Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

The Bitcoin price continues to become a headwind, like the latest report on Digital actival fund flows shows a stunning $ 751 million in the digital active. The pure volume of this withdrawal increases alarm bells about whether Settings may apply From the flagship cryptocurrency.

Bitcoin price is confronted with pressure in the midst of massive outskirts

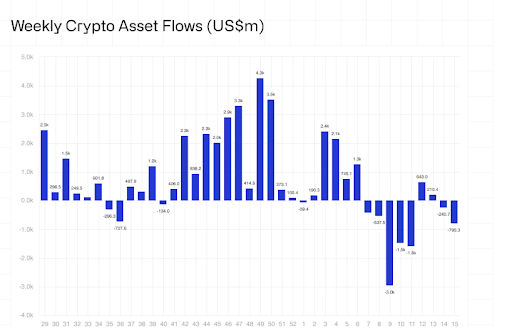

Coinshares’ weekly report A huge fame has announced on the digital assets Fund Fund $ 795 million in flow Of the cryptomarkt – shocking, of which $ 751 million only came from Bitcoin. This mass of exodus marks one of the greatest outskirts of the year of the year, and it comes at a time when the Price of Bitcoin has hit a wall.

Related lecture

James Butterfill, the head of research on Coinshares, revealed that since the beginning of February 2025 have had digital investment products for assets Walked cumulative outflows From around $ 7.2 billion, which means that almost all inflow of the year is effectively deleted. In particular this week is the third consecutive week of falls, with Bitcoin leads the decline And the absorption of the most important losses with important digital assets.

From this report, the net flows before 2025 have decreased to a modest $ 165 million, a sharp decrease in a multi-billion dollar peak just two months ago. This steep decline underlines one Cooling sentiment under Institutional Investors And emphasizes a growing sense of caution in the midst of continuous market volatility.

Currently the Bitcoin -Price struggles To regain all time, with recent outflows that serve as one of the many barriers that hinder the cryptocurrency Breakout potential. Until these outflow and stabilizes the market, Bitcoin’s path remains to set new all-time highlights.

Despite losing $ 751 million in outskirts, Bitcoin still maintains a moderately positive position with $ 545 million in net-date-date inflow. However, the enormous scale and speed of the latest outflow output brought concern. The fact that Bitcoin has suffered such a massive withdrawal indicates a possible shift in sentiment between institutions. Whether it is due to taking a profit or macro-economic uncertainty, this movement suggests that large players are starting to attract-Esthans in the short term.

In addition to Bitcoin, Ethereum Saw $ 37 million in flowing, while Solana, Aave and Sui also booked $ 5.1 million, $ 0.78 million and $ 0.58 million respectively. Surprisingly, even short Bitcoin products, designed to take advantage of the decline of the market, were not spared, with $ 4.6 million.

Rates and political volatility float

One of the most important factors behind the withdrawal over digital assets is the rising economic uncertainty that is fueled by tariff policy that has adversely affected the investor sentiment. The wave of negative started in February after the President of the United States (US) has announced Donald Trump plans rates About all the import that enters the country from Canada, Mexico and China.

Related lecture

However, a rebound in the late week in crypto prizes was seen after that of Trump Temporary reversal of the controversial ratesOffering a short delay for the market. This policy shift helped to stimulate the total asset in control (AUM) on digital assets from a low of $ 120 billion on 8 April to $ 130 billion, which marked a recovery of 8%.

Featured image of Adobe Stock, Chart van TradingView.com