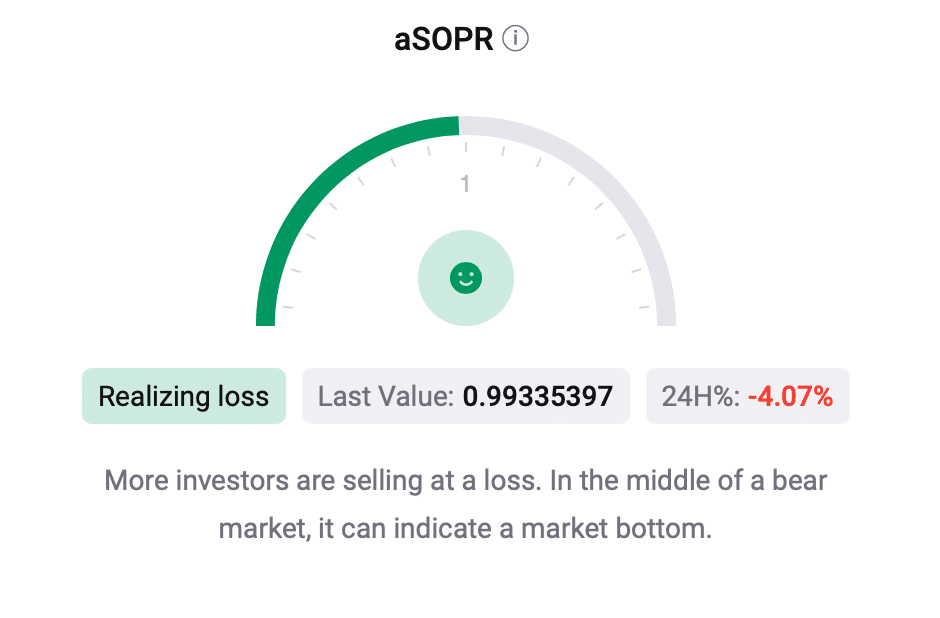

However, if BTC manages to stay above $61,100, it could experience a trend reversal and reach its resistance zone around $66,000 again. The possibility of a trend reversal cannot be ruled out as BTC’s aSORP turned green.

This meant that more investors sold at a loss. In the middle of a bear market, this could indicate a market bottom.

Source: CryptoQuant

Read Bitcoins [BTC] Price prediction 2024-25

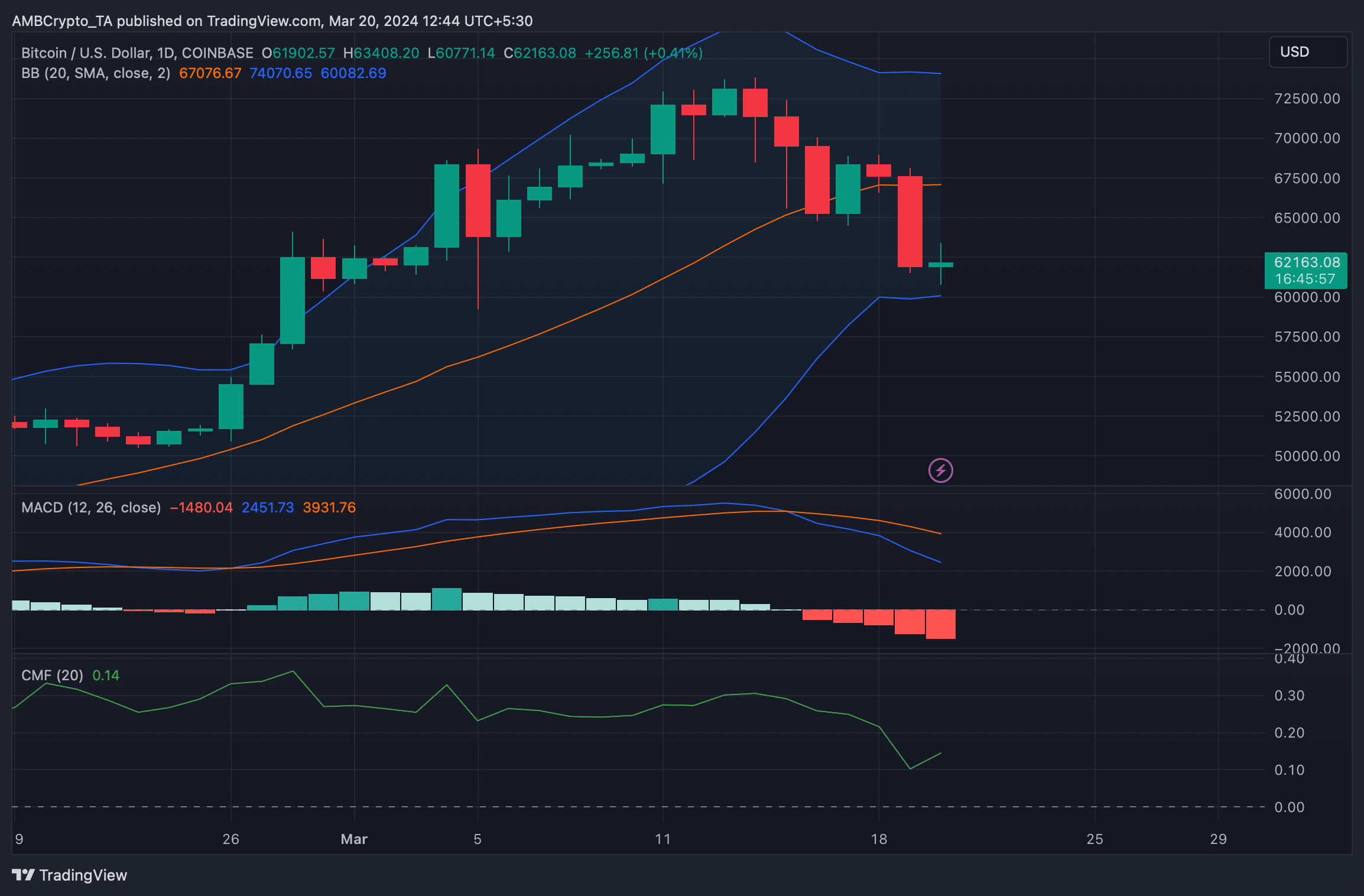

Therefore, AMBCrypto next looked at the daily chart of BTC to see what the technical indicators had to say. Our analysis showed that Bitcoin’s Chaikin Money Flow (CMF) registered an increase. The price also reached the lower limit of the Bollinger Bands, indicating that a trend reversal could occur soon.

Nevertheless, the MACD continued to support the sellers as it showed a bearish advantage in the market.

Source: TradingView