- Long positions made up approximately 83% of total liquidations.

- An analyst reaffirmed that the market overall is becoming “significantly volatile” ahead of Bitcoin’s halving.

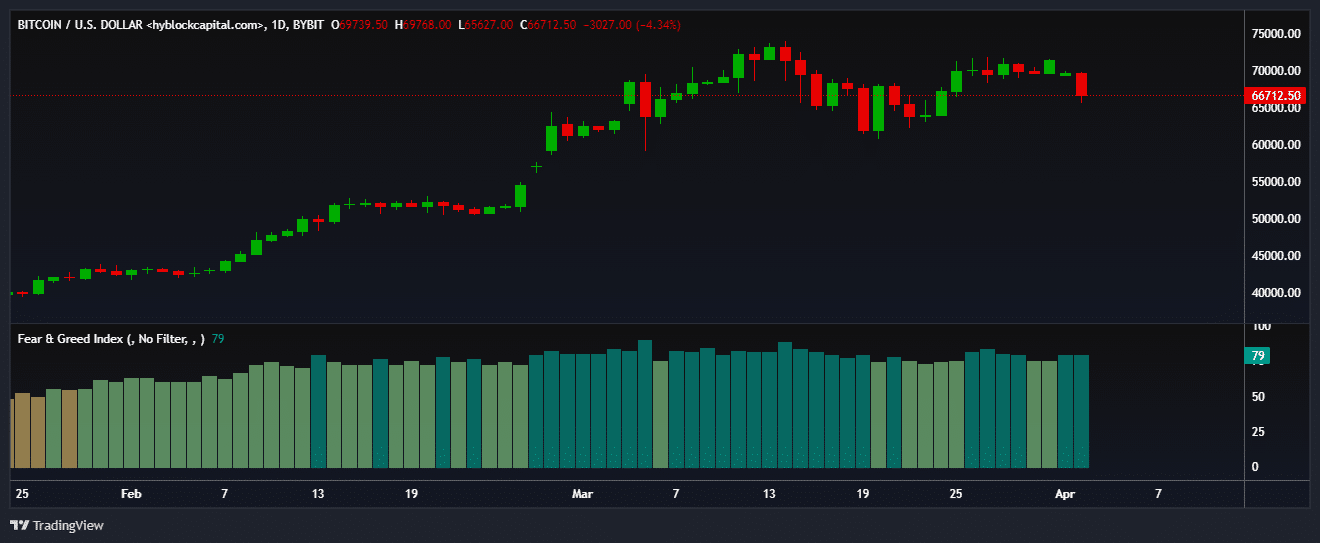

Bitcoin [BTC] sharply corrected during the early hours in Asia on Tuesday, falling 5.7% to a low of $66,000.

The sudden retracement caused liquidations worth $200 million of the entire crypto market in the past four hours, according to AMBCrypto’s analysis of Coinglass data.

Long positions made up approximately 83% of total liquidations.

Source: Coinglass

The dip also caused the majority of BTC derivatives traders to turn bearish on the asset.

Also the Long/short ratio fell sharply below 1 in the last few hours up to the time of writing, indicating a sharp increase in bearish leveraged positions.

This slump followed a weak start to the week for Bitcoin Spot Exchange Traded Funds (ETFs).

Ten new investment opportunities, which track the spot prices of the world’s largest digital assets, witnessed net outflows of $85 million on April 1, AMBCrypto noted using SoSo Value data.

Source: Coinglass

The downward pressure was also in response to stronger-than-expected data from the US manufacturing sector, Shivam Thakral, CEO of Indian cryptocurrency BuyUcoin, told AMBCrypto.

Typically, risk-based markets such as cryptocurrencies and stocks interpret such events as a lower likelihood that the US Federal Reserve will cut interest rates.

Wall Street’s major indices, such as the S&P 500 and Nasdaq Composite, also fell lower on the development.

Read Bitcoin’s [BTC] Price forecast 2024-25

However, Thakral reaffirmed that the crypto market overall is becoming “significantly volatile” ahead of Bitcoin’s halving. So participants could brace themselves for more ebbs and flows over the next two weeks.

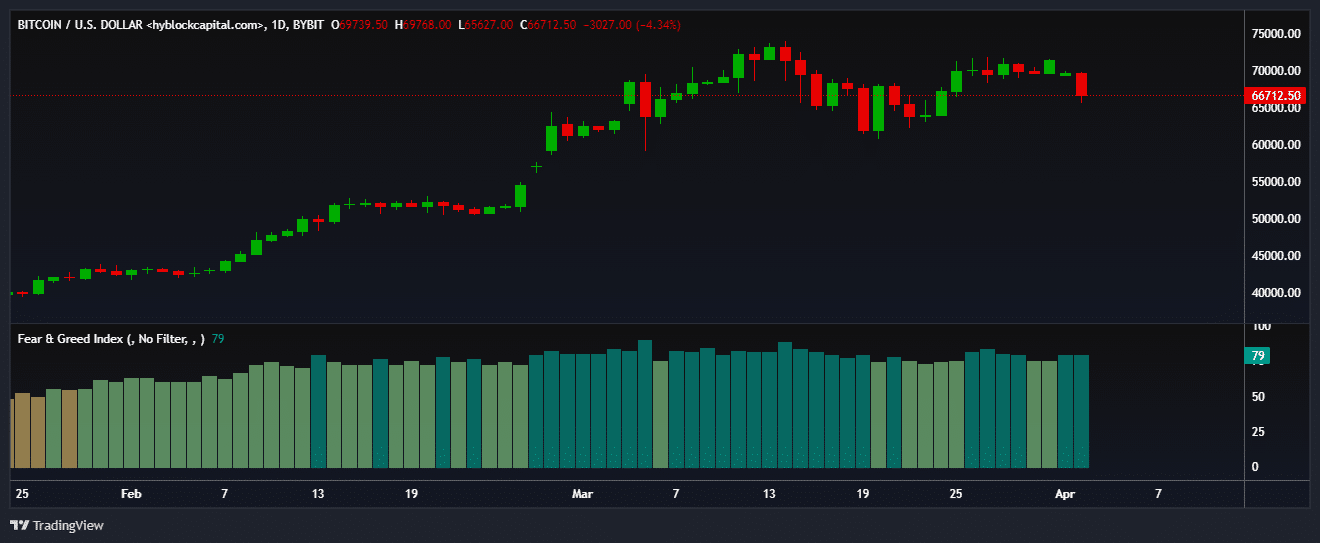

According to Hyblock Capital data, market sentiment at press time was of “extreme greed.” This could accelerate buying pressure in the coming days, pushing Bitcoin further north.

Source: Hyblock Capital